Nominal might be more real than Real

September 1, 2024

********************

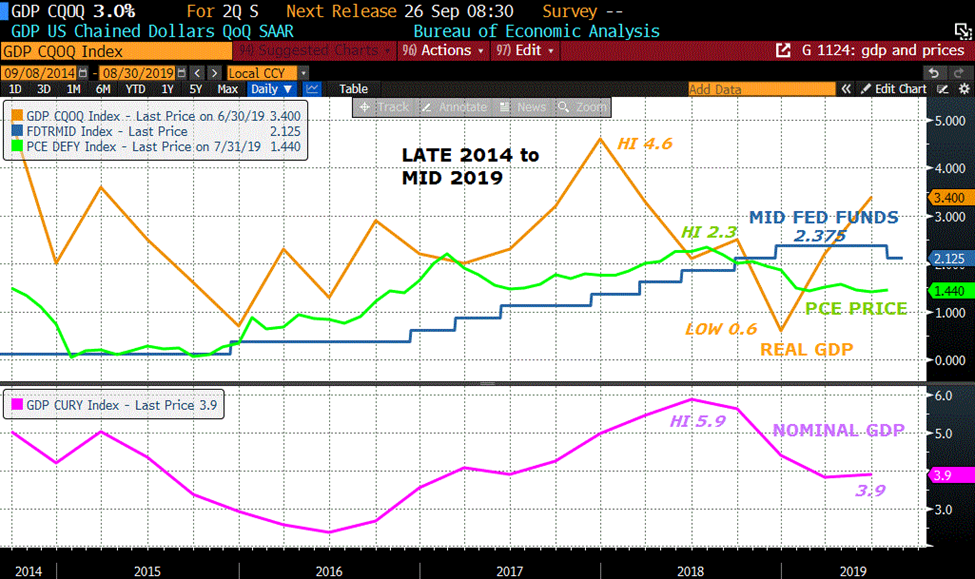

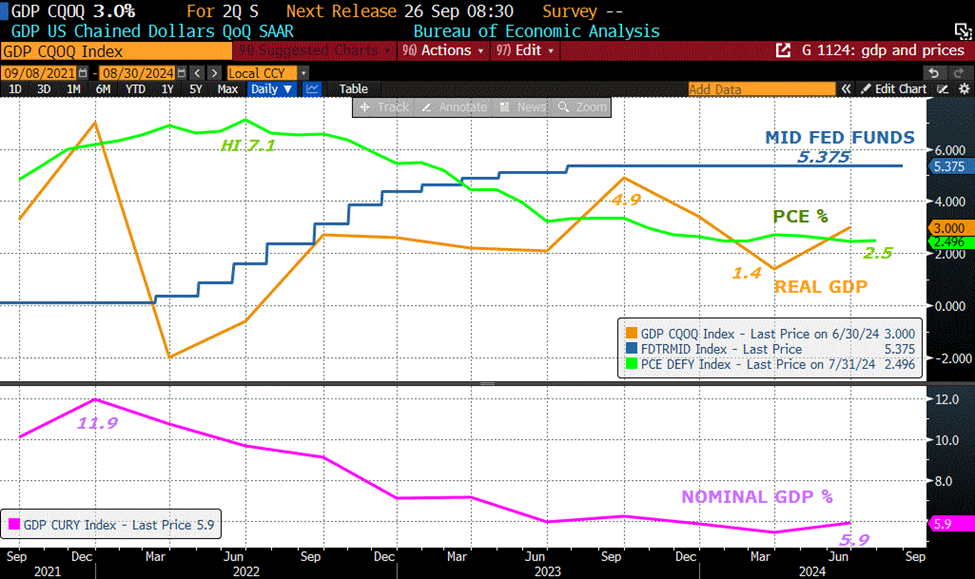

On Saturday I created the following two charts, covering two different time periods (pre- and post-covid). On the top panel of each are the Midpoint of the FF target range (blue), Real GDP (amber) and yoy PCE price changes (green). On the bottom panel is the yoy change in nominal GDP.

I was thinking about how some people are adamant the Fed should not ease, because what Powell deems as “restrictive” policy, really isn’t doing all that much to stifle (real) growth.

First, consider the top chart, which covers 2014 to 2019. Around the middle of 2016 PCE prices started to accelerate, from below 1% to just above 2%. Real GDP was stair-stepping higher as well. Powell took it as an opportunity to begin ‘normalizing’ policy. Going into 2018 (when Trump’s tax cuts were moved over the finish line) real GDP topped as inflation moved higher, but nominal GDP kept marching up. In Q4 2018 SPX tumbled by 20%, and both real and nominal GDP declined. PCE had topped at 2.3% in Q3 2018 but was under 1.5% by Q1 2019. The peak FF rate of 2.375% was above PCE prices and exceeded real GDP for a couple of quarters, but was always well below nominal GDP. NOTE: Real GDP is adjusted using the GDP Deflator, not PCE prices.

Now consider the chart below from post-covid to present. FF are above real GDP and have been above PCE prices since Q2 2023 (restrictive). At the low, nominal GDP grew by 5.6%, just a little above the FF target of 5.375%. The other thing to notice is that nominal GDP has been decelerating for the past two-and-a-half years. Just these metrics provide justification for easing, though it’s debatable if the 200 bps being priced by September of next year is reasonable. [FFV5 is 9675.5 or 3.245% vs the lower end of the current FF target of 5.25%]

The inclusion of Nominal GDP made me think of the Michael Lewis book ‘The Undoing Project’. This is a fascinating read about human decision making. Here’s an excerpt:

The theorists seemed to take it to mean “the utility of having money.” In their minds, it was linked to levels of wealth. More, because it was more, was always better. Less, because it was less, was always worse. This struck Danny as false. He created many scenarios to show just how false it was:

Today Jack and Jill each have a wealth of 5 million,

Yesterday, Jack had 1 million and Jill had 9 million.

Are they equally happy? (Do they have the same utility?)

Of course they weren’t equally happy. Jill was distraught and Jack was elated. Even if you took a million away from Jack and left him with less than Jill, he’d still be happier than she was. In people’s perceptions of money, as surely as in their perception of light and sound and the weather and everything else under the sun, what mattered was not the absolute levels but changes.

Maybe relatively low levels of confidence are related to the deceleration of nominal income even though the level itself is solid. Consider this as well: Money Market Fund assets stand at $6.26T. At a yield of 4.75% that’s about $300b per year or 1% of GDP. Perhaps Rick Rieder’s comments from several months ago ring true… the economy and inflation may well SLOW on rate cuts. That $6t isn’t anxiously sitting on the sidelines just waiting to be deployed into equities…oh, maybe some of it is. But most of it is sitting there saying, if nominal income is just a little over what I am making in a money market, and if stocks in aggregate are making somewhere around nominal income, why should I take risk vs a sure thing?

One of the other key lines from this section of the book is: “When they made decisions, people did not seek to maximize utility. They sought to minimize regret.” An example:

You must choose between having :

1) $5 million for sure

or, the gamble:

2) An 89% chance of winning $5 million

A 10% chance of winning $25 million

A 1% chance to win zero

Most people chose 1. They preferred the certainty of being rich to the slim possibility of being even richer. “If people mostly chose option 1, it was because they sensed the special pain they would experience if they chose option 2 and won nothing.”

“But what was this thing that everyone had been calling ‘risk aversion?’ It amounted to a fee that people paid, willingly, to avoid regret: a regret premium.”

In today’s lexicon, FOMO captures regret premium in another dimension, the fear of being Jill when Jack is printing money being long NVDA. The Fed is well aware that changes at the margin drive the economic narrative. I think Powell is, in part, managing risk in order to avoid a repeat of late 2018, when the Fed was blamed for a sharp setback in stocks and had to reverse course in 2019.

Perhaps this meandering stroll about decision making is a bit much, only to justify rate cuts which the market is already aggressively pricing into next year. On the other hand, the deceleration of nominal GDP, which is rarely mentioned, is likely more important to the nation’s economic psyche than published real GDP data. But here’s another tangible event which is likely to weigh on the economy. BBG reports the end of $1.6T student loan leniency… set to conclude at the end of September. More than 40 million Americans have federal student debt.

I’ll just end with a decision-making story from CME days, which I found perfectly reasonable in terms of avoiding ‘special pain’ no matter how miniscule the odds. On the first floor of the CME was a concession stand that sold candy, sundries, lottery tickets. There was a large lottery and I was in line behind another member who was wearing his trading jacket as well. He placed his order and the clerk said ‘fifty dollars’. The guy whined, ‘I asked you for just FIVE dollars worth.’ I interjected and said, ‘No problem, I’ll take the other $45.’ The customer turned around, looked at me, looked at the acronym on my trading badge, and said to the clerk, ‘I’ll take all fifty.’ Suspicion, superstition, paranoia. It’s hard to model those aspects of a snap decision, even for AI. Of course, when it was my turn I said, ‘I’d like $50 as well, and I want the exact same numbers as that guy.’ Just kidding, I took the random draw.

This week culminates with Employment data, which is once again the most important data release. NFP expected 165k with a rate of 4.2%.

The main feature of what was a pretty quiet week was curve steepening. Tens rose 11 bps on the week to 3.909%. 2/10 ended at -1.4 bps (3.923/3.909), the highest level since mid 2022. The halfway back level from the high in March 2021 of 157.6 to the low of June 2023 of -108.7 is just under 25 bps (next target). On the SOFR strip, the weakest contract was March’28 which settled down 9 on the day at 9676. H5 -5.5 at 9624.5, H6 -6 at 9688, H7 -8 at 9686.5 and then H8 at 9676. Modest but surprising weakness in back end of curve.

| 8/23/2024 | 8/30/2024 | chg | ||

| UST 2Y | 387.3 | 392.3 | 5.0 | |

| UST 5Y | 362.3 | 371.3 | 9.0 | |

| UST 10Y | 379.9 | 390.9 | 11.0 | |

| UST 30Y | 410.1 | 419.6 | 9.5 | |

| GERM 2Y | 237.4 | 239.2 | 1.8 | |

| GERM 10Y | 222.5 | 229.9 | 7.4 | |

| JPN 20Y | 170.1 | 170.9 | 0.8 | |

| CHINA 10Y | 215.5 | 217.8 | 2.3 | |

| SOFR U4/U5 | -168.5 | -164.3 | 4.3 | |

| SOFR U5/U6 | -19.0 | -18.0 | 1.0 | |

| SOFR U6/U7 | 7.0 | 9.0 | 2.0 | |

| EUR | 112.11 | 110.51 | -1.60 | |

| CRUDE (CLV4) | 75.54 | 73.55 | -1.99 | |

| SPX | 5634.61 | 5648.40 | 13.79 | 0.2% |

| VIX | 15.86 | 14.96 | -0.90 | |

Excerpts from The Undoing Project are from pages 257 to 267.