Roll Calls

August 30, 2024

*****************

–Yields rose as Q2 second estimate GDP proved stronger than expected at 3.0%. Weakest contracts on the SOFR strip were Z4 and H5, both down 3 on the day (9576 and 9627.5). Deferred contracts -2 to -2.5. The lean for a 25 bp cut rather than 50 at the Sept 18 FOMC increased, but the outcome is far from certain, and may have to wait for next week’s NFP for market expectations to solidify. Curve was stagnant, with 2s -2.7 bps to 3.89% and 10s -2.6 to 3.865%. 2/10 remains close to its recent high at -2.5 bps, threatening to dis-invert. FFV4 settled 9500.5.

–Today’s news includes PCE prices, expected yoy +2.5 to 2.6 (vs 2.5 last) and Core +2.7%. Powell downgraded the importance of the inflation mandate vs labor at Jackson Hole, so today’s data is not likely to shake things up unless there’s an outlier. Chicago PMI follows, expected 45.6 from 45.3 last.

–There were a flurry of late trades in TY options, mostly a roll of long October calls into December:

Sells on block

TYV 115.0c 10k at 22

TYV 115.5c 9k at 15

TYV 116c 15k at 9

all covered 113-28+, 70d

then new buys:

TYZ 116c 45 paid 30k

TYZ 117c 31 paid 30k

TYZ 111p 29-30 paid 30k

(deltas on 117c and 111p both 21, delta on 116c is 29

Net bias to upside.

TYX 114 straddle, paper sells 10,000 at 2-19 (settled 2’18)

**Abbreviated screen session on Monday’s holiday. Won’t be in.

NVDA approximately priced “right”?

August 29, 2024

*****************

–Stock futures sold off going into NVDA earnings, and fell further post-call, but are higher this morning. SMCI was down over 25% yesterday, though it rallied back with a loss of only 19% at 443.49. In March this stock traded over 1200, yesterday the low was just under 400, a drop of 2/3rds. Of course, its market cap is less than 10% of NVDA, but it’s still a dramatic move for a former darling.

–Rates were quiet. Net change on SOFR strip +0.5 to -1.0. Tens rose 2.3 bps 3.839% in front of today’s 7-year auction. Other news today includes Jobless Claims expected 232k and the 2nd revision of Q2 GDP. PCE prices are released tomorrow, expected 2.6% yoy with Core 2.7%, both up 0.1 from last month. TYV4 114^ settled 1’37 ref 114-025. To get the same vol all else equal on Sept 3, the straddle price would have to be 1’23…likely to be some weight on premium today and Friday.

Quart of Blood

August 28, 2024

*****************

–SFRU4 settled 9509.5 as the market modestly adjusted odds on easing. The lean is still for 25 rather than 50 at the Sept meeting, but it’s a pretty small bias. SFRU4/U5 settled at a new low -170 (9509.5/9679.5).

–The morning featured large TY call buys:

+50k TY wk1 114c cov 11330, with 49d, 33 paid. (1’06 in straddle). Settled 38 vs 114-03. Call OI +50k. Sept 6, NFP, expiry.

+17k TYV 114c cov 113-29.5, 49 paid (1’39 in straddle). TYV 114^ settled 1’38 (Call 54s)

–On Monday morning TYV 113p had been bought in size 50k for 18.

–Treasury curve steepened. 2’s fell a few bps in yield to 3.901% (good auction) while tens rose 1.7 to 3.833%. SFRH5 best performer, +4.5 to 9631.5, while H6 was up 1.5 to 9695.5 and H7 was unch’d at 9694.0. Five-yr auction today.

–Post settlement Gold (GCZ4) edged above 2560.

–The big news today is, of course, NVDA earnings. It’s like the Quart of Blood technique. Might be the longs, might be the shorts, but a quart of blood is gonna drop out of one side. Maybe both. Over $3T market cap trading at nearly 30x SALES.

Below is Corn priced in Gold…new ALL-TIME low.

Time to buy an RV? Or Rolex

August 27, 2024

*****************

–Last week PDD (parent of Temu) traded 150. Today, after warning on revenue, it’s 100. A BBG headline says this: crash “…Sends a warning on Chinese Economy” but it’s likely more than just China. Nasdaq Comp down 0.85%… NVDA reports Wednesday. Vast amounts of capital can appear or evaporate very quickly in this environment.

–Rates were quiet, though there were a couple of interesting large trades. SFRU4 9512.5/9518.75/9525c fly traded 0.25 about 20k and settled there ref 9507.75. The b/e is 9512.75 to 9524.75…pretty wide window with 23 days until FOMC. Why count the weekends instead of just trading days? Because a big geopolitical bomb could go off on any given day. As an aside, CLV4 up 2.59 yesterday to 77.42 on Mideast spiral.

–New low settle in SFRU4/U5 1-yr calendar at -168.75; traded as low as -172.5.

–Also a buyer of 50k TYV4 113p for 18, and then 112.75p, paid 18 for about 30k. New positions: TYV 113p settled 22 with OI increase of 36k and 112.75p settled 18 with OI +39k. On the day, total TY futures OI +91k to 5.522m. Bearish signal even though 10y yield only rose 1.7 bps to 3.816%. 2yr auction today, followed by 5’s and 7’s Wed, Thurs.

–Consumer Confidence expected 100.9 vs 100.3 last.

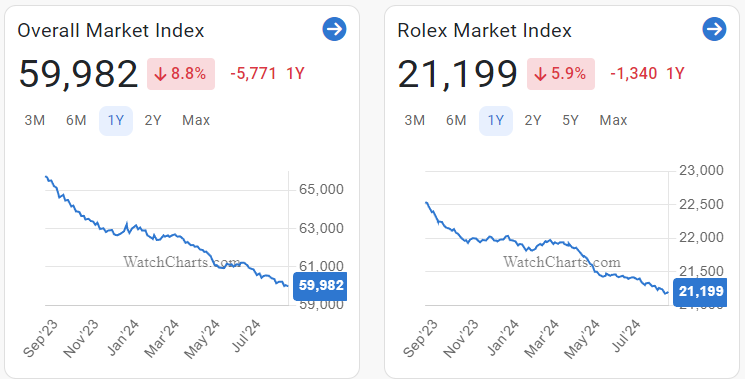

–Just a couple of anecdotal clips indicating that all is not well. The first is from watchcharts.com The luxury watch market is sliding (but at least it’s holding better than that Winnebago you bought post-covid!)

From ZH:

RV Downturn Turns Apocalyptic With Largest Dealership Offering 55% Discounts

LazyDays Holdings (GORV) an RV retailer, has seen its stock slip from 3 in December to 1.75 yesterday.

https://www.zerohedge.com/markets/rv-downturn-entering-apocalyptic-mode-largest-dealership-offering-55

Could NVDA earnings be the deciding factor for 25 or 50?

August 26, 2024

*****************

–Powell said “the time has come for policy to adjust”. That was last week’s story. This week the focus will be on NVDA earnings on Wednesday, or at least that’s what I am led to believe by scanning financial sites this morning. Dan Ives of Wedbush says NVDA earnings make this the most important week for the stock market of this year, and maybe beyond. I view that as somewhat fanciful, but we’ll see.

–New low settles on Friday in near SOFR calendar spreads. SFRU4/Z4 3-month spread settled -69, down 4 on the day (9509.5/9578.5). SFRU4/SFRU5 one-yr settled -168.5, down 7 on the day (9509.5/9678). While the market is undecided about whether the first ease next month will be 25 or 50 (currently leaning for 25) the easing post-election is being priced forcefully. The high contract on the SOFR strip is SFRM6 at 9697. I continue to view 3% as a soft cap on the forward part of the strip. It might not ultimately be the “terminal rate” but I think the market will be reticent to price for anything sub-2.5% in this cycle.

–2s, 5s and 7s are auctioned Tues, Wed, Thursday. PCE prices are Friday.

–Treasury rolls are in full swing, with about 550k TY rolled Friday, 32% complete as of Friday’s close.

Let’s Get Moving!

August 25, 2024 – Weekly Comment

**************************************

In the image below, that first guy, the one with the white hard-hat and the clipboard? That’s the interest rate futures market. The second guy that’s tagging along? That’s Powell. The pile of rocks is job losses and slowing growth, with the consumer getting buried.

First guy: “Look Jay, like I told you before, we’re going to have to use the front-loader to move these rocks. Get in there and start shoveling!” JP, “Can it wait for Jackson Hole?”

The graphical image in the futures market that is saying the same thing is the 6-month SOFR futures spread, SFRU4 to SFRH5. As can be seen on the chart below (which is only a six-mo range) in just three months from late May to Friday, the calendar imploded from -36.5 to a NEW LOW of -120.5. On May 29, SFRU4 was 9478.5 and H5 was 9515.5. Friday’s settles were 9509.5 and 9630.0. The current SOFR rate is 5.31 to 5.35. The rate on SFRH5 (ignoring compounding) is 3.70%, around 1- 5/8% lower than the current SOFRRATE. That’s a lot of easing front-loaded into a six month period.

In his Jackson Hole speech Powell said, “The time has come for policy to adjust.” The SOFR futures calendars have increasingly been telegraphing that message, which Powell has now overtly blessed. He stressed concerns about labor conditions as opposed to inflation. Fire up the Komatsu. (We bought it back in June as it became apparent we’d need it, when $/yen was 157).

In an interview Thursday, following the BLS downward revision of -818k from the originally reported payroll numbers, KC Fed President Schmid shrugged off the massive miss, and said it didn’t really change the broad strokes of his outlook. He deemed the labor market as relatively strong.

On the chart above, I note the last three NFP releases. There is clear deterioration, accentuated by lower revisions of the data in both June and July. The new narrative is that illegal immigrants are adding to jobs through “under-the-table” arrangements, so payrolls are being under-counted. I suspect it’s pretty tough for a company of any size to pay cash to employees with no benefits. Is it worth the risk? My guess is that the undercount is not relevant with respect to trend. And if I’m wrong, using lower cost labor is clearly deflationary.

The chart below shows the same SOFR spread on a rolling basis, along with the greenback (DXY). So, while the spread is currently represented by SFRU4 to SFRH5, before mid-June it was SFRM4 to SFRZ4, etc. Over the admittedly short time frame of the past year, the spread and DXY are well correlated. Both DXY and the calendar made new lows Friday. DXY has plunged from 106.05 to 100.72 just since the end of June, though $/yen at 144.37 hasn’t quite taken out the early Aug low of 144.18.

Takeaways from the above are 1) there is currently a LOT priced for near-term easing. 2) following expected aggressive easing, the rate of change slows significantly. While U4/H5 is -120.5, the next 6-mo spread, H5/U5 is -48, and then U5/H6 is -16. 3) if easing is currently being priced too enthusiastically, the dollar will likely stop declining. 4) markets are quite volatile.

The most important news of this week will likely be PCE prices on Friday. Q2 GDP revision is Thursday. On a yoy basis, both PCE prices and Core are expected to be 1/10th higher than last, at 2.6% and 2.7%. Keep in mind, the payroll data has now become more important. Next NFP is 5-Sept. Currently expected 155k. If one has a conspiratorial bent with respect to data massaging, this report will be a big one.

Note that Oct FF settled 9501, up just 2.5 bps on the week. Current Fed Effective is 5.33%. A cut of 25 is 5.08% (9492) and a cut of 50 is 4.83% (9517). The midpoint is 9504.5, so the market leans slightly towards just 25 at the September 18 FOMC. (Btw, on Aug 5, FFV4 settled exactly at 9517). Payrolls will likely be a deciding factor. April 2025 is a “clean” FF contract in that there is no FOMC in that month. Similar in price to SFRH5 it’s 9628 or 3.72%. Obviously FFJ5 will adjust like any other contract to NFP. But just for fun, let’s say the Fed only goes 25 in Sept, but FFJ5 remains around its current price. That would mean FFV4 settle 9492 with FFJ5 still 9628, a difference of 136 bps. There are four FOMCs in that period: 7-Nov, 18-Dec, 29-Jan and 19-March. Fifty bp cuts are coming. But if you think the max move by the Fed will be increments of only 25, then FFJ5 is too damn high! Same with SFRH5.

| 8/16/2024 | 8/23/2024 | chg | ||

| UST 2Y | 406.2 | 391.0 | -15.2 | wi 387.3 |

| UST 5Y | 376.2 | 364.7 | -11.5 | wi 3.623 |

| UST 10Y | 389.0 | 379.9 | -9.1 | |

| UST 30Y | 415.1 | 410.1 | -5.0 | |

| GERM 2Y | 243.3 | 237.4 | -5.9 | |

| GERM 10Y | 224.7 | 222.5 | -2.2 | |

| JPN 20Y | 169.0 | 170.1 | 1.1 | |

| CHINA 10Y | 219.0 | 215.5 | -3.5 | |

| SOFR U4/U5 | -155.5 | -168.5 | -13.0 | |

| SOFR U5/U6 | -22.0 | -19.0 | 3.0 | |

| SOFR U6/U7 | 3.0 | 7.0 | 4.0 | |

| EUR | 110.20 | 112.11 | 1.91 | |

| CRUDE (CLV4) | 75.54 | 75.54 | 0.00 | |

| SPX | 5557.74 | 5634.61 | 76.87 | 1.4% |

| VIX | 14.70 | 15.86 | 1.16 | |

Powell at Jackson Hole

August 23, 2024

*******************

–Yields rose with tens up 8.4 bps to 3.86%. In yesterday’s note, I mentioned that SFRH5 and M5 were the stars, both rallying 10 bps on Wednesday. Those moves were reversed yesterday: H5 fell 10.5 to 9620.5 and M5 -11 at 9650. Positioning is predicated on Powell’s Jackson Hole comments, which occur today at 10:00. A link to the KC Fed is below, for viewing of Powell’s speech.

–KC Fed President Schmid, in an interview yesterday with Steve Liesman, noted that the labor market is still relatively strong and there’s “more work” to do with respect to inflation. Clearly there are a range of views within the Fed. Yesterday FFV4 settled 9498, edging closer to 9492 or 5.08%, which would be the new target on an ease of 25. Having said that, there is still large buying of SFRU4 call spreads — just in case the Fed cuts 50. For example, SFRU4 9531.25/9543.75cs 0.5 paid for about 100k. This trade requires high odds of 50 bp cuts both in Sept and Nov. The high print on August 5 in SFRU4 was 9547.5, though the settle that day (high sett of the month) was 9528.5.

–It’s three and a half weeks until the Sept 18 FOMC. A lot can happen, no matter what Powell says, though I expect him to lean towards 25 bps. If he goes a step further and implies that future eases of 50 are unlikely, I suspect that stocks will have a negative reaction. Sept treasury options expire today. TYU4 settled 113-09+. Peak OI in calls is still the 112 strike with 125k, the 112p settled cab so it’s all intrinsic. Next highest is 113.5c with 60k open. Settled 7. I suspect we’ll pin that strike. Put open interest is pretty sparse.

.

https://www.youtube.com/KansasCityFed

Just call…but ask POLITELY

August 22, 2024

*****************

–Yields continued to drop with tens down 4.2 bps to 3.776%. Curve steepened, with twos down 7.6 bps to 3.92%. On the SOFR strip SFRH5 and M5 were the stars, both closing +10 (9631 and 9661). Again, just looking at M5 yield, it’s 3.39% – nearly 200 bps lower than the current midpoint of the FF target of 5.375%. Steeper SOFR curve illustrated with March contracts: H5 +10 at 9631, H6 +8.0 at 9694, H7 +5 at 9695 and H8 +3.5 at 9686.5. Every contract from H6 back is nearing 3%.

–New low settle in SFRU4/U5 one-year calendar at -166.75 (9511.25/9678). New low in U4/Z4 at -68.25. While the financial press dutifully reports that the FOMC minutes (released yest) support the idea of a rate cut, the market is projecting AGGRESSIVE easing over the next few quarters. If one has already positioned for that outcome, (and has perhaps called the BLS for an early tip on the benchmark job revisions), then one might use market strength as an opportunity to unwind large longs. Early exit sales of 20k Z4 9600/9700c 2×3 at 15.0 and 50k H5 9675/9775cs 1×1 at 12.0. Settles in Dec were 14.75 and 4.25 so 16.75 in 2×3 and 20.0, 6.5 so 13.5, OI down 22k, 38k, and 50k in both H5 options. I am NOT saying this account had the BLS revision early, however, it was reported that during the long delay awaiting the ultimate -818k revision to payrolls, sev’l shops reportedly called the BLS and were given the data over the phone (by Todd, in accounting, who had already positioned accordingly). Can’t blame Commerce Sec’y Gina Raimondo for any insider trading, she’s not even familiar with the BLS.

–The market is awaiting Powell’s testimony to determine a strong lean for 25 or 50 bp cut at the Sept 18 FOMC. FFV4 settled 9501.5, a slight bias for only 25 (9504.5 is the “pick-em” level). As friend JJ (metals, oil and everything else, on Substack) says: “…the committee will be cutting into a stock bubble, a bear market in dollars and all-time highs in gold; three powerful trends that will be contemporaneously accelerated and highly counter-productive to each other!” $/yen late was 144.53, pressing lows.

–I’ve attached a chart of SFRU4/Z4/H5/M5 condor. New low. Sept/Dec is -68 and H/M is -30. If the market knew with CERTAINTY there would be a 25 bp cut each quarter, then, simplistically, every 3m calendar would be -25. No matter what Powell does in Sept, the mkt is expecting the axe to come out post-election.

–Today’s news includes Jobless Claims expected 230k. S&P Comp PMI expected 53.5 from 54.3. Existing Home Sales. Jackson Hole has started, Powell tomorrow at 10:00 am. If you call the Fed first, and ask politely, maybe they will release the text to you early.

Let’s all be a little bit more like Rick Monday today:

Official recognition of weaker labor conditions

August 21, 2024

********************

–Yields dropped Tuesday as Philly Fed Services fell to the lowest level since 2020 at -25.1. Tens down 4.7 bps to 3.818%. On the SOFR curve, June and Sept’25 were leaders, settling +8 (9651 and 9669). Today’s news includes BLS benchmark nonfarm payroll revisions. Estimates range from a downward revision of 400k to 1 million in the year ended March. From BBG: “There are a number of caveats in the prelim figure, but a downward revision to employment of more than 501,000 would be the largest in 15 years and suggest the labor market has been cooling for longer – and perhaps more so – than originally thought.” Notable weakness in DXY as rates eased.

–20 year auction today as well, followed by FOMC minutes.

–Flows were generally weighted towards an easier Fed. Powell speaks at Jackson Hole on Friday at 10:00 on the Economic Outlook. Exit seller of 60k 0QU4 9650p 8.0 to 7.5, settled 7.0 vs SFRU5 9669.0. Buyer of 30k 0QU4 9687.5/9700cs vs selling 9625p at flat. Call spd settled 3.0 and put at 1.75.

–October FF settled 9499.5, still leaning a bit closer to a 25 bp ease rather than 50 at the Sept FOMC (9504.5 is the dividing line). However, SFRU4/SFRZ4 spread is near -65. (9506.75/9571.5) a huge inversion for a three month period. And SFRH5 is at a price of 9621, a yield of just 3.79%. The market is pricing serious easing post-election.

As mentioned, U4/Z4 is -65, but U5/Z5 is -10.5 (9669/9679.5), U6/Z6 is 0 (both 9690.5, the peak of the SOFR strip) and U7/Z7 is +2 (9687.5/9685.5).

The whole yen, recession, emergency ease thing was just… nevermind

August 16, 2024

*****************

–Retail sales expected +0.4 and actual +1.0%, enough to send SOFR contracts hurtling lower from precarious highs. Leader was SFRM5 which ended -20.5 at 9639.5; I had highlighted the settlement of 9661 the other day as being around 200 under the current FF target midpoint. The two-year yield jumped 15 to 4.097% while tens rose 10.5 to 3.923%. Odds for a 50 bp cut are slipping away, with FFV4 settling 9498.5, down 3 on the day. A cut of 25 bps at the Sept meeting would put FFV4 at 9492.0

–NDX partied like it was Nov of 1999, +2.3% yesterday. From Nov’99 to March’00 CCMP went from 3000 to 5000. Maybe that’s the analog.

–Buyer of 50k TYV4 113.5p for 58 covered 50d vs 113-17, straddle price of 154 which is where the Oct straddle settled. Open interest in the put increased 44.5k.

–A friend sent the following link yesterday, regarding employment in the transportation sector.

https://www.bts.gov/newsroom/us-cargo-and-passenger-airlines-gained-200196-jobs-june-2024

| U.S. Cargo and Passenger Airlines Gained 200,196 Jobs in June 2024 | Bureau of Transportation StatisticsU.S. airline industry (passenger and cargo airlines combined) employment increased to 1,002,700 workers in June 2024, 200,196 (24.95%) more workers than in May 2024 (802,504).www.bts.gov |

Looks official. Next time you see labor stats, economic data, or a political poll, just remember that in June 2024, Fed Ex doubled its workforce, adding 198k jobs to a total of 438k. Does that data look correct? Is that filtered into NFP?

–Chicago Dem Convention starts next week. No missives for the next few days, I’m leaving town.

Here’s The HU. Good way to start the trading day. Mongolian Metal. I don’t understand it, but I like it. And if played at the right volume, it’s appropriately mind-numbing.