Oct 12. Pinning hopes on China?

–ESZ (Dec mini-S&P) tested the 2748 level four times yesterday before breaking through and making new lows, apparently due to a large sell program. However, there was a strong snap-back late in the day coinciding with news that Trump and Xi will meet at the G20 in November. Yes, Kanye will be there too. That support has carried over this morning, leading to pressure on fixed income.

–While the treasury reported that China is not manipulating its currency, CNY is near a new low this morning at 6.9249, and Reuters reports that China’s exports surged at a 14.5% annual pace in September, leading to a record surplus with the US. “The big picture is Chinese exports have so far held up well in the face of escalating trade tensions and cooling global growth, most likely thanks to the competitive boost provided by a weaker renminbi.” said Julian Evans-Pritchard of Capital Economics (RTRS). The article doesn’t say how much of that surge is related to building inventory before tariffs took place.

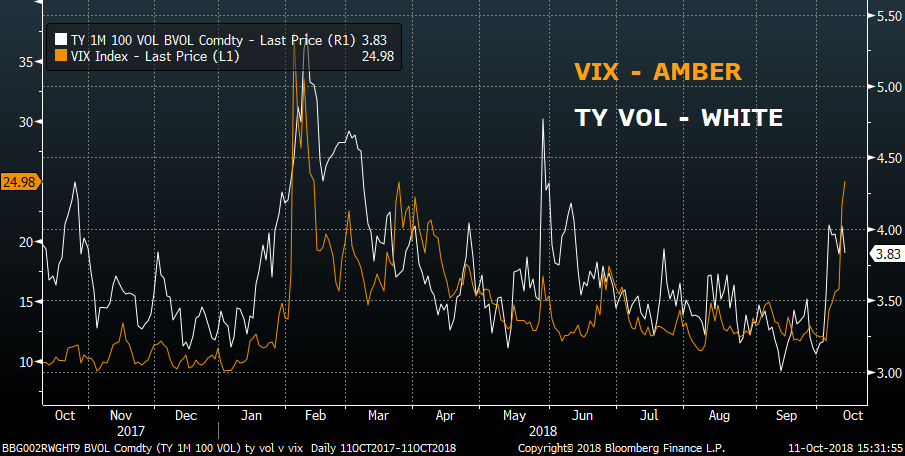

–Yields fell appreciably yesterday with a solid bond auction on the back of weak stocks. Tens fell 8.7 bps to 3.135% (right around the previous high which had been set in May). The curve flattened with reds +6.625, greens +8 and blues +9. EDH9 9725/9737 call 1×2 was bought in size of 100k for flat. There has been a decent amount of covering of otm puts, including a buy of 50k EDH9 9687p for just over 1 bp. There were also some wider call 1×2’s, for example a buyer of EDU9 9737/9787 1×2 bought for 1.5, 20k. Looks like it might have been a cover or roll, but probably not a bad trade. Pressure on interest rate premium is unrelenting even in the face of stock market jitters. Chart below shows VIX move significantly outpacing TY.

–Gold was another beneficiary of stock market turmoil. GLD etf broke out of downside consolidation on the heaviest volume since 2016 and gained 2.90. GCZ8 was up $34 to 1227.60. WTI plunged 2.20 to settle just under $71 (CLX8).

–CPI slightly softer than expected yesterday. Today brings import and export prices, with U of Mich inflation expectations and sentiment.