It’s a league game Smokey

October 3, 2024

*****************

–Given all the other things going on in the world, I hadn’t thought much weight would be placed on tomorrow’s payroll data. The Boeing strike and longshoreman strike and effects of Helene will probably make this data volatile over the next few months. However, they were happy to use stronger than expected ADP (143k) as an excuse to sell rate futures. Red SOFR contracts settled -4.0 and the ten year yield rose the same amount, to close at 3.783%. 30y was up 5 bps to 4.13%. The ten year breakeven (treasury yield – tip) edged to a new recent high of 222 bps, coming off a low of 203 in early September. It seems to me that the long end has an undercurrent of weakness related to inflation concerns, supply in the context of unsustainable spending, and a possible lack of foreign sponsorship. Days of QT are numbered.

–Slight new high in SFRZ4/H5 at -51.5 (9596.5/9648) up 1 on the day. The next 3-m spread is H5/M5 at -30.5, and then M5/U5 at -15.5. Fair amount of fluidity represented by these spreads, dependent in large measure by the pace of easing. FFV4/FFG5, Oct/Feb which covers the next three FOMCs, is hanging around -100, yesterday at -100.5 (9518/9618.5). If inflation expectations flare up (evidenced by the 10y breakeven continuing to move up), it’s possible that pricing of near-term easing will reset to a slower pace.

–Several articles about depositor balances at BofA being marked at ZERO. (“Mark it zero dude”). Bloomberg headline today: Warren Buffet sells $338 million of BofA stock as spree slows.

Coincidence?

–And a nod to fellow conspiracists worried about a global monetary order controlling and reviewing all flows, here are the one-year futures calendars:

SFRZ4/Z5 is -1.045 (9595.5/9701)

ERZ4/Z5 is -1.025 (9718.5/9821)

SFIZ4/Z5 is -1.020 (9550.0/9652)

All the same price. Why OF COURSE I own gold. And tin, for my foil hat, which is why tin is near ytd highs.

–Today:

Jobless Claims expected 222k.

S&P services PMI 55.4 and Composite 54.3

ISM Services 51.7 from 51.5

Payrolls on Friday, NFP expected 140-150k with a rate of 4.2%

Strikes and strikes

October 2, 2024

******************

–Background: Israel weathers strikes by Iran. Massive damage from Helene. Longshoremen strike; they’re against automation. Right. Let’s bring back all futures pits…my trading jacket is still hanging in the closet, ready for action.

–At one point ESZ4 was down 80 before coming back to settle -54.5 at 5759.75, down around 1%. In some ways that’s a strong showing. CLX4 settled 69.83, up 1.66, but it’s currently 71.70 and about to explode like a China stock.

–Ordinarily I would have expected a steepener and mad grab for the front end, but the official press narrative following Powell’s speech on Monday is that November will be dialed down to 1/4 ease. So, the “flight” was evident in longer maturities. Twos fell just 3 bps to 3.617%, while tens dropped 5.7 bps to 3.741%. SFRZ4 barely budged, up only 1.5 to 9597.5, while Z5 rose 5.0 to 9705 and Z6 +6.5 to 9702.5. Every contract over the 2 years from U25 to U27 is between 9694.5 and 9708…all clustered around 3%. Economic data shows weakness but has refused to completely roll over, and Powell has deftly guided towards a terminal rate that won’t be revisiting anywhere near the zero-bound. Events are likely to overwhelm both conditions (in my opinion).

–In terms of the Nov 7 FOMC, FFX4 had decent trade and settled +0.5 at 9544.5. The month has 30 days. The first seven days of the contract will price at the current EFFR of 4.83 and the other 23 days will either be 4.58 or 4.33 (assuming there’s not an emergency ease, and to me, that’s not zero odds). FFX4 should go out at either 95.3617 or 95.55334. The difference is 19.164 bps and the midpoint is 9545.752. So there’s a lean towards 25, just like there was in October. Now let’s place it in context. JPM has called for 50 and the world is under stress that (domestically) is likely to increase with the election. Do the math. I guess it’s not going to register until there’s an official proclamation from Timiraos, but I’d like to get ahead of that particular X post. I am not a buyer of the long end, but would personally want to own Dec FV calls and call spreads on SFRZ4. NOT RECOMMENDATIONS.

–It’s hard to ignore the inflationary implications of higher oil and supply chain bottlenecks from the strike. Big headwind for the long end, and probably for stocks. In fact, ten-year breakeven edged to a modest new high of 219 bps. But if bad things are happening, the Fed cuts. A lot.

–ADP expected 125k from 99k. Employment Friday.

Recalibration

October 1, 2024

*****************

–Powell’s speech was succinct. Here’s all you need:

That decision [50 bps] reflects our growing confidence that, with an appropriate recalibration of our policy stance, strength in the labor market can be maintained in an environment of moderate economic growth and inflation moving sustainably down to our objective.

Looking forward, if the economy evolves broadly as expected, policy will move over time toward a more neutral stance. But we are not on any preset course. The risks are two-sided, and we will continue to make our decisions meeting by meeting.

–The market took it as a signal of slower easing. FT this morning: “Powell signals Fed will revert to quarter-point cut in November”. BBG: “BlackRock’s Fink says market is wrong on Fed rate-cut bets.”

–Front end has been pricing substantial cuts, as everyone knows. Yesterday, a bit of air came out. SFRM5 was the weakest contract, falling 13 bps to 9679. The high in that contract was 9700.5 on 16-Sept, so it’s gone from 3% to 3.21% in the last half of September. The current FF target is 4.75 to 5.00, so M5 is still pricing about 150 bps of ease by summer. The PEAK contract on the SOFR strip is now SFRH6 at 9702.5. OK, so let’s say 3% is the terminal rate, might even be neutral. Maybe things are priced about right, not wrong, like Larry says. “I’m smart and I want respect.”

–Anyway, there doesn’t seem to be a lot of edge from here. Escalation risks are obvious in the mideast and Russia, supply lines could be impacted due to the longshoremen strike and devastation in the southeast, the election looms, and of course the Diddy tapes are floating around. Flight-to-quality vs inflation risks and the need for gov’t re-building, all against a backdrop of an unsustainable debt build-up. From the Eagles: “Somebody’s gonna hurt someone. Before the night is through.”

–Today’s news includes S&P Mfg PMI expected 47.0

ISM Mfg 47.5 from 47.2

JOLTs unch’d from last at 7673k

Bowman and Powell today

September 30, 2024

**********************

–Bowman, the lone dissenter at the FOMC, who preferred a cut of only 25, speaks this morning at 8:50 EST. Powell later this afternoon at 1;55, both speaking on economic conditions. This morning also features Chicago PMI, expected 46.0 vs 46.1 last, and Dallas Fed Mfg expected -10.3 from -9.7. Quarterly Grain report at noon.

–JPM collar trade in SPX to reset today (JHEQX). According to ZH the current short call is the 5750 strike (my guess is that front-running has already occurred).

https://www.zerohedge.com/markets/what-will-happen-tomorrow-jpm-collar-trade

–But for pure stock market entertainment, look to China, where the CSI 300 continues to scream higher, now up 25% from 20-Sept! Should have listened to David Tepper when he said he was “buying everything” related to China’s stimulus packages.

–This is another potentially important piece of info, the first clip is from March, taken from tomsHardware.com. The facility is in Spruce Pine, North Carolina.

…Sibelco North America Inc. facility where ultra-high-purity quartz is mined. This location is vitally important as it is claimed to be “the sole supplier of the quartz required to make the crucibles needed to refine silicon wafers.”

The next clip is taken from linked article below, published today:

North Carolina’s Spruce Pine, devastated by Hurricane Helene, is the world’s main source of high-purity quartz needed for semiconductors, the production of which could be disrupted

–Yields eased Friday, led by the front end. SFRZ4 settled 9605, +4.5. SFRZ5, near the peak on the SOFR strip, settled 9709, +6.0, and Z6 settled 9701, +5.0. Two year note yield declined by 5.7 to 3.563% and tens eased 3.8 to 3.751%.

In: Eurodollar Options

Risks from many directions

September 29, 2024 -weekly comment

**********************

Little net change in US markets last week, even as huge events shook various parts of the globe. The US 10y yield rose just 3 bps to 3.751%. The 30y was up 3.2 to 4.099%. SPX +0.6% to 5738.17.

On the financial scoreboard, China’s stimulus package sparked a big rally in stocks and a sizable jump in yields. CSI 300 index surged 16% on the week! China’s 10y leapt from new lows approaching 2% to 2.18%. Perhaps I’ve mischaracterized the thrust of policy, but it seems to be targeted domestically rather than towards (deflationary) exports. Indeed the renminbi powered to the highest level in over a year to 7.011. In a broader context, DXY has weakened and is testing the bottom of a two year range from 100 to 107. Last at 100.38, the low in July 2023 was 99.58.

Below is a chart of ShanghaiComp priced in gold (idea from Rob Luxem at TJM who used CSI300) which looks, well…cheap. Not much of a stimulus boost on this chart, so far.

Escalation in Mideast hostilities with the confirmation of Hezbollah leader Nasrallah’s death raises risks of a much wider spillover. As of Friday, oil hadn’t responded at all as KSA abandoned its $100/bbl target. By Friday CLX4 was -2.82 on the week at 68.18. While China’s stimulus gave copper a big boost, oil faltered. Where’s the bet? A flood of supply from Saudi Arabia and a weaker US economy? Or supply disruptions and demand from China?

The natural disaster of Helene has left 3 million without power in the southeast US and has caused massive destruction to property. Here’s an old storm summary from William Dudley, former NY Fed President, speaking in 2017 regarding Hurricanes Harvey and Irma:

“Those effects tend to be pretty transitory,” Dudley said in a live interview with CNBC. “The long-run effect of these disasters unfortunately is it actually lifts economic activity because you have to rebuild all the things that have been damaged by the storms.” [what if Dudley’s wrong about ‘transitory’ this time?]

In previous natural disasters, bonds sold off because insurance companies sold bonds to pay claims. That doesn’t seem to occur anymore. Much of the burden has fallen to Federal and State governments, which of course, also must sell bonds, but for now, there appears to be adequate demand. Immediate loss of economic output is another major consideration.

Notwithstanding the price of oil, everything above would seem to lean towards a boost in inflationary pressures, due to increased demand and possible supply chain issues. Despite the yoy PCE price measure having only been 2.2% last week, the lowest since the start of the hiking campaign, the best news may be behind us.

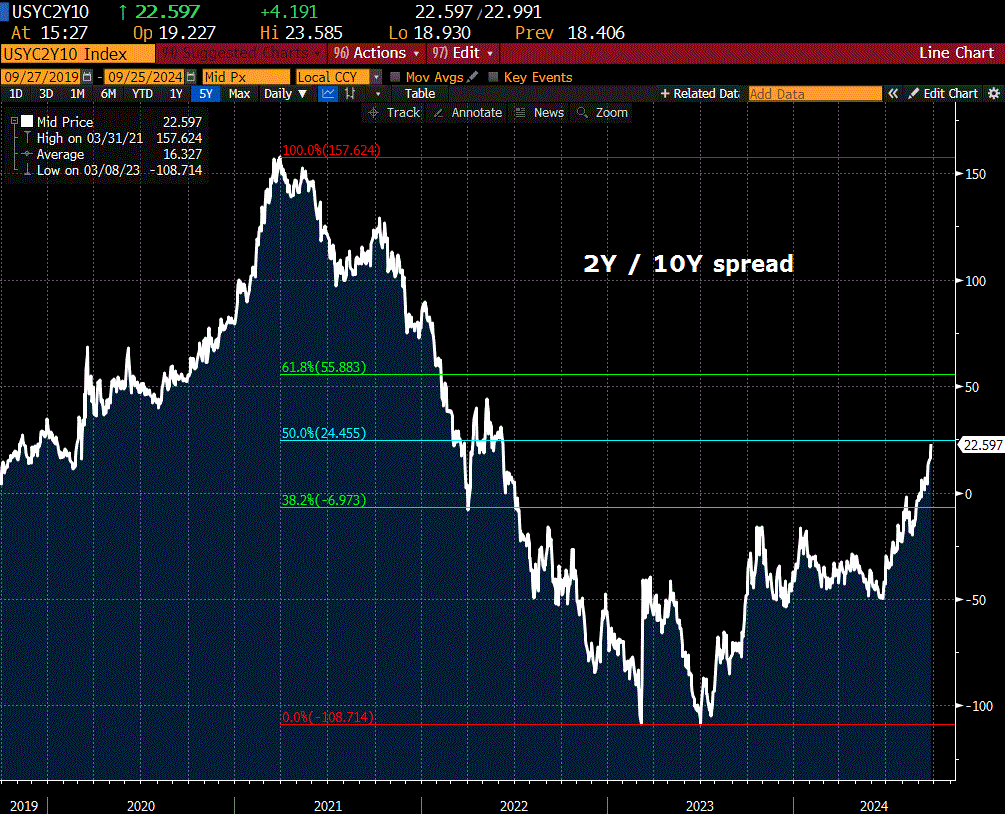

The question of finding a home for new long-bond issuance may become a concern going forward. Clearly, the Fed is thinking about Treasury market liquidity and functioning as Vice-Chair for Supervision Barr’s speech last week indicated. Foreign demand for US treasuries is likely to waver, even from Japan, as last week’s election was a factor in the yen’s surge. My takeaway from Barr’s speech is that US banks will have to absorb more treasury supply, bolstered by the implicit promise of a positive curve even if inflation ticks back up. 2/10 treasury spread may perhaps pause here after a 75 bp run from late June, -50 to +23, but the trend is still strong and supported by fundamentals. In fact, comparing the price/yield of SFH5 (9661 or 3.39%) to everything on the treasury curve projects positive carry by spring…IF the pricing of the Fed’s aggressive front-loading is correct. The 5y yield is lowest at 3.558% and the funding level implied by SFRH5 is just 3.39%.

The week ahead is capped by the employment report, with NFP expected 146k from 142k last. Rate expected 4.2% from 4.2. ISM Mfg and JOLTs on Tuesday. Service ISM on Thursday.

| 9/20/2024 | 9/27/2024 | chg | ||

| UST 2Y | 353.7 | 356.3 | 2.6 | |

| UST 5Y | 348.3 | 350.7 | 2.4 | |

| UST 10Y | 372.2 | 375.1 | 2.9 | |

| UST 30Y | 406.7 | 409.9 | 3.2 | |

| GERM 2Y | 223.0 | 207.6 | -15.4 | |

| GERM 10Y | 220.8 | 213.3 | -7.5 | |

| JPN 20Y | 169.2 | 166.7 | -2.5 | |

| CHINA 10Y | 204.1 | 218.3 | 14.2 | |

| SOFR Z4/Z5 | -107.0 | -104.0 | 3.0 | |

| SOFR Z5/Z6 | 7.5 | 8.0 | 0.5 | |

| SOFR Z6/Z7 | 12.0 | 12.0 | 0.0 | |

| EUR | 111.59 | 111.66 | 0.07 | |

| CRUDE (CLX4) | 71.00 | 68.18 | -2.82 | |

| SPX | 5702.55 | 5738.17 | 35.62 | 0.6% |

| VIX | 16.15 | 16.96 | 0.81 | |

In: Eurodollar Options

Selling pressure on front end

September 27, 2024

*********************

–Main feature yesterday was weakness in front end. Almost like a delayed reaction to Wednesday’s large block sale of 118k SFRZ4 at 9606.5; on Wed SFRZ4 settled 9606, but yesterday it dropped 5.5 to close at 9600.5. Vol was bid. Changes from Wednesday to Thursday: SFRZ4 9606.25^ 28.75 to 31.25. SFRZ4 9600^ 28.5 to 30.0. 2yr note rose 6.9 bps to 3.62% while the 10y was up less than 1 bp to 3.789. In another example of flattening, SFRM5 was the weakest contract on the strip, -9 at 9685. M6 was -5.5 at 9702.5, M7 -2.0 at 9690.5 and M8 unch’d at 9679.5. Despite pressure on Z4, Z5 was a bit weaker yet at -7.0 (9703), so Z4/Z5 spread edged to a new high -102.5

–Yesterday I had noted that 2/10 was testing its 50% retracement (~25 bps) from the 2021 high to 2023 low. Perhaps that was a target area that some used as an exit level; 2/10 fell from 23 to 17 yesterday.

–Despite front end selling, there is continuous accumulation of SFRV4 9618.75/9625cs for 1, about 65k yesterday. This trade requires high certainty of a string of 50 bp eases. Simplistically, EFFR is now 4.83% vs the lower strike 3.8125%; ~100 bp difference. So even if we know 50 and 50 are coming, that still doesn’t quite get us over the hurdle for the call spread to fill out…need Jan too. Oct options expire on 11-Oct, capturing the employment report. Same cs in Nov settled 1.25, but of course November expiration covers another employment report, the election and FOMC on 7-Nov. So what difference does an election make? Well, $/yen has dropped about 1% today to 143.29 on Shigeru Ishiba’s victory in Japan. $/yen is nearing the level it reached on Aug 5, which sent tremors through markets relating to yen-carry unwinds.

–Speech yesterday by Fed Vice Chair for Supervision seemed to have an undertone of bank monetization of US debt. Perhaps that’s a stretch, but there seems to be emphasis on banks holding treasuries. From Barr:

When firms understand that they will not be fully constrained by the capacity of private markets or their individual credit lines to monetize HQLA immediately in stress, they can reduce their demand for reserves in favor of Treasury securities, all else being equal, for their stress planning purposes. This dynamic improves the substitutability of holding reserves and holding Treasury securities either outright or through repo transactions.

–Below I’ve included a chart of BBB/Baa spread to treasuries. No stress apparent.

–PCE prices expected 0.1 with Core 0.2. Yoy expected 2.3 from 2.5 last and 2.7 from 2.6 last.

In: Eurodollar Options

Full Steam Ahead

September 26, 2024

*********************

–There was a BLOCK seller of 118k SFRZ4 at 9606.5 yesterday, but the contract held (had been trading slightly higher at time of block post) and settled 9606. On huge volume of 650k in Z4, open interest was up 15.6k. Perhaps the guy was long 60k and doubled up to now get short. Yields were mostly up 4 to 4.5 across the board. 10y rose 4.5 to 3.781%. SFRZ4/Z5 made a new high at -104. Even with the large sale in SFRZ4, it only closed down 1.5 at 9606 while SFRZ5, still the peak contract on the strip, settled -4 at 9710.

–Treasury spreads continued to make new highs, with 2/10 now testing the 50% retrace from 157 high in 2021 to -109 low in 2023. 5/30 made a new high at 62…this is just slightly thru the 50% level (163 to -46).

–There is a Treasury Market Conference at which Powell is making pre-recorded comments at 9:20. Some additional Fed speakers as well. Other news includes final Q2 GDP, expecting no change from the second estimate of 3%. Durable Goods, Jobless Claims expected 223k.

–SNB delivered a “dovish” 25 bp cut (little reaction in CHF). Saudi Arabia is considering abandoning its $100 price target in order to reclaim market share (CLX4 down 1.54 at 68.15). China continues to announce massive stimulus; SHCOMP from 2700 to 3000 in the past week and +3.6% today. Of course, US equities are in rally mode as well.

–From Fed Governor Kugler yesterday:

“The labor market remains resilient, but the FOMC now needs to balance its focus so we can continue making progress on disinflation while avoiding unnecessary pain and weakness in the economy as disinflation continues in the right trajectory. I strongly supported last week’s decision and, if progress on inflation continues as I expect, I will support additional cuts in the federal funds rate going forward.” Nothing in the speech about asset prices except for “…high levels of household wealth relative to income.”

–Supportive Fed, stimulus from China, lower energy prices. Firing on all cylinders. Does inflation follow? Or is it just financial asset inflation again? New high Dec Gold $2692, and Dec Silver making a run as well, now printing 32.54.

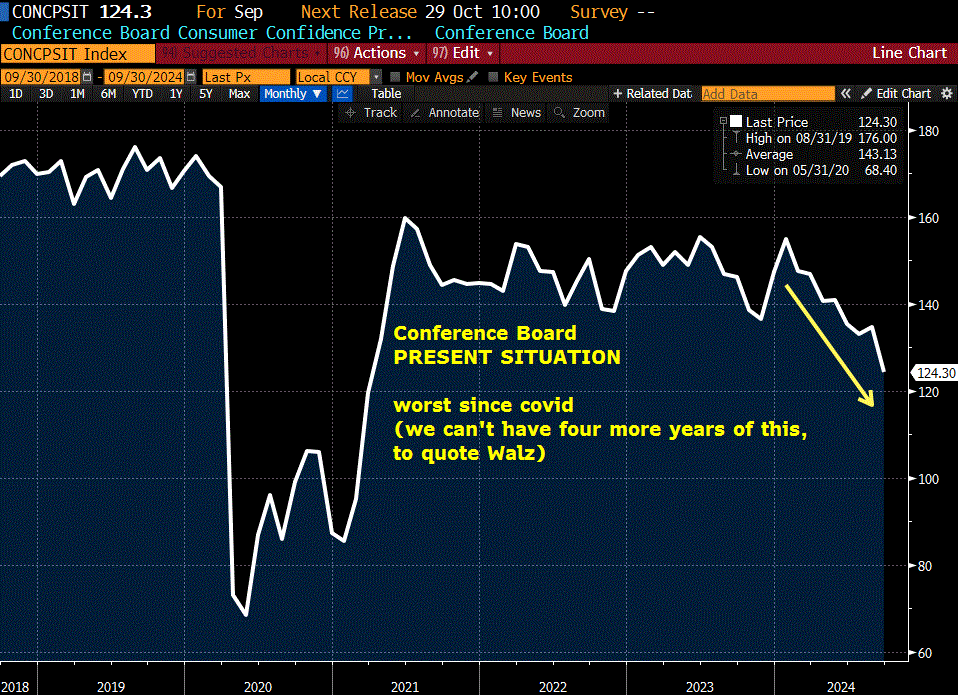

–Interesting post below, citing the plunge in the ratio of the Conference Board’s leading to lagging indicators. “We have seen 8 plunges like this since the 1960s and each one flagged a recession.” [thanks TS]

https://x.com/JeffWeniger/status/1838690956331163975

In: Eurodollar Options

Curve steepening, but it’s already been a big run

September 25, 2024

*********************

–New high settle 9607.5 in SFRZ4. Curve trades made new highs, 2/10 up to 19 (3.546, -2.6 bps and 3.736, -0.2 bp). 5/30 up to 61, also a new high. Slight new high in 10y breakeven at 218 bps. On the SOFR strip, Z4 +3.0 at 9607.5, Z5 +3.5 at 9714 (peak contract), Z6 +2.5 at 9704 and Z7 +1.0 at 9690.

–Consumer Confidence awful at 98.7 and the Present Situation was at its lowest reading since Covid at 124.3. In comparison, in 2019 it averaged around 170.

–Today’s news includes New Home Sales expected 700k from 739k last. 5-yr auction. Powell speaks on Thursday.

–I’ve included a chart of SFRZ4/M5/Z5 six-month butterfly. Prices are 9607.5/9697.5/9714.0. So the near six-month spread settled -90 and M5/Z5 settled -16.5 yielding a fly value of -73.5. Just another visual representation of market expectations of concentrated easing in the first half of next year followed by a soft glide. Not to overstate it, but if the easing cycle were expected to be in 25 bp increments at every meeting, then the fly would be a lot closer to zero.

In: Eurodollar Options

China Stimulus

Sept 24, 2024

**************

–Curve steepening as the market continues to expect front-loaded easing. Look at this for example: Oct/Feb Fed Fund spread, FFV4/G5 captures 3 FOMCs, Nov 7, Dec 18, Jan 29. It settled yesterday at -110, 9517.5 and 9627.5. Then look at FFG5 to FFG6… that one-year spread is only -91. In other words, the market expects more ease over the next four months than it does over the following YEAR (which contains 8 FOMCs). Pricing remains highly aggressive. FFV4 9617.5. FFG5 9627.5. FFG6 9718.5.

–On the SOFR curve near 1-yr calendars made new recent highs. SFRZ4/Z5 settled -106 (9604.5/9710.5) +1 on the day. SFRZ4 is the lowest contract at the front end of curve and SFRZ5 is now at the apex. Ten year yield edged higher, +1.6 bps to 3.738%.

–BBG: China Unleashes Stimulus Package to Revive Economy, Markets. [rate cuts, measures to boost property]

This morning oil is responding with CLX4 +1.77 at 72.14. Copper also trading at highest level since mid-July. US treasuries are softer across the board; US bond contract down nearly a point at 124-07. US stocks modestly bid.

–S&P Mfg PMI was dismal at 47.0 vs 48.5 expected. Services were solid at 55.4 vs 55.2 exp. Today brings Philly Fed Services, expected -9.3 vs -25.1 last. Consumer Confidence as well. Two-yr auction.

–There used to be a guy who compiled an economic Vice Index. He used data on street drug prices, prostitution and alcohol sales (and maybe other data points) as a leading indicator. Well, as we say, history rhymes, and the Star is running this headline: ‘Economics expert, 20, uses her sex-work experience to predict the next recession’. Amelia Lynne calls it the ‘Stripper Index’ and says “Sex work is typically something that’s cut out before everything else; people will stop going to the club and spending cash there.” adding, “It’s been a really slow month in the US.”

In: Eurodollar Options

A little TOO smart

September 23, 2024

*********************

–Friday featured continued strength in front-end contracts with SFRZ4 at a new high settle 9603.5. (86 bps premium to the new EFFR of 4.83%) Peak contract on the SOFR curve has moved forward to SFRZ5 at 9710.5; Z4/Z5 spread settled -107. There was a late block buy of 10k SFRZ4 9600/9575p 1×2 for 7.5 (appears new) which serves to highlight skew. The put 1×2 settled 12.25 and 2.5 so 7.25 ref 9603.5. Same otm on the call side? Z4 9606.25/9631.25 c 1×2 settled 13.0 and 6.25 so just 0.5. The equally otm 9575p 2.5s and 9631.25c 6.25s. The call with the same 2.5 settle as the 9575p is way up at 9675! The risk-aversion with respect to otm call sales is amazing….but not to anyone that got caught in the Q2 2023 regional bank crisis.

–Note that if there were certainty of 50 bp Fed cuts at the 7-Nov, 18-Dec and 29-Jan FOMC meetings, then SFRZ4 should target 9642 to 9644. (Below is a link on the CME site for SOFR calculations, thanks TD).

–EuroZone PMI weaker than expected today at 48.9 vs 50.5 estimate. China continues to take measures to support the economy, yet China’s 10-yr yield is sinking to new lows, currently just above 2%.

–A couple of interesting snippets this morning. From WSJ: Electronic Warfare Spooks Airlines, Pilots and Air Safety Officials. From BBG: The US Commerce Department is planning to reveal proposed rules that would ban Chinese- and Russian-made hardware and software for vehicles as soon as today, according to people familiar with the matter.

After the 9/11 attack, the CME (and other office buildings in major cities) erected concrete and/or steel barriers around building perimeters to deter auto bombs. It was a somewhat expensive safety measure. After the hacking of pagers and other technology in Lebanon, it’s not much of a stretch to imagine vulnerabilities in all sorts of new “smart” gadgets. In a way, there should be acceleration towards ‘on-shoring’ ; new security measures could ultimately be inflationary. I don’t think it’s hyperbole to think that cyber-security on this scale is comparable to Y2K remediation.

[We’re bringing back the muscle car. No computers, just metal and gasoline]

–Headline on ZH: ‘The biggest wild card in the Presidential Election’ : Just days left until a crippling port strike paralyzes the east coast.

I don’t really perceive this as much of a wild card. The administration is likely to just pay the demands to put the problem to bed at the last minute.

–Powell speaks on Thursday. Today we get comments from Bostic, Goolsbee and Kashkari. S&P PMI numbers this morning. 2, 5 and 7 year auctions begin tomorrow.

In: Eurodollar Options