Kon-Tiki

April 14, 2024 -Weekly comment

***************

When I was a kid I read Kon-Tiki by Thor Heyerdahl. It’s an epic tale documenting his 1947 voyage to the Polynesian Islands from South America on a raft. The adventure took 101 days covering 4300 miles.

From Wikipedia:

Heyerdahl believed that people from South America could have reached Polynesia during pre-Columbian times. His aim in mounting the Kon-Tiki expedition was to show, by using only the materials and technologies available to those people at the time, that there were no technical reasons to prevent them from having done so. Although the expedition carried some modern equipment, such as a radio, watches, charts, sextant, and metal knives, Heyerdahl argued they were incidental to the purpose of proving that the raft itself could make the journey.

Fabulous book for a kid. I recall one of the problems was that when they were building the prototype, they found that the grass ropes that lashed the raft together would immediately begin to fray from the friction of the logs and motion of the seas. However, they discovered that by using native balsa wood, the ropes would actually cut into the logs, creating channels which prevented the fraying. People solve problems.

The reason I brought this book up is I recall another particular passage. The expedition was approaching the end of the voyage. The seas were wild and the raft was nearing an island with rocky outcroppings. The crew of six were exhausted. They had a meal, and my specific recollection is that Thor decided not to clean his dish and utensils that day, as they probably were destined to crash on the rocks which would tear the 45-foot raft into pieces.

I searched for the specific passage from Kon-Tiki. But internet inquiries now are all about the colonization of indigenous peoples, rather than the spectacular theory and resulting adventure. It’s tedious. I quit.

The weather is beautiful this weekend in the Chicago area. Trees and flowers are beginning to blossom. ‘Nature’s first green is gold’. People are out walking their dogs, kids are playing. I was about to recap the week and organize some thoughts for next week, but instead, I’m having friends over and going to enjoy the backyard as the world hurtles into thoughtless conflagration. Not going to worry about washing the dishes today.

Just one other quick thought. Kevin Muir had a guest on last week’s Market Huddle named Paulo Macro. Though he was mostly raised in the US, his family is from Brazil, and he related an amusing story about when he was a kid in Brazil during hyperinflation. He said that prices were going up something like 2% EVERY day. So, when people went to the store, there was an employee with a price tag gun who would start at the front and just raise prices of everything, every day, working his way down the aisles. The shoppers would, of course, race in front of the guy to buy the items where the prices hadn’t yet been increased. To me, it’s the extreme degree of the ‘inflation expectations’ spectrum. Some people might be thinking about input supplies, etc. but the end consumer just has a mindset that these prices are going to be higher tomorrow, and they act accordingly. The latest US inflation data highlighted a 22% increase in the price of auto insurance since last year. Are expectations here truly anchored?

Untethered expectations can create an almost automatic and unthinking strategy. And that’s where the world seems to be in the geopolitical race toward conflict.

‘Then leaf subsides to leaf/ So Eden sank to grief’

********************************************

Below chart is attributed to BofA

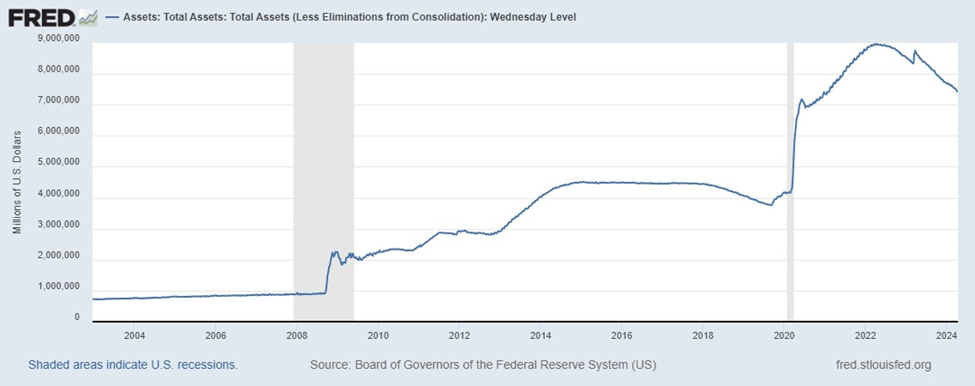

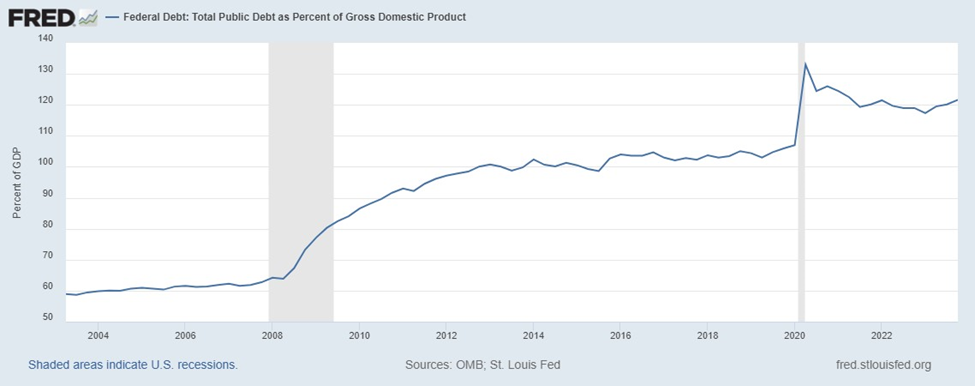

The next two charts are from St Louis Fed’s FRED website. The top is the Fed’s balance sheet, and the bottom is the US Debt as a percent of GDP. In the period after the GFC, both went up and then leveled off. The authorities were, more-or-less, buying prosperity. Then covid hit. The Fed’s trying to dial its initial response down, but the Federal Gov’t isn’t. War is not likely to help.

| 4/5/2024 | 4/12/2024 | chg | ||

| UST 2Y | 473.0 | 488.0 | 15.0 | |

| UST 5Y | 436.5 | 453.1 | 16.6 | |

| UST 10Y | 437.3 | 449.7 | 12.4 | |

| UST 30Y | 452.8 | 460.1 | 7.3 | |

| GERM 2Y | 287.5 | 285.6 | -1.9 | |

| GERM 10Y | 239.9 | 235.9 | -4.0 | |

| JPN 20Y | 153.1 | 162.6 | 9.5 | |

| CHINA 10Y | 229.1 | 228.4 | -0.7 | |

| SOFR M4/M5 | -93.5 | -76.0 | 17.5 | |

| SOFR M5/M6 | -40.5 | -42.5 | -2.0 | |

| SOFR M6/M7 | -7.0 | -14.0 | -7.0 | |

| EUR | 108.40 | 106.44 | -1.96 | |

| CRUDE (CLM4) | 86.10 | 85.08 | -1.02 | |

| SPX | 5204.34 | 5123.41 | -80.93 | -1.6% |

| VIX | 16.03 | 17.31 | 1.28 | |