Life is full of trade offs

December 10, 2023 – Weekly Comment

******************************************

Last time I focused on SFRZ4 which had rallied 49.5 on the week ending Dec 1, with a final settle of 9601.0. The settle from the previous Friday was 9551.5. The midpoint between 9551.5 and 9601 is 9576.25. Friday’s settle was right there at 9576.5, a fall of 20.5 on the day, on the back of a stronger than expected employment report. NFP was 199k, the unemployment rate ticked back down to 3.7%, and Average Hourly Earnings rose 0.4% on the month.

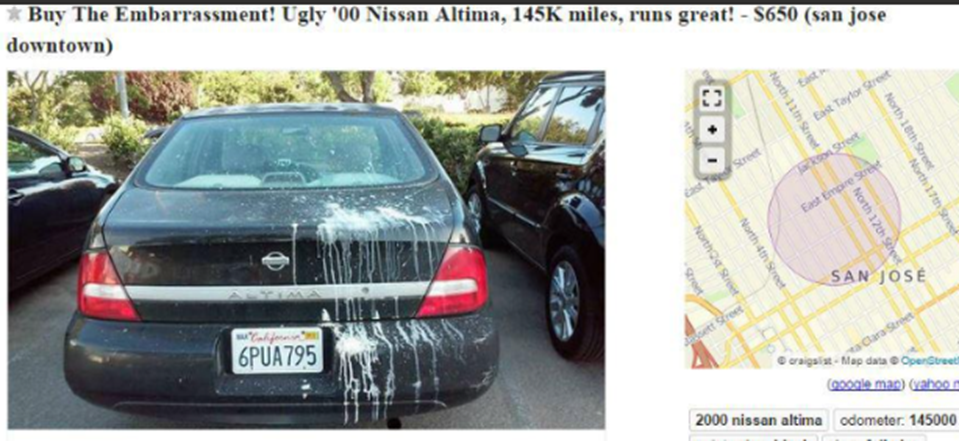

This week brings CPI on Tuesday, expected 0.0% m/m and 3.1% yoy, from 3.2% last. Core is expected 4.0 yoy, same as last. Other inflation measures have been declining, for example the 6-month annualized rate of Core PCE prices was just 2.5%, something mentioned by Powell in his comments on Dec 1, and sure to be trotted out at Wednesday’s FOMC press conference. What’s not likely to be noted is the decline in the Manheim Used Car Index. It’s down 5.8% from a year ago to 205.0. The peak at the end of 2021 was 257.7. The surge in used car prices was one of the leading indicators of inflation to come. It’s over. (See Used Car ad at bottom for reference to today’s title).

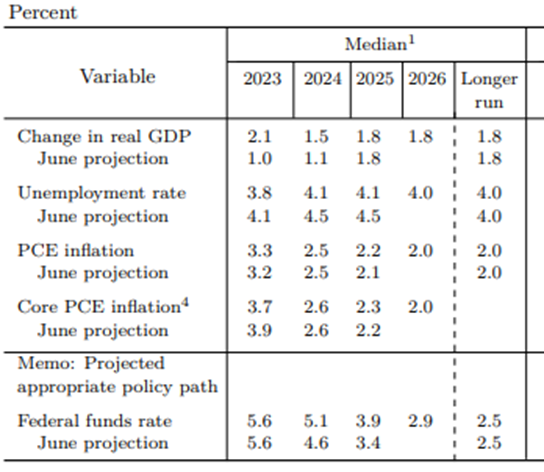

This week’s FOMC also features new economic projections. And dots. Which also brings Dec’24 SOFR into focus. In both June and September the median projection for Fed Funds in 2023 was 5.6%. We’re obviously not going to get there. Interestingly, the 2024 projection in June was 4.6% which was jacked up to 5.1% in September. Twelve of the nineteen dots were between 4.875% and 5.375% in September’s projections. In price terms, 9512.5 to 9462.5. Note that SFRZ4 at 9576.5 (4.235%) is 89 bps above the midpoint of those guesses. And that’s with projections of PCE prices 2.5% and Core 2.6%, right at the aforementioned 6-month annualized rate.

It’s likely that the 2024 FF median dots will be lowered at this FOMC, perhaps back down to June’s 4.6%. Even if that DOES occur, a price of 9537.5 (4.625%) is still well under the current Z4 price. Powell should be fighting hard against any tendencies to project easing. Even though a slowing economy and inflation (Atl Fed GDP Now just 1.2% for Q4) might ordinarily support less restrictive monetary policy, we’re going into election season. How do you bolster chances of re-election? By buying votes. Note that in last week’s Fed’l Reserve Z.1 report, the growth in Fed’l Gov’t debt was at a 12.7% rate in Q2 and 10.6% rate in Q3. Household and Business debt growth rates pale in comparison, 2.5% for HH and 1.5% for Business in Q3. Federal Gov’t spending is arguably juicing stocks. The Fed may soon have to end QT. So Powell, who has gone on the record saying that government spending is unsustainable, has every incentive to stick a finger in the dike of election spending, and to lean against rapidly easing financial conditions.

What might be appropriate market moves for a Fed that emphasizes the need to “keep at it until the job is done” with respect to slaying inflation? A rally in near 1-yr calendars, for example SFRH4/SFRH5 went from -137.5 to -125 on the week with the late sell-off in reds (9481.0/9606.0). Might also expect reds to greens to sell off a bit as the one-year forward contracts (reds) decline more in price relative to deferred. For example, SFRH5/SFRH6 went from -26 to -40 (9606.0/9646.0). Precious metals might give a nod to a slightly more restrictive posture. And indeed spot gold had a complete round turn in the past two weeks: 2000.82 on Nov 24, 2072.22 on Dec 1, and 2004.67 on Dec 8. The ten year yield more-or-less held the 50% retracement of the year’s range: 3.31% in April to 4.99% in October. Halfway is 4.15%; last week’s low was 4.105% and we ended at 4.24%.

Usually the market digests the Fed’s dot plot fairly quickly and moves on. Over the 2023 calendar year, the 2nd to 6th contract spread has been inverted all year, in a range of -177 to -62. [Chart above]. I.e. the market has consistently priced lower forward rates. At -125 we’re almost exactly at the midpoint of the year. SFRZ4 9575 straddle settled 110 vs 9576.5, so breakevens at 9465 (approximately the current EFFR) and 9685 or 3.15%. This Friday’s straddle on SFRZ4 (0QZ3 9575^) settled 22.5.

Besides CPI Tuesday and FOMC Wednesday, there are 3 and 10 year auctions Monday ($50b, $37b), followed by 30s on Tuesday ($21b). PPI on Wed. Retail Sales Thursday, S&P PMIs on Friday.

My personal bias is to be long SFRZ4. I know that idea is a bit inconsistent with what I have written above. I also know that trading purely on fundamentals doesn’t generate the greatest results. Life is full of trade-offs.

I would like to buy as closely as possible to the upward sloping trendline which comes in around 9567.0. Stop out 9550, target 9612 to 9625. THIS IS NOT A RECOMMENDATION TO READERS. I know that I would advise Powell and the Fed to lean hawkish and that being long Z4 might not be appropriate in that case. However, Powell was balanced during Dec 1 comments, and economic data has generally softened. The market is likely to look through restrictive comments, if they occur.

In keeping with the Manheim Used Car index idea, I had to include the following ad. This one isn’t AI generated. The owner has lived it!

The Embarrassment is For Sale – Really Ugly Nissan Altima. 145k miles. $650 Runs Great.

What a great running car that is practically theft proof! Meet The Embarrassment.

This no-frills Nissan is absolutely horrendous looking and as dependable as the day is long. Gets about 25-28 MPG plus enjoys a quart of oil for every thousand miles it goes. I call that the ‘self changing oil feature’.

Salvage title, manual transmission. Shakes like it has the DT’s if you drive it over 65 mph. I call that a safety feature. You shouldn’t be driving that fast anyway.

Trunk doesn’t open, gas door is stuck open. You will make lots of new friends as everyone honks and gestures to let you know the gas door is open.

Several panels are different shades of black. Some matte, some shiny. Call it abstract impressionism.

No radio. AC makes noise like a screaming baby is stuck in the fan belt. You can get that fixed for about $300 if you want. Or you can just not use the AC like I did. Save some bucks.

It looks like a pterodactyl crapped on the back of it. I’m trying to clean that off but you might get stuck with it.

Plates are valid through April. Passed smog no problem last time but can’t make any guarantees on next time. Really strong engine that refuses to die. Even when I really wanted it to so I could have an excuse to get a new car. Never left me stranded.

Two new used tires on the front. Unfortunately the guys who sold me them stole the hubcaps. No joke. Life is full of trade-offs.

Great first car, run-about-towner, dog mobiler. Cheaper than a year of zip car if a bit embarrassing. Just park it where no one can see it and you’re fine.

Best offer, cash only, save your shady cashier’s check for grannies in Omaha.

| 12/1/2023 | 12/8/2023 | chg | ||

| UST 2Y | 456.7 | 472.5 | 15.8 | |

| UST 5Y | 415.6 | 425.3 | 9.7 | |

| UST 10Y | 422.6 | 424.3 | 1.7 | WI 424.5/424.0 |

| UST 30Y | 441.9 | 432.4 | -9.5 | WI 433.0/432.5 |

| GERM 2Y | 268.2 | 269.3 | 1.1 | |

| GERM 10Y | 236.2 | 227.6 | -8.6 | |

| JPN 20Y | 143.7 | 153.5 | 9.8 | |

| CHINA 10Y | 268.3 | 268.5 | 0.2 | |

| SOFR H4/H5 | -137.5 | -125.0 | 12.5 | |

| SOFR H5/H6 | -26.0 | -40.0 | -14.0 | |

| SOFR H6/H7 | 9.0 | 4.0 | -5.0 | |

| EUR | 108.95 | 107.63 | -1.32 | |

| CRUDE (CLF4) | 74.07 | 71.23 | -2.84 | |

| SPX | 4594.63 | 4604.37 | 9.74 | 0.2% |

| VIX | 12.63 | 12.35 | -0.28 | |

https://site.manheim.com/en/services/consulting/used-vehicle-value-index.html