Long end suspect

February 28, 2020

–Extraordinary session yesterday with yields continuing to fall and stocks plunging from an early gain. SPX was down 4.4% and Nasdaq down 4.6%. Tens at the 3:00 pm futures settle were -1.5 to 1.299 but are lower by another 10 bps this morning. The reds have sliced through the 9900 strike like butter….red pack settled yest at 99.03125 and are 13 higher as of this writing. HUGE volume in eurodollar options,a lot of it in fronts. For example, buyer of 100k EDM0 9950c 1.5 and buyer of 100k EDN0 9962.5c for 1.5. On block trades alone ED options did over 1.5 million.

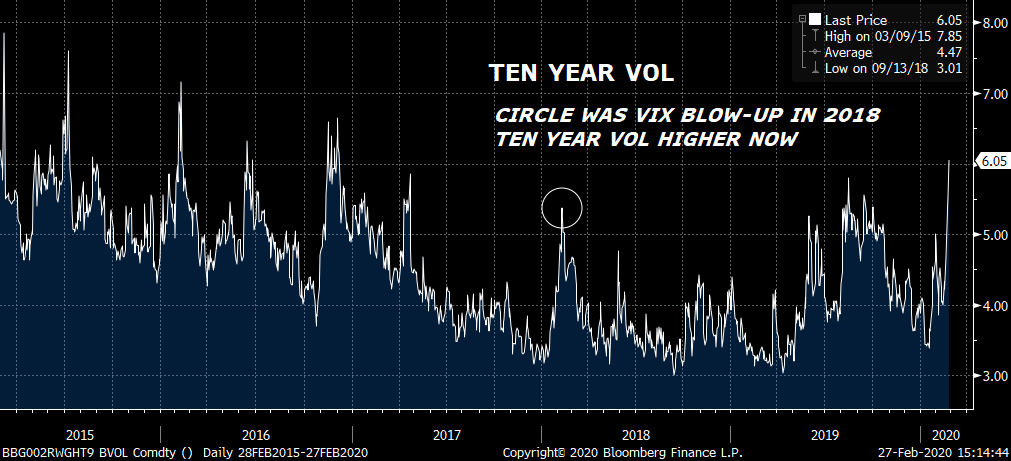

–Saw interesting good late trade; buyer of 4EZ 9800p for 3.0, 75 bps out of money with EDZ4 9875.0. As an example, the EDM0 9950c settled 1.5 and are also 75 out, but the Dec options have 288 days left vs 109. If we’re on the verge of ‘helicopter’ money, the back end could see soaring yields. In fact, after the futures settlement yesterday Ultra Bonds briefly went negative on the day before coming back. The idea of ‘where SHOULD it be?’ is going to evaporate in the long end. Vols are an indication, the chart below shows TY vol which has (in nearer maturities) exceeded the spike in Feb 18 associated with VIX blow up.

–Back euro$ calendars made new recent highs. Example, red/gold jumped over 5 bps yesterday to 26 bps. Red/green which was near +1 early in the week, settled 7.0. The market wants eases NOW.