Open the Discount Window

Weekly Comment – February 9, 2020

Summer has come and passed

The innocent can never last

Wake me up when September ends

–Green Day, from the album American Idiot

The Fed is obsessed with September, specifically of course, the mid-Sept 2019 repo surge. For example, in the Fed’s addendum ‘Monetary Policy Implementation’ which is attached to post-FOMC announcements, the language remains the same from its onset in October, into December and then January: “…the Committee directs the Desk to continue purchasing Treasury bills at least into the second quarter of 2020 to maintain over time ample reserve balances at or above the level that prevailed in early September 2019.” The September flare-up has been mentioned in many Fed speeches since it occurred. This brief event has been seared into the Fed’s psyche. It reminds me of one of those action flicks where the protagonist says through the rolling credits, ‘The world will never know how close we were to a global disaster.’ The repo market is now the Fed’s line in the sand. Or coronavirus.

On Thursday evening, Randal Quarles, the Fed’s chair of the Financial Stability Board gave a speech on the economic outlook, monetary policy and the demand for reserves. The last topic was of particular interest, but in its entirety the speech showed that the continuous evolution of the Fed’s framework for policy now revolves around ample reserves and IOER.

Unsurprisingly Quarles’ speech initially noted strength in

the labor market, added concern about weak capex, highlighted risks associated with

the coronavirus. He said that policy is

in a good place, sure to be repeated by Powell in his upcoming Congressional

testimony on Tuesday. He then moved to

the size of the balance sheet. There

were a couple of interesting excerpts:

Although

I fully support the FOMC’s current plan to purchase Treasury bills and increase

the size of the balance sheet in the very short term, over the longer-term, I

believe that the viability of balance sheet policies is enhanced if we can show

that we can meaningfully shrink the size of the balance sheet relative to gross

domestic product following a recession-induced balance sheet expansion. In

effect, I believe that balance sheet policies are more credible if we can show

that there is not a persistent ratcheting-up effect in the size of the Fed’s

asset holdings.

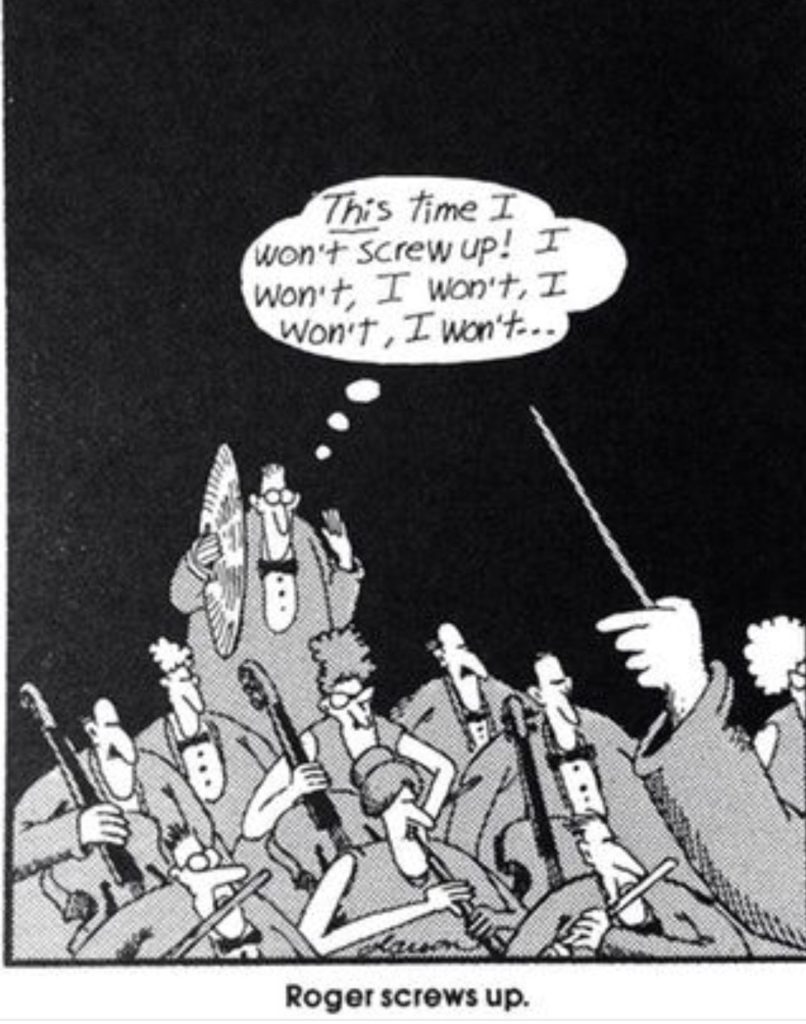

In my opinion, Quarles is worried that the Fed’s strong response to September in terms of expanding the balance sheet could get out of hand. He seems to envision an ‘ebb and flow’ in the balance sheet akin to Keynes’ original thoughts about government spending, namely that it should grow when the economy is experiencing a lack of private demand and investment and should retract as growth returns to normal. [ How does that end in practice? A constantly growing deficit and balance sheet. Here’s a Far Side cartoon that captures the thought. ‘The Fed screws up’ ]

Continuing with Quarles speech:

Following the mid-September volatility, the Committee stated that it would seek to maintain, over time, a level of bank reserves at or above the level that prevailed in early September, a level that we believe is sufficient to operate an ample-reserves regime. Looking ahead, I judge that it is reasonable that we ask ourselves whether it may be possible to operate with a lower level of reserves and remain consistent with the ample framework.

This line is important because Quarles is already leaning against the idea of a constantly ballooning balance sheet.

The (beyond) meat of the speech is in the final section which I will summarize. Due to the Liquidity Coverage Ratio, banks are required to hold High Quality Liquid Assets. (LCR and HQLA). HQLA includes central bank reserves, Treasury securities and Ginnie Mae securities. The issue, spurred by mid-Sept: “Even though the Treasury market is the most liquid in the world, in an actual stress event, banks would still need to take steps to monetize Treasury securities to meet cash outflows.” Quarles solution is summarized by this line: “…I think it is worth considering whether financial system efficacy may be improved if reserves and Treasury securities’ liquidity characteristics were regarded as more similar than they are today- that is to say, that reserves and Treasury securities were more easily substitutable in the context of liquidity buffers.” To this end Quarles proposes use of the Fed’s discount window with Level 1 HQLA as collateral. Remove the discount window stigma and let it become a frictionless way for banks to meet large cash outflows by using treasuries in HQLA as collateral. This idea by the way, was brought up to me in October by friend GH who had previously been at the Boston Fed. Again from the speech, “Such an approach could improve the efficiency of monetary policy implementation as firms might show a greater willingness to reallocate to Treasury securities, reducing reserve demand and improve market functioning.”

In short, this proposal removes the need for a standing repo facility and can be immediately implemented. Implications are as follow, 1) as noted by WGN, a colleague at RJO, it significantly lessens the odds of an end-of-year repo blow-up, 2) it encourages banks to buy treasuries, and we all know there’s plenty for sale in the pipeline, 3) it inserts the Fed more directly but perhaps allows it to use the balance sheet as a more potent tool. On point 2, the Fed knows the supply of treasuries is growing, and there have been some discussions of the Desk extending its buying from bills into shorter coupons. If the stigma to the discount window is removed and the Fed is keeping repo capped, then banks can buy the avalanche of treasury debt instead of the Fed directly monetizing it, (and the Fed can then monetize the banks).

On Friday, this proposed solution affected pricing by alleviating pressure on December contracts, which have traded at a discount due to year-end funding concerns. As an example, EDU0/EDZ0/EDH1 butterfly closed Thursday at +7.5. EDU0 settled 9849.5, Z0 9852.5 and H1 at 9863. So Sept/Dec is -3.0 and Dec/March -10.5 while the next 3-mo spread, H1/M1, settled -2.0. On Friday EDZ0 was the lead performer on the front end of the curve. EDU0 9854.5 (+5.0) EDZ0 9859.0 (+6.5) EDH1 9868.5 (+5.5) and EDM1 9871.0 (+6.0). Sept/Dec/March fly settled +5.0. In other words, the Dec discount related to turn pressure was lessened. Also consider EDZ0 vs FFF1, a rough proxy for libor/ois going into the end of the year. On Friday while EDZ0 closed up 6.5, FFF1 only rose 4.5 to 9879.0. So this spread is now just 20, having been 24.0 a week ago. EDH0/FFJ0 was 11.5 a week ago and is now at a new low 9.5. Credit compression; Fed to the rescue, but it’s only got one cymbal.

OTHER MARKET/TRADE THOUGHTS

Want to see a chart that’s not particularly optimistic with respect to the impact of the Wuhan virus? Here’s China’s ten year yield. Getting back to pre-Trump days. Crude oil also paints a picture of slack demand, off over 20% from last year’s high and pretty much at the low of 2020. CLH0 settled 50.32.

A couple of weeks ago I suggested selling the EDH0 3-month double butterfly at 7.5. It finally broke down to 4.0. Again, probably a function of EDZ0 outperformance.

Last week I suggested buying some midcurve put spreads, which worked through Thursday. However, Friday’s price action re-affirmed upside fear. As a friend sometimes says, “You can be bearish. Just don’t be short.” Here’s a quick pricing example: EDZ0 settled 9859.0 as noted above. EDZ0 9812.5p, 46.5 otm settled 1.5. EDZ0 9912.5c, 53.5 otm settled 6.0. Four times the premium.

Treasury auctions 3, 10, 30 year paper this week. Powell begins Congressional testimony on Tuesday. Inflation data Thursday with Retail sales Friday. Friday’s employment report makes it pretty clear that data is not the driving factor; strong numbers were ignored and vol surged directionally with treasury prices. It’s hard to buy 5’s 20 bps below IOER and 10’s 2 bps under. But for now, that’s the trend.

| 1/31/2020 | 2/7/2020 | chg | |

| UST 2Y | 132.5 | 140.1 | 7.6 |

| UST 5Y | 132.1 | 140.3 | 8.2 |

| UST 10Y | 151.7 | 158.0 | 6.3 |

| UST 30Y | 200.8 | 204.4 | 3.6 |

| GERM 2Y | -67.0 | -64.3 | 2.7 |

| GERM 10Y | -43.4 | -38.6 | 4.8 |

| JPN 30Y | 36.5 | 39.1 | 2.6 |

| EURO$ H0/H1 | -41.5 | -34.0 | 7.5 |

| EURO$ H1/H2 | -3.0 | -2.5 | 0.5 |

| EUR | 110.97 | 109.46 | -1.51 |

| CRUDE (1st cont) | 51.56 | 50.32 | -1.24 |

| SPX | 3225.52 | 3327.71 | 102.19 |

| VIX | 18.84 | 15.47 | -3.37 |

https://www.federalreserve.gov/monetarypolicy/files/monetary20200129a1.pdf

https://www.federalreserve.gov/newsevents/speech/quarles20200206a.htm