Poco a poco? Not any more

November 17, 2024 – weekly comment

*****************************************

This note is not about the market, but about the realignment of incentives.

I think this clip of Nayib Bukele, President of El Salvador, crystallizes the inflection point where we now find ourselves.

https://x.com/nayibbukele/status/1846375736308887723

In summary Bukele’s advisors said:

“You know that you can’t eliminate crime all at once, right?” Bukele asked, “Why?” Because the money the criminals make is recycled into the legitimate economy. “All of that economic activity will fall all at once, without a legal, parallel economic structure to replace it at the same speed. He [the advisor] said “you need to stop crime little by little (poco a poco) so that poco a poco you can offset that criminal economy.”

Bukele: ‘These are the kinds of theories that sound good to intellectuals but don’t apply in reality. The reality is that crime is crime. Punto. (Period).’

Bukele goes on to talk about incentives for the youth. “We’ll never be able to win the war of incentives. We found out the only way was to go after the gangs and arrest them. Not to punish them, but to remove them from society. They have to be out of the equation.” “So this young man [in his example] now thinks about his new incentives and says: ‘What should I do? Be a gang member and end up in prison, or should I get to work and earn money that now nobody [the gangs] will take from me?’ The point is that the incentive structure becomes right for society.”

“We understand we’ll pay an economic price for eliminating crime. …The alternative is to do nothing. …Our calculations – not from our financial cabinet, but from within our security cabinet – were that we would have a cost of 10% of our GDP. GDP would fall by 10% to eliminate crime. But our GDP didn’t fall by 10% it GREW by 3.5%.”

A good plan violently executed now is better than a perfect plan executed next week.

General George Patton

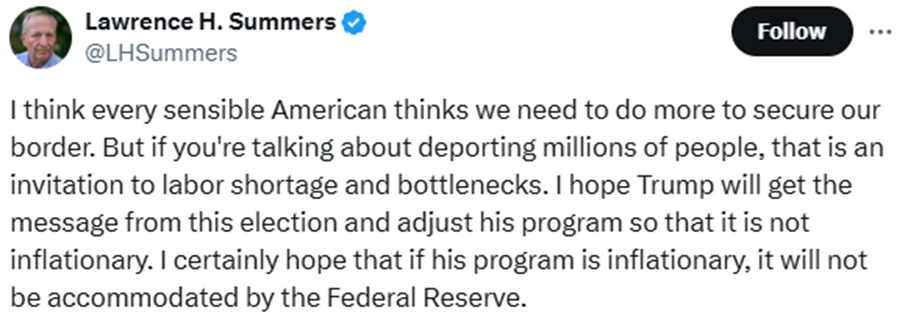

Here’s a typical response from the “intellectuals”:

I’m not personally on board with the idea of mass deportations. But it’s NOT because I am afraid it could be slightly inflationary. I think Summers’ argument is pretty stupid. The point is that INCENTIVES are changing, not only with respect to illegal immigration, but across the spectrum. Slow and sensible are out. There will be wrenching changes.

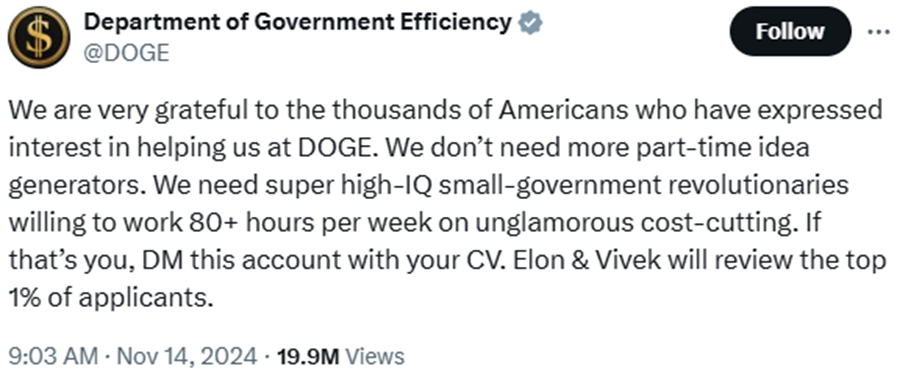

Consider this X post from DOGE:

https://x.com/DOGE/status/1857076831104434289

Notice what they did NOT say: “Go to this site and fill out an application. We’ll review your education credentials, mindful of our diversity goals, etc.” What they want: RESULTS. High IQ hard workers who share a vision. I doubt they care about anything else.

It’s like one of my favorite scenes in Ghostbusters, where Dr Ray Stantz (Dan Akroyd) tells Venkman (Bill Murray). “Personally I like the university, they gave us money and facilities. We didn’t have to produce anything. You’ve never been out of college. You don’t know what it’s like out there! I’ve worked in the private sector. They expect results.”

https://www.youtube.com/watch?v=RjzC1Dgh17A

I’m not saying it’s good. I’m not saying it’s bad. But there is a new reality to adjust to.

Bukele, Millei, Musk, Trump. Disruptors. The old order is obsolete. There are many legacy columnists and authorities demeaning Trump’s choices for important posts. I googled “editorials condemning Trump’s choices for policy roles”. Starts with NY Times (of course) ‘Reckless Choices for National Leadership’. They’re all there. Wash Post, LA Times, Vox, etc. Michael Bloomberg warning on RFK. Shrill admonitions on Gabbard. The key word is ‘legacy’. You lost. Your authoritative proclamations will now just bounce around sidelined echo chambers like the 4B movement.

The change in incentives already has created initial winners and losers in markets. Gone is the ‘participation trophy’. Passive investing might fall by the wayside. Banks soared. Big pharma was crushed. Bitcoin’s a winner. Gold’s a loser (for now). A friend had mentioned that the Defense Dept was already shifting funding and emphasis to smaller, more nimble companies working on drones, cybersecurity, etc. That dynamic will surely accelerate. In terms of rates, a new burst of entrepreneurial energy argues for higher base rates (in my opinion). In the short term, perhaps there will be economic pain as government transfers to households and the private sector are cut. The bar for Druckenmiller’s ‘hurdle for capitalism’ will probably be set to a higher standard. That means higher rates / higher neutral.

OTHER THOUGHTS / TRADES

Government hiring and spending has been an undeniable prop for stocks since covid. The broad equity market has also been supported by the idea of less restrictive forward rates. Both of those tailwinds are in jeopardy. Last week Powell indicated the Fed could take more of a wait-and-see posture given the resilience of the economy and balance in the labor market.

The green sofr pack, 3rd year forward, ended Friday at 9617.25, nearing 4%. It’s down 99 bps since Sept 10, just prior to the FOMC. Chart below.

The election surge in SPX retraced by exactly half (Nov 4 low 5696 to Nov 11 high 6017, halfway is 5857; Friday’s close 5870). It wouldn’t be surprising if stocks correct lower due to perceptions of renewed restriction by the Fed, and the realization that reduced gov’t spending will negatively impact GDP. Such a move might provide temporary support for fixed income, but the trends of a more normal positively sloped curve and funding rates that stay high relative to the past decade are likely to persist.

| 11/8/2024 | 11/15/2024 | chg | ||

| UST 2Y | 425.0 | 429.5 | 4.5 | |

| UST 5Y | 419.0 | 429.4 | 10.4 | |

| UST 10Y | 430.4 | 442.4 | 12.0 | |

| UST 30Y | 447.6 | 459.7 | 12.1 | |

| GERM 2Y | 218.5 | 212.2 | -6.3 | |

| GERM 10Y | 236.7 | 235.6 | -1.1 | |

| JPN 20Y | 183.1 | 188.4 | 5.3 | |

| CHINA 10Y | 210.7 | 207.3 | -3.4 | |

| SOFR Z4/Z5 | -60.5 | -57.0 | 3.5 | |

| SOFR Z5/Z6 | -7.5 | -5.5 | 2.0 | |

| SOFR Z6/Z7 | -2.0 | -1.5 | 0.5 | |

| EUR | 107.20 | 105.36 | -1.84 | |

| CRUDE (CLF5) | 70.11 | 66.92 | -3.19 | |

| SPX | 5995.54 | 5870.62 | -124.92 | -2.1% |

| VIX | 14.94 | 16.14 | 1.20 | |

In: Eurodollar Options

Fed has the ability to approach policy carefully. Uh-oh

November 15, 2024

*********************

–Knee-jerk selling of rate futures on higher than expected PPI, 0.2 with Core 0.3 m/m. Then prices reversed. TYZ4 109-04+ on the number, then back up to 109-24+ pre-Powell, then to 109-08 post-Powell.

–SFRZ5 9600p seller of 40k at 37.0 covered 9614.5, 42d. SFRZ5 9612.5^ settled 90 on Wednesday and immediately traded 88.5 after put sale, where it settled. 9600p settled 38.25 v 9612.5. As attached vol chart attached indicates, this sale is near the lower end of the vol range, but is near 20-day historical. I think this is a program sale, as it seems to happen every couple of quarters (large put sales on first red, just out of the money). For the sake of comparison (roll) SFRU5 9600p settled 32.5 against 9608.

–Event of the day was Powell. He indicated the Fed is in no hurry to cut rates. Still wants to recalibrate but says with the economy strong the Fed has the luxury to see how things develop. Said that fiscal policy takes a fairly long time to work its way through the system… but in my opinion, the change in incentives is unquantifiable, and can happen very quickly. DXY ended near 107, a new high for the year, after being as low as 100.38 (low of the year) on Sept 27. Hard whiplash in the dollar over past six weeks. Heavy corporate bond issuance adding marginal pressure on rates.

–Powell spoke right at futures settlement time. This morning back SOFR contract from Dec’26 out are down 1.5 to 0.5, but near contracts (and stocks) are still absorbing the idea that the Fed could be on hold. SFRZ4 settled 9558.5, but trades as low as 9553.5, -5 from settle of 58.5 . EFFR is 4.58 (Price 9542). SOFR is 4.60ish (9540 and daily compounding adds a bp or so). SFRZ4 not quite ready to give up on a “recalibrating” ease on Dec 18, but it’s getting harder to make that argument.

–BOJ’s Ueda speaks Monday. I attached 20y JGB chart from yesterday. Longer maturities in Japan pushing for new yield highs (10y JGB around 1.07, 20y 1.89 with high 1.95 in July, just prior to the yen-carry volatility).

This chart is SFRZ5 implied vol with 20 and 60 day historical

Wide range of outcomes

November 14, 2024

*********************

–PPI today but the only thing that matters is Powell, on the Economic Outlook, at 3:00.

–Big steepening rebound yesterday. 2y yield was DOWN 6.1 bps to 4.379% while 30s were UP 6.1 to 4.636%. As can be seen on attached chart, that’s a new high bond yield. 5/30 had made a new recent low Tues at 26 bps, but snapped back yesterday to 33.7 (5y yield -1.5 to 4.299%). Strongest SOFR on the board was M5, + 10.5 to 9601.5. By contrast M6 +3.0 to 9616.5, M7 -0.5 to 9616.0. Nov SOFR midcurves expire tomorrow, ATM settles: 0QX4 9612.5 = 8.0, 2QX4 9612.5 = 8.0, 3QX4 9612.5= 7.5. These are all down from about 13 the day before. Dec treasury options crushed. TYZ4 109.5^ settled 62 on Tuesday ref 109-135, and 49 yesterday with unch’d futures (Dec opts expire 22-Nov).

–New high DXY yesterday over 106.50, and this morning it’s around 107.0. (Level of USD is one factor in financial conditions; bonds and USD are tightening). Rishi notes the 30y yield is above SOFR (4.60) and EFFR (4.58) for the first time in years. Forward SOFR contracts are locked up ~ 3.85% – all contracts from SFRZ5 to SFRZ8 are between 9612.5 and 9616.5. Throw a blue dart for one to buy and a red dart for one to sell. From many standpoints, it seems to me that the market perceives an easy glide into inauguration. Or maybe paralysis. I don’t think so.

–Reasons for front end strength and related steepener are mostly pinned to CPI which came out as expected, yoy 2.6%. Lame excuse. I saw a snippet saying Citi still going for 50 in December. I feel as if something from Powell’s comments today might have leaked, but that’s just wild speculation.

–With respect to odds of ease in Dec: FFZ4 settled 9551.5. FOMC is Dec 18. EFFR is 4.58. On an ease, contract should settle a shade below 9552.5. On no ease, 9542.0. So every bp is ~10% in terms of odds. Pay 1 (sell 51.5’s) to make 9.5? Pretty cheap put…but what if Citi’s right? Or pay 2.25 for SFRZ4 9556.25/9543.75 to make 9.75. Of course, SFRZ4 options expire pre-FOMC on 12/13. But there’s a limit on the risk.

–I feel like there’s a lot “wrong” with current pricing. Stocks too high given valuations and high forward yields. Long end treasury yields still too low. Vol should perhaps be higher both MOVE and VIX. Curve should be steeper. Of course, I can make good arguments why all the former conditions are “right”. Stocks expect high forward growth; inflation is quiescent and bonds will be supported by positive carry. Initial moves by Trump to slash gov’t will cause a bit of economic pain in the near term, but will be positive in the future, and will help keep inflation down.

If the Gov’t Efficiency Team is cutting, does Powell ease?

November 13, 2024

*********************

–CPI today expected 0.2 with Core 0.3 (same as last month) and yoy 2.6 from 2.4 with Core 3.3 from 3.3.

–Trump places Musk and Ramaswamy to tighten up gov’t efficiency. When an individual company announces layoffs, the stock often rallies. But culling government bureaucracy may not have the same effect on equities as a whole. There are a lot of companies depending on government largesse. Great in the long run though.

–Yields up across the board yesterday. New lows for many contracts. A few large trades I’ll cite. For a more thorough list see Art Main’s (TJM) summary below.

0QM 9537.5/9512.5ps 4 paid 25k (settled 4.0 vs SFRM6 9613.5). New

0QM4 9550/9500ps 8.25 paid for 34k (settled 8.25). New

SFRM6 made a new low for the move at 9610.5, but on Oct 1 it was 9713.5…100 higher. Seems a bit late to be selling into it here. On the other hand SFRZ5 fell from 9680 to 9557 in the four month period from start of January to end of April.

–SFRZ4 buyer of 35k 9556.25/9562.5cs for 3.25 covered 9556.5, 13d. Looks to be roll with 9556c OI +40k and 9562c down 40k. There was an outright seller of 50k SFRZ4 9556.5 which sparked a move to the day’s low of 53.5. Last time I saw a block that big was on 9/25 when 82k SFRZ4 were sold on block at 9606 (the top). Also buyer of 20k SFRX4 9556.25/9550ps for 1.75, 20k. New EFFR is indeed 4.58 or 9542 (officially posted for Friday).

–Activity favored put sellers in TY… vol just a bit easier on the move to higher yields. Suggests that there’s little panic left in terms of grabbing long maturity puts. TYZ4 108.5p 30k sold 6 to 5 (109-23+) settled 8 vs 109-135 (exit). TYF5 107p 20k sold at 12, settled 14 vs 109-18 (appears new).

–In combination with weakness in SOFR contracts (& straddles bid)…it argues for flatter curve and indeed 5/30 made new low at 26 bps. 5y yield +12.4 to 4.314 and 30y +9.9 bps to 4.575.

–EUR touched low of the year just under 106…last time there was April, and interceding high in Aug/Sept was just over 112. $/yen modest new high just under 155. DXY 105.90, with a high 106.18. High of year in April 106.51.

–Given the change in forward rates in Euribor (none) and SOFR (Z5 rate up >110 bps) it’s no wonder EURUSD has sold off.

Player summary from Art Main.

+32k SFRZ4 95.5625/95.625 call spread covered 95.565/.59 delta .16/.05 at 3.25

+26.75k SFRF5 96.50 call at 1

+13.9k SFRF5 96.875 call at 0.5

+10k SFRM5 98.00 call covered 95.88/.955 delta .05 from 1.5 to 2

+7k SFRM5 96.375/96.625/96.75/97.00 call condor at 2

+7.2k SFRU5 98.25 call covered 95.965 delta .03 at 2.5

+12k 0QF5 96.25/96.50/96.25 call fly from 5 to 5.25

+10k SFRX4 95.50 put at 0.75

+7k SFRZ4 95.625/95.5625/95.50 put fly at 0.5

+10k SFRZ4 95.625/95.50/95.4375/95.375 put condor at 4.5

+10k SFRH5 95.75/95.265 put 1 x 2 at 1 (bot one leg)

+15k SFRZ5 96.25 put (5k covered 96.065 delta .56) from 55 to 55.5

+34k 0QM5 95.50/95.00 put spread at 8.25

+25k 0QM5 95.375/95.125 put spread at 4

somewhat interesting note from a BBG chat (anon) / China stimmy less than expected accelerated the sell off according to friend WS at MNI.

Luxury company meltdown in europe continues:

MC FP is LVMH

873 in March, now new low 582

KER FR is Kerig

426 in March now new low 212

RMS FR is Hermes

2414 in March, now 2016 (not new low)

CFR SW is Richemont

150 in June, now 118 (not new low)

Bitcoin up/ Gold down / School’s out

November 12, 2024

*********************

–Light volume as treasuries were closed. Flattening bias with SOFR reds down 7.5 but greens -7.125 and blues -6.25.

–Bitcoin explosion with Dec futures up over 10k late to 88300. Precious metals went the other way as DXY continues to rally. DXY now near 106. Dec Gold down nearly $15 this morning at 2603/oz. DXY 105.87.

–Buyer of about 30k SFRH5 9600/9625/9637.5 broken call fly for 3.5 to 3.75, even as odds for more Fed easing are squeezed out (SFRH5 settle 9578). FFG5 which captures both Dec and Jan FOMC meetings settled 9566.5, down 2. That ‘s a rate of 4.335; new EFFR is 4.58 so looking for just one more ease over two meetings. Actually. a bit more priced for the Dec 18 meeting than Jan 29; FFF5/FFG5 settled -7.5 (9559/9566.5).

–NFIB and SLOOS today. NFIB just out at 93.7, but these are pre-election surveys. There are several Fed speakers, most important is Waller at 10, but he’s talking about payments.

–Trump to dismantle the national Education department. He says results can’t get much worse and is probably right.

Flatter curve

November 11, 2024

*********************

–Veteran’s Day. Cash bonds are closed. CME should be but isn’t.

–Friday was a flattener trade on light volume. On SOFR strip weakest contract was SFRM5 which closed -6 at 9600 or 4%. Red SOFR contracts (2nd year forward) were -2.75 with an average price of 9622.25 while greens (3rd yr) were up on the day, only by 0.5, to 9626.875. Two year note up 3.6 bps to 4.25%, tens were down in yield by an equal amount, to 4.304%. New low in 2/10 spread at 5.4, just holding positive as the market perceives a much less generous Fed.

–New highs in stocks to start the week. Bitcoin explosion continues, now 82k. Rate futures lower. USD higher, Oil and gold down.

–Gundlach on CNBC Thursday made interesting comments about the Fed “truing up” with the 2-yr note. He mentioned that since September, FF have fallen by 75 bps while the two-yr note yield has risen (now UP about 70 bps since just prior to the Sept FOMC, a swing of over 140 bps. He joined with Druckenmiller and PTJ in saying that he would avoid buying long bonds due to supply concerns. Link below.

–I haven’t read it yet, but the FT has a lead article today: Is Chicago’s Don Wilson the smartest man in trading?

Post Election and FOMC

November 10, 2024 – Weekly Comment

*******************************************

Following the FOMC’s 25 bp cut and Trump’s sweep, SFRZ4 closed on the low at 9557.5 or 4.425%. After Thursday’s Fed cut, EFFR is 4.58 or 9542. So SFRZ4 is only 15 away from EFFR. SFRZ4/H5 spread closed at a new high of -24 (9557.5/9581.5). Roughly looking at just one ease in Q1. FFG5, which captures Dec and Jan FOMCs, settled 9568.5 or 4.315%, just 26.5 bps under EFFR; 1 cut.

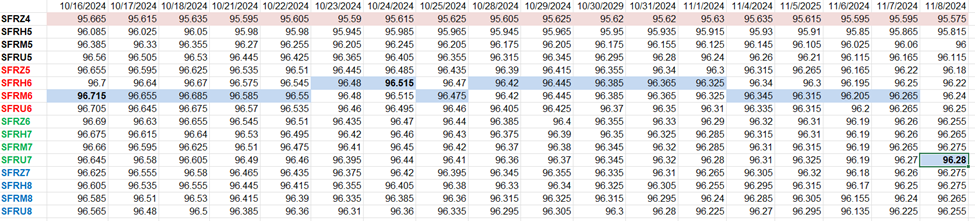

The table below is a bit hard to see, but focus on the red and blue shaded areas. The contracts are SOFR, for the first four years, whites, reds, greens, blues. The start date is October 16 (random start date, about 3.5 weeks ago). The red shade represents the lowest contract/highest yield on the strip: SFRZ4 (from 9566.5 to 9557.5). The blue shade is the peak price on the strip. One might roughly equate it to the terminal rate. As the peak (blue) moves closer in time, it gives a rough measure of how aggressive the Fed is going to be in terms of easing policy. A week ago it appeared, from this table, as if the Fed would be done easing in about a year and a half.

A couple of things to note. The peak on Oct 16 was the third red at 9671.5 or 3.285%. The next week on Oct 24 it had moved closer in terms of time, to the second red slot, (SFRH6) at 9651.5. On Oct 16 the spread from lowest to highest was -105 bps. On Oct 24, -90. On Friday, the peak contract moved all the way back to the third green, SFRU7, at a price of 9628 or 3.72%. The lowest/highest spread is just -70.5 and covers a lot more time. All contracts from SFRH6 to SFRH9 settled between 9622 and 9627.5. Rough terminal rate of 3.75%.

I hope the market is wrong, because that could bring a boring few years for SOFR. What does this limited data set tell us about market sentiment? Whether the Fed articulates it or not (and Powell speaks on Econ Outlook again on Thursday) it will be leaning against stimulus measures by the new administration and rates will generally be higher.

So why did the treasury curve flatten? I think a lot was vol/long put related. Consider the charts below. The top is over a six-month time frame. Since the FOMC on Sept 18, yields moved significantly higher. Market sentiment shifted to fears of unsustainable deficits and re-acceleration of inflation. Going into the election, bearish bets on the long end were expressed by heavy demand for puts. The huge rise in the MOVE index bears this out. With both the election and the FOMC decided, there was a huge decline in MOVE. Put liquidation. Which sparked a yield decline into Friday. The curve flattened as the Fed is expected to be in more of a wait-and-see posture. The chart on the next page shows that dynamic. Five-yr yield fell, but not nearly as much as 30s. Does the yield drop Friday portend a change in trend? Doesn’t look like it to me.

One other thing to notice on chart above: my friend Totman is always pointing out the correlation of $/yen to US yields. It’s obvious on the six-month chart, with $/yen in red. While global yields mostly fell late in the week, JGBs didn’t. Before the “yen-carry” debacle in early August, the 10y JGB had reached a high of 1.09 in July. In mid-August it hit 78 bps as the BOJ calmed the market, then chopped around before the latest run from 81 to 100 bps post-FOMC. Same with the 20y JGB: 1.94 in July, 1.62 right before the FOMC, now 1.83. $/yen in July 161.70. Just before Fed 140.62. Now 152.64. A further rise in JGB yields could siphon away some demand for USTs.

The chart below covers a one-year time frame and shows the 5y and 30y yields in the top panel, with the spread in the lower panel. Last two FOMC meetings marked with purple vertical lines. The 50 bp ease almost exactly marked the bottom in treasury yields. The spread declined/flattened. The market appears to be telegraphing a less accommodative Fed (just as the SOFR table above shows). Five-year note yield ended the week at 4.19%. Still about 40 bps underneath funding rates. However, SFRH5 is 9581.5 or 4.185% and SFRM5 is 9600.0 or 4%. If inflation stays around these levels and the Fed cuts a couple more times into Q2, then it will be a lot easier for the Treasury to place debt, as the US banking system will likely absorb a larger share of issuance.

News this week includes NFIB optimism on Tuesday…but this survey was done pre-election.

CPI Wednesday, PPI Thurs and Retail Sales Friday, but again, data may change quickly going forward. Powell speaks on Economic Outlook on Thursday.

The Fed’s quarterly Sr Loan Officer Opinion Survey (SLOOS) is Tuesday. The last report from July indicated modest tightening, though most banks/categories were unchanged. About 60 banks participate, 20 are large banks.

Home Depot (HD) reports on Tuesday. I was surprised to see a BBG article which says that same store sales have declined for 8 straight quarters (following the Covid surge). Pretty tough to do given inflation.

| 11/1/2024 | 11/8/2024 | chg | ||

| UST 2Y | 419.7 | 425.0 | 5.3 | |

| UST 5Y | 420.6 | 419.0 | -1.6 | |

| UST 10Y | 435.5 | 430.4 | -5.1 | |

| UST 30Y | 455.5 | 447.6 | -7.9 | |

| GERM 2Y | 224.7 | 218.5 | -6.2 | |

| GERM 10Y | 240.5 | 236.7 | -3.8 | |

| JPN 20Y | 177.7 | 183.1 | 5.4 | |

| CHINA 10Y | 214.3 | 210.7 | -3.6 | |

| SOFR Z4/Z5 | -67.0 | -60.5 | 6.5 | |

| SOFR Z5/Z6 | 1.0 | -7.5 | -8.5 | |

| SOFR Z6/Z7 | 2.5 | -2.0 | -4.5 | |

| EUR | 108.35 | 107.20 | -1.15 | |

| CRUDE (CLZ4) | 69.49 | 70.38 | 0.89 | |

| SPX | 5728.80 | 5995.54 | 266.74 | 4.7% |

| VIX | 21.88 | 14.94 | -6.94 | |

Settling in for higher terminal rates

November 8, 2024

*******************

-Fed cut 25 as expected, so EFFR should now be 4.58% (from 4.83%). Jan FF contract settled 9560.5, +0.5 on the day, or 4.395%, so the spread to the new EFFR is -18.5, i.e. about 75% chance of another 25 bp cut in Dec. FFG5, which also captures the Jan 29 FOMC, settled 9570 or 4.3%. It’s somewhat surprising, given the surge in equities post-election, that rate cut expectations remain fairly well entrenched. However forward rates remain stifled. SFRZ4 settled 9559.5. The highest contract on the strip is now SFRM6 at 9626.5, a spread of just -67 to front Dec. On Oct 1, SFRM6 was 9708 and SFRZ4 was 9597.5, a spread of -110.5. Every SOFR contract over the three year span from Z’25 to U’28 is between 9622 and 9626.5, about 3.75%. I had thought a ‘terminal rate’ would be about 2.75% in this cycle, which was around the high in Trump’s first term in 2018. Either I am wrong, or it’s worth looking at long-dated call spreads in SOFR.

–Premium across rate futures continues to compress, accentuated by the countertrend rally in bonds. On Monday the Jan atm US straddle was 5’22 ref 117-28 (30y yield 4.494). Yesterday, the Jan US atm 117 straddle settled 4’10, with futures just 20 lower than Monday at 117-08 and cash yield of 4.543. Similar story in SOFR. On Monday SFRU5 9625^ settled 81.5 vs 9626. Yesterday SFRU5 9612.5^ settled 74.0 vs 9616.5. Ten year yield fell 8.5 bps 4.341%.

–Today brings U of M sentiment and inflation expectations. All polls are now taken with a grain of salt. Next week CPI Wednesday and Retail Sales Friday. Powell speaks on Thursday.

Front runners

November 7, 2024

********************

–FFX4 are locked-in for a 25 bp ease today. A cut will take EFFR from current 4.83% to 4.58%. The Jan FF contract prices the Dec 18 FOMC. It currently is 9560 or 4.40%. If, after today, the Fed holds at 4.58, then FFF5 goes to 9542.0, or 18 lower. On another 25 bp cut it goes to 4.33 or 9567.0 (ignoring the Jan 29 FOMC). Obviously, the lean is for another cut after today. Note that it was after the 50 bp cut in September that longer treasuries began their slide.

There’s a Reuters headline today:

‘China’s exports soar past forecast as factories front-run Trump tariff threat’

There’s a lot of front-running going on right now in markets. The other day I joked that on the Sept-18 50 bp cut, ten year yields ultimately soared by about 65-70 bps. Same magnitude after a 25 cut today should spark a move of about 30 to 35 bps. I had marked tens at 4.36% on Friday and suggested perhaps 4.70% should be the target. Got a bit of a front-running head start yesterday with 10y +13.7 to 4.426. The curve steepened with 2s only +6.5 to 4.266%.

–Having said that, I am looking for long-end rate futures to bounce, at least temporarily. Implied vol was crushed in the past 2 days, and demand for the 30-yr auction was strong, posting a result 2.2 bps through at 4.608% on bid-to-cover 2.64. A friend said, “well that’s no surprise given the 20 bp yield back-up” (30s +15.2 yesterday to 4.60%). But that’s the point: the yield rise brings in buyers, i.e. support.

–To give an idea of the vol move, there was an exit block yesterday: TYZ4 109.5p covered 109-12, 54 delta, seller of 17k at 46.

On Tuesday. TYZ4 109.5p settled 33 with a delta of 34 against 110-13. Change in futures of 1’01 or 65/64s should have caused the put to be around 56. But it traded 46. Long puts did NOT perform. Long puts hedged were a disaster. TYZ4 109.5p settled 40 ref 109-175. Open interest fell 11.5k

–There were a lot of big trades yesterday. I am just going to mention a few option trades on SFRZ5, which settled -10 at 9616.5 and had the largest change in open interest at +78k. SFRZ5 9875c 2.5 paid for 30k, new position. These are 259 bps out-of-money. Z5 9325/9275ps 0.75 paid for 50k (new). Top strike 291 otm. Settled 0.75. Z5 9575/9550ps covered 9615.5, 8d, buyer of 40k 7.75 (new, settled 7.5).

The Fed’s September end-of-2025 FF projection was 3.4% or 9660. Exactly one month ago on Oct 7, SFRZ5 settled 9657.5, and on Oct 8 at 9660. Right on target. We now see that the Fed’s guidance, much like that of professional pollsters, has been discredited. In fact, on Sept 10, SFRZ5 settled 9720, so we’ve travelled 100 bps in two months. Maybe the otm stuff in Z5 isn’t so crazy!

–Powell’s future: From the Fed website: Powell’s new term as Chair ends on May 15, 2026.

–Yesterday I mentioned the Frenchman who bet correctly on Trump. In case missed the original story:

Polymarket’s French Whale Scores a $48 Million Trump Jackpot

2024-11-06 17:50:36.537 GMT

By Emily Nicolle and Max Harlow

(Bloomberg) — Many people involved in crypto markets had

reason to gloat on Wednesday about Donald Trump’s win, but one

closely watched French trader’s bets are poised to pay out

millions of dollars on the election’s outcome.

The pseudonymous trader — known best as Fredi9999, the

username of one of his four known accounts on the Polymarket

predictions platform — is expected to haul in a total profit of

around $48 million on the results of the election, according to

calculations made by Bloomberg.

In the platform’s most-popular market, where users bet on

which candidate will be the next president, the four accounts

will net around $22 million, Polymarket data showed on Wednesday

morning in New York. Another $26 million was the result of other

bets related to the election, such as Trump winning the popular

vote or winning Pennsylvania. Two of the trader’s accounts rank

first and second place as Polymarket’s most-profitable users of

all time.

Scrutiny of Fredi9999’s trading patterns ramped up in

recent weeks as his bets ranked among the largest wagers on

Polymarket’s presidential markets, prompting concerns of

possible market manipulation. Following an investigation,

Polymarket said the person behind the four accounts is a French

national with extensive experience in financial services, who

simply wished to bet on Trump’s chances.

Read More: Polymarket Says Trump Whale Identified as French

Trader

On Polymarket, which does not permit US users, traders use

cryptocurrency to buy what it calls “yes” or “no” shares

tracking outcomes of future events. The amount of buying and

selling of those instruments then determines the implied

probability of each outcome at any point in time. The platform

displays profits under each account’s positions, which represent

the difference between the price of the shares when they were

bought and $1.

While polls had been showing a neck-and-neck race between

Trump and his Democrat rival Kamala Harris in the days leading

up to the vote, betting markets swung heavily in favor of the

Republican. Polymarket had been a particular favorite for Trump

supporters, often displaying probabilities of his victory that

were several percentage points higher than other prediction

markets.

Read More: Betting Markets, Vindicated by Trump Win, Set to

‘Run the World’

In comments published by his accounts on Polymarket, the

trader described himself as a European investor, statistician

and “big gambler” who was willing to bet millions on Trump’s

chances. “A land of the free, a home of the brave, not a KAMALA

LA LAND. She is WEAK!!” he wrote on Oct. 6.

The trader said in other comments that he viewed most

traditional polls with caution, given how outcomes were

misjudged in previous presidential elections. Instead,

prediction markets offered the best risk versus reward. Even

then, Polymarket wasn’t his preferred way to wager, just a

portion of his bets, he said.

“Best play is Bitcoin,” the trader said on Oct. 18. “So do

you think that I care about manipulation the odds here ??”

To contact the reporters on this story:

Emily Nicolle in London at enicolle@bloomberg.net;

Max Harlow in London at mharlow4@bloomberg.net

To contact the editors responsible for this story:

stacy-marie ishmael at sishmael@bloomberg.net

Anna Irrera, Michael P. Regan

To view this story in Bloomberg click here:

https://blinks.bloomberg.com/news/stories/SMJ7XQDWRGG0

It’s over

November 6, 2024

********************

–It’s my solemn hope that I don’t have to watch Mark Cuban lectures any more. Apparently Americans don’t like being talked down to. Congrats to the Frenchman (bad news is that he hedged with bitcoin!). And congrats to Musk who went all-in.

–Yesterday brief summary: Curve flatter and implied vol eased from extended levels. On the SOFR strip SFRU5 and Z5 were both -5 on the day (9621 and 9626.5). Two years further down the strip SFRU7 and Z7 were both +1.5 at 9632.5). 5/30 spread made another new low at 27.8 bps. On June 25 this spread was near its low at 10 bps. After the FOMC on 9/25 it was 61, and it’s been pretty much straight down from there (down over 5 bps today, Tuesday). Buyer yesterday of 35k SFRM5 9725/9825cs for 5.25 (settled 5.0)

–This morning the curve is steeper and bonds are printing 116 (118-05s). I mentioned SFRU5 and SFRZ5, currently 9615.5, -5.5 and 9620.0 -6.0 (4:40 EST). SFRU7 is -10 at 9622.5. So SFRU5 to U7 is close to dis-inverting. Stocks at new highs, but it will be tough to hold those gains with long end yields surging.

–Thirty year auction today. FOMC tomorrow with FFX4 continuing to project a 25 bp cut (9535.75s). I am a bit surprised that Jan FF are printing 9559.0 this morning or 4.41, down just 3. A fed cut this week takes EFFR to 4.58%. I would think that Dec now becomes a 50/50 proposition at best (4.58 or 4.33, and halfway is 4.455, a price of 9554.5). Of course, government spending has kept the US economy looking spritely, and for the short term at least, that’s going to change; the baton will be passed to the private sector.