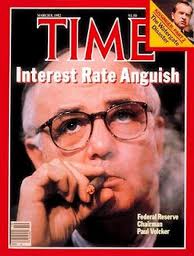

No cigar

March 22, 2022

–It has been an amazing March so far. On March 1, EDM3 settled 9818.0, At yesterday’s settle it was 9702.5, down 115.5 bps in three weeks. The 2 yr note yield has gone from 1.34% to 2.12%. FFF’23 settled yesterday at 9778.5 or 2.215%, which prices 188.5 bps of tightening over the next six meetings (avg 31.4). The next four meetings are even more aggressively priced, with October FF (clean month, no meeting) 9822.5 or 1.775%, down 17.5 on the day, averaging 36 bps per meeting. Powell said yesterday the Fed could be more aggressive if needed.

–The lowest priced contract on the euro$ strip has now moved forward to EDM’23 at 9702.5 or 2.975%. That is, every contract out further than a year and a quarter has a successively lower yield. On the SOFR curve M’23 and U’23 are essentially the same price, with June at 9731 or 2.69%, higher than all treasury yields with the thirty year bond, for example, at 2.527% (up 11.2 on the day). The curve, of course, flattened to new lows by many measures. 2/10 closed at 18.8 and 5/30 at 19.6. The eurodollar curve plunged to historic lows with the red/green pack spread (2nd to 3rd year) at -30.875 and red/gold (2nd to 5th years forward) at -52.25. The US 2yr note is clearly the recipient of safety flows, while the eurodollar curve is likely pricing some near term credit stress.

–EDZ2 settled 9745.0, and a put condor bracketing this level was bought 60k: EDZ2 9787.5/9762.5/9737.5/9712.5 p condor bought for 6 and settled 5.25. Ultimately worth 25 with a settle between the middle strikes, which would be consistent with a FF target of ~2.25.

–Euro$ vol is exploding as Powell puts a lampshade on his head and says that anything can happen. In 2020 he was the anti-Volcker begging for inflation. Now he’s got it and all of a sudden he wants people to believe that he’s an ardent inflation fighter. No cigar. As an example of the vol surge, EDZ’23 atm 9725 straddle settled 123.5 on Friday. Yesterday the atm 9712.5 straddle settled 136.0

–The last time Powell tried to ‘normalize’ rates he was beaten into submission by a big slide in stocks in Q4 2018, and of course Trump was a vocal critic as well. No Trump this time, and stocks are signaling a free pass so far, but my guess is that equities will eventually deliver a bitch-slap that the Fed won’t be able to ignore.