Loans

November 26, 2023

********************

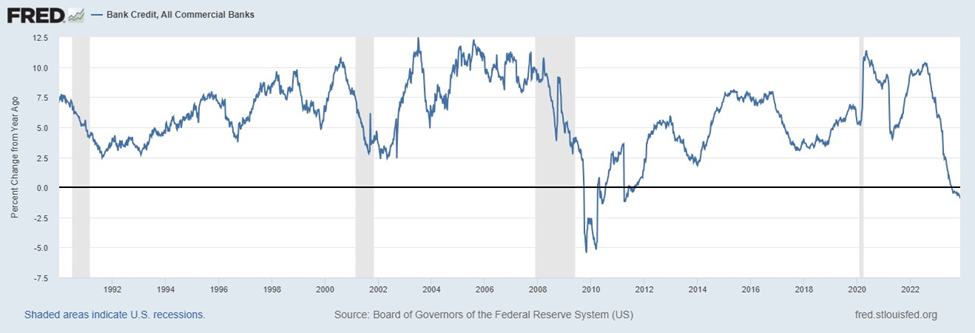

From The St Louis Fed: Bank Credit is a category on the asset side of a banks balance sheet. It is the sum of (i) Treasury, Agency, and other securities, and (ii) loans and leases.

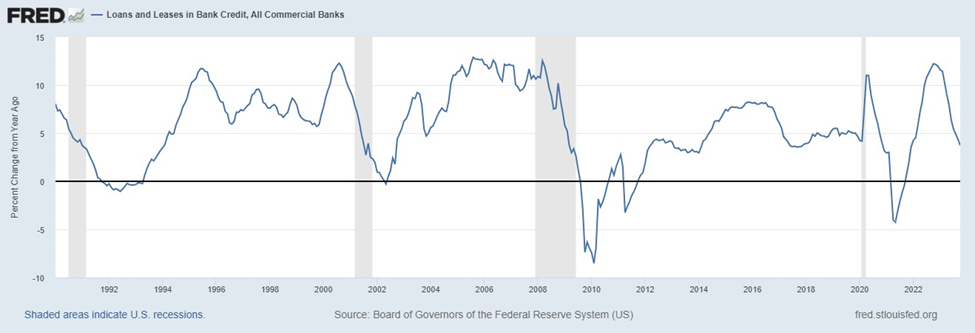

Below charts are % yoy changes from the St Louis Fed (Fred)

The top chart is ‘Bank Credit, All Commercial Banks’ last at -0.9%. Graph starts in 1990, and before now has only been negative In the period associated with the GFC.

The chart below covers the same time period but is just the ‘Loans and Leases’ part of bank credit. Obviously doesn’t look quite as dire, but has also seen a rapid drop, last at +3.7%.

In my opinion, the biggest factor going forward is the health and propensity to spend by the US consumer. I would surmise that the decline in the growth rate of loans and leases suggests a weaker rate of growth in the economy and in labor demand, to be followed by a softening in consumer spending. Q3 Chained $ GDP QoQ was 4.9% (second estimate is out on Wednesday). The Atlanta Fed’s GDPNow projection for Q4 is 2.10% and the NY Fed’s Nowcast is 2.17%.

The Nov 20 edition of Almost Daily Grants has this tidbit:

It’s the choice of a new generation: CEOs are dusting off some old-school vernacular in their communications with investors and analysts. The term “choiceful” – whether used to describe cost-conscious consumers responding to recent price pressures or their company’s own strategic actions – has appeared in 15 S&P 500 earnings calls year-to-date…up from nine mentions last year and just a pair of instances in 2021.

That adjective, which dates from the late 1500s according to the Oxford English Dictionary… resides within a category of terms “which are not part of a normal discourse and would be unknown to most people.”

Continuing:

Growing ranks of cash-strapped Americans, meanwhile, are compelled into some difficult “choicefulness” of their own. Citing data from Fidelity Investments, BBG reports that 2.3% of domestic workers tapped their retirement accounts via a hardship withdrawal to cover emergency expenses last quarter, up from 1.8% during the same period last year.

One might think that Black Friday sales are a solid metric to gauge the US consumer. However, headlines are confusing. The data from Adobe regarding ONLINE spending seems to have garnered the most attention (from Newsweek):

Americans set a new record for Thanksgiving online shopping, signaling robust economic activity despite inflation concerns, according to new data from Adobe Analytics.

Adobe Analytics reported $5.6 billion in online sales during the Thanksgiving holiday on Thursday, marking a 5.5 percent increase from last year. The figure shatters previous records and represents a near doubling of the $2.87 billion spent in 2017. Mobile sales took the lions share, accounting for $3.3 billion or 59 percent of total online sales. [not adjusted for inflation]

It’s got a bit of a cheerleading aspect to it, doesn’t it? A bit more measured take is this clip from Reuters:

Nov 25 (Reuters) – Mastercard (MA.N) Spendingpulse said on Saturday that U.S. retail sales on Black Friday rose 2.5% year-over-year excluding automotive sales, not adjusted for inflation.

And then this from BBG:

Black Friday shoppers spent a record $9.8b online in the US, Adobe Analytics reported… helped boost the day’s online sales by 7.5% compared with last year.

Consumers extended their budgets by leaning on buy-now, pay-later options, which climbed by 72% from the week before Thanksgiving.

The Buy-Now gimmick, though up a large percent, only accounted for $79 million of Black Friday sales according to Amy Nixon. So, miniscule in comparison to total sales, but a stupid idea nonetheless.

My view is that the US consumer either has or is very close to rolling over.

However, even with a tremendous amount of call spread buying in SFRH5, M5 and U5, the SOFR curve is only pricing a modest amount of ease next year (a little over 1%).

Two year and five yr notes saw the largest yield increases on the week: 2s +5.0 bps to 4.955% and 5s up 5.2 to 4.503%. The ten-yr was up 4.3 to 4.48% while the thirty year was up only 1.8 to 4.61%. On the SOFR curve SFRU4 was the weakest, down 8.5 bps to 9520.5 which bolsters the higher-for-longer theme. Another pricing clue along the same line is that the most inverted one-year sofr calendar has moved into the third slot. SFRH4/H5, the second slot, settled -110.0 while SFRM4/M5 settled -110.5. That is, slightly more easing is expected in the year from June’24 forward than March’24.

This week features:

Monday: New Home Sales. 2 and 5y note auctions

Tuesday: Consumer Confidence and 7y auction

Wednesday: Q3 GDP (second est) and Beige Book

Thursday: PCE prices. Deflator expected 0.1% from 0.4% last. YOY 3.1% from 3.4% last. Core yoy 3.5% from 3.7% last.

Friday: Mfg ISM. The Employment report is Friday, December 8.

| 11/17/2023 | 11/24/2023 | chg | ||

| UST 2Y | 490.5 | 495.5 | 5.0 | wi 492.0/915 |

| UST 5Y | 445.1 | 450.3 | 5.2 | wi 448.0/475 |

| UST 10Y | 443.7 | 448.0 | 4.3 | |

| UST 30Y | 459.2 | 461.0 | 1.8 | |

| GERM 2Y | 296.4 | 307.1 | 10.7 | |

| GERM 10Y | 258.8 | 264.7 | 5.9 | |

| JPN 20Y | 146.7 | 149.1 | 2.4 | |

| CHINA 10Y | 265.8 | 270.6 | 4.8 | |

| SOFR H4/H5 | -110.5 | -110.0 | 0.5 | |

| SOFR H5/H6 | -36.0 | -39.5 | -3.5 | |

| SOFR H6/H7 | 2.5 | 4.5 | 2.0 | |

| EUR | 109.20 | 109.48 | 0.28 | |

| CRUDE (CLF4) | 76.04 | 75.54 | -0.50 | |

| SPX | 4514.02 | 4559.34 | 45.32 | 1.0% |

| VIX | 13.80 | 12.46 | -1.34 | |