Oct 10. China’s not the only one depreciating

–Light volume Tuesday. Implied vol opened with a strong bid due to ongoing concerns with the Italian budget, but sellers quickly engaged. For example, 3EZ 9675 straddle had settled 24 on Monday, opened 24.5 bid Tuesday and was sold there soon after the open, settling at 23.5. The curve had a flatter bias in treasuries, with auctions today in 3 and 10 year notes. Decent selling in TYZ 116 and 116.5 puts; appears new sales against higher strike longs.

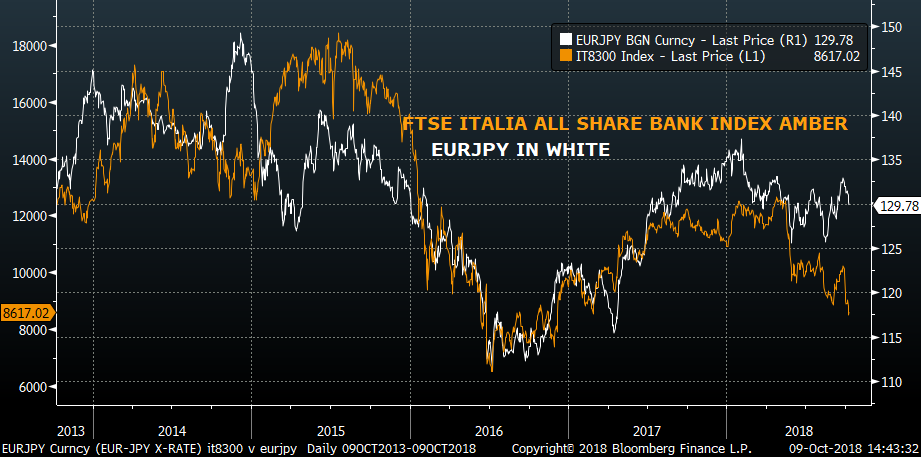

–This morning the FT reports that Mnuchin is warning China not to devalue its currency in response to US tariffs; CNY now 6.923, nearing 7. However, other currencies in the region continue to depreciate vs USD. New low in India rupee, and the Indonesian rupiah is close to a new low. Korea won also close to breaking out to new lows. In spite of that, I would be tempted to sell EURJPY over 130 with a target of the double bottom just over 125.

–PPI expected +0.2 with yoy +2.8. Core PPI expected +2.5 yoy. Crude oil was just breaking out to the upside in late September, and I would think there’s a risk that Hurricane Michael could further disrupt the market.