Just add that interest payment to principal. We good with that?

October 14, 2024

******************

–Yields eased Friday led by front end. 2y down 5 to 3.94. 10y down 2.3 to 4.07 and 30s down just 1.2 to 4.38 as sentiment shifts on the long-end. Similar with SOFR curve: reds +6.75, greens +4.5, blues +2.375 and golds only +1.5. I marked 10 year breakeven at 233.3 bps, a new recent high; inflation expectations are edging higher.

–FFX4 settled 9534.5. 25 bp cut at the Nov 7 meeting should be 9536.2 and 50 bp cut 9555.3. Meeting is Nov 7. Seven days of a 30 day month is 0.2333, so a 25 bp ease will only be worth 0.7666* 25 for the contract. 3-month SOFR compounds daily but FF contracts are a simple average of EFFR over the contract month.

–2007/8 GFC was about the household sector and mortgage/housing overextension. Now it’s the same dynamic with the US gov’t. However, FT runs this headline: Corporate Debts mount as credit funds let borrowers defer payments. “Use of payment-in-kind loan terms is growing as companies struggle with heavy leverage and high interest rates.”

PIK typically used by private creditors. Why does the futures market work? Because contracts are marked to market and cash flows transfer EVERY day. PIK is on the other end of the spectrum and can lead to cascading credit problems. As I personally know from Refco, calling an unpaid debt (which will never be paid) an “asset” can backfire. There’s been a lot of talk about borrowers having “termed out” debts. For homeowners with 30y mortgages it’s true. But for corporates, that window is now about 4 years ago. The five year roll is coming up. I’m guessing that’s part of the urgency for the Fed to lower rates. Risk a little inflation or watch already increasing bankruptcies surge? I’ll take door number 2, Bob.

Really Awesome

October 13, 2024 -Weekly comment

**************************************

One of Bloomberg’s top headlines on its website Sunday is:

Retail Traders Embrace Market Turbulence With Bets on Volatility

Here’s a quote:

“We’re starting to get into unprecedented territory here,” says Akshay Aravindan, a 25-year-old software engineer at Microsoft who trades early in the morning before work starts. “This market is going to be really awesome to adjust your positions based on how intense vol gets.”

This article is about VIX and related ETFs. But I’m right with Akshay. Things are about to get “really awesome” though I might not exactly phrase it that way.

With all the new technology and AI out there, I still feel the way you really LEARN about something is by making your OWN mistakes. As Elle King sings in ‘The Let Go’, “…expensive lessons are always the best to know.”

Anyway, I worked on the CME floor ages ago for Chase. Our desk had an error, only discovered the next day. We had traded the wrong contract, something like Red Dec vs Green Dec Eurodollars. The strip at the time didn’t go past greens. In those days, it wasn’t all that uncommon to realize a problem the next day; after phone tapes had been checked, physical tickets pulled, see what cleared. No 24 hour trading; you got out next day. Of course, that morning the calendar spread was against us. It was my job to exit. So I figured I would leg out of it. Brilliant. Sold out the near contract in a weak market and hoped to buy the deferred contract cheaper. You all know what happened next. I chased the back contract up by more than a few basis points to close out. Then, I had to go upstairs and confess the larger than expected loss at the end of the day. The spread had moved such, even before I pulled the trigger on the first leg, that the near contract was printing down on the day and the deferred was positive. I explained that I hadn’t seen that before. Led to one of my rules: “Always leg from the illiquid side first.” (You were probably thinking: “Hit the bid in the SPREAD.” That’s a good one too).

I’m not mentioning this story in relation to VIX, but more as a cautionary tale with respect to interest rate and curve volatility, which I think will catch a lot of traders offsides in the upcoming several months. My themes are 1) trim position size because there are likely to be “really awesome” i.e. random moves. 2) even after the flattening post-employment and hints of a slow-play ease cycle, the curve is likely to steepen.

Below is the MOVE index. After Druckenmiller said he is modestly short bonds due to the fiscal situation, I thought I should post a vol chart on US, but then concluded that things could easily go haywire across the entire curve. The MOVE looks elevated, but I think there is more to come. If I recall correctly, Harley Bassman’s (MOVE inventor) loose rule is to buy at 80, sell at 120. This calendar year that’s pretty much been the range. I think risk is to the upside. [if I recall correctly, MOVE is weighted 40% 2yr and 20% each, 5, 10 and 30yr]

The next chart I featured last week and put out related posts on Linked-In and X. I thought the long-bond would probably chop around the midpoint of this calendar year’s range (4.37%). At futures settle on Friday I marked it at 4.38%, but the chart shows a higher yield of 4.41. (And YZ, you’ll notice that I DID include your suggested trendline that has now been broken!)

Though I favor higher long-bond yields, this isn’t so much about direction, but rather movement. Bill Fleckenstein was interviewed on the Thoughtful Money podcast and echoed Druckenmiller, saying that the relatively sharp yield increase of 50 bps in tens and bonds since the 50 bp cut at the FOMC meeting is a possible signal of a revolt. Again, he was tentative in terms of timing, but it feels to me as if sentiment has changed.

The final chart below is a SOFR calendar spread, SFRZ6/Z7. There’s nothing particularly compelling about this specific spread, but on my summary of weekly changes (shown at bottom) I always mark the first three one-year SOFR calendars. Note that Z4/Z5 was DOWN 6.5 bps from -90 to -96.5 (continued weakness in Z4 as easing projections are pared back). Z5/Z6 was DOWN 6 from +4.0 to -2.0. But Z6/Z7 was +3.5 from 4.5 to +8.0. Contracts from Z7 back are successively weaker. It’s another possible clue that market participants aren’t anxious to own longer dated paper, perhaps due to inflation concerns, but also due to fiscal irresponsibility.

Last week I highlighted the front-end puke, as stronger than expected payrolls caused reassessment of easing speed. That continued to some degree over the past week as Fed officials tamped down on easing hopes. However, despite tempered rate-cut prospects, 2/10 rallied last week (same dynamic as Z6/Z7) from 5.3 to 13.3 bps. We’ve entered an environment where specific parts of the curve respond to different macro concerns.

I’ve always liked the “Gotta hunch? Bet a bunch!” slogan. But going into the election, it’s probably best to keep risk close to home.

| 10/4/2024 | 10/11/2024 | chg | ||

| UST 2Y | 392.8 | 393.9 | 1.1 | |

| UST 5Y | 381.3 | 387.7 | 6.4 | |

| UST 10Y | 397.7 | 407.1 | 9.4 | |

| UST 30Y | 426.8 | 438.1 | 11.3 | |

| GERM 2Y | 220.3 | 223.5 | 3.2 | |

| GERM 10Y | 221.0 | 226.5 | 5.5 | |

| JPN 20Y | 165.6 | 173.4 | 7.8 | |

| CHINA 10Y | 221.0 | 214.7 | -6.3 | |

| SOFR Z4/Z5 | -90.0 | -96.5 | -6.5 | |

| SOFR Z5/Z6 | 4.0 | -2.0 | -6.0 | |

| SOFR Z6/Z7 | 4.5 | 8.0 | 3.5 | |

| EUR | 109.77 | 109.52 | -0.25 | |

| CRUDE (CLX4) | 74.38 | 75.56 | 1.18 | |

| SPX | 5751.07 | 5815.03 | 63.96 | 1.1% |

| VIX | 19.21 | 20.46 | 1.25 | |

Closing out the week

October 11, 2024

*******************

–You’re not going to find this interesting, but I’m throwing it out there anyway. On Wednesday, SFRZ5 settled 9655. The October midcurve 9556.25^ settled 15.25 with two days to go (expires today). Pumped up, because of Milton and the CPI data, both of which came and went by yesterday afternoon. SFRZ5 settled up just 1.5 at 9656.5 yesterday, and the Oct midcurve straddle lost over half its value, settling at 7.25. The call settled 3.75 and the put at 3.5. Riveting tale right? But it’s not over! SFRZ5 rallied post-settle to 9661.0. So the call that settled 3.75 was in the money by 4.75. Not sure what sparked the post-settle rally; settles vs late prices are as follow: Z4 9565.5s, up to 68. Z5 9656.5s to 61, Z6 9660.5s to 64 and TYZ4 112-025s to 08.

–Vol was sucked out of the Nov treasury options as well of course. TYX4 112^ settled 1’07 Wednesday against 112-065, but just 0’61 yesterday vs 112-025. Nov expires one week from today. TYZ 112^ went from 2’17 to 2’13.

–Nothing particularly surprising about premium evaporation after large events, but underlying price movements still seem random. Of course, Atlanta Fed’s Bostic comment just before the 30yr auction sparked selling:

I’M OPEN TO NOT MOVING AT ONE OF THE LAST TWO MEETINGS IF THE DATA COMES IN AS I EXPECT -WSJ

But the auction was well received with USZ4 trading near the low of the day just above 120-00, and settled 120-06. This morning Goolsbee speaks as a counterweight to Bostic. PPI also being released, expected 0.1 m/m with Core 0.2, vs 0.2 and 0.3 last. Michigan expectations as well.

–Put buyers on SFRZ4 (both Nov and Dec) did well on this sell-off. For example, a few weeks ago there was a buyer of 80k or more SFRX4 9562.5/9550ps for 0.5. Settled yesterday at 3.5 (6.0/2.5). They’re going back to the well (though at less advantageous entry) buying over 30k SFRF5 9575/9562.5ps for 2.5 to 2.75, settled 7.25, 4.5 ref SFRH5 9604.5.

–It seems as if the idea of fiscal austerity is creeping in… I think (forced) austerity will be a 2025 theme in the US.

From MNI:

-Gilts Risk Buyer Strike If Borrowing Surges, Citi Economist Says…UK 10-Year Real Yields Headed for 11-Month High…gilts risk a “buyers’ strike” if fiscal rules are relaxed too far to borrow tens of billions for investment…IFS says Reeves has to raise taxes by £25b at the budget Spending has to increase by £30b to avoid austerity

(see also George Austin of PricingMonkey https://www.linkedin.com/posts/george-austin-a9725b72_uk-giltsthere-has-been-much-talk-in-the-activity-7249390365022052352-Y1z1?utm_source=share&utm_medium=member_desktop

For more on inflation see Michael Ashton’s summary (snippet below on college tuition, emphasis added).

But it wasn’t just transportation goods and services, either. This is the time of year when the jump in college tuitions happens. And it looks like the jump in tuitions this year is the largest since 2018. The seasonally-adjusted numbers will smooth this out, but that means tuition is going to be adding a little more over the next 12 months than it added over the last 12 months.

This is also somewhat surprising. Normally, when asset markets are going gangbusters we tend to see smaller increases in tuition because endowments are doing well and the financial model for colleges is basically (exogenous cost increases we don’t really try to control, minus endowment contributions or federal support, divided by number of students). If markets are doing well and college tuitions are still accelerating, it implies an increase in costs. My guess is that insurance is part of that, but so will be teachers’ salaries. Provision of education is ‘labor intensive,’ and wages continue to refuse to slip back down to the old levels.

https://inflationguy.blog/2024/10/10/inflation-guys-cpi-summary-september-2024/

CPI might be lower, but inflation expectations edging up

October 10, 2024

******************

–CPI today expected 0.1 with Core 0.2. On yoy basis, 2.3 expected from 2.5 last with Core 3.2, same as last.

I would note that the ten-yr breakeven (treasury – tip) rose to 229.5. Exactly one month ago on 10-Sept it hit the cycle low at 202.8. Those that believe the Fed made an error with the 50 bp cut can point to evidence of increased inflation expectations.

FOMC minutes, only 1 dissenter, but some favored only 25:

“A few participants also added that a 25 basis point move could signal a more predictable path of policy normalization. A few participants remarked that the overall path of policy normalization, rather than the specific amount of initial easing at this meeting, would be more important in determining the degree of policy restriction.”

–Yields rose yesterday with fives the weakest, +4 bps to 3.904%. 2s, 10s and 30s all have a 4 handle; 30s were up 1.4 bps at futures settle at 4.065% in front of today’s auction. However, USZ continued to press lower after the settle of 120-25, printing as low as 120-14 early this morning, and now at 120-19. Implied vol was firmer across the board on demand for TY puts. For example, new buyer of about 30k each TYZ4 106p for 3 and 105p for 2 (settled 4 and 3).

–Vol bid isn’t surprising on weaker prices and uncertainty related to inflation and Milton. October SOFR midcurves expire Friday. 0QV4 9656.25^ settled 15.25 ref 9655 in SFRZ5. Hefty premium for a 2 day straddle. TYX4 atm 112.25^ settled 1’07 yesterday with 16 days left. That’s 16.5 to 17 bps.

Calm before the storm

October 9, 2024

*****************

–Little change in rates Tuesday as selling pressure related to NFP abated. SFRH5 settled 9609, +3.0, the strongest contract on the strip. Every contract on the SOFR strip from SFRZ5 to SFRZ7 is between 9660 and 9666. In fact, Z5 is 9660 and Z7 is 9661, a spread of just -1. On June 26 this spread was -35.5 (9599/9634.5). Three months later on Sept 25 the spread hit a high of +24.5 as prices flipped (9710/9685.5) due to perceptions of front-loaded easing. Now what? Which to buy and which to sell? Ginger, or Mary Ann? One thing you can’t go wrong with: Dec Wheat. Popping over $6 this morning, looks ready to run.

–FOMC minutes today, following the 10y auction. At the futures close, 10y WI was 4.033. On July 1 the yield was 4.463%. On 9/16, just two days before the FOMC it was 3.62%.

–CLX4 erased Monday’s rally, down 3.26 bbl yesterday at 73.88. Many markets are spiking and fading.

–Boeing at risk of being cut to junk by both Moody’s and S&P. Google at risk of being broken up by the Federal Gov’t (according to FT). Florida facing a dire storm. Against this backdrop, a pillar of American consumerism, the french fry, is also under assault:

Lamb Weston, the largest producer of french fries in North America and a major supplier to fast-food chains, restaurants and grocery stores, is closing a production plant in Washington state. The company announced last week that it would lay off nearly 400 employees, or 4% of its workforce, and temporarily cut production lines in response to slowing customer demand.

https://www.cnn.com/2024/10/08/business/mcdonalds-french-fries-lamb-weston/index.html

–They can tell you the economy is great, that confidence is up, and that jobs are plentiful. “You want fries with that?”

–A post on X: “Elon Musk says he would like to fire about 80% of the federal government while working with Donald Trump.”

There’s a widespread belief that a Trump admin would blow out (the already shattered) budget, just like Harris. Gov’t spending has had the major supporting role, or, make it the lead role, in creating economic activity. Maybe those assumptions need to be examined more closely.

NFIB uncertainty index at new high

October 8, 2024

******************

–Follow-thru front end selling and continued flattening. On the SOFR strip, reds -8.5, greens -5.375, blues -3.625 and golds -3.125. On Oct 1, SFRZ5 settled 9705, yesterday it was -9 at 9557.5, down nearly 50 in four sessions. For comparison, over the same time period, SFRZ7 fell just 30, from 9691.5 to 9662. October midcurves expire Friday, and 0QV4 9662.5 straddle settled 16.5. Seems high. For good reason.

–New recent low in 5/30 at 43.8 bps; it had posted a high of 62 on Sept 25. TYZ4 settled 112-15+, down 11+ while cash tens were up 4.3 bps to 4.024% in front of tomorrow’s auction. Three year today, 30s on Thursday. There was not much evidence of a reach for puts in the long end. ATM TY straddle settled 2’17 (112.5^) from 2’20 Friday (113^). Some profit-taking sales noted in SFRZ4 puts, for example SFRZ4 9550p sold at 4.0 and settled there, 19 bps otm (9569s). The 9593.75 call settled 4.5.

–From Governor Kugler’s speech yesterday:

…my approach to any policy decision will continue to be data dependent and to rely on multiple and diverse sources of data to form my view of how the economy is evolving. For instance, I am closely monitoring the economic effects from Hurricane Helene and from geopolitical events in the Middle East, since these could affect the U.S. economic outlook. If downside risks to employment escalate, it may be appropriate to move policy more quickly to a neutral stance. Alternatively, if incoming data do not provide confidence that inflation is moving sustainably toward 2 percent, it may be appropriate to slow normalization in the policy rate.

–CLX4 was up nearly $3 bbl late at 77.34. Not only are the effects from Helene important to monitor, Milton is now bearing down on Florida. On another note, the Hang Seng index was down ~10% today. China’s stimulus packages had sparked a rally from 17k to 23k, but HSI fell to 21k today. Global volatility.

–Consumer Credit up just $8.9b with Revolving -1.2% annualized. Data from August, but seems surprising given the “roaring” job market.

Today’s news includes NFIB Small Business Optimism….just released; here’s a snippet:

The NFIB Small Business Optimism Index rose by 0.3 points in September to 91.5. This is the 33rd consecutive month below the 50-year average of 98. The Uncertainty Index rose 11 points to 103, the highest reading recorded.

–Trade balance and 3-year auction coming up.

Eases dialed down to quarter point increments

October 7, 2024

******************

–On September 24, FFG5 settled 9631 or 3.69%, 114 bps below the current Fed Effective rate of 4.83%. This contract captures the next three FOMC meetings. On the attached chart, I’ve marked eases in terms of 25 bp increments. Obviously, with the contract having settled -20 on Friday at 9592.5, one ease came out. This morning there is follow-through from Friday’s sell-off, with the contract down another 5 at 9587.5. If the Fed were to ease 25 bps at the Nov, Dec and Jan meetings, the final settle would be 9592.0 (right at Friday’s level). November FF settled 9537.0, and would settle 9536.17 on a cut of 25. So, even though the first cut was 50, Friday’s NFP of 254k has dialed down future cuts to quarter point increments.

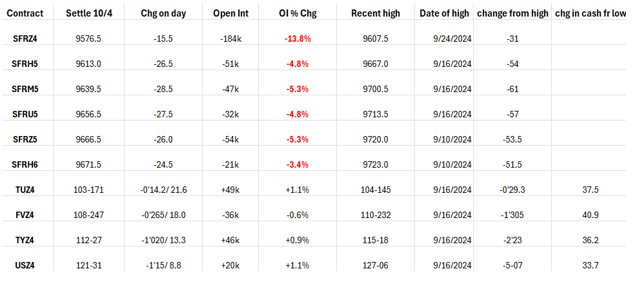

–As mentioned over the weekend, there were huge declines in SOFR open interest, with SFRZ4 shedding 184k contracts or 14% of open contracts. Recalibration continues this morning with SFRZ4 down another 5.5 to 9571 (was -15.5 on Friday). SFRM5, which was the weakest contract on Friday, -28.5 at 9639.5, is down another 8 at 9631.5. Clearly some of the price action is simply forced liquidation.

–Curve flattened hard, with the 2yr yield up 21.6 to 3.928% and 10y up 13.3 to 3.981% 2/10 closed at 5.3 bps coming off a high of 23 on Sept 25. As previously mentioned, that area is essentially the halfway point between the 2021 high of 158 and the 2022 low of -109. Will likely hold between -10 and -5.

–Consumer Credit this afternoon. Several Fed speakers including Bowman and Kashkari. Auctions of 3s, 10s, 30s begin tomorrow. CPI Thursday.

Puke

October 6, 2024 – weekly comment

*****************

Friday’s payroll report showed a surge of 254k vs expected 150k, and the unemployment rate fell back to 4.1% from 4.2%. Rate futures plummeted. Curve flattened. Some are now saying that September’s 50 bp cut by the Fed was a policy error.

Below is a table of selected futures prices, along with bp changes and open interest changes. I only went as far as SFRH6 in SOFR because that was the peak contract for most of last week. In treasury futures, I marked the daily tick change along with cash treasury bp changes (even though durations are somewhat mismatched). Two main points. 1) There was an absolutely massive position puke in near SOFR contracts. Total open interest on the strip plunged by 432k contracts on Friday. 2) Net changes from mid-September highs (pre-FOMC) have been huge with near SOFR contracts rising in yield by half to 5/8% and cash treasuries by around 3/8%. The last FOMC was 18-Sept, nearly an exact top-tick as most futures prices peaked on 16-Sept.

November Fed Funds, which price the Nov-7 FOMC, settled 9537.0, -6.5 on the day. I calculate that a 25 bp ease at that meeting will result in a final settle of 9536.17. (A 50 bp cut would be 9555.33). As of Friday, the market is close to pricing a 25 bp cut, which one might say had been guided by Powell. The forward shift to a lower glide-path of rate cuts has been extraordinary this week.

As an aside, I’ve heard several commentators remark on huge, uncomfortable, shorts in crude oil, much having to do with COT reports. Just as a comparison, using the sum of the first two contracts in WTI, open interest fell by 6.8% on a price rise in CLX4 of 6.5% from 69.83 to 74.38 from 01-Oct to 04-Oct. However, using COZ4 and COF5 Brent contracts, open interest actually rose a bit from 01 to 03-Oct (04-Oct OI unavailable). Huge moves in oil, rates, and China’s stocks have likely caused large swings in hedge fund returns.

The late September surge in BCOM (Bbg Commodity Index) and in oil have some saying that inflation is likely to reaccelerate. BCOM closed 102.07; high of the year has been 107.24 and low (last month) was 93.33. Front WTI contract settled 74.38 vs this year’s high at 86.91. Last year’s high was 93.68 (in September, so a year later it’s down $19/bbl). In 2022 the high was over 120. We’re not even close to the year’s peak. While inflation may firm a bit from here, the shelter component is likely the most important piece of the forward outlook. CPI is released Thursday and is expected 0.1 with Core 0.2 month/month. YOY expected 2.3% from 2.5% last, with Core 3.2% from 3.2%. In March/April of 2023 when the regional banking ‘crisis’ flared, Powell refrained from easing even though SOFR futures briefly projected aggressive cuts. At the time, yoy CPI was declining, but was still 5.0 in March’23, 4.9 in April and 4.0 in May. If the yoy estimate of 2.3 is correct it will be the lowest since 2021. Pre-covid, the average CPI was 2.45% in 2018 and 1.8% in 2019. PPI is Friday. Also this week are auctions of 3s ($58b), 10s ($39b) and 30s ($22b). As the below chart shows, the low yield of 3.93% on 30s was set on 16-Sept, just two days prior to the FOMC. Since then, the yield has risen 33 bps and has broken a loosely drawn channel. Halfway back of this year’s range is 4.37, which is an appropriate short-term target. In futures terms, USZ4 settled 121-31 vs 4.267% on the long-bond. Ten bps in the contract is approx. 1-11 or a price of 120-20, which should be a solid support area (yield resistance).

Auction demand will be an interesting signal going forward. I believe the Fed wants to make sure that funding conditions are favorable for sustaining US debt, and that means a positive curve with a lower FF rate. In my view, geopolitical conditions coupled with uncertainty around (and just after) the election make an ease in November highly likely. With the market now pricing at 25 bps, I think plays for 50 are advantageously cheap.

Druckenmiller said last week, “Bipartisan fiscal recklessness is on the horizon.” My thought is that post-election, no matter who wins, markets may rebel. No one is talking about fiscal responsibility presently, but that may start to change. There was a quote on X from @SpecialSitsnews: “If you don’t rein in your mind, the market may have to.” -My first boss. Quote actually used “reign” so I guess this guy has a couple of things to work on.

There were a couple of BBG News bullet points that I found interesting last week:

– FRENCH PM BARNIER: REDUCTION OF DEFICIT PART OF POLICY PRIORITIES

– FRENCH PM BARNIER: PILE OF DEBT WILL WEIGH ON OUR CHILDREN IF WE DON’T ACT NOW

– FRENCH PM BARNIER: DEFICIT IS MAKING FRANCE WEAKER IN EUROPE (Tuesday Oct 1)

And on Thursday:

*ITALY PLANS WINDFALL LEVY ON COMPANIES TO NARROW DEFICIT

Perhaps the widening of France to Germany 10y spread this year is a nudge in the right direction. My thought is: when comments/critiques on a topic like excessive deficit spending begin at the periphery, it doesn’t take very long to affect the core. Markets may have to help rein in thoughtless spending. Bond yields will reign.

OTHER THOUGHTS/ TRADES

Last week I mentioned SFRZ4/M5/Z5 butterfly which settled -70 on Friday, 27-Sept. My inclination was to sell the back end of this fly, the M5/Z5 calendar. Obviously, it would have been better to be long the fly, as it exploded to -36 on Friday. SFRM5/Z5 still went from -17 to -27 on the week.

| 9/27/2024 | 10/4/2024 | chg | ||

| UST 2Y | 356.3 | 392.8 | 36.5 | |

| UST 5Y | 350.7 | 381.3 | 30.6 | |

| UST 10Y | 375.1 | 398.1 | 23.0 | |

| UST 30Y | 409.9 | 426.7 | 16.8 | |

| GERM 2Y | 207.6 | 220.3 | 12.7 | |

| GERM 10Y | 213.3 | 221.0 | 7.7 | |

| JPN 20Y | 166.7 | 165.6 | -1.1 | |

| CHINA 10Y | 218.3 | 221.0 | 2.7 | |

| SOFR Z4/Z5 | -104.0 | -90.0 | 14.0 | |

| SOFR Z5/Z6 | 8.0 | 4.0 | -4.0 | |

| SOFR Z6/Z7 | 12.0 | 4.5 | -7.5 | |

| EUR | 111.66 | 109.77 | -1.89 | |

| CRUDE (CLX4) | 68.18 | 74.38 | 6.20 | |

| SPX | 5738.17 | 5751.07 | 12.90 | 0.2% |

| VIX | 16.96 | 19.21 | 2.25 | |

Payrolls

October 4, 2024

*****************

–Service ISM stronger than expected at 54.9 versus 51.5 last. Yields rose, with rate contracts closing at new lows, wiping out all gains made since the last employment report. For example, SFRH6, the peak SOFR contract, settled 9696, the first settlement below 9700 since 3-Sept. The high settle was 9723, a couple of days after the last NFP. Price action is bearish. Ten year yield rose 5.5 bps to 3.948%. The question becomes: Is a possible trend change due to Powell cooling off easing expectations? Is it due to renewed strength in the economy? Or is it a more insidious and pervasive recognition that reckless spending policies could rekindle inflation and resurrect bond vigilantes. Druckenmiller has taken the reins, saying he’s short bonds, but doesn’t know the timing. “Bipartisan fiscal recklessness is on the horizon.” [It’s not only on the horizon, it’s been a feature for years]. He said his ex-boss [Soros] “would be embarrassed” of him failing to make a bigger short bet on U.S. bonds, as he suggested inflation could now surge to levels last seen in the 1970s. (marketwatch.com)

–I mentioned the ten-year breakeven (10y minus tip yield) yesterday, and it edged to another slight new high at 221 bps. Not dramatic, but persistent. Treasury vol was flat to a bit softer, so there’s no real sense of panic despite closing on the lows, but we do have NFP today and 10, 30 year auctions next week. My guess is that a weak NFP will lead to a rally in TY which will be met with patient sellers, who might become more aggressive if yesterday’s lows are taken out. The Fed’s job is about to become much more difficult: rising long-end yields in the context of a slowing economy.

–I always associated 1970s inflation with oil shocks. CLX4 was up 3.61 to 73.71 and is well over 74 this morning. Not quite a “shock” but just as rate futures completely erased the September rally, WTI has erased September weakness. Longshoremen strike has ended; perhaps the union boss didn’t appreciate the limelight of seeing his sprawling mansion on every news show. 62% pay raise over 6 years.

–Payrolls today expected 140 to 150 from 142 last. Rate expected 4.2%.

It’s a league game Smokey

October 3, 2024

*****************

–Given all the other things going on in the world, I hadn’t thought much weight would be placed on tomorrow’s payroll data. The Boeing strike and longshoreman strike and effects of Helene will probably make this data volatile over the next few months. However, they were happy to use stronger than expected ADP (143k) as an excuse to sell rate futures. Red SOFR contracts settled -4.0 and the ten year yield rose the same amount, to close at 3.783%. 30y was up 5 bps to 4.13%. The ten year breakeven (treasury yield – tip) edged to a new recent high of 222 bps, coming off a low of 203 in early September. It seems to me that the long end has an undercurrent of weakness related to inflation concerns, supply in the context of unsustainable spending, and a possible lack of foreign sponsorship. Days of QT are numbered.

–Slight new high in SFRZ4/H5 at -51.5 (9596.5/9648) up 1 on the day. The next 3-m spread is H5/M5 at -30.5, and then M5/U5 at -15.5. Fair amount of fluidity represented by these spreads, dependent in large measure by the pace of easing. FFV4/FFG5, Oct/Feb which covers the next three FOMCs, is hanging around -100, yesterday at -100.5 (9518/9618.5). If inflation expectations flare up (evidenced by the 10y breakeven continuing to move up), it’s possible that pricing of near-term easing will reset to a slower pace.

–Several articles about depositor balances at BofA being marked at ZERO. (“Mark it zero dude”). Bloomberg headline today: Warren Buffet sells $338 million of BofA stock as spree slows.

Coincidence?

–And a nod to fellow conspiracists worried about a global monetary order controlling and reviewing all flows, here are the one-year futures calendars:

SFRZ4/Z5 is -1.045 (9595.5/9701)

ERZ4/Z5 is -1.025 (9718.5/9821)

SFIZ4/Z5 is -1.020 (9550.0/9652)

All the same price. Why OF COURSE I own gold. And tin, for my foil hat, which is why tin is near ytd highs.

–Today:

Jobless Claims expected 222k.

S&P services PMI 55.4 and Composite 54.3

ISM Services 51.7 from 51.5

Payrolls on Friday, NFP expected 140-150k with a rate of 4.2%