Net Worth

August 15, 2021 – Weekly Comment

I don’t care for Alexandria Ocasio-Cortez. On August 12, 2021 she tweeted:

“It is absolutely wild that members of Congress are still allowed to buy and sell individual stock. It shouldn’t be legal.”

There oughta be a law.

Bravo AOC. Even she realizes how easy it is for individual members of Congress to game the system with information generally unknown to the masses. Anyone on my side of the business is constantly reminded: “Don’t do ANYTHING that could even vaguely be perceived as conflict of interest.” Not so with our elected officials. Hmm, why is there distrust of government?

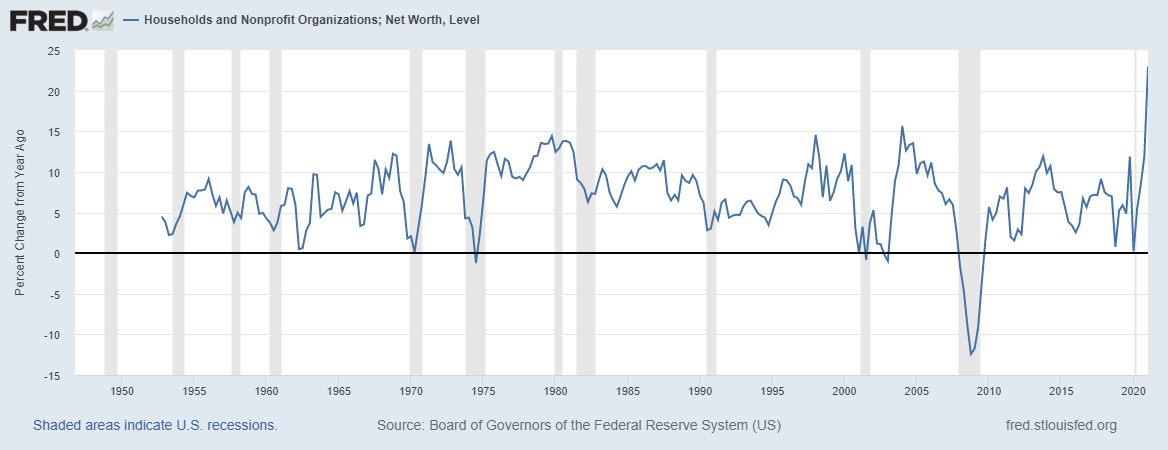

On the other hand, we’re all geniuses now just by being long SPX. Your government at work. The chart below is Household and Non-Profits Net Worth, percent change from year ago. In Q1 the yoy gain was a blazing 23%, above anything shown on the chart which goes back to the 1950s. The largest slice of net worth is corporate equities. Of course these gains are, to use a topical word, transitory. The yoy gain is due to the brief plunge associated with Q1 2020, and the fact that monetary and fiscal policy went into hyper-overdrive. Like inflation, certain categories of wealth are likely to stall, if not actually reverse. Although, since the end of Q1, SPX is up about 15%. So… it’s not ending yet. In fact, the one-year gain from the end of June 2020 to end of June this year is over 38%.

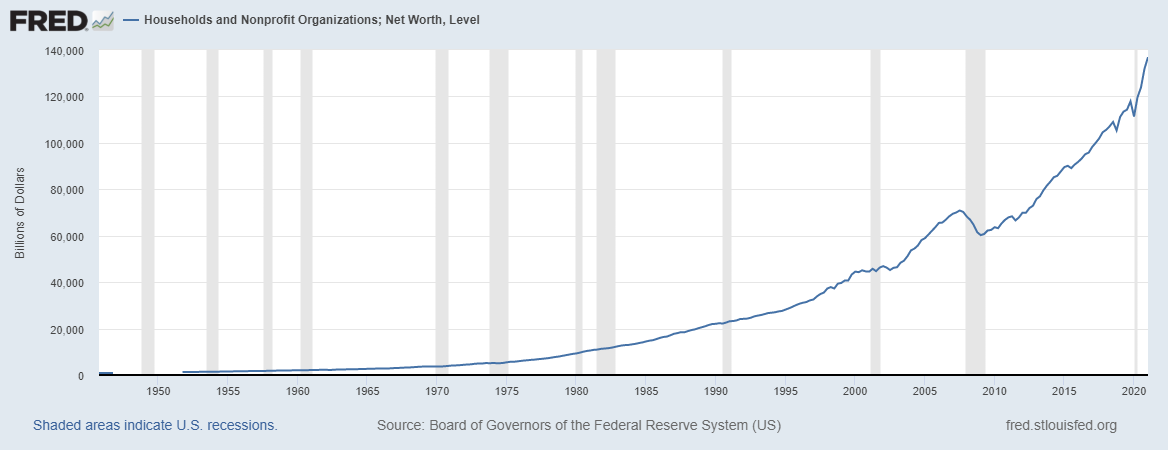

I’ve included the chart of the level (rather than yoy change) of net worth below. It’s now at $137 trillion. Over six times GDP. By any reasonable definition, net worth is inflated. Somehow, we are supposed to suspend belief that this set-up could trickle over into sustained strength in the prices of goods and services. It’s pretty obvious that prices are increasing, and inflation numbers from last week bear this out. Yoy CPI 5.4%, PPI 7.8% and U of Mich 5-10 year inflation expectations survey was 3%, equaling the high of the last ten years.

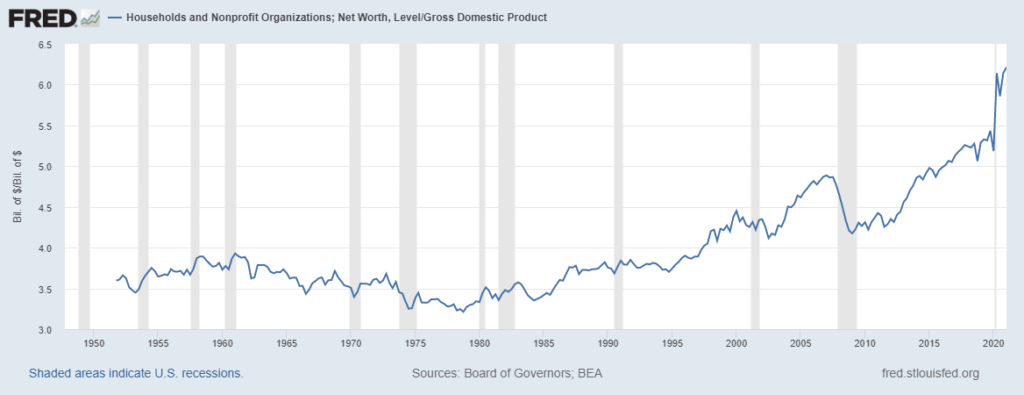

The final chart below is Net Worth divided by GDP. For proponents of “reversion to the mean” this one is sending out a little warning. From 1950 until 1995 this ratio never got above 3.9x. From 1995 until 2014, what we might call the age of the internet, it never got above 4.9x. From then on, what we might call the age of QE and extreme Central Bank Intervention, it has taken off.

This is the outcome of financial repression. Fun while it lasts.

Retail Sales on Tuesday. Also on Tuesday, Powell Hosts a Town Hall meeting with educators. On Wednesday we have a 20 year auction and the Fed minutes; discussions about trimming bond purchases is the main topic of interest. Phllly Fed Thursday, along with 30-year TIPS.

OTHER MARKET THOUGHTS/TRADES

Last week there was a buyer of 100k 3EH2 9950 calls for 2.0 (ref 9852), which caught the market’s attention. The underlying contract is EDH’25 which settled Friday at 9858.5. 3EH2 9950c settled 2.0. Since the onset of COVID, the only time the 15th quarterly ED contract (now EDH’25) settled above 9950 was the brief period from May to September of 2020, during lockdown, where the high price on settlement hit 9968.5. Maybe this buy a hedge for the idea that the delta variant is going to run right down the Greek alphabet and spark renewed lockdowns.

An alternative message is sent by the peak one-year calendar on the Eurodollar strip. As mentioned last week, this peak is EDU’22/EDU’23 at 61.0 (9970.5 and 9909.5). Last Friday it settled 59.5, so the spread rose 1.5 in spite of some rate contracts closing at lower yields on the week. The market still looks for the onset of an attempt at Fed normalization beginning around the end of 2022.

| 8/6/2021 | 8/13/2021 | chg | ||

| UST 2Y | 20.6 | 21.3 | 0.7 | |

| UST 5Y | 76.4 | 78.7 | 2.3 | |

| UST 10Y | 131.2 | 129.7 | -1.5 | |

| UST 30Y | 197.4 | 194.6 | -2.8 | |

| GERM 2Y | -75.6 | -73.9 | 1.7 | |

| GERM 10Y | -45.6 | -46.7 | -1.1 | |

| JPN 30Y | 63.6 | 65.0 | 1.4 | |

| CHINA 10Y | 281.5 | 289.2 | 7.7 | |

| EURO$ Z1/Z2 | 28.0 | 27.5 | -0.5 | |

| EURO$ Z2/Z3 | 54.0 | 55.5 | 1.5 | |

| EURO$ Z3/Z4 | 34.5 | 35.5 | 1.0 | |

| EUR | 117.64 | 117.99 | 0.35 | |

| CRUDE (active) | 68.28 | 68.44 | 0.16 | |

| SPX | 4436.52 | 4468.00 | 31.48 | 0.7% |

| VIX | 16.15 | 15.45 | -0.70 | |