A little TOO smart

September 23, 2024

*********************

–Friday featured continued strength in front-end contracts with SFRZ4 at a new high settle 9603.5. (86 bps premium to the new EFFR of 4.83%) Peak contract on the SOFR curve has moved forward to SFRZ5 at 9710.5; Z4/Z5 spread settled -107. There was a late block buy of 10k SFRZ4 9600/9575p 1×2 for 7.5 (appears new) which serves to highlight skew. The put 1×2 settled 12.25 and 2.5 so 7.25 ref 9603.5. Same otm on the call side? Z4 9606.25/9631.25 c 1×2 settled 13.0 and 6.25 so just 0.5. The equally otm 9575p 2.5s and 9631.25c 6.25s. The call with the same 2.5 settle as the 9575p is way up at 9675! The risk-aversion with respect to otm call sales is amazing….but not to anyone that got caught in the Q2 2023 regional bank crisis.

–Note that if there were certainty of 50 bp Fed cuts at the 7-Nov, 18-Dec and 29-Jan FOMC meetings, then SFRZ4 should target 9642 to 9644. (Below is a link on the CME site for SOFR calculations, thanks TD).

–EuroZone PMI weaker than expected today at 48.9 vs 50.5 estimate. China continues to take measures to support the economy, yet China’s 10-yr yield is sinking to new lows, currently just above 2%.

–A couple of interesting snippets this morning. From WSJ: Electronic Warfare Spooks Airlines, Pilots and Air Safety Officials. From BBG: The US Commerce Department is planning to reveal proposed rules that would ban Chinese- and Russian-made hardware and software for vehicles as soon as today, according to people familiar with the matter.

After the 9/11 attack, the CME (and other office buildings in major cities) erected concrete and/or steel barriers around building perimeters to deter auto bombs. It was a somewhat expensive safety measure. After the hacking of pagers and other technology in Lebanon, it’s not much of a stretch to imagine vulnerabilities in all sorts of new “smart” gadgets. In a way, there should be acceleration towards ‘on-shoring’ ; new security measures could ultimately be inflationary. I don’t think it’s hyperbole to think that cyber-security on this scale is comparable to Y2K remediation.

[We’re bringing back the muscle car. No computers, just metal and gasoline]

–Headline on ZH: ‘The biggest wild card in the Presidential Election’ : Just days left until a crippling port strike paralyzes the east coast.

I don’t really perceive this as much of a wild card. The administration is likely to just pay the demands to put the problem to bed at the last minute.

–Powell speaks on Thursday. Today we get comments from Bostic, Goolsbee and Kashkari. S&P PMI numbers this morning. 2, 5 and 7 year auctions begin tomorrow.

In: Eurodollar Options

Heading into (for a) Fall

September 20, 2024

*********************

–Autumn solstice September 22.

–Fed’s SEP on Wednesday had 4.4% as their end-of-year FF projection for 2024. So someone bought 70k SFRX4 9562.5/9550ps for 0.5, probably in the belief that the Fed’s target has merit. You know when the Fed is REALLY good with their year-end projection? At the December FOMC, that’s when. In any case, it’s not a lot of premium, and if stocks continue their run, maybe Powell will reconsider easing into an asset melt-up. Even with put buyers, SFRZ4 posted a new high settle at 9601, up 2 on the day and sub-4%. Contracts from SFRM5 on back settled successively lower on the day, M5 -0.5 at 9690.5, M6 -0.5 at 9708.5 but M7 -4.0 at 9696.5 and M8 -6.5 at 9684.5. All sort of clustered around 3%.

–Nov SOFR options expire 15-Nov, capturing NFP (nov 1), election (nov 5) and FOMC (nov 7). There is no update to the SEP (projections) at the Nov meeting.

–Steepening was mirrored in the treasury curve with 2s down 1.9 bps to 3.596 and 10s up 3.6 to 3.73 . That level of 13.4 is a new high in 2/10 spread, and is nearing the 50% retrace level from the 2021 high of +157 to the 2023 low of -108, which is +25. (chart below) Late in the day there was a buyer of 30k TYZ4 105p for 2/64s. On Wednesday same guy paid 2 for 35k of the TYZ 105.5 strike. I’m not sure of the equivalent yield level; right now there’s about 15 bps per point in the TYZ contract which settled 114-235. This guy is protecting the BIG move, (and taking advantage of lower vols). Perhaps a modicum of concern is creeping into the market that Treasury won’t have such an easy time selling debt post-election. However, if SFRZ4 is “right” at 4%, then by year end, there will no longer be negative carry on the long bond (30s are now 4.066%). I’m taking liberties regarding relative moves, but the point is that a positively sloped curve with lower funding rates will make debt sales a lot easier. 5/30 also closed at a new high of +57 bps (3.496% and 4.066%). Note that 2, 5, 7 year auctions are next week.

–$/yen rebounding as BOJ stands pat on rates, holding at 0.25%. Current 143.83 having briefly dipped below 140 on Monday. Equity op-ex today.

In: Eurodollar Options

Risk Management?

September 19, 2024

*********************

–Regarding my comment yesterday “Post-election comes with heaps of uncertainty and the Fed addresses uncertainty with liquidity” a friend responds with, “I know. I am taking extra time at the gun range.” INSURANCE. You buy it before you need it. Not when the hurricane hits.

–Powell says the economy is in a good place, but my thought is that he’s worried about the trajectory. And, I can’t help but feel as if Powell’s 50 bp cut had just a twinge of F-you to Trump. Of course, there was only one dissenter, Bowman. The chair also tried to tamp down on the pace of forward easing, saying, “…nothing in the SEP that suggests the committee is in a rush.” By now the dots and projections have pretty much been discredited, on the other hand the Fed’s recent focus on inflation seems to have paid off…for now.

–On Tuesday, SFRZ4 settled 9596.5 and the 9600^ for Dec was 34 bps. After yesterday’s FOMC, the futures settle was 9599 and the straddle was just 28.5. (Probably a bit on the low side given the environment). The news is known, so the air came out of premium. I was going to emphasize this point by noting the huge drop in FFV4 open interest as shorts threw in the towel and longs were happy to book an extra 0.5 to 1.0 bp in “premium” as the contract traded 9517.5/18 vs the new target of 4.83. However, the prelim bulletin shows open interest having INCREASED by 9k. My comment there is BULLSH-T. Bad data. But then I thought, did someone really, really big say, ‘look, the mideast is about to explode, and NATO seems intent on provoking WW3 by using long-range missiles in Russia, and the next attempt on Trump is probably right around the corner, and Diddy is going to commit “suicide” in jail. Why not squeeze the shorts and pay another bp for the possibility of an emergency ease?’ Just my own musings…probably crazy. Right?

–But in a related development, late in the day buyers of Oct TY calls that expire tomorrow: ref 115-025, 116.5 and 116.75 calls expiring Friday were bought for c-7 25k and 15k. Also a buyer of TYZ4 105.5p 2 paid for 35k. All of these are new trades. A few lotto tickets for “Crazy”.

–I marked a few levels just in front of the FOMC, then just after, then settles then late (nr electronic close)

FFV4 9506.5 9518 9517.5s 9517.5

SFRZ4 9591.5 9502 9599.0s 9598.0

SFRH5 9651.5 9666 9659.0s 9657.5

TYZ4 115-025 115-16 115-025s 114-290

ESZ4 5699 5755 5680.0s 5688

GCZ4 was up $32 at one point post-FOMC but was 2584, down 8.4 late in the day.

–There’s a lot more that could be said, but it probably will take a little more time for volatility to settle down. Curve steepened with a slight new high in 2/10 to +8 bps. SFRZ4 is back above 9600 this morning, 40 bps lower in yield than the Fed’s 4.4 yr-end dot projection. Think about that for a second before selling the straddle at 28. But then go ahead and sell it anyway. It’s fun managing short gamma with this backdrop.

In: Eurodollar Options

They don’t review it in the booth

Sept 18, 2024

***************

–It’s 25 or 50. Just like the election, about half the trading population is going to be very angry. We’ll get some whiners. FFV4 settled 9508. If only 25, it still will probably hold 9493-93.5 instead of pegging 9492. The upside will exactly target 9517, and I wouldn’t be surprised to see 18 print. It’s like that song about the end of the night at the pub: “Closing time, you don’t have to go home / But you can’t stay here”

At the last June FOMC dot plot, in terms of Fed Fund projections:

2024 was 5.1, up from 4.6 in March. SFRZ4 is 9596.5 or 4.035%, 100 lower than the Fed’s last projection.

2025 was 4.1, up from 3.9 in March. SFRZ5 is 9513 or 2.87%, about 1.25% lower than the Fed’s last projection.

2026 was 3.1 from 3.1. But what does it matter…they were off by a million miles last time with only 6 months until year end.

SFRZ4/Z5 is -116.5 (9596.5/9713), not all that far from the implied spread of -100 on the dot plot, just off by 100 bps in each contract. By the way, ERZ4/Z5 is -106 and SFIZ4/Z5 is -104.5.

–There will be typical hand-wringing over the dots. They don’t matter. Post-election comes with heaps of uncertainty and the Fed addresses uncertainty with liquidity.

–Had a client check Wednesday’s (today) TU atm straddle (104.375). At end of day it was 13 mid-market ref 104-115. DV01 on contract is about $39.80…straddle is a bit over 10 bps. Priced about right.

–Convexity Maven (Harley Bassman) piece out yesterday suggesting the 2-yr yield has way too much ease priced in. Obviously clear from near SOFR contracts; there’s concern the economic and political wheels could come off. Hasn’t paid to load up on shorts. Probably worth selling the pop across the curve and stocks on 50, but don’t overstay the welcome. Longs remain in control, and sell-offs will likely be brief.

https://www.convexitymaven.com/wp-content/uploads/2024/09/Convexity-Maven-Forests-and-Trees.pdf

In: Eurodollar Options

One day til FOMC announcement

Sept 17, 2024

**************

–As Sept SOFR options have expired, I consider SFRZ4 to be ‘front month’. That is now the lowest quarterly at 9600 or 4%. The peak contract on the SOFR strip has been moving forward and is now SFRH6 at 9719.5. It’s now the 6th quarterly contract; it was the 7th quarterly last week. That spread is -119.5.

–From SFRH6 forward the SOFR calendars are positive, and becoming more so. Price action is indicative of front-loaded easing.

–The lowest 1-yr calendar is now Z4/Z5 at -118 (9600/9718). It was +4 on the day. (U4/U5 is, of course, still listed, and that’s -195, but I don’t consider it to be front any more). There was a huge block buy of SFRH5/SFRH6 at -55.5 in size of 81.5k. Both contracts gained >60k open interest, so new trade. That spread settled -52.5 (9667/9719.5). The difference between Z/Z and H/H is 65.5 which is nearly 1 bp of negative roll (for the buyer) for each trading (not calendar) day. However, perhaps the spread buy is really focused more on being short the peak contract SFRH6. In that case I am guessing he’s looking for better than a soft landing, perhaps a new surge of economic activity.

–The other large trade relating to SFRH5 was a seller of 100k SFRH5 9675/9750/9775/9850 call condor at 12.0 to 12.25, Said to be a roll-up of 9675/9775cs (20.25s) to 9750/9850cs (7.0s). Open interest was up >90k in both 9750 and 9850 strikes, but surprisingly was also higher in 9675 and 9775 calls by about 40k.

–Treasury yields fell by 2 to 4 bps on a slightly flatter curve. 2y -1.9 to 3.555% and 30y -4.1 bps to 3.934%. Former WSJ Fed whisperer Jon Hilsenrath posted late in the session that he’s now in the 50 bp cut camp. However, FFV4 settled 9507.5, very close to the dividing line between 25 and 50 which is 9504.5.

Retail Sales expected -0.2 m/m from +1.0. Ex-auto expected +0.2 and ex-auto and gas +0.3%

Industrial Production +0.2 and Capacity Utilization 77.9%…post-covid low has been 77.2

In: Eurodollar Options

In 2007 the first cut was 50 bps, on Sept 18…

September 16, 2024

*********************

–On Sept 18, 2007 the Fed initiated the first cut, from 5.25 to 4.75. SPX rallied, gaining about 6% from the Sept 17 close, to the high settle on 10/9 of 1565. That remained the high until 2013. (High print was 10/11/07). So 16 or 17 trading sessions after the first ease was the high from which the GFC unfolded. Dates line up the same; I would note that Oct 4 is the employment report. FOMC announcement and press conf is Wednesday, September 18.

–Friday featured continued strength in the front end, with SFRZ4, H5, M5 and U5 closing at new highs. 9596.5, 9662.5, 9697.5 and 9712. SFRH5 was the leader, settling +9.0 on the day. The price of 9662.5 is 200 bps above where the recently expired SFRM4 ended, at 9463. SFRH6 was only +2 at 9720 (high point on the curve) and SFRH7 was +1 at 9712. Buyer of 50-60k SFRZ4 9550p for 2.25 to 2.5.

–Treasury curve steepened to new highs on strength in front. 2’s fell 7.4 bps to 3.574 and 10’s fell 3.2 to 3.646. 2/10 was as low as -50 on June 25, now +7.2 less than three months later. 5/30 also at a new high of +55.2.

–BOJ meeting is at end of week. While today is a holiday in Japan, this morning JPY is at a new low for the year sub-140 (139.91 as of this note). Low on 12/28/23 was 140.25.

–News today includes Empire Mfg, expected -4.0 from -4.7. While -4 would be close to the high for this calendar year, it hasn’t been above zero since late 2023.

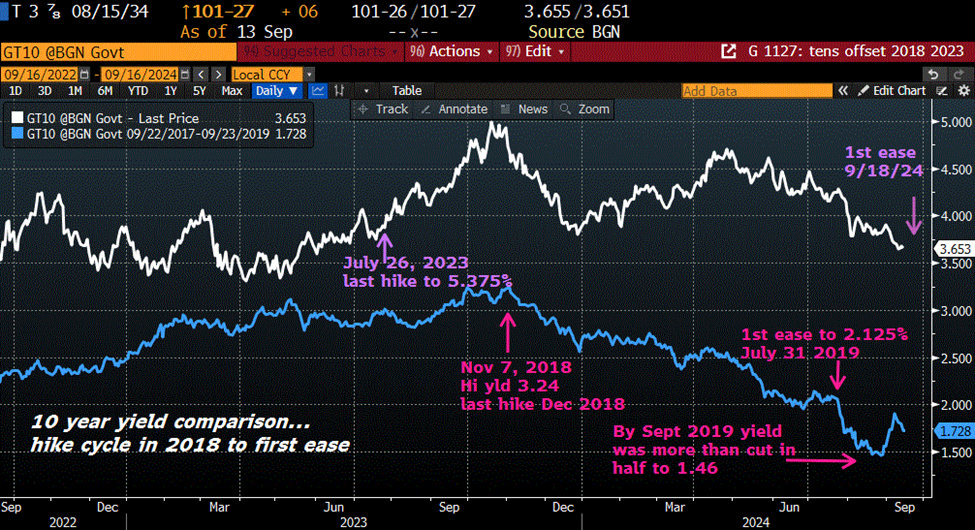

–The end of the hiking cycle in 2018 probably isn’t much of a comparison for today as the peak rate was only 2.25 to 2.50%, but I suppose the takeaway would be a lower 10y yield. Image below. I am guessing that the high FF target of 2.25 to 2.5 at the end of 2018 should act as a floor for the easing to come.

In: Eurodollar Options

Strange

Sept 15, 2024 – Weekly Comment

***********************************

How many lives are living strange? – Oasis

The US ran a $318 billion deficit. In August. Yuge. Gold settled at a new all-time high this week with GCZ4 2610.70 and spot 2577.50. In early 1979 gold was around 200. By September it got to a little over 400. Chopped around a bit but then, from December 1979 to January 1980 it doubled again like a champagne supernova, from 400 to 850. We’re now about 10x higher…in 2023 gold chopped around 2000. It’s crazy to think of $8500. Right? Maybe not. Strange things can happen. Who would’ve ever thought the Gallagher brothers would reunite in concert?

In late August the NFL approved a plan to allow private equity to buy stakes in teams. Owners distributing equity (risk) at the top. The US is considering a Sovereign Wealth Fund (as private equity owners are having problems meeting cash flow ‘promises’ to investors). Is this the same idea? Distribute (the losers) to the US Government at the top?

Stats below are clipped from Credit Bubble Bulletin’s analysis of the Fed’s Z.1 Q2 data:

https://creditbubblebulletin.blogspot.com/

For the quarter, Household Net Worth (assets minus liabilities) surged $2.760 TN to a record $163.797 TN, with four-quarter growth of $10.812 TN. Household Net Worth has inflated $46.586 TN, or 40%, since the end of 2019 (18 quarters). Net Worth ended June at 572% of GDP, up from 2019’s 535%, and the previous cycle peaks 488% (Q1 2007) and 444% (Q1 2000).

Household Real Estate holdings inflated $1.752 TN during the quarter to a record $52.319 TN (one-year growth $3.007 TN). Real Estate ended June at 183% of GDP, up from the end of 2019’s 153% – and now only moderately below the mortgage finance Bubble peak 190% (Q3 2006).

Household Financial Asset holdings inflated another $1.134 TN to a record $123.238 TN, with one-year growth of $8.180 TN. Financial holdings ended 2019 at $93.937 TN. Financial Holdings ended the quarter at 430% of GDP, versus previous cycle peaks of 373% (Q3 2007) and 354% (Q1 2000).

Total Household Equities holdings-to-GDP ended June at 161%, versus previous cycle peaks 105% (Q2 2007) and 115% (Q1 2000).

These data suggest a broader picture of the ‘Buffet Indicator’, the Wilshire 5000 market cap to GDP. According to longtermtrends.net that value is now at a record 192%. I would posit that much of this ‘wealth’ was driven by massive US deficit spending which will likely decelerate, no matter who controls the apparatus of government next year. “Wealth” to GDP is at insane levels. From last week’s Thoughtful Money interview with Neil Howe: “What worries me is the amount of reconstruction we have to do around public priorities. We have a very large public sector today which is overwhelming oriented toward redistributing income to old people. Half of the federal budget excluding interest payments, ten years from now, according to the CBO, will be going to Americans age 65 and older. …In a crisis, you have to look at the numbers.”

There are increasing mentions of credit stress, including a surge in bankruptcies and delinquencies. For example, WSJ ran this headline over the weekend: ‘Americans Are Falling Behind on Bills, Alarming Wall Street’ – Lenders are seeing a rise in late payments on credit cards and auto loans. Ally Financial (ALLY) is down 23% so far in Sept as the CFO says its borrowers are struggling.

This data is from end of Q2 2024 from the American Bankruptcy Institute:

“Bankruptcy filings including all chapters totaled 40,276, a 7% increase from the June 2023 total of 37,790.”

In my experience, financial stress sparks selling of assets, but since the GFC, the model seems to be to transfer private debts to the federal government’s balance sheet. The Feds then deftly manipulate manage these pools, with examples ranging from the SPR to the composition of debt issuance at the Quarterly Refundings. In Europe as well, Draghi is calling for a new “industrial strategy.”

Even with a 4% surge in SPX this week, net changes in rates were somewhat subdued in front of the FOMC. Largest mover was 2y from 3.65% to 3.574%. Several ‘news plants’ suggested the Fed should ease 50 rather than 25 bps (immediately after Wednesday’s CPI data shifted market sentiment to 25). The most influential piece was by Nick Timiraos of the WSJ: ‘The Fed’s Rate-Cut Dilemma: Start Big or Small?’ On Friday FFV4 settled 9504.5, the exact dividing line between 25 and 50. It had traded as low as 9495 after CPI. SFRU4 settled 9514.5. Both of these contracts are likely to be 11-12 bps different at Wednesday’s settle. What is less clear is how forward contracts will react.

On the SOFR strip, Z4, H5, M5 and U5 closed the week at new highs, 9596.5, 9662.5, 9697.5, 9712. The 2yr note is at a new low yield of 3.57%, a level last seen exactly two years ago in September 2022 as the hiking campaign was in full swing. (Ultimate high was 5.22%). Let’s consider SFRZ4 just over 4% and SFRM5 at just over 3%. If the Fed only eases 25 to a midpoint target of 5.125%, can Dec’24 hold near 4%? That would take certainty of 50 bp cuts in Nov and Dec. Another 100 by June? Not out of the question, but a lot will depend on guidance at the press conference. My assumption is a cut of 50 on Wednesday, as a risk management maneuver to support both the labor market and the Harris campaign. (I’ll take the Guiness bet payoff on Thursday, YZ and RD). I think the Chair will stress data-dependency going forward, which isn’t much of a stretch considering post-election uncertainties.

The chart below is something I just find interesting. The last hike of this cycle was July 26, 2023 to a midpoint FF of 5.375% At the time, the 30-yr bond yield was 3.97%. Since that time, the 30-yr yield has had a floor right around that 4% yield. On Friday, going into the first ease, the 30-yr yield is exactly where it was at the last hike. 3.975%. For the sake of comparison, changes on other treasuries from July 26, 2023 to Friday are:

2yr 4.85% to 3.57% (-128 bps)

5yr 4.12% to 3.42% (- 70 bps)

10y 3.87% to 3.65% (- 22 bps)

Clearly the 2-yr note reflects the same expectations of ‘front-loaded’ eases as are embedded in the SOFR curve. As another point of comparison, in 2006 the last hike was June 29 to 5.25%. At that time, the 30-yr yield was exactly the same, at 5.25%, near the high of the move. The first ease was Sept 17, 2007. At that time the yield was 4.75% (though it had exploded up to 5.40% in June 2017).

My thought is that the Fed could easily take back the last 175 to 200 bps of ease by Q1. SFRH5 is essentially priced that way: SFRM4 just went off the board at 9463.0 and SFRH5 is 200 higher at 9662.5. The natural play is to fade that certainty. Indeed there was a buyer of some 60k SFRZ4 9550p on Friday for 2.25 to 2.5.

| 9/6/2024 | 9/13/2024 | chg | ||

| UST 2Y | 365.2 | 357.4 | -7.8 | |

| UST 5Y | 349.0 | 342.3 | -6.7 | |

| UST 10Y | 370.8 | 364.6 | -6.2 | |

| UST 30Y | 401.8 | 397.5 | -4.3 | |

| GERM 2Y | 223.0 | 221.1 | -1.9 | |

| GERM 10Y | 217.2 | 214.8 | -2.4 | |

| JPN 20Y | 165.8 | 163.5 | -2.3 | |

| CHINA 10Y | 213.8 | 207.3 | -6.5 | |

| SOFR Z4/Z5 | -122.0 | -121.5 | 0.5 | |

| SOFR Z5/Z6 | 4.5 | 3.5 | -1.0 | |

| SOFR Z6/Z7 | 13.5 | 11.5 | -2.0 | |

| EUR | 110.86 | 110.76 | -0.10 | |

| CRUDE (CLV4) | 67.67 | 68.65 | 0.98 | |

| SPX | 5408.42 | 5626.02 | 217.60 | 4.0% |

| VIX | 22.38 | 16.56 | -5.82 | |

In: Eurodollar Options

An exciting Sept expiration!

September 13, 2024

*********************

You start a conversation, you can’t even finish it

You’re talking a lot, but you’re not saying anything

When I have nothing to say, my lips are sealed

Say something once, why say it again?

Psycho Killer

Qu’est-ce que c’est? -Talking Heads

–Talking a lot but not saying anything. That’s the world we’re in. Post-Wednesday’s CPI the market became pretty darn certain that the Fed would only ease by 25. In yesterday’s note I posed the question, “Are you sure about that?” Yesterday the ECB cut 25, as expected. But, WSJ’s Nick Timiraos wrote a somewhat wordy article suggesting 50 as a possibility for Wednesday’s FOMC. October Fed Funds, which traded 9495 early (near the 25 bp cut price of 9492) rallied back to settle at 9499 and were 9500 bid shortly after settle. SFRU4 settled 9509.25 after posting a low of 9504.25, and this morning we’ve traded through the expiring 9512.5 strike! High as of this note is 9514. (Sept SOFR and midcurves expire today).

–Title of Nick Timiraos article: The Fed’s Rate-Cut Dilemma: Start Big or Small?

“That the Fed will cut rates at its meeting next week is all but settled, But how much is shaping up to be a close call.”

Last line, quoting former Fed vice chair Donald Kohn:

“We are at a point where you might say, ‘I could go either way- 25 or 50,’ but I think the risk management has shifted to the labor market and favors doing 50,” he said.

–It’s not all that frequent that the last couple of days before option expiration have this kind of juice. As of this morning’s prelims, SFRU4 had 1.35 million open positions, up 50k on the day. SFRU4 9512.5c had 382k, down 25k on the session. Adding to the day’s mix was a surge in gold to a new high. GCZ4 settled 2580.60 but was 2586 late and is currently just a buck shy of $2600. Looming over everything, but being ignored by most western media and ‘leadership’ is the threat of military escalation. From the Guardian: “Vladimir Putin sends direct threat to the UK over ‘act of war’ move against Russia”. Maybe it’s just me, but the Timiraos headline seems somewhat inconsequential by comparison.

–A couple of notable downside trades: +35k SFRZ5 9675/9600/9525p fly for 12.5. Settled 13 ref SFRZ5 9714.5.

Buyer of 47.5k 0QV4 9693.75/9675/9656.25/9637.5p condor for 5.0. This also has SFRZ5 as underlying, but expires 11-Oct.

https://x.com/AlexManzara/status/1834275418788053435

In: Eurodollar Options

Are you sure?

September 12, 2024

*********************

–In the old days on the floor, when asking the pit for quotes by way of hand signals (and not realizing exactly where prices should be in active markets) there were times when quotes would be wrong. So, you might quote a call diagonal and get 4 bid/at 5 and it was really 4 ask. I always appreciated the client who would say, “Are you sure of that?” And of course, rather than get buried I would say, Nope, not sure, please give me a second to double-check that quote.

–Yesterday’s slightly stronger than expected CPI boosted the market’s certainty for a 25 bp cut next week rather than 50. SFRU4 sank 6 bps to 9505.25, and FFV4 fell 5 to 9495.5, nearing the 9492 price that should be the ultimate settle on 25. Are you sure about that? What I am definitely not sure about is stocks, where NQU4 traded lower early and then surged like a rocket into the end of the day, closing up 2% (+407) on a range of nearly 750 points. NVDA? Really?

–In any case the curve flattened. 2’s were up 3.4 bps in yield to 3.641% while tens and thirties added only 1 bp to 3.65% and 3.963%. 30yr auction today. On the SOFR strip, while U4, Z4 and H5 fell 6, 9 and 7, 2027 contracts were down only 0.5. Near 1-yr calendars made new lows, with U4/U5 below -203 (9505.25/9708.5) Z4/Z5 at -132, down 6 on the day (9585/9717) and H5/H6 -68, down 4.5 (9652.5/9720.5). The peak contract is currently SFRM6 at 9721, just 2.79%.

–Today’s news includes PPI expected 0.1 and 0.2 for Core m/m, with yoy 1.7 and Core 2.4.

Jobless Claims 227k

Household Net Worth and other data from Fed’s Z.1 quarterly report. HH net worth will be at a new high as S&P added a few percent last quarter.

In: Eurodollar Options

9/11

September 11, 2024

*********************

–The trading floor always respected the moment of silence on the anniversary of 9/11

–If the payroll data didn’t provide a clear-cut signal for 25 or 50, it’s quite unlikely that today’s CPI will. Expected 0.2% with Core also 0.2% on m/m basis. YOY 2.6 from 2.7 last with Core 3.2 from 3.2. Markets, as evidenced by another strong rally in SOFR and treasuries, are clamoring for forceful rate cuts to counter increasing economic weakness. SFRU5 (strongest contract on the strip) was up another 7 bps to 9712 or just 2.88%. SFRU4/SFRU5 is sub-200 bps (9511.25/9712) New LOW. Ten year yield dropping like it’s on Ozempic, down another 5.3 in front of today’s auction, to 3.644% (More on that below). What IS going to decide 25 or 50? Stocks. The trend in inflation is unambiguously lower. A stronger number today would not likely change that trend, but might have a negative effect on stocks, which are currently a bit lower at 5484.25, -18.75 on ESU4.

–ALLY financial was crushed yesterday, down 18% partially due to increased auto loan delinquencies. JPM fought back from a drop of 7% to close down 5.2%. Not all financials were hard hit, but remember, no matter what they TELL you, the Fed’s main concern is soundness of the TBTF banking system. Mandates -inflation and employment – are really 1(b) and 2(b)

–Some exits of SFRZ4 long calls and call spreads. Example 25k SFRZ4 9600c sold at 14.5 covered 9590.5, 42d. Settled 16.5 ref Z4 at 9594.0. Think about that for a second: breakeven given premium of 16.5 is 9616.5 or 3.835%. In FOUR months. Current EFFR is 5.33%, so breakeven is around 150 bps lower. The press is hand-wringing about 25 or 50 for Sept, but SFRU4/Z4 calendar made a new low -82.75 bps.

–TYZ4 settled 115-14+ with cash marked 3.644%. DV01 on the contract is ~$68. The low in April of 2023 (as regional banks were imploding) was 3.31%. High settles in the front contract around that time were 116-30 to 117. The difference between yesterday’s closing yield and the 4/6/23 low is just over 33 bps, or a bit over 2.25 points (assuming parallel shifts). So futures would likely take out the 117 level in significant fashion on a return to that cash yield.

In: Eurodollar Options