May 1, 2018. “There is a lot of supply”

–Even the Drudge Report is highlighting concerns about Treasury buying, with one linked article to Bloomberg (US borrowed record $488b in Q1), and one linked to WSJ reporting that indirect auction bids (which often represent foreign buying interest) are dwindling. From BBG:

“It’s a very large, robust market — it’s the most liquid market in the world, and there is a lot of supply,” he [Mnuchin] said in a Bloomberg TV interview on Monday. “But I think the market can easily handle it.” Earlier on Monday the Treasury said net borrowing totaled $488 billion from January through March, a record for that period and about $47 billion more than it had previously estimated…”

–By the way, the last time borrowing was this large was 2008, during the crisis. Now the borrowing comes at a time of slightly accelerating inflation amid domestic stimulus and risk of trade wars. Sure, the market can handle it, but at what yield?

–Month end buying and jitters related to Netanyahu’s speech on Iran caused bull flattening on light volume. As is often the case, premium sellers like the flatter curve. Bund vol closed at or near an all time low at 3.2. Treasury vol also weakened. Notable selling of EDZ8 9737/EDH9 9725 straddle strip at 49.5 (had settled 50.5 Friday). The entire strip of ED straddles lost 0.5 to 1.5 bps.

–USD continues to strengthen this morning with EUR at new recent low of 120.35. Negative for commodities, but also a headwind for stocks.

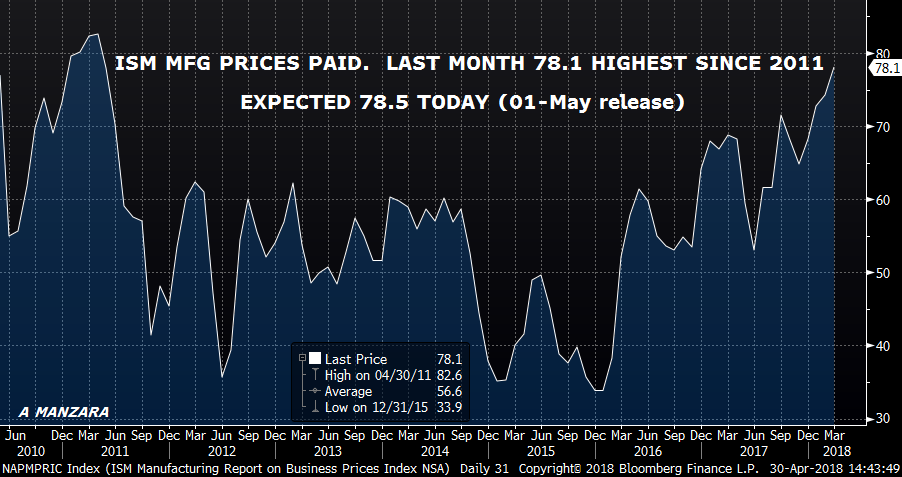

–Headline PCE prices hit the Fed’s 2.0 target, but yoy Core just missed at 1.9%. Today we get ISM Mfg, expected 58.6, which also include price data. As can be seen on the attached chart, last month’s 78.1 was the highest since 2011. Today it’s expected 78.5.