Musing about the Composition of Employment

January 19, 2025

******************

Last week I touched on the decline in yields which began globally in Q3 2018. In November 2018, tens were 3.24 and fell though 2019 to 1.50 by September. Another huge decline followed as Covid hit in late 2019 into Q1 2020.

I don’t think we will copy that experience, but last week featured a solid performance in bonds, with yields falling smartly, more than reversing the previous week’s rise which was associated with the blowout payrolls report.

In the past week yield declines were as follow: 5s -17.5 to 4.415%, 10s -16.3 to 4.609% and 30s -12 to 4.844%. On the SOFR strip, greens (3rd yr forward, H7, M7, U7, Z7) led the way higher, ending +19. The green pack (avg of 4 contracts) settled 9593.75 or 4.0625%. The main catalyst was lower than expected CPI with m/m Core up 0.2% and yoy 3.2% vs 3.3% expected. With Wednesday’s release of CPI, the previous Friday’s sell-off (sparked by 256k NFP) was erased. Though CPI is nowhere near the Fed’s target, Waller still opined that three to four eases could occur this year.

My first sentence in last week’s note was: “I don’t believe the payroll data.” Last week’s price action concurred. The strong jobs report was dismissed. There have been many explanations for solid economic data and payroll anomalies, many related to the difficulties in capturing illegal immigrants’ influence on various economic data. What’s pretty clear in the short term is that there will be job losses both in gov’t jobs (which were another major growth industry in the past few years) and undocumented workers.

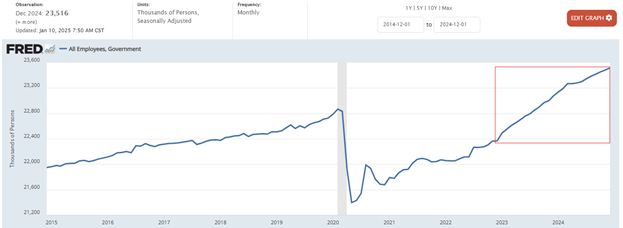

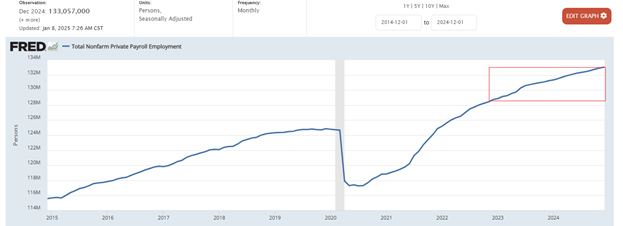

In the last two years, total Gov’t employment went up just over 5.1% from 22.367m in Dec 2022 to 23.516m in Dec 2024. Over the same period, Total Private nonfarm employment rose 3.6% from 128.426m to 133.057m. The charts below indicate relative gains over the past two years in the red rectangles. Top chart is Gov’t Employees (USGOVT on St Louis Fed Fred) and the lower chart is total non-farm Private Payrolls (ADPMNUSNERSA). This is what DOGE is likely to address. However, even if the last two years of gov’t jobs were eliminated, it’s only 1.15m jobs, which is less than 1% of private payrolls. Ignoring other factors, it seems to me that new business incentives could lead to a fairly painless (in aggregate) hand-off from Gov’t to Private employment.

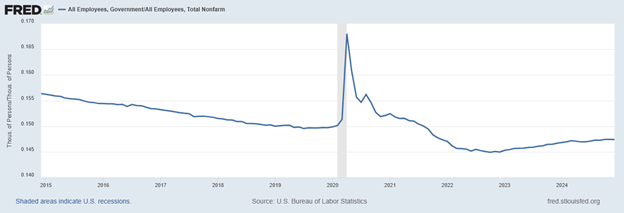

In fact, to be fair, and this is quite surprising to me as I looked at the data, the percentage of Gov’t payrolls to Total Nonfarms has had a pretty modest bounce in the past two years. The ratio chart is below.

We know that government deficits have exploded in the past several years, which has led to investor trepidation with respect to long-bond yields. Since Q3 2022 to Q3 2024 the Federal Debt grew 15.2% from $26.851T to $30.966T or 15.2%. But those gains haven’t sparked the same percentage magnitude in employment. Perhaps the gov’t is ALREADY getting more efficient. We’re spending MORE PER EMPLOYEE! Hahahahahahah, that’s a good one, right? The deficits seem more related to government transfers, to both the US population and to foreign lands.

Treasury Sec’y nominee Scott Bessent repeatedly said at his hearing last week that the US has a spending problem, not a taxation problem. I suspect cuts in spending will happen quite rapidly. An interesting line from John Mauldin’s weekend missive:

I think we can expect the White House to get organized faster than they did in 2017, simply because they have more experience and will get their people in place more quickly. “At President Trump’s inauguration in 2017, he had filled 25 appointments (no typo) of the thousands of open spots required to be filled by the new administration. Going into next week’s inauguration, two thousand positions have been filled.” (h/t David Bahnsen)

A 50% retrace of the 10y yield rise from mid-Sept to last week is 4.21%. (3.62 to 4.79). In futures, 110-24 to 111-08 is a reasonable target for those who believe that a change in gov’t spending trajectory can provide legs to last week’s rally.

| 1/10/2025 | 1/17/2025 | chg | ||

| UST 2Y | 439.2 | 427.0 | -12.2 | |

| UST 5Y | 459.0 | 441.5 | -17.5 | |

| UST 10Y | 477.2 | 460.9 | -16.3 | |

| UST 30Y | 496.3 | 484.4 | -11.9 | |

| GERM 2Y | 228.4 | 222.9 | -5.5 | |

| GERM 10Y | 259.5 | 253.5 | -6.0 | |

| JPN 20Y | 195.9 | 191.0 | -4.9 | |

| CHINA 10Y | 165.3 | 166.1 | 0.8 | |

| SOFR H5/H6 | -12.5 | -24.0 | -11.5 | |

| SOFR H6/H7 | 10.0 | 5.5 | -4.5 | |

| SOFR H7/H8 | 6.5 | 6.5 | 0.0 | |

| EUR | 102.55 | 102.76 | 0.21 | |

| CRUDE (CLH5) | 75.75 | 77.39 | 1.64 | |

| SPX | 5827.04 | 5996.66 | 169.62 | 2.9% |

| VIX | 19.54 | 15.97 | -3.57 | |

| MOVE | 99.73 | 92.72 | -7.01 | |