Often Wrong, Never in Doubt

January 30, 2022 – Weekly comment

The ten year note ended the week at 1.777% and the thirty year bond at 2.08%. Core PCE prices 4.85%.

The news media duly noted Powell’s hawkish press conference, with repetitive comments about the strength of the labor market, the resilience of the economy, and the fact that some factors feeding inflation aren’t likely to quickly abate. Of course he also said he expects inflation to come down, and noted that the federal government’s contribution to growth this year will be negative. The financial press and analysts are tripping over themselves to ratchet up hiking estimates. Nomura is calling for a 50 bp hike in March, and Bostic, in an interview with the Financial Times suggested 50 is on the table for March.

I was completely wrong in anticipating a dovish press conference. My thought was that the Fed, from a risk management perspective, faces little pushback from a slow and steady increase in rates, and trimming the MBS portfolio would be a good adjunct over time. I felt as if Powell wouldn’t want to relive the humiliating last quarter of 2018, which featured a 20% decline in SPX culminating in Mnuchin having to call the heads of the major banks to ensure liquidity in the event of a further meltdown. Recall that in October of 2018, with the FF target 2.0 to 2.25% and the ten year yield about 3.05%, Powell said rates were nowhere near neutral. QT had ratcheted up to $50b per month. It may be that the stock market sell off was also a reaction to the sugar-rush tax cuts that had been enacted at the very end of 2017, but monetary policy was definitely a factor, and the flattening yield curve was a clear sign of trouble. Powell was forced into an embarrassing about-face. At the start of Q4 2018, the “Buffet Indicator” of total stock market cap to GDP was 146%. A 20% decline in SPX bordered on panic. At the start of this year, market cap to GDP was a record 200%. A 20% decline would equate to 40% of one year’s income.

The Fed’s preferred measure of inflation is Core PCE prices, released last week at +4.85%. Every idiot knows that real rates are highly negative. I most certainly agree rate hikes are in order. But the back end of the curve is NOT signaling desperate concern over spiraling inflation. The long bond is barely above 2%. At the end of June Core PCE prices were +3.6%, well above the 2% target. The ten year rate ended June at 1.47%. At the end of September, Core PCE was 3.7%, with a ten year yield of 1.52%. There has now been rapid acceleration of Core PCE prices to 4.85%, and yet the ten year yield has gone up about ¼% from Sept. The two-year note has risen 87 bps since the end of September.

Once again Powell was dismissive when asked a question about the yield curve. He mentioned that 2/10s were about 75 bps, and deemed that level relatively steep. Of course, by Friday this spread was 61, a new low. The 5/30 spread was 46 and red/gold euro$ pack spread at just 19.25, less than 25 bps from 2018’s inversion. As can be seen on the chart below, the red/gold euro$ spread and 5/30 treasury spread seem to lead 2/10 in forecasting warnings; both are now at pre-covid levels.

[chart: 2/10 blue line, 5/30 white line and red/gold red line]

When asked by Steve Liesman at the previous FOMC press conference why the Fed didn’t immediately stop buying treasuries, Powell said that monetary policy works best when it’s moving in a predictable way, and that it works in concert with market expectations. Now all of a sudden we have Bostic floating an initial 50 bp move. Why not just hike by 200 bps and immediately get real rates closer to normal Raphael? Here’s China’s President Xi from January 18: “If major economies slam on the brakes or take a U-turn in their monetary policies, there would be serious negative spillovers,” Xi said. “They would present challenges to global economic and financial stability, and developing countries would bear the brunt of it.”

Currently FFF2/FFF3 is 120.5 bps, a new high, forecasting nearly 5 hikes in 2022. EDH2/EDH3 closed at a high of 113 on Thursday. The Fed’s most rapid hiking cycle was in 1994. After one and a quarter years at the then historic low 3% FF rate, the Fed started 1994 with three consecutive 25 bp hikes in 3 months, followed by 50 in May. By the end of 1994 Mexico devalued the peso: the tequila crisis. An IMF bailout ensued. If I recall correctly, the Fed, in hindsight, considered its course of action as too aggressive, which contributed to economic dislocations. That one was a bit different from the current tequila crisis that Diageo mentioned a few days ago on an earnings call. There are supply constraints due to barrel aging and bottle shortages. But a financial crisis could easily develop if the Fed goes too fast. Which, naturally, leads to more tequila consumption. You can see where I’m going here. It’s a vicious cycle.

OTHER MARKET THOUGHTS/TRADES

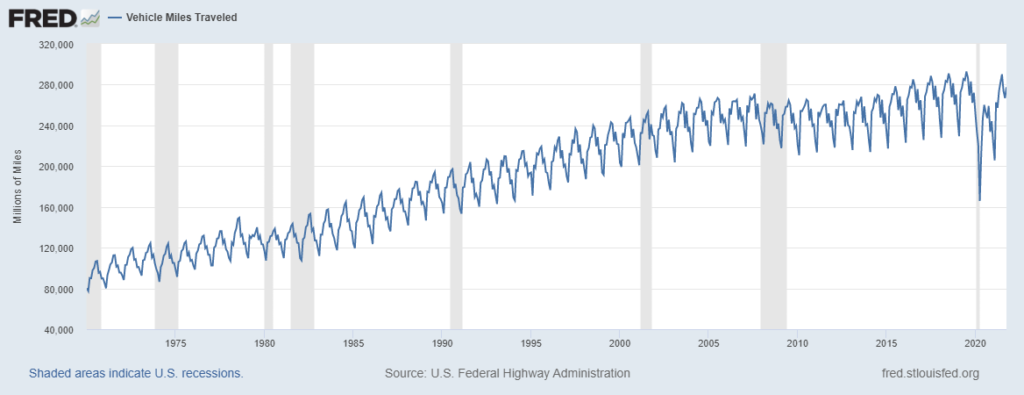

WTI ended the week at 86.82 (CLH2). Highest level since 2014. One might think that it’s due to the rebound in economic activity, and that’s how things should work: more demand, higher prices, more investment in productive capabilities which brings increased supply thus capping prices. But in this case, perhaps the war on fossil fuels has something to do with it. I’m not sure how this data is computed, but below is a chart from the St Louis Fed on Vehicle Miles Traveled. The 2019 peak has not been exceeded.

As mentioned above FFF2/FFF3 calendar settled 120.5, nearly 5 hikes. April FF settled 9962.5, more than one hike. FFJ2/FFN2 settled 40, closer to two hikes than one in the period that encompasses the May and June FOMCs.

Last week I thought EDH4/EDH5 was an enticing buy at 6.5. Powell crushed it. Settled 1.5. As my friend Larry used to say, “I don’t want the cheese any more, just help me get my head out of this trap.”

On Tuesday ISM Mfg is released. Price index topped in June at 92.10. The high in 2018 was 79.5. Last was 68.2 with expectations of 67.0. Payrolls on Friday with NFP expected 150k from 199k.

The Fed’s semi-annual testimony to Congress is usually at the end of February, though I don’t see it on the calendar yet. If stocks now take a tumble, the Humphrey-Hawkins testimony might be the setting for a dovish pivot.

| 1/21/2022 | 1/28/2022 | chg | ||

| UST 2Y | 103.2 | 116.8 | 13.6 | |

| UST 5Y | 155.7 | 161.9 | 6.2 | |

| UST 10Y | 174.4 | 177.7 | 3.3 | |

| UST 30Y | 206.0 | 208.1 | 2.1 | |

| GERM 2Y | -61.8 | -60.7 | 1.1 | |

| GERM 10Y | -6.5 | -4.5 | 2.0 | |

| JPN 30Y | 70.8 | 75.4 | 4.6 | |

| CHINA 10Y | 270.7 | 271.1 | 0.4 | |

| EURO$ H2/H3 | 104.0 | 111.5 | 7.5 | |

| EURO$ H3/H4 | 45.5 | 34.0 | -11.5 | |

| EURO$ H4/H5 | 6.5 | 1.5 | -5.0 | |

| EUR | 113.44 | 111.49 | -1.95 | |

| CRUDE (active) | 85.14 | 86.82 | 1.68 | |

| SPX | 4397.94 | 4431.85 | 33.91 | 0.8% |

| VIX | 28.85 | 27.66 | -1.19 | |