Decades happen in weeks

September 10, 2024

*********************

–Yields little changed on a reactive flattening day after Friday’s steepener to new highs. 2/10 remains above 0 at 3.2, with 2s up 1.3 bps to 3.665% and 10s down 1.3 bps to 3.697%. A couple of large option plays capture the election: +50k SFRX4 9612.5/9625cs 2.5 to 2.75, settled 2.5 ref 9591.0 in SFRZ4. New position, expires Nov 15, just past the Nov 1 payroll report, Nov 5 election and Nov 7 FOMC. In tens, buying of TYZ4 117.5 and 118c. 117.5c settled 39 with OI +11k and 118c settled 32, OI +19k ref TYZ4 115-015. These options expire Nov 22.

–Debate tonight. How’s this? Debate is a mess, stocks take another big tumble, Biden resigns to make Harris the new President, an ‘apolitical’ Fed cuts 50. “There are decades where nothing happens, and there are weeks where decades happen.” Lenin.

–3 year auction today, followed by 10s and 30s Wed and Thurs. Sept SOFR midcurves expire Friday.

SFRU4 9512.5^ settled 7.5 ref 9510.5

0QU4 9700.0^ 15.5 ref 9705.0

2QU4 9712.5^ 12.5 ref 9714.5

3QU4 9700.0^ 12.5 ref 9703.0

On Thursday prior to NFP, SFRU4 9512.5^ settled 13 ref 9512.25. Pretty accurate as Friday’s range was 9501.75 to 9524.25. 0QU 9687.5^ settled 25.5 ref 9692.5; contract had a range of 30.5 from 9681 to 9711.5.

In: Eurodollar Options

Pricing looks aggressive…for a reason?

Sept 8, 2024 – Weekly Comment

(NOTE: the Sept 9 daily note is BELOW. Out of order on days)

******************************************************************

Let’s start with October Fed Funds, the contract which most closely prices the September 18 FOMC. It settled 9499.5, down 2.5 on the day and unchanged on the week. Volume was a whopping 935k, but open interest barely changed, down 4k at 571k. Almost seems boring in terms of net price changes. However, Friday’s range was 9497 to 9512. Huge for a one-month contract near expiration.

On a 25 bp cut, EFFR should move from current 5.33% to 5.08% or 9492. On a 50 bp cut, EFFR should go to 4.83% or 9517. So, Friday’s range faded the two extremes by exactly 5 bps either way. The midpoint between 25 and 50 is 9504.5, so the settlement is favoring just 25.

Both Williams and Waller blessed a cut at the September meeting. A couple of excerpts from their speeches:

Williams (clear on a cut, but in terms of size, I would lean towards 25):

With the economy now in equipoise and inflation on a path to 2 percent, it is now appropriate to dial down the degree of restrictiveness in the stance of policy by reducing the target range for the federal funds rate. This is the natural next step in executing our strategy to achieve our dual mandate goals. Looking ahead, with inflation moving toward the target and the economy in balance, the stance of monetary policy can be moved to a more a neutral setting over time depending on the evolution of the data, the outlook, and the risks to achieving our objectives.

Waller (overall, more forceful than Williams. If we’re going to start, let’s start with 50. That’s my read. However, the market is suggesting caution on the first cut).

I believe our patience over the past 18 months has served us well. But the current batch of data no longer requires patience, it requires action.

But I also believe that maintaining the economy’s forward momentum means that, as Chair Powell said recently, the time has come to begin reducing the target range for the federal funds rate.

Furthermore, I do not expect this first cut to be the last. With inflation and employment near our longer-run goals and the labor market moderating, it is likely that a series of reductions will be appropriate. I believe there is sufficient room to cut the policy rate and still remain somewhat restrictive to ensure inflation continues on the path to our 2 percent target.

As of today, I believe it is important to start the rate cutting process at our next meeting. If subsequent data show a significant deterioration in the labor market, the FOMC can act quickly and forcefully to adjust monetary policy.

If the data suggests the need for larger cuts, then I will support that as well. I was a big advocate of front-loading rate hikes when inflation accelerated in 2022, and I will be an advocate of front-loading rate cuts if that is appropriate.

It was the “front-load” phrase that popped FFV4 up to 9512, but prices quickly retreated.

Now let’s look at SFRU4. On the day it settled -1.75 bps at 9510.5, up 2.25 on the week. Volume was the most of any SOFR contract at 1.7 million. Open interest fell by 44k to 1.3 million. Though open interest in calls fell by 97k, there are still 6.4 million open, max being the 9525 strike with 620k. That call settled 1.0. Expiration of Sept options is Friday. SFRU4 9500p settled 0.25.

SFRM4 is still trading, but has now been pegged by SOFR settings of the past three months. It settled 9463.0. Simplistically, add 25 or 50 and get 9488 or 9513. Then add about 23% of the expected move for the November 7 FOMC, as that date is a bit more than halfway through the contract term. At extremes, I would say 25 and 25 would yield a final settle around 9494 and 50 and 50 would be around 9524.5. Cuts of 25 and 50 would be in the neighborhood of 9500. In a way SFRU4 appears slightly expensive.

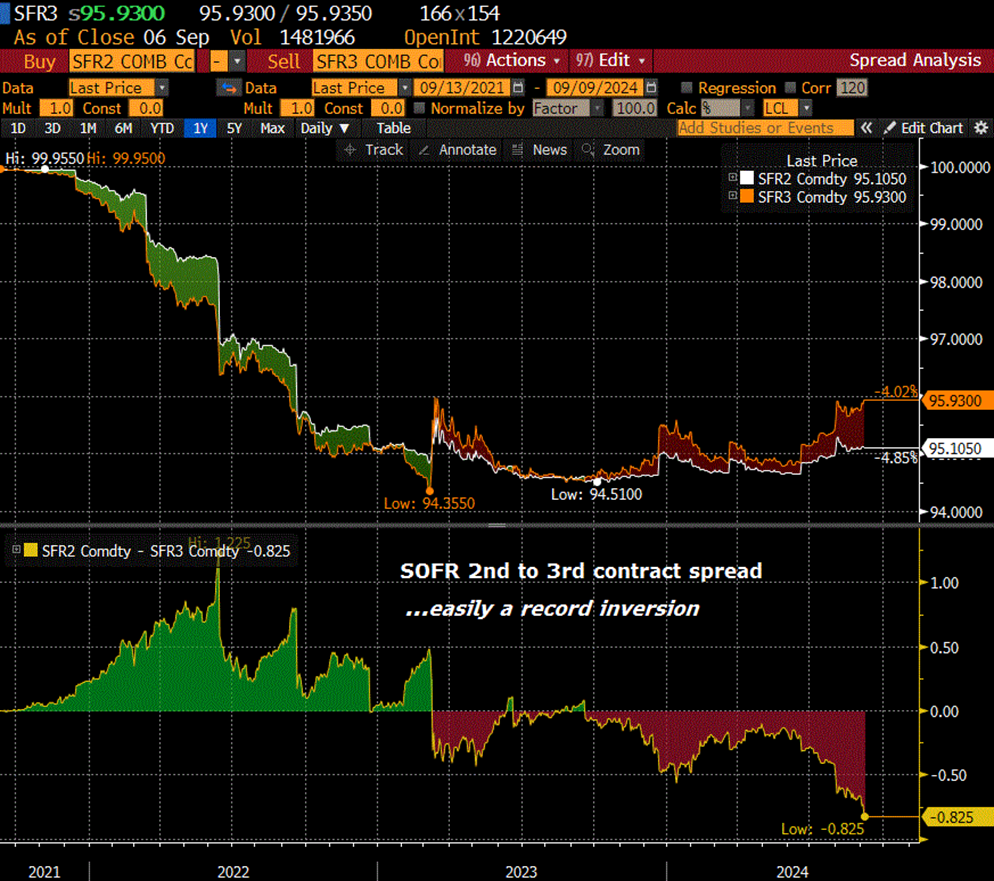

However, consider the next few contracts. SFRZ4 settled 9593.0, up 7.0 on the day, and 18.5 on the week; a new high settle (since Feb). U4/Z4 calendar settled -82.5, easily the most inverted a 3-month SOFR spread has traded.

The market obviously took Waller’s ‘front-loading’ comments to heart. SFRU4 to SFRH5, just a six-month spread, settled 9510.5 to 9656.5, nearly 1.5% of inversion. Extremely aggressive. However, SFRH5 at its high on Friday (9667) didn’t quite exceed the Aug 5 high of 9670.5, even though the settlement was higher.

SFRM5 DID exceed the August 5 high of 9695, posting a top price for the year of 9698 and a settle of 9691.0. 3.09% by next summer! SFRU5 also made a new yearly high and settle at 9711.5 and 9707.5s. The peak contract on the SOFR strip moved forward one slot to SFRH6 which settled 9718 against a high of 9719.5. This contract posted a low of the year at 9566.5 on April 30. It has rallied over 150 bps without an actual ease.

Now observe the chart below. It is the sixth quarterly (rolling) EURO$ contract back in 2007 to 2008. Prior to the first ease (of 50 bps) back in Sept 2007, the contract rallied from a low of 9450 to just above 9550. One hundred bps in a few months. I’ve noted the corresponding level on the chart with a helpful, “You Are Here” tag. From the September 2007 FF target of 5.25%, the Fed cut to 2% by the end of April 2008, 325 bps in a little over seven months. By the way, the sixth quarterly ED contract reached 9800, or 2% in March 2008.

I’ve argued it isn’t the same, that the household sector in aggregate is in much better shape than 2007, that it’s the government sector we need to be worried about, that the ‘terminal’ FF target shouldn’t be much below 3% this time around. However, the affluent sector of households that we’re all depending on to keep the economy chugging into a soft landing is heavily exposed to stocks and private equity. Maybe aggregate household leverage isn’t the same as 2007, but a rapid reset in equity values of the sort that we’re STARTING to see will erode confidence.

The real risk is that fiscal stimulus is dialed back in the new year. Seems unlikely that the private sector will be able to plug the hole.

News this week includes 3, 10, and 30yr auctions Tuesday, Wednesday and Thursday.

Consumer Credit for July is released Monday afternoon, expected $12b (old data)

CPI is on Wednesday expected 0.2 both headline and Core, with yoy 2.6% from 2.9% and Core 3.2% from 3.2%

PPI on Thursday, along with Q2 Z.1 report which includes Household Net Worth. That figure will be at a new record high as SPX rose about 4.5% in Q2. Just eyeballing it, a reversion to the trend from 2011 through 2019 would likely put this number (nominally) at $130T. In Q1 it was $152T.

| 8/30/2024 | 9/6/2024 | chg | ||

| UST 2Y | 392.3 | 365.2 | -27.1 | |

| UST 5Y | 371.3 | 349.0 | -22.3 | |

| UST 10Y | 390.9 | 371.0 | -19.9 | wi 370.8 |

| UST 30Y | 419.6 | 401.8 | -17.8 | wi 401.8 |

| GERM 2Y | 239.2 | 223.0 | -16.2 | |

| GERM 10Y | 229.9 | 217.2 | -12.7 | |

| JPN 20Y | 170.9 | 165.8 | -5.1 | |

| CHINA 10Y | 217.8 | 213.8 | -4.0 | |

| SOFR U4/U5 | -164.3 | -197.0 | -32.8 | |

| SOFR U5/U6 | -18.0 | -7.5 | 10.5 | |

| SOFR U6/U7 | 9.0 | 13.5 | 4.5 | |

| EUR | 110.51 | 110.86 | 0.35 | |

| CRUDE (CLV4) | 73.55 | 67.67 | -5.88 | |

| SPX | 5648.40 | 5408.42 | -239.98 | -4.2% |

| VIX | 14.96 | 22.38 | 7.42 | |

Ease now, ease (more) later

Sept 9, 2024

**************

–Though Friday’s employment data wasn’t soft enough to convince the market of a 50 bp cut at next week’s FOMC, deferred SOFR contracts made new highs. For the record, NFP was +142k and the Unemp Rate was 4.2%. Action was primarily in SOFR contracts; ten year yield fell only 1.5 bps to 3.71%. TYZ4 closed +8.5 at 115-005. Pre-data TYZ4 115^ was 3’02/3’04, it immediately sank to 2’57/2’59 and settled 2’59. TYV4 115^ went from 1’33 to 1’15. This week’s main events are the Presidential debate tomorrow, CPI Wednesday and treasury auctions of 3s, 10s, 30s starting tomorrow.

–As noted on weekend piece, SOFR spreads recorded extreme closing levels. SFRM5 was the star performer, closing +16 at 9691, or 3.09%, vs current FF of 5.25-5.5%. SFRU4 settled -1.75 at 9510.5, but SFRZ4 was +7.0 at 9593. The 3-month spread of -82.5 bps is easily a new low. The message seems to be, ‘if the Fed doesn’t ease 50 at the Sept meeting, then it may have to cut more forcefully post-election.’ SFRU4/SFRU5 settled with nearly 200 bps of inversion: 9510.5/9707.5 or -197. FFV4 settled -2.5 at 9499.5, leaning closer to a 25 bp ease (9492 or 5.08%). FFF5 which captures FOMCs on Sept 18, Nov 7 and Dec 18 settled 9584.0 or 4.16%. Current EFFR is 5.33% so that’s 117 bps of ease over three meetings.

–If the buying was all up front (H5, M5, U5 strongest) then it makes sense that the curve steepened from there, which indeed it did. 2/10 at new high near +6 bps, with 2’s -9.4 bps to 3.652 and 10’s down 1.5 at 3.71%. 5/30 spread also posted a new high at +53. Ten-yr breakeven ended just above 2% at 2.036.

–Markets are pulling back this morning. TYZ4 prints 114-20 which is under Thursday’s close of 114-24. Stocks have rebounded as $/yen has popped from Friday’s drubbing, now 143.48. Today’s news includes Consumer Credit for July, a lagging piece of information, but it still may provide hints on the state of the consumer. Expected +$12b.

Got a lot priced in

September 6, 2024

********************

–Big data today: NFP expected 165k vs last of 114k. Unemp rate expected 4.2 from 4.3.

–October FF settled 9502, a slight bias for 25 bps at the Sept 18 meeting. SFRU4 settled 9512.25. High settle Aug 5 in FFV was 9517, exactly pricing a 50 bp cut. High settle in SFRU4 on Aug 6 was 9528.5. I think today’s range will be capped by 9525 to 9529 on weak data and will have a floor of 9503 to 05. My guess for ultimate settle on 13-Sept is 9525 to 30. I think today’s data will be weak and given that the FOMC is 2 days after what is likely to be a contested election marked by sporadic violence, I think the market will lean heavily for another 50 in Nov.

–Ten year breakeven made a new low just above 2%; I marked at 2.045.

–Seller of 50k SFRH5 9675/9750/9775/9850 at 9.25 (exit of 9675/9775cs and now long 9750/9850 which settled 6.5 ref 9643). Market obviously expecting (or fearing) large eases. Consider SFRM5 which settled 9675 or just 3.25%. The M5 9875c settled 12.5, 125 otm, a strike price of 1.25%. The equidistant put, the 9550 strike, which is STILL lower than the current FF rate by 75 bps, settled 4.5. New low in SFRU4/U5 1-yr calendar at -180.25 (9512.25/9692.5).

–One interesting trade, buyer of Wednesday Week-2 (Sept 11) 113.75p for 10 in size 12k. The 113.5p also traded 19k. Settles were 11 and 7 vs TYZ4 114-24. Apart from being a solemn anniversary, CPI and 10y auction are on that date. (Hard to find these settles on CME website, symbol is WYW near the end of the Treasury Daily Bulletin page).

–Best of luck today.

Pressing into NFP

September 5, 2024

********************

–Impressive strength in short-end rate contracts as JOLTs continues to make new lows. From a high in job openings of 12182k in March 2022, it’s now 7673k. For the sake of comparison, pre-covid high in late 2018 was 7594k. SFRM5 was the strongest contract on the strip, settling +16 at 9674.0. Highest settle in this particular contract since Jan 12 at 9681.5.

–A lot of recent extremes posted on Wednesday, somewhat surprising in front of NFP tomorrow:

New low SFRU4/Z4 -74.25 (9513.25/9587.5) Post-election the Fed’s axe is going to swing?

New low SFRU4/U5 -177.75 (9513.25/9691) Nearing the low of any 1-yr calendar which I believe was -192

New high settle SFRM5…strongest contract on the strip +16 at 9674. Yield of 3.26 is 200 bps below the low end of current FF target 5.25%

New high SFRM6 9706… pressing thru 3% and highest in this slot since the regional banking crisis in Q2 2022. SFRM6 is currently the PEAK contract on the SOFR strip.

New high 2/10 just above zero, highest since July 2022. (3.766/3.767)

New high 5/30 50 bps, highest since March 2022…(which is when the hiking cycle started)

New low 10yr breakeven (treasury – tip) at 206.6 bps.

–There was quite a bit of trade in week-1 (expiring tomorrow) TY puts. TYZ4 settled 114-18, I think BBG might be making a big deal out of a buy of 50k wk1 112.5p bought for 1. It was a cover, as OI fell 48k. 113.25p settled 2, OI rose 12k on 30k of volume. Closer to the money, 114p settled 13, traded 42k and OI was up 13k. The 114 strike is somewhere around 8 bps otm. Not nearly as much call volume. Wk-1 115c settled 15, traded 26k and OI rose 12k. A price of 28 for a 1-point 114/115 strangle is pretty juicy, but for now we’ll just chalk it up to uncertainty.

–News today includes ADP expected 145k, Job Claims 230k, S&P Global PMI Comp 53.9 vs 54.1. ISM Services 51.4 from 51.4

As a follow-up to yesterday, Cap Goods Orders nondef ex-air was -0.1 and Shipments were -0.3…continued weakness

–Are they stopping us?

I think a price of 9674 in SFRM5 is sort of crazy. But I felt the same way 10 to 15 bps lower. There was a new buyer of 10k SFRM5 9700c for 33.5. This is when a pure trading mentality takes over…the fundamentals are nebulous. The only question is, are there sellers stopping the buyers. We’re not thinking about the actual PRICE, just whether or not it goes up from here.

https://x.com/concodanomics/status/1831384368407023933

Large Amount of Capital Vanished

September 4, 2024

********************

–Treasuries bid on weakness in equities. SPX down 2.12%, Nasdaq Comp -3.26% and NVDA -9.5%. Crude oil (CLV4) plunged 3.21 to 70.34, and as of this note is sub-70 at 69.93. I’d wager that if we get a few more days like this in stocks, the Fed will cut 50, but for now the bias is still for just 25. FFV4 settled +2 at 9501.5; the dividing line for 25 or 50 is 9504.5.

–SFRZ4 settled +1.5 at 9576, but there was a large exit of 40k SFRZ4 9525/9575cs around 43 bps. Price of 9576 is 4.24% yield. We’ll get a new SEP at the September FOMC, but in June the Fed’s estimate of end-of-year FF was 5.1%. For end of 2025 it was 4.1%…the market has moved that timetable up by ONE YEAR! Well, not exactly, FFF5 settled 9570 or 4.30%.

–Today’s news includes Trade Balance and JOLTs, expected 8100k. Capital Goods orders and Shipments as well, along with Beige Book in the afternoon. In an interview on Thoughtful Money, Lacy Hunt mentioned Capital Goods Shipments (ex-defense and air) as a key economic component, and noted that July’s data had been revised lower, making the nominal value lower than it was in Q2. The softness in CapEx, even across tech shipments, is a negative development for forward growth. On the link below, 46:00 to 48:00 minute.

TYZ call buying

September 3, 2024

********************

–Friday featured higher yields, with 10s up 4.4 bps to 3.909% and 30s up 4.6 bps to 4.196%. 2/10 spread once again threatening to go positive, ending at -1.4 bps. On 7-Aug this spread reached -2.5 bps; these are the highest levels since July 2022. For now, it can be considered a double top with the interceding low on 19-Aug at -20 bps. However, the upward trend this summer has been powerful, having rallied from -50 in late June. Buy pullbacks.

–Some reasonably large new buys in TYZ calls Friday: TYZ 116c covered 113-165, 39 paid 10k. TYZ 117c 28 paid 9k. TYZ 116.5/117c stupid cov 113-19 with 50d, 61 paid 12k. With TYZ4 113-18s calls were 40, 33, 27 at settle.

–News today includes ISM Mfg, expected 47.5 from 46.8. Construction Spending 0.1 from -0.3.

Treasury yields since the start of 2024

September 3, 2024

********************

Treasury yields since the start of 2024

Sept 3, 2024

************

At the QRA in October 2023, Yellen loaded issuance with t-bills rather than coupons. Along with other factors, the result was a huge decline in yields into the end of December, accentuated by Powell’s dovish pivot at the December FOMC.

As the charts below show, 5’s tumbled from just under 5% to 3.8%.

Tens went from exactly 5% to 3.8%. And the 30-yr went from just over 5.1 to 3.93%. This year saw a rebound in yields into April, and now a renewed decline, as labor market conditions decelerate.

I think it’s instructive to look at end-of-year lows vs the current decline. Fives have edged to a lower level, but tens held the Dec low and are tentatively edging higher, and 30s never really reached end-of-year lows. The differences aren’t exactly dramatic, but they do reinforce the theme of curve steepening, and make buying the long end a bit problematic, at least until new lows in yields are actually made. Until then, 3.95% should be considered a floor for the 30yr bond yield.

SOFR OPEN INTEREST IS RELATIVELY LOW

September 2, 2024

********************

Anyone have a good reason for this??

Sept 2, 2024

In 2018 the Fed was gently hiking rates. Peak FF level was 2.25 to 2.5%.

At the time, PEAK OPEN INTEREST in eurodollar futures (aggregate) reached over 18 million as the chart below shows.

(blue line is aggregate open interest. ED1 is rolling first quarterly Eurodollar contract)

Eurodollars are now long gone, replaced by SOFR contracts. SOFR futures aggregate open interest is near a record, but it’s only 11.276 million in total. As the chart below shows, that’s with the Public Debt increasing 16% in two years.

I’m assuming 2y, 5y and 10y treasury futures have siphoned off a lot of open interest that might have otherwise gone into SOFR. All have recently hit record highs, TU 4.49m contracts, FV 6.95m and TY 5.516m. In fact, in 2018 when ED open interest surged, FV OI peaked at 5.076m. Last month’s FV peak OI was 37% higher. Perhaps ERIS SOFR swaps have taken a share.

One of the trades that has been lost is ED contracts vs Treasuries, as the credit aspect of STIRS was eliminated with SOFR.

I’m not drawing any big conclusions, just posting for interest.

(white line is 3rd contract slot, currently SFRZ4. Blue line is aggregate open interest. Purple in lower panel is public debt).

Nominal might be more real than Real

September 1, 2024

********************

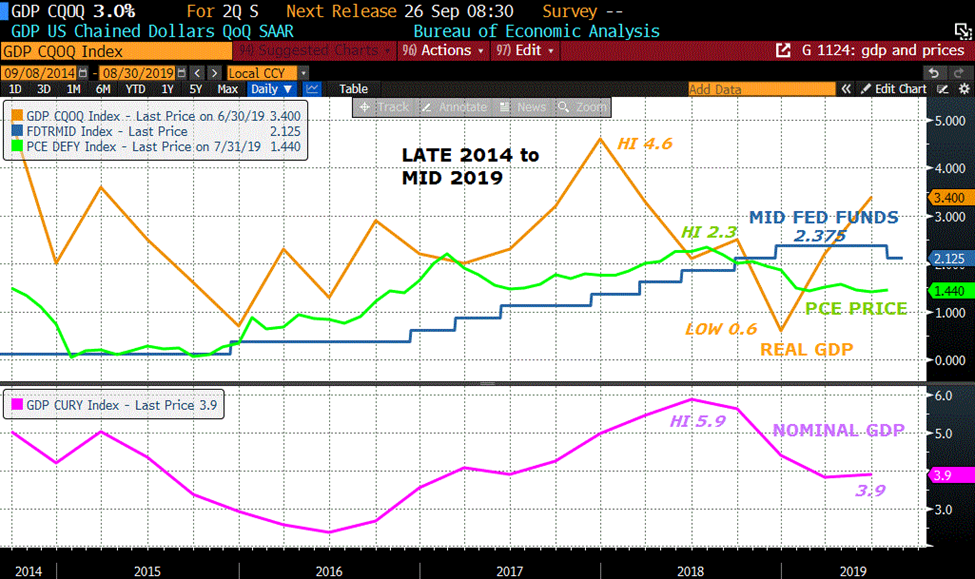

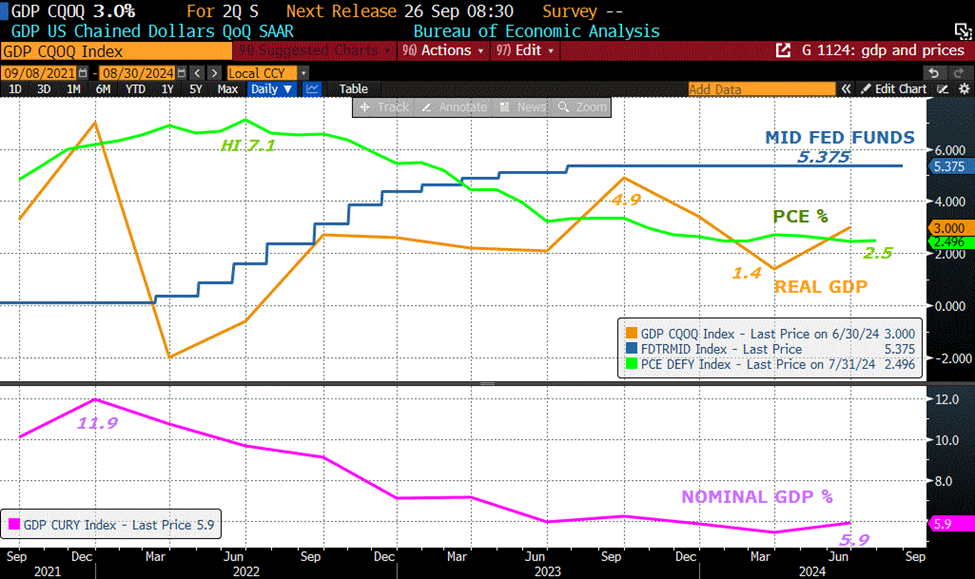

On Saturday I created the following two charts, covering two different time periods (pre- and post-covid). On the top panel of each are the Midpoint of the FF target range (blue), Real GDP (amber) and yoy PCE price changes (green). On the bottom panel is the yoy change in nominal GDP.

I was thinking about how some people are adamant the Fed should not ease, because what Powell deems as “restrictive” policy, really isn’t doing all that much to stifle (real) growth.

First, consider the top chart, which covers 2014 to 2019. Around the middle of 2016 PCE prices started to accelerate, from below 1% to just above 2%. Real GDP was stair-stepping higher as well. Powell took it as an opportunity to begin ‘normalizing’ policy. Going into 2018 (when Trump’s tax cuts were moved over the finish line) real GDP topped as inflation moved higher, but nominal GDP kept marching up. In Q4 2018 SPX tumbled by 20%, and both real and nominal GDP declined. PCE had topped at 2.3% in Q3 2018 but was under 1.5% by Q1 2019. The peak FF rate of 2.375% was above PCE prices and exceeded real GDP for a couple of quarters, but was always well below nominal GDP. NOTE: Real GDP is adjusted using the GDP Deflator, not PCE prices.

Now consider the chart below from post-covid to present. FF are above real GDP and have been above PCE prices since Q2 2023 (restrictive). At the low, nominal GDP grew by 5.6%, just a little above the FF target of 5.375%. The other thing to notice is that nominal GDP has been decelerating for the past two-and-a-half years. Just these metrics provide justification for easing, though it’s debatable if the 200 bps being priced by September of next year is reasonable. [FFV5 is 9675.5 or 3.245% vs the lower end of the current FF target of 5.25%]

The inclusion of Nominal GDP made me think of the Michael Lewis book ‘The Undoing Project’. This is a fascinating read about human decision making. Here’s an excerpt:

The theorists seemed to take it to mean “the utility of having money.” In their minds, it was linked to levels of wealth. More, because it was more, was always better. Less, because it was less, was always worse. This struck Danny as false. He created many scenarios to show just how false it was:

Today Jack and Jill each have a wealth of 5 million,

Yesterday, Jack had 1 million and Jill had 9 million.

Are they equally happy? (Do they have the same utility?)

Of course they weren’t equally happy. Jill was distraught and Jack was elated. Even if you took a million away from Jack and left him with less than Jill, he’d still be happier than she was. In people’s perceptions of money, as surely as in their perception of light and sound and the weather and everything else under the sun, what mattered was not the absolute levels but changes.

Maybe relatively low levels of confidence are related to the deceleration of nominal income even though the level itself is solid. Consider this as well: Money Market Fund assets stand at $6.26T. At a yield of 4.75% that’s about $300b per year or 1% of GDP. Perhaps Rick Rieder’s comments from several months ago ring true… the economy and inflation may well SLOW on rate cuts. That $6t isn’t anxiously sitting on the sidelines just waiting to be deployed into equities…oh, maybe some of it is. But most of it is sitting there saying, if nominal income is just a little over what I am making in a money market, and if stocks in aggregate are making somewhere around nominal income, why should I take risk vs a sure thing?

One of the other key lines from this section of the book is: “When they made decisions, people did not seek to maximize utility. They sought to minimize regret.” An example:

You must choose between having :

1) $5 million for sure

or, the gamble:

2) An 89% chance of winning $5 million

A 10% chance of winning $25 million

A 1% chance to win zero

Most people chose 1. They preferred the certainty of being rich to the slim possibility of being even richer. “If people mostly chose option 1, it was because they sensed the special pain they would experience if they chose option 2 and won nothing.”

“But what was this thing that everyone had been calling ‘risk aversion?’ It amounted to a fee that people paid, willingly, to avoid regret: a regret premium.”

In today’s lexicon, FOMO captures regret premium in another dimension, the fear of being Jill when Jack is printing money being long NVDA. The Fed is well aware that changes at the margin drive the economic narrative. I think Powell is, in part, managing risk in order to avoid a repeat of late 2018, when the Fed was blamed for a sharp setback in stocks and had to reverse course in 2019.

Perhaps this meandering stroll about decision making is a bit much, only to justify rate cuts which the market is already aggressively pricing into next year. On the other hand, the deceleration of nominal GDP, which is rarely mentioned, is likely more important to the nation’s economic psyche than published real GDP data. But here’s another tangible event which is likely to weigh on the economy. BBG reports the end of $1.6T student loan leniency… set to conclude at the end of September. More than 40 million Americans have federal student debt.

I’ll just end with a decision-making story from CME days, which I found perfectly reasonable in terms of avoiding ‘special pain’ no matter how miniscule the odds. On the first floor of the CME was a concession stand that sold candy, sundries, lottery tickets. There was a large lottery and I was in line behind another member who was wearing his trading jacket as well. He placed his order and the clerk said ‘fifty dollars’. The guy whined, ‘I asked you for just FIVE dollars worth.’ I interjected and said, ‘No problem, I’ll take the other $45.’ The customer turned around, looked at me, looked at the acronym on my trading badge, and said to the clerk, ‘I’ll take all fifty.’ Suspicion, superstition, paranoia. It’s hard to model those aspects of a snap decision, even for AI. Of course, when it was my turn I said, ‘I’d like $50 as well, and I want the exact same numbers as that guy.’ Just kidding, I took the random draw.

This week culminates with Employment data, which is once again the most important data release. NFP expected 165k with a rate of 4.2%.

The main feature of what was a pretty quiet week was curve steepening. Tens rose 11 bps on the week to 3.909%. 2/10 ended at -1.4 bps (3.923/3.909), the highest level since mid 2022. The halfway back level from the high in March 2021 of 157.6 to the low of June 2023 of -108.7 is just under 25 bps (next target). On the SOFR strip, the weakest contract was March’28 which settled down 9 on the day at 9676. H5 -5.5 at 9624.5, H6 -6 at 9688, H7 -8 at 9686.5 and then H8 at 9676. Modest but surprising weakness in back end of curve.

| 8/23/2024 | 8/30/2024 | chg | ||

| UST 2Y | 387.3 | 392.3 | 5.0 | |

| UST 5Y | 362.3 | 371.3 | 9.0 | |

| UST 10Y | 379.9 | 390.9 | 11.0 | |

| UST 30Y | 410.1 | 419.6 | 9.5 | |

| GERM 2Y | 237.4 | 239.2 | 1.8 | |

| GERM 10Y | 222.5 | 229.9 | 7.4 | |

| JPN 20Y | 170.1 | 170.9 | 0.8 | |

| CHINA 10Y | 215.5 | 217.8 | 2.3 | |

| SOFR U4/U5 | -168.5 | -164.3 | 4.3 | |

| SOFR U5/U6 | -19.0 | -18.0 | 1.0 | |

| SOFR U6/U7 | 7.0 | 9.0 | 2.0 | |

| EUR | 112.11 | 110.51 | -1.60 | |

| CRUDE (CLV4) | 75.54 | 73.55 | -1.99 | |

| SPX | 5634.61 | 5648.40 | 13.79 | 0.2% |

| VIX | 15.86 | 14.96 | -0.90 | |

Excerpts from The Undoing Project are from pages 257 to 267.