Labor Day comes with more balance in jobs market

Sept 3, 2023 – Weekly comment

**********************************

On the week, the 2y yield fell about 15 bps, the 5y 13 bps, 10y 7 bps and 30y 1 bp. As mentioned in last week’s note, Powell, in his Jackson Hole comments, focused on non-housing services, which account for over half the core PCE index. He noted, “Production of these services is relatively labor intensive, and the labor market remains tight. Given the size of this sector, some further progress here will be essential to restoring price stability.”

This week there were signs of further progress, which trimmed odds of another hike this year. JOLTs came in at 8.827m vs expected 9.5m. At the end of last year the number was 11.234m. While NFP was 187k, the unemployment rate jumped to 3.8% from 3.5% and the participation rate ticked up to 62.8% from 62.6% However, ISM Mfg Employment component increased to 48.5 from 44.4. ISM Service data comes out next week on Wed; the last Service Index was 52.7 and the Employment piece was 50.7. I would further note that ISM Service Emp bounced around either side of 55 from 2017 through mid-19. Since 2021 it has bounced around 51. The GDP Price Index for Q2 was 2%, exactly at the Fed’s target.

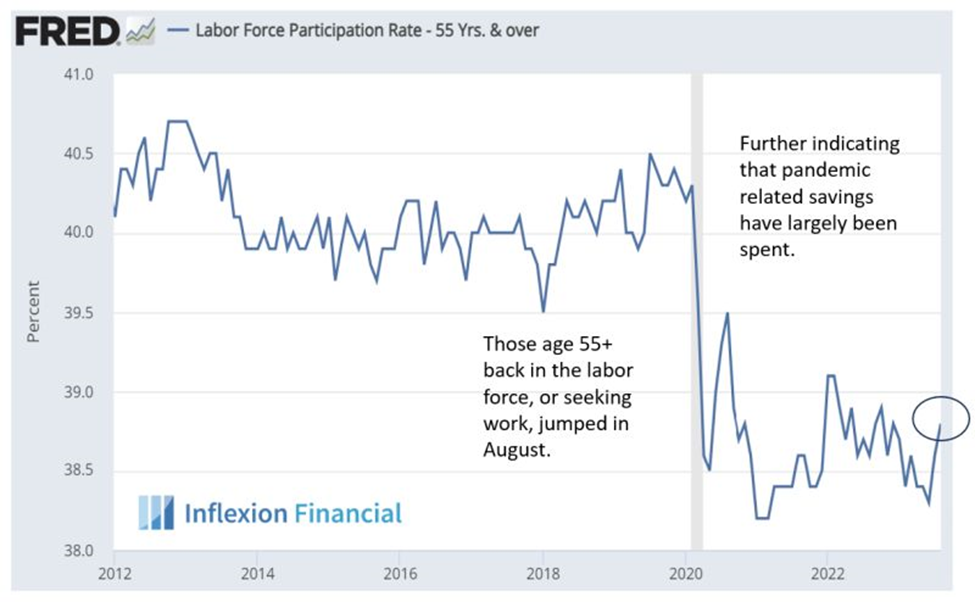

Friend Joseph Hogg, proprietor of Inflexion Financial, posted this comment and chart on Linked-In. “This jump in 55+ Participation is another indication that the pandemic savings buffer that has been supporting consumer spending – is probably gone.”

So yields fell, but the drop was tempered by this:

September 1 – Bloomberg (Alyce Andres): “Preparations for an onslaught of corporate supply next week have weighed in Treasuries today… Banks that underwrite the bonds expect about $120 billion to be issued [this] month, much more than the $78 billion sold in September 2022… Expectations are for that number to get revised higher as the market is ripe for debt issuance. That’s because investment-grade credit default swaps fell to an 18-month low this week.”

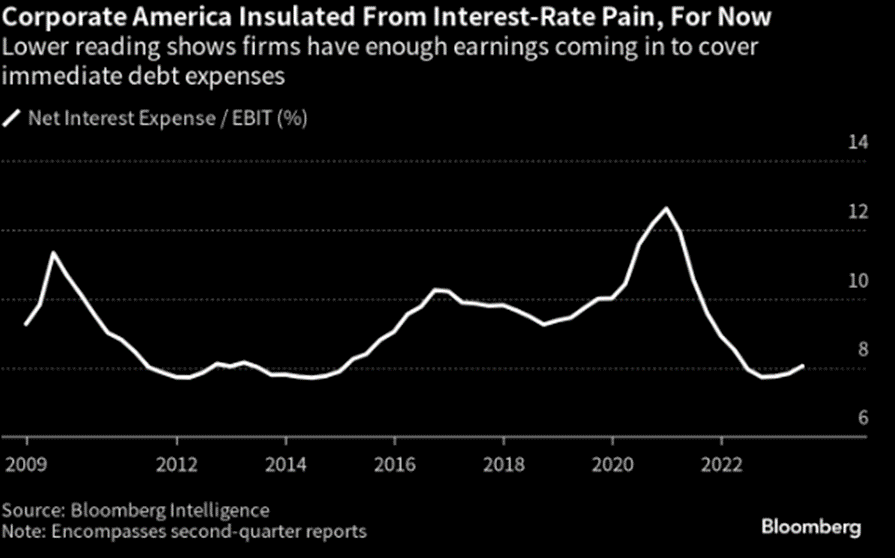

The above chart is from a BBG article:

‘S&P 500 Bulls Get Back to Believing Everything Is Just Perfect’

(interest rate expense is still low as a percentage of earnings)

Another Saturday morning BBG article had this (cheerleading) title

‘Sputtering Europe and Jittery China Add Bull Case for US Stocks’

…because TINA, There Is No Alternative.

The problem isn’t what interest rate costs are right now, it’s what they are GOING TO BE as billions in corporate debt need to be rolled at higher rates, just as earnings are crimped by a stretched consumer. Can’t vouch for the accuracy of this tweet by Jack Farley, but the Commercial Real Estate market is a case in point. Farley says, “I have it on good authority that 84% of office CMBS were not paid off in August. 16% pay-off rate; 84% were either modified/extended or entered maturity default.”

Of course, those in the higher inflation camp are still prevalent, as evidenced by this clip from Doug Noland’s Credit Bubble Bulletin:

Recent tempering of wage gains doesn’t negate the strongest compensation momentum in decades. Importantly, labor markets remain sufficiently tight to further embolden unions and workers alike. And especially with the U.S. economy having evolved over recent decades to be services dominant, wage growth today plays a pivotal inflationary role.(CBB)

The market has remained priced for easing over the coming year, and last week’s data bolstered that view. For example, SFRZ3/SFRZ4 calendar settled -121 (9460.5/9581.5) on Friday, from -113.5 the previous week.

I thought I would take a cursory look at some open interest levels:

Open interest in SFRZ3 is 1.262m.

Open interest in SFRH4 is 976k

Open interest in Z3 options excluding serials is just over 11 million, nearly 10x futures. Of course, with the tremendous changes in short term rates, OI is spread across many strikes. In calls, from the atm 9462.5c (47d) to 9550c (11d) OI is 1.807m. On the put side, atm 9462p (-53d) to 9425p (-11d) OI is 1.517m. That’s either a lot of pressure to monetize on small moves, or a lot of gamma if an outside catalyst intervenes. Note, I’m not trying to draw conclusions about direction, only looking at values.

However, there was a reasonable amount of upside bought in SFRH4 last week (SFRH4 settle 9479.5, +15 on the week). Examples: SFRH4 9500/9525cs 5 paid 15k. SFRH4 9500/9512.5cs 3 paid covered 84.5, 14k. SFRH4 9550/9600/9650 paid 1.5 to 1.75, 10k. SFRH4 9500/9600c 1×2, 1.0 paid Wed and 2.0 Thursday. There’s only 190k open in SFRH4 9500c +35k Friday, so it’s not overwhelming.

But let’s take a look at skew:

SFRH4 9500c settle 22.0 with 40d. 20.5 otm ref 9479.5. SFRH4 9462.5p settled 18.0 with 39 delta, closer to the money and cheaper. SFRH4 9437.5p, which would be the midpoint strike if the Fed hiked to 5.5/5.75% is 8.5 with 24d. It’s 42 bps otm. To find an equal premium call one has to go all the way to the 9618.25 strike which settled 8.5. It’s 138.75 otm!

As has been the case for a while, the market is expecting, hoping, clamoring for an ease. It’s clear from calendar spreads and option pricing. Only the degree has changed.

Now consider the longer end of the yield spectrum. USZ3 settled 120-11. 1.342m in open int. 127c settled 44 with 18d. 114p settled 53 with -19d and 113p settled 43 with -16d. Much more balanced. Of course, here too, the yield on the 30y treasury is 4.28%, much lower than fed funds. However, USZ3 has a DV01 of $136.02 per 100k, which is closer to the 20y cash bond, which has DV01 $129.70. The 20y yields 4.48%

Long treasuries decisively rejected Friday’s post-data rally. TYZ had an outside day and closed 110-185, down 14.5/32 on the day. US and WN weren’t able to exceed Thursday’s highs and settled in the bottom quarter of the day’s ranges. The long end continues to be in a bear market.

It’s a light news week with ISM Services and Beige Book on Wednesday

| 8/25/2023 | 9/1/2023 | chg | ||

| UST 2Y | 501.7 | 486.4 | -15.3 | |

| UST 5Y | 441.7 | 428.5 | -13.2 | |

| UST 10Y | 423.9 | 416.7 | -7.2 | |

| UST 30Y | 429.3 | 428.2 | -1.1 | |

| GERM 2Y | 303.5 | 299.0 | -4.5 | |

| GERM 10Y | 258.7 | 254.9 | -3.8 | |

| JPN 20Y | 139.0 | 134.2 | -4.8 | |

| CHINA 10Y | 256.7 | 262.3 | 5.6 | |

| SOFR Z3/Z4 | -113.5 | -121.0 | -7.5 | |

| SOFR Z4/Z5 | -55.0 | -54.5 | 0.5 | |

| SOFR Z5/Z6 | -6.0 | -4.0 | 2.0 | |

| EUR | 107.96 | 107.77 | -0.19 | |

| CRUDE (CLV3) | 79.83 | 85.55 | 5.72 | |

| SPX | 4405.71 | 4515.77 | 110.06 | 2.5% |

| VIX | 15.68 | 13.09 | -2.59 | |

https://blinks.bloomberg.com/news/stories/S09Q15DWRGG0

https://blinks.bloomberg.com/news/stories/S075TFDWLU68