What the hell is the world gonna look like post-election?

August 15, 2024

*****************

–Pressure on near contracts and on implied vol in rate futures as CPI printed as expected: 0.2% m/m headline and core. SFRU4 was the weakest contract on the SOFR strip, settling 9511.0, down 4.5 on the day. The high tick on August 5 was 9547.5 with a settle of 9528.5. Was it Roaring Kitty advocating emergency rate cuts? Because this looks an awful lot like GME. October FF settled 9501.5 yesterday, also down 4.5, and now leaning closer to a 25 bp cut in September rather than 50 (even odds is a price of 9504.5). Due to weakness in SFRU4, U4/Z4 3-month calendar and U4/U5 1-yr calendar made new lows at -68 (9511/9579) and -166.5 (9511/9677.5). It appears as if sentiment currently favors near-term easing to be somewhat aggressive (after the election), followed by a lull. Actually, U4/Z4 at -68 is an extraordinary level capturing pre- to post-election. SFRZ4 9581.25 straddle settled 44.75. I’m not saying I would be a buyer at that level, but it’s not a good sale.

–Consider this: SFRZ4 settled 9579 or 4.21%, 116 bps UNDER the current midpoint of the FF target. So there’s a lot of easing priced in. Now, look at the 9650c, which is ANOTHER 71 out of the money. That settled 7.25. Breakeven is 9657 or 3.43%. OK, so 71 out-of-the-money is worth 7.25…it’s a crazy world right? How can I say that’s “wrong”? Now look at the downside. SFRZ4 9525p settled 1.75 (traded 2) and are just 54 otm. So I buy 3 of the puts for 2, sell one of the calls at 7, and still have $25 left over for the breakfast special at Denny’s. What could go wrong? (THIS IS NOT A RECOMMENDATION. THERE ARE MUCH BETTER BREAKFAST PLACES THAN DENNY’S)

–Treasury curve reflected the same dynamic. Curve flattened with 2s up slightly in yield to 3.947% and 10s down 3.4 bps to 3.818%. Retail sales today expected +0.3, Jobless Claims 235k and Philly Fed Mfg 7 (from 13.9 last). The market is expecting to glide through this data without much drama. Treasury vol was hit fairly hard yesterday. For example, TYU4 113.75 straddle settled 53 vs 113-245. On Tuesday, TYU4 113.5^ settled 1’04 vs 113-20. The atm October straddle went from 2’03 to 1’59. Worth noting that Sept treasury options expire one week from tomorrow, after Powell addresses Jackson Hole.

Screaming recession

August 14, 2024

*****************

–CPI today expected 0.2 with Core also +0.2 m/m. On a yoy basis, expected 3.0 from 3.0 with Core 3.2% from 3.3%. Lower than expected prints in yesterday’s PPI, yoy 2.2% and Core 2.3%, helped spark a rally in rate futures. SFRH5 and M5 led the charge, settling +10 at 9630.5 and +10.5 at 96.61. SFRM5 at 3.39% is nearly 200 bps below the current FF target midpoint of 5.375%. By NEXT SUMMER. While stocks welcome the prospect of lower rates, it’s hard to see the Fed slashing 200 in a “soft landing” scenario. Something is not right. Rate futures are screaming recession, while stocks enjoyed a rollicking rally with Nasdaq +2.4%.

–Tens fell 5.5 bps to 3.852%.

–Block steepener in SOFR yesterday in size 37k, SFRH5 9626 vs H6 9690, a spread of -64. On Monday the spread settled -64.5 and yesterday at -62.0. Trade was new, open interest jumped 54k and 46k. Concentrated buying in 2025 contracts also responsible for new low in SFRU4/U5 1-yr calendar at -162.5 (9515.5/9678.0), down 7 on the day.

–A few option curve trades reflected the trend: 0QZ/3QZ 9700/9750cs spread 2 paid for red, 2k, (underlying contracts Z5 at 9687.5 and Z7 at 9682.5).

SFRM5 9675/9725cs vs 2QM 9712.5/9762.5cs -0.25 credit to buy the near, 5k

And then, depression set in

August 13, 2024

******************

–PPI today expected 0.2 for both headline and core. Yields fell yesterday with 10s down 3.5 bps to 3.907%. Probably should just ignore the interest rate arena and buy gold for the inevitable $100 run as soon as GCZ4 breaks through 2525.

–From NY Fed’s Survey of Consumer Expectations: “Labor market expectations were mixed, with respondents expecting lower earnings growth and a lower likelihood of finding a new job within three months if they were laid off. Delinquency expectations continued their upward trend in July and have risen to the highest level since April 2020.”

To paraphrase: “making less, worried about getting sh-t canned, and the car is about to be repo’d”.

On the plus side, KFC expands its $5 meal offerings.

There used to be a goofy kid trading eurodollars in the third and fourth on the CME floor with the acronym KFC. Nicknamed, “the colonel”.

–New buyer yesterday of 20k TYU4 114.5c for 13, settled 12 ref TYU4 113-075. Also a large buy of SFRH5 9800/9900c 2×3 for 3.5 to 3.75; size of 60k x 90k. Settles 3.75 and 1.25 so 2×3 3.75s ref H5 9620.5. In a way, might as well consider SFRZ4 9700c which settled 4.0 ref 9575. If the wheels are about to come off, the next few months ought to do it.

–NFIB Small Business Optimism Index popped up to 93.7 this morning. However, NFIB economist Bill Dunkelberg was suitably downbeat:

“Despite this increase in optimism, the road ahead remains tough for the nation’s small business owners… Cost pressures, especially labor costs, continue to plague small business operations, impacting their bottom line. Owners are heading towards unpredictable months ahead, not knowing how future economic conditions or government policies will impact them.”

C’mon Bill, let’s go out for a couple of Leinenkugel’s and take the edge off… my buy.

Yes, I know I’ve used this clip before. And, I will use it again.

Lazy days of August

August 12, 2024

*****************

—Main Friday feature was curve flattening with 2s UP 1.3 bps to 4.053% and 10s DOWN 5.7 bps to 3.942%. 2/10 spread, which had nearly poked into positive territory, slipped back to -11. On the SOFR strip, Z4 was -1.5 at 9574, Z5 unch’d at 9673.0, Z6 +2.0 at 9680 and Z7 +5.5 at 9673.5. Just a couple of things to notice from those prices:

1) Z4/Z5 is inverted by almost exactly 1% (-99.0s). The front U4/U5 spread is inverted by 1.5% at -149 (9513.5/9662.5)

2) prices for the next two years from Z5 to Z7 are almost exactly the same, 3.2 to 3.25%. I’m figuring 3.0 to 3.25% as a soft floor for a terminal funds rate.

–This week brings inflation data, with CPI on Wednesday looming as the most important release. Expected 3.0% yoy, unch’d from last month’s print, with Core 3.2%, down 0.1 from previous. Nothing likely to derail Powell from teeing up a 50 bp ease at the Aug 23 Jackson Hole Symposium. Actually, the market is about evenly priced for 25 or 50 with FFV4 settling 9505.5 or 4.945%, 38.5 bps below the current EFFR of 5.33%. Retail Sales on Thursday may have additional importance this week on Thursday. The following week is somewhat light on economic data, and culminates with Jackson Hole.

–August midcurve options expire Friday. SFRU5 settled 9662.5 and the atm 9662.5 straddle settled 20 bps. Rather high straddle price given only five trading days left. On the other hand, in five trading sessions from July 30 to August 5, SFRU5 traded from 9621.5 to 9706.5, a range of 85 bps!

It’s not just yen-carry. It’s lower employment and consumer spending.

August 11, 2024 – Weekly comment

**************************************

If it’s all about the yen-carry trade, then it’s instructive to look at $/yen chart. Because in order to unwind, it’s necessary to buy yen.

A case can be made that the 10.8% move from 161.69 to Monday’s low of 144.18 was dramatic enough to have cleaned out the majority of weak hands. $/yen held at the 50% retrace of the rally from early 2023 to the July high. Similarly, the low in 2023 was made around the 50% retrace from the low at the start of 2021 to the high in 2022. So, maybe that part of the carnage is over…but maybe it’s not. The 50% retracement of the big move from the 2021 low to last month’s high is 132.20. My guess is that the low set right at the beginning of this year, 140.89, will be tested, and we’re likely to see 130’s. JPM says yen-carry is about 75% exited. From the chart, I don’t see it.

Jim Bianco relates the size of yen carry to the Bank of Japan’s balance sheet:

No definitive statistic shows its [yen carry] size, so we have to infer it from the size of the Bank of Japan’s balance sheet. …the Bank of Japan’s balance sheet is larger than the country’s GDP, at 127.5% of GDP. By comparison, the Fed’s balance sheet is 25% of GDP.

BOJ Deputy Governor Uchida helped stabilize the currency on Wednesday:

(BBG) ‘I believe that the bank needs to maintain monetary easing with the current policy interest rate for the time being, with developments in financial and capital markets at home and abroad being extremely volatile,’ Uchida said.

Certainly part of the action in US markets is associated with yen-carry. However, it’s not just Japan that has had out-sized government influence on markets. US deficit spending has remained at emergency levels but the economic boost has faded. Gov’t hiring has contributed about 25% to payroll growth. It’s likely to slow significantly, no matter who wins the election.

Yields rose and the curve flattened as panicked pleas for emergency rate cuts subsided. Twos popped back above 4%, ending the week at 4.053%, up over 17 from the previous Friday’s 3.88%. Tens rose 14.7 bps to 3.942% and thirties 11.8 to 4.228%. Auctions of 10s and 30s were soft, as both tailed by 3 bps. On the SOFR strip, SFRH5 and M5 were the pivot, retracing the previous week’s rally by nearly one-quarter percent. Both down 24.5 at 9618 and 9646.5. The previous Friday high in SFRH5 was 9670.5! But even last week’s close is a rate of only 3.82%, a bit over six months forward, about 1.5% below the current Fed Effective Rate. SFRU4/SFRU5 spread is also around -150 bps, ending the week at -149 (9513.5/9662.5) from -158.

This week brings inflation data and retail sales. PPI on Tuesday expected 2.3% yoy, with Core 2.7%. CPI on Wednesday expected 3.0% yoy, unchanged from last month’s print, and Core 3.2%, down 0.1 from previous. Retail Sales on Thursday, expected +0.4% on the month. Inflation data has receded in importance relative to the labor market. However, Fed Governor Bowman in a speech Saturday said “…the recent rise in unemployment may be exaggerating the degree of cooling in labor markets.” “I will remain cautious in my approach to considering adjustments to the current stance of policy.” Of course, Chair Powell’s comments at the upcoming Jackson Hole Conference on August 23 will be key in determining the size of the September rate cut. October Fed Funds settled Friday at 9505.5 or 4.945%, almost exactly between 25 and 50 bps. (A 25 bp cut should take the EFFR to 5.08%, and 50 to 4.83%).

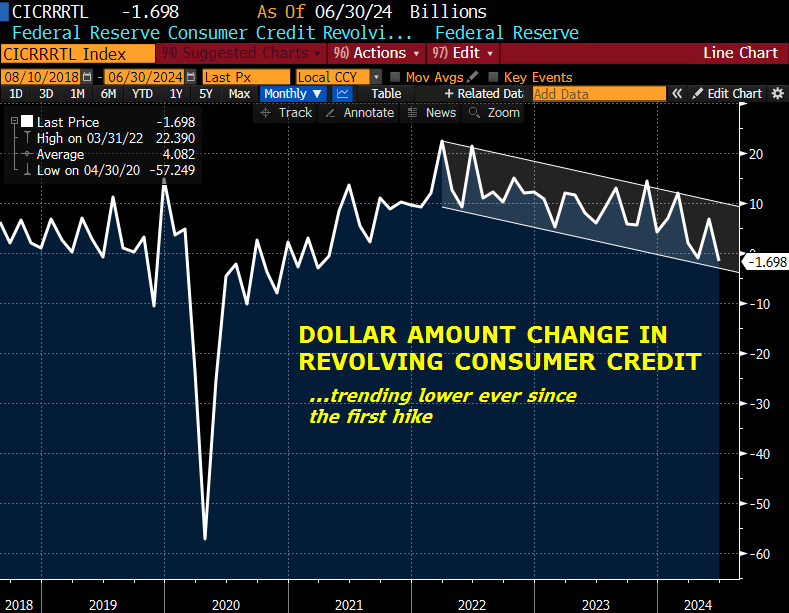

Consumer Credit isn’t a particularly closely watched monthly figure. However, last week’s print for June showed a dollar change of -$1.7 billion in revolving (credit card) debt. The data is a bit noisy, but the trend is declining. Some of that is likely due to increased stringency by lenders, and some due to tapped out consumers.

| 8/2/2024 | 8/9/2024 | chg | ||

| UST 2Y | 388.0 | 405.3 | 17.3 | |

| UST 5Y | 362.5 | 379.4 | 16.9 | |

| UST 10Y | 379.5 | 394.2 | 14.7 | |

| UST 30Y | 410.8 | 422.6 | 11.8 | |

| GERM 2Y | 235.2 | 238.6 | 3.4 | |

| GERM 10Y | 217.4 | 222.5 | 5.1 | |

| JPN 20Y | 172.1 | 168.3 | -3.8 | |

| CHINA 10Y | 212.4 | 220.5 | 8.1 | |

| SOFR U4/U5 | -158.0 | -149.0 | 9.0 | |

| SOFR U5/U6 | -13.5 | -18.0 | -4.5 | |

| SOFR U6/U7 | 6.0 | 4.5 | -1.5 | |

| EUR | 109.11 | 109.29 | 0.18 | |

| CRUDE (CLV4) | 72.59 | 75.61 | 3.02 | |

| SPX | 5346.56 | 5344.16 | -2.40 | 0.0% |

| VIX | 23.39 | 20.37 | -3.02 | |

Back to ‘normal’

August 9, 2024

****************

–Rate futures declined as the most aggressive easing projections continued to be pared back. October FF settled 9507, -4.5, fully 25 bps off of Monday’s panic high 9532.5. This contract directly prices the Sept FOMC, a price of 9492 represents a cut of 25 and 9517 a cut of 50, so we’re close to midpoint. Ten year yield rose 3.3 bps to 3.999%. Yesterday’s 30-yr auction was soft, with the yield just before cut-off at 4.285, but actual result at 4.314%. However, there was little reaction following the midday sale. At futures settle, the thirty-yr yield was 4.287%.

–Block trade yesterday: TYU4 112c / TYV 116c 1×2 diagonal covered U4 112-24, 30d, 12.5k sold at 25. Settled there with Sept calls 63 and Oct 116c 19. The only reason I highlight this trade is because TYU 112c has the most open interest of any strike, still 135k open after yesterday, and this in-the-money call is being rolled into Oct 116s. Likely a lot more of this trade to come. Note that Sept options expire 23-August, after the Dem convention and right at the start of the Jackson Hole Conference. I don’t see it on the Fed calendar, but I believe Powell will give an address on Friday, Aug 23.

–The peak contract on the SOFR strip has moved forward as easing expectations become concentrated. SFRM’26 is highest at 9678.5, or around 3.25% (under 3% earlier in the week). The near one-year calendars are around -150 bps: U4/U5 settled -149 (9515.5/9664.5) and FFV4/FFV5 settled -161 (9507/9668). I would have previously said these levels represent six [25 bp] rate cuts, but we’re likely to get a couple of 50s.

worked for Venezuela

Debt Sustainability

August 8, 2024

****************

–Uninspiring 10y auction yesterday, which resulted in a three bp tail; yield at cut-off was 3.93% and actual auction was 3.96%. As suggested yesterday, demand might not be as hearty at these (relatively) low yield levels. At the margin, buying predicated on funding in yen has likely evaporated. (JPM says 75% of the yen-carry trade has been unwound). In my opinion, it’s going to become increasingly necessary for the US to fund its debt domestically, which will be a lot easier if US funding rates decline below long-end yields (or if longer yields RISE above funds). The attached chart showing 2/10 at a new high is a good start; at -4 bps it’s the highest it has been since July of 2022 (the first hike was in March 2022). In my opinion, “debt sustainability” is going to course through the financial market lexicon the same way that “climate change” does on a Public Television nature series.

–Thirty year auction today. One other bit of lagged news concerns yesterday’s Consumer Credit release. Revolving fell by 1.7 billion. The amazing thing is that revolving has been growing at all, given credit card rates of over 21%. On the other hand, those balances compound pretty quickly. We’re seeing it in delinquency rates, and of course, banks are shutting off the spigots. So, take out a school loan if possible… In a way, that’s the story of ‘debt sustainability’ at the ‘stretched consumer’ level: rates high, delinquencies up, credit availability getting shut down. With respect to the biggest debtor of all, the US Federal Gov’t, the issue of debt sustainability might manifest itself in the form of really bad auctions. However, if long end rates are somewhere between 4 and 5.5%, and the Fed cuts to 3% and implicitly (explicitly to Jamie Dimon) guarantees positive carry for the foreseeable future, then maybe the Fed won’t be forced to monetize the debt. Domestic banks and funds will be glad to milk the positive carry, which will help absorb increased consumer and corp delinquencies.

–Jobless Claims and 30y auction today. Claims expected 240k from 249k last. After the 10y auction, both stocks and bonds slid. At futures settle tens had risen 8.4 bps to 3.966%. On the SOFR curve, Z4 was +2.5 at 9582, Z5 -4.5 at 9677.5, Z6 -7.5 at 9680.5 and Z7 -8.0 at 9671.0. So if we jumped in the time machine and shifted a year forward, Dec’25 contract is only 3.25% and we could fund longer dated paper with positive carry…

Just a couple of trades from yesterday, new buyer of about 25k SFRU4 9506.25p for 3.5 and a seller of 20k SFRU4 9525c at 8.5 covered 9520.5, 40d. SFRU4 settled 9520. The Sept FOMC is Sept 18, options expire Sept 13. The Fed is not going to emergency-cut unless a nuclear bomb is detonated. They’re ready for small bank failures, etc. So, absolute certainty of 50 bp cuts on both Sept 18 and Nov 7 would probably see a final U4 settle at 9530 -35 (on Sept 13). But if Powell dialed it back to 25 at Jackson Hole, it wouldn’t be surprising to see the 9506 strike in play.

Reassessing blah-blah-blah

August 7, 2024

****************

–(RTRS) “The Bank of Japan’s influential deputy governor said on Wednesday the central bank will not hike interest rates when markets are unstable, playing down the chance of a near-term hike in borrowing costs.”

Seems to have broken the fever of the yen-carry panic. $/yen back above 147. Nikkei recovering as well, up about 1.2%. And of course US risk assets also bouncing. What if though, the real problem in the US is deteriorating labor markets and debt sustainability issues? Ten year auction today and 30s tomorrow may give clues for demand at these lower yields.

–Jeremy Siegel (stock market cheerleader) unabashedly called for an emergency 75 bp rate cut by the Fed. Because stocks declined. Previously, when there were ACTUAL reasons for emergency cuts, the Fed didn’t have programs in place for financial intermediaries to access liquidity. The funding rate was THE TOOL. The discount window carried stigma. Now, there are social workers and therapists for financial stress, and a lot of Fed programs to provide band-aids for boo-boos, and there have been repeated attempts to remove the taint associated with discount window borrowing. They’re thinking of changing the name from the Discount Window to a fancy acronym: the LOVE window. (Leverage-On-Virtually-Everything). Jackson Hole is just two weeks away: “Reassessing the Effectiveness and Transmission of Monetary Policy,” will be held Aug. 22-24.

I would note this line from Bernanke’s 2007 Jackson Hole speech: “It is not the policy of the Federal Reserve – nor would it be appropriate – to protect lenders and investors from the consequences of their financial decisions.” I guess that’s ancient history now…

–Powell will likely prepare the market for a 50 bp cut at the September meeting at that venue (Jackson Hole). Of course, CPI is one week from today on August 14, but is unlikely to derail easing prospects, which are already priced. Yields did back up yesterday, tens rose 10 bps to 3.882%. We’ll see if there’s been enough of a concession to draw buyers for the auctions.

Early morning panic abates as the day progresses

August 6, 2024

****************

–Interesting clip of Peter Lynch, star manager of Fidelity’s Magellan, “…in 93 years there have been 50 declines of 10% or more, about once every two years.” Yesterday at the low the SPX was down 9.7% from the recent high. On the day SPX fell 3.0%.

–After an early morning surge higher in rate futures, net changes were rather small. I marked 5s at an unchanged yield of 3.625%, with tens down just 2 bps at 3.781%. SFRZ4 settled 9592.5 up just 0.5 on the day, but the high was a panicky 9620, so the close was 27.5 off the high! Oct Fed Funds settled 9517 or 4.83% (hi 9532.5). Assuming no intermeeting shenanigans, if the Fed eases 50 in Sept, then EFFR should decline from the current level of 5.33% to 4.83%. And that’s where FFV4 is. Interestingly the curve flattened slightly, with 2s nearly unchanged at 3.883% but 10s down 2 and 30s down 4.6 to 4.066%. In the old days I would have figured a 30y mortgage would be around 5 to 5.25% given these treasury yields; that would loosen up the housing market in my opinion.

–All of a sudden there are a lot of experts on the yen carry trade. Not sure how that plays out, but Nikkei rebounded significantly today. Apart from flows related to Japan, it’s clear the US faces many uncertainties and a slowing job market that is likely to result in recession. As the WSJ says today “The Easy Money Reckoning Arrives”

–Just a couple of other FF prices: FFF5 settled 9590 or 4.10% and FFF6 settled 9699 or 3.01%. These contracts roughly price end-of-year 2024 and 2025 as the FOMC meetings are typically late January or early Feb. At the June FOMC, the SEP projections for Fed Funds for end-of ’24, ’25 and ’26 were 5.1, 4.1 and 3.1. The market has moved the calendar a year forward from the Fed’s timeline! (but other than that, the estimates are SPOT ON!).

–Trade deficit today, and auctions kick off with the 3yr. 10s and 30s may have a bit of drama this time. Are tens a value at 3 3/4% given a new administration (whoever it is) that will feel the need to spend heavily?

Risk Management

August 4, 2024 – Weekly comment

************************************

My only real run-in with the risk management department was a long time ago at Refco, and it wasn’t really the risk department, it was the boss of that department, who simply said, “If you’re late on a margin payment ever again, you’re fired.” In those days they weren’t particularly tight on the rules, but even I was smart enough to know a line that could no longer be crossed.

Of course, I have friends who relate vivid stories of risk manager interactions. Invariably, and this is in the old days, it starts with: “And this clown, who doesn’t know ANYTHING about trading, is telling me to exit my position.” The first one relates to a couple of friends making markets in the euro$ option pit, who moved to a new firm. They were bleeding money, and felt the model at the new place wasn’t correctly calculating greeks for the front months. In the conference discussion about pricing models, the risk manager blithely said, “Your guys’ problem is that you’re losing $20 grand a day in time decay.” My friend had to be physically restrained from jumping across the table.

Another one was a friend who was short calls the risk manager wasn’t comfortable with, so the trader bought deep-in calls and sold an equal amount of futures and just pointed to the long calls to explain that he had covered the position, which of course he hadn’t. Bought a little time.

A third friend has the most practical approach. He said that almost everyone at every shop he has ever worked with hates getting a call from the risk manager. Always uncomfortable and adversarial. Not this guy. He says, when I see the risk guy’s number, I immediately answer and greet him like a long lost friend and ask how I can help; “I’d rather have an ally than an enemy in risk. That way he listens to my rationale for the position.”

The reason I mention the role of the risk manager is because of this: the prices in interest rate markets seem COMPLETELY crazy after Friday’s employment report. However, there were a couple of new, high-profile prognostications from out of left field: WSJ’s Nick Timiraos reports: “Citi and JPM now expect the Fed to cut rates by 50 bps in Sept, 50 bps in Nov, 25 in Dec.” Well. That was quick.

What happens now? A lot of risk manager “discussions” about cutting positions. Did it all happen on Friday? I doubt it. Let’s just look at something specific like SFRU4 9550 calls. At the start of the week you could have bought all you wanted at 1.0 or 1.25. SFRU4 had spent the early part of July around 9487.5, then had a nice pop after the CPI report, spiking to 9500. The next couple of weeks were spent between 9490 and 9498.5. Again, the 9550c just languished around 1. On Friday they settled 7.25 vs 9527.5. If I have no position, and walk in Monday, I am a seller at that price. A cut of 50 in Sept would imply ~9515, and absolute certainty of another 50 in November is worth 21 to 22 bps. The Sept FOMC on the 18th is AFTER the option settlement. Contract could MAYBE settle 9540 at the very outside. It’s what we call a gimme. However, we’ve forgotten about the shoulder-tappers. “What if they cut intermeeting?” CUT INTERMEETING ON ONE NUMBER? What are you, a moron? “What if WW3 starts?” THEN WE’RE ALL DEAD ANYWAY.

The question is, has risk been cut enough? The price doesn’t really matter. Because, if you sell these calls at 7, you have to be willing to sell at 10 and higher. Sometimes things just get stupid. Or “weird” to use the new favorite word of the bought-and-paid-for press.

A trade I had flagged as worthy of consideration (I didn’t personally execute any, but a smart guy at RJO got a client involved) is listed below. This traded on July 10, prior to CPI. (Hope you kept it NN!) This what I noted on July 11:

Another interesting curve trade, +10k SFRH5 9600c/-10k 0QH5 9700c for flat. Both calls settled 16.0, but the front is just 47 otm (9553) while 0QH is 73 otm as SFRH6 settled 9526.5. This trade works best on aggressive, forced easing. The roll is a headwind, as Z4 9600c settled 4.25 and 0QZ 9700c settled 9.25. (9520.5/9616.5).

Nice example of using midcurves in a curve trade. Typically they don’t work out like this one!

Here’s the history:

July 10:

SFRH5 9553.0

H5 9600c 16.0

SFRH6 9626.5

0QH 9700c 16.0

Call calendar settle ZERO

August 2

SFRH5 9642,5 +89.5

H5 9600c 57.25 +41.25

SFRH6 9697.5 +71.0

0QH 9700c 40.25 +24.25

Call calendar settle 17.0, while the futures calendar went from -73.5 to -55, a change of 18.5.

Another trade that went through in large size on July 9 or 10 was a buy of 50-60k SFRZ4 9525/9550cs for 6 to 6.5 ref 9520.5. Friday settle, 20.5.

Friend Tim O’Leary has often expressed disdain (yes, I think that’s the proper word) for all those that are trying to peg the near contract with tight butterflies. Had a call fly that tried to peg SFRU4 between 9500 and 9512.5 using 9518.75 or lower as top strike? It’s now a put fly. The six call strikes from 9487.5 to 9518.75 have 1.65 million of open interest and have all vaulted in-the-money. That’s a lot of fine tuning on a contract that only has 1.1 million open. SFRU4 was up 23 on Friday. The atm straddle settled 25.5 (9525 strike) vs the atm straddle on Wed, July 31 at 11.75 (9493.75 strike).

What to do now? Well, I think prices may be somewhat different from Friday’s settle by the time we walk in Monday. FFF6 sub-3% ? The contract settled 9704, up 32.5 on the day!

I feel as if 3% should be considered a soft cap on reds and greens (Contracts from Sept’25 to June’27). Peak settle on the SOFR curve Friday was SFRM6 at 9699. I would favor patiently working offers in green midcurve call spreads.

In blue midcurves I am a buyer of put spreads. Vol will most likely decline on any sell-off, but the calendars hint at relative weakness in blues (or back end of curve in general). For example, SFRZ7 settled 9690, which was up 18. That compares to SFRZ5 which settled 9693.5, +28.5.

**********

NOTE: I am not denigrating risk managers. (And to my peer brokers, denigrate means “put down”) Frankly, I’ve always been amazed at how well the CME and the clearing firms respond to rapidly changing conditions. The Fed could use some of these guys. I have to relate one more quick story of ‘old days’ risk management. I worked for a guy who had owned a small clearing firm at the CBOT; he cleared a bunch of grain locals. After crazy days he would stand at the floor entrance and watch his guys coming in the next morning. Anyone with glazed eyes was pulled off for a discussion.

BULLET POINTS FROM FRIDAY

*NFP just 114k. Rate leapt to 4.3%…last time here in late 2021.

*Yields imploded. The 2yr treasury sank 50 bps this week to 3.88%. 5’s fell 45 bps, 10s 40 and 30’s 34. Things are so volatile it’s not even worth being specific; for my purposes I’ll characterize the curve using old fractional conventions: Twos 3 7/8%, Fives 3 5/8%, Tens 3 ¾% and Thirties 4 1/8%.

*SFRU4/U5 down to -158 > 6 twenty-five bp eases

*October FF are now 9513.5. Current EFFR 5.33%. Cut of 25 is 5.08% or 9492. Cut of 50 is 4.83% or 95.17. October is essentially there…after MANY have said Fed should stay on hold thru year-end.

*I titled my July 23, 2024 daily missive: TU (2yr) calls for earthquake insurance. I wrote: “…worth considering buying TUU4 103c which settled 3.5 ref 102-14.

On Friday, TUU4 settled 103-186, and U4 103c settled 41. Even a blind squirrel….

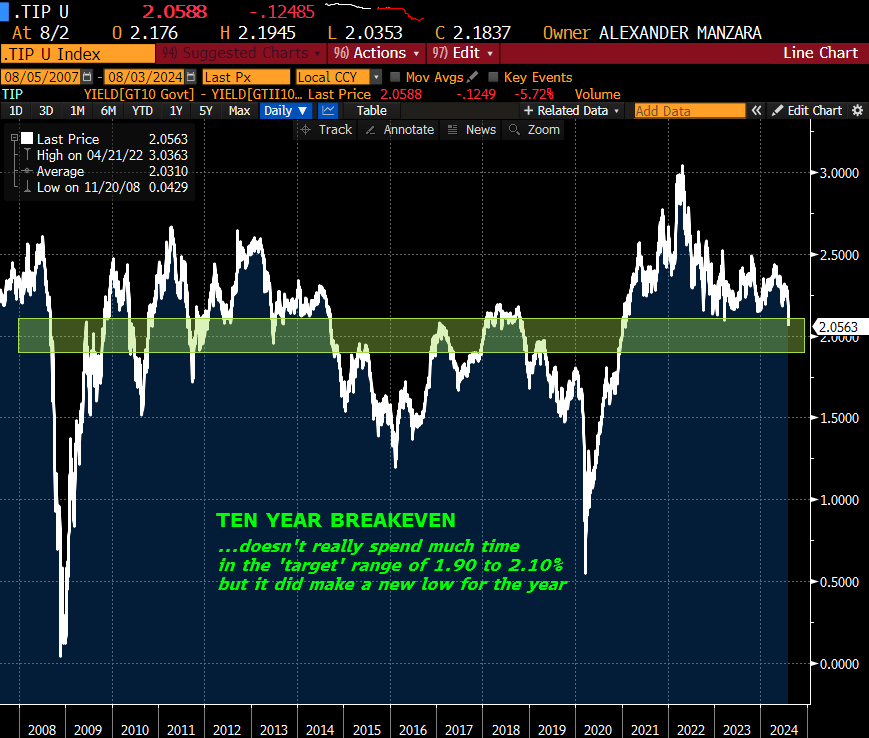

*New low in forward inflation measures, Below is a chart of ten-year breakeven; 204 bps on Friday, just at the upper end of pre-Covid levels.

| 7/26/2024 | 8/2/2024 | chg | ||

| UST 2Y | 438.9 | 388.0 | -50.9 | |

| UST 5Y | 408.0 | 362.5 | -45.5 | |

| UST 10Y | 419.8 | 380.0 | -39.8 | wi 379.5 |

| UST 30Y | 445.5 | 411.2 | -34.3 | wi 410.8 |

| GERM 2Y | 262.2 | 235.2 | -27.0 | |

| GERM 10Y | 240.7 | 217.4 | -23.3 | |

| JPN 20Y | 182.7 | 172.1 | -10.6 | |

| CHINA 10Y | 219.0 | 212.4 | -6.6 | |

| SOFR U4/U5 | -127.5 | -158.0 | -30.5 | |

| SOFR U5/U6 | -30.0 | -13.5 | 16.5 | |

| SOFR U6/U7 | -0.5 | 6.0 | 6.5 | |

| EUR | 108.60 | 109.11 | 0.51 | |

| CRUDE (CLU4) | 77.16 | 73.52 | -3.64 | |

| SPX | 5459.10 | 5346.56 | -112.54 | -2.1% |

| VIX | 16.39 | 23.39 | 7.00 | |