Nominal growth below cost of funds

July 7, 2024- Weekly Comment

*********************************

Never interfere with an enemy while he’s in the process of destroying himself.

–Napoleon Bonaparte

This quote could apply to many of the plots and subplots swirling around the modern world. The most obvious application is to Biden and the Democratic party, but it has some bearing on the economic landscape as well, with Powell holding rates steady rather than interfering with decelerating economic trends – which are moving in his favor in the fight against inflation.

The latest indication comes from jobs figures. Sure, JOLTs had a small rebound to 8140k, but the trend has been decidedly lower since the peak in February 2022 of 12182k. In Friday’s employment report, Private Payrolls were up only 136k. Since 2021 there have only been 4 months out of 42 with lower Private Payroll prints. Total NFP of 206k included 70k gov’t jobs. Let’s consider gov’t ‘job creation’ over a longer period.

The BLS website says that just a shade under 25% of jobs created in 2023 were government jobs. By examining St Louis Fed data and checking monthly totals, it’s clear that NFP is the sum of private payrolls and gov’t jobs. This year so far, government has accounted for just over 22% of new jobs. However, the birth/death adjustment for private business has overstated private payroll data. I conclude that gov’t payrolls as a percentage of total are even greater than the amounts indicated above. In any case, I am confident that increases in gov’t payrolls don’t directly feed into productivity gains.

[The Fed’s semi-annual report specifically cites strong gains in healthcare and in state and local gov’t hiring. Pg 18 of pdf]

https://www.federalreserve.gov/monetarypolicy/files/20240705_mprfullreport.pdf

Now consider real GDP and annualized inflation figures. CPI comes out on Thursday, expected yoy 3.1% from 3.3% last. GDP Price Index for Q1 was 3.1% (released on June 27) and Q1 GDP was 1.4%. PCE Price Index yoy was released on June 28, and was 2.6%. Taking the highest measure of inflation at 3.3% and adding it to real GDP of 1.4% yields nominal growth of 4.7%. The FF rate is 5.25 to 5.5%. Two-year treasuries yield 4.6%. Cost of funds is now exceeding nominal growth, which likely puts a damper on business expansion plans.

Going forward, the Atlanta Fed’s GDP Now forecast for Q2 is 1.5%. The Blue Chip average, which hasn’t been updated as recently, is 2.0%. The NY Fed’s Nowcast for Q2 is 1.79% (July 5) down from 1.93 at the end of June. If we take the (higher) NY Fed growth estimate and add the CPI projection of 3.1%, then we get 4.9 nominal. The math for new expansion isn’t working out.

Let’s compare recent data with the Fed’s June (SEP) Projections. For 2024, Real GDP in the SEP was estimated at 2.1%. Both Q1 and likely Q2 are lower. Unemployment 4.0%, with Friday printing above that level at 4.1%. PCE inflation 2.6%, last at 2.6%, so right at projection. The year-end 2024 FF projection is 5.1%. FFV4 (which captures the Sept 18 FOMC) settled Friday at 9488, or 5.12%. FFF5 (which covers the Dec 18 FOMC) settled 9520 or 4.8%, essentially forecasting TWO 25 bp cuts by year-end.

Powell appears in front of Congress on July 9 and 10. The actual Monetary Policy Report was released on Friday. I posted the link above, but here it is again with a couple of excerpts:

https://www.federalreserve.gov/monetarypolicy/files/20240705_mprfullreport.pdf

In asset markets, corporate bond spreads narrowed, equity prices rose faster than expected earnings, and residential property prices remained high relative to market rents.

Therefore, measures of market rent growth for new leases can help predict future changes in the PCE price index. Since mid-2022, market rents have decelerated and returned to a growth rate similar to or below their average pre-pandemic pace, while the PCE index continues to show elevated inflation, reflecting the gradual pass-through of market rates to existing tenants. As this process continues, PCE housing services inflation should gradually decline, though much uncertainty remains about the extent and timing.

The report’s Special Section on Housing Services Inflation (page 15) cites alternative shelter price measures including those published by CoreLogic, Zillow, Apartment List and RealPage. All are below the Official PCE Housing Services.

******************************

Friday’s data led to a drop in yields. Tens fell 7.4 bps on the day to 4.271% with 30s down 5.1 bps to 4.467%. Changes on the week were -6.8 bps and -3.3 bps; the largest change on the week was a 12 bp fall in the two-year yield to 4.597%.

This week brings auctions of 3s, 10s and 30s starting Tuesday. ($58b, $39b and $22b). CPI Thursday and PPI Friday.

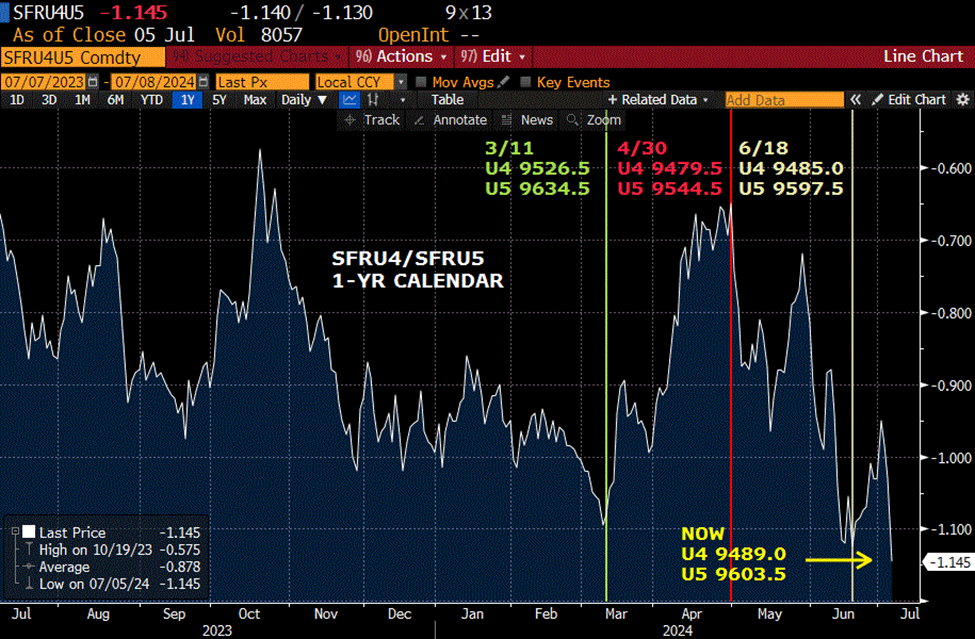

Below is a chart of SFRU4/SFRU5 one-year calendar. On Friday, this spread made a new low of -114.5 bps (9489 /9603.5). This is not the lowest level for the near 1-year calendar; in May 2023 it was -192!

At the start of this year, the near 1-yr calendar was -146 to -162 (mid-Dec to Jan). At the time, referring in part to the pricing of this spread, analysts were saying the market expected 6 to 7 rate cuts. Even at that time, many traders thought that pricing was far too aggressive, and by April the near 1-yr calendar peaked at -70 to -60 as forward contracts sold off. However, at present, the first calendar is projecting 4 to 5 rate cuts over the period from Sept’24 to Sept’25. On Friday SFRU5 settled 9603.5 or just below 4%, while the Fed’s end-of-2024 FF projection is 4.1%. By the way, SFRZ5 settled 9618, or 3.82%. With economic data slowing, is it possible to see SFRU4/SFRU5 print below -150? Note that in mid-March, SFRU5 was 9634.5. If SFRU4 remains pegged near its current level of 9489, easing prospects may be pushed forward to just after the election, and -150 could easily print.

Last week I wrote this:

Adjusting for new 2 and 5yr notes, I marked 2/10 up 5.1 bps on the week to -37.7 and 5/30 up 4.2 bps to 17.3. If this latter spread closes above 20 a couple of times, the next test will be upper 30’s. Target should be 60 to 70. 58.5 is the 50% retrace from the 2021 high of 163 to the March 2023 low of -46. The double bottom target from 9/2022 and 3/2023 (both lows around -46) is +68 bps.

On Friday I marked 5/30 at 25.1. Feels like a breakout. Any hawkish comment out of Powell and it could slip back down to 20, but it will likely start moving towards the 60-70 bp initial target.

OTHER THOUGHTS

Referring again to the quote at the top of the page, I think the upcoming Democratic Convention, August 19-22 in Chicago, is becoming more important. It’s not surprising that Biden is still insistent that he’s in the race. Whether he knows it or not, he isn’t. However, the distraction is helpful in giving strategists time to shape a united front (wealthy donors) for the new front-runner. There are already major concerns about violent protests which might echo the Dem Convention of 1968, also held in Chicago. Mayhem at this year’s Dem convention would lead to an easy Republican jab: “They can’t even control protests at their own convention, how are they going to run the country?” I wouldn’t be surprised if those visuals aren’t being planned and plotted right now. Note that September treasury options expire 23-August, just after the convention.

SFRU4 options expire 13-Sept. The FOMC is 18-Sept, but it should be fully priced by the 13th. The Kansas City Fed’s Jackson Hole Symposium is August 22-24 (Sept treasury options expire 8/23). Prior to SFRU4 option expiry we get two more payroll reports and two more PCE price releases. Including this week’s there are three CPI reports, the other two being 8/14 and 9/11. The July FOMC is 31-July. The election is Nov 5, followed by another FOMC announcement on Nov 7. I believe the Fed will ease in September, and pricing will lean towards better than 50/50 for another in November. If so the 9500 strike could play. SFRU4 9500c traded and settled 3.0 on Friday ref 9489.