Keystones

August 1, 2021 – weekly comment

***********************************

“If you lose the keystones, you’re going to see very big changes.” – John Terborgh, Duke University

I watched a fascinating documentary on PBS called Serengeti Rules, which outlined experiments and advances regarding the concept of “keystone species”. The first scientist was a guy named Bob Paine, who in the 1960’s developed a natural experiment in the wild tidepools along the Washington State shore. These individual tidepools teemed with diverse aquatic life, mussels, small crabs, plants, bottom feeders. Amazingly enough, the top predators in these pools are starfish, which are strong enough to open and devour shellfish. What Paine did was to remove starfish from several of these pools. Over time, what occurred was that the pools were overrun by mussels and all diversity was lost. The health of the system severely deteriorated. He also found that if he left the starfish and removed other species, the health of the pools remained more or less constant. Hence, the starfish was deemed the keystone species.

Forward to the 1990’s where Jim Estes was working on sea otter populations in the Aleutian Islands. The otters had been decimated by fur hunters but were staging a comeback, moving westward on the island chain. He was totally captivated by the diversity of grand kelp forests around the islands. His thought was, ‘How do these spectacular kelp forests with their diverse ecosystems help to support the health of the sea otter population?’ As it happens, Bob Paine had come to Alaska to see a former student, and Estes and Paine had a meeting. Estes described his “bottom up” ideas about the kelp forests supporting the growth of the otter population. Paine had a suggestion: “Why don’t you think of them as predators?” For Estes, the lightbulb went on, and he began to consider the situation from the top down. He needed to find an area where there were no sea otters. As it turned out, the islands at the far western end of the Aleutian chain hadn’t been reclaimed by otters…and what Estes found, or rather, didn’t find, were huge kelp forests. Instead these areas were barren because the sea urchin population (which otters feed on) dominated everything, devouring life at the sea bed, preventing more diverse growth. There were no predators to keep them in check.

The program documented similar research by many scientists over different ecological settings, both aquatic and on land, and results were startlingly similar. “Some species are more equal than others.” These are the ‘keystones’ that hold the system together. Mary Power, who studied smallmouth bass in Oklahoma rivers also mentioned another factor, which is that predators instill the ‘landscape of fear’ in prey, which also makes the system healthier as a whole. A scientist named John Terborgh studied the area around the Guri hydroelectric plant in Venezuela, which led to the loss of the big cats. “Remove the predator and it leads to the deterioration of the whole system. Loss of predators is almost always a loss of diversity. We coined the word “downgrading” to describe it.”

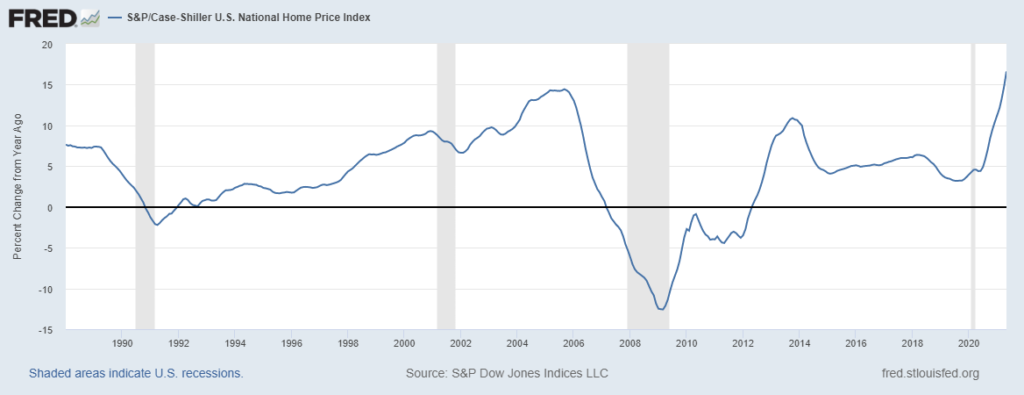

The program notes that a keystone is not always an apex predator. My question regarding markets is, “what is the keystone?” Is the Fed thinking about the system and its health in the correct way? Are they doing a bottom up: “Keep rates low and growth and beneficial inflation will follow”? Maybe the thing that holds the system together is more of a hurdle in the true capitalistic system, a COST of capital. Druckenmiller often refers to this concept… “for years now a mix of financial repression and central bank intervention has made long-term interest rates largely determined by government fiat.” He thinks it leads to distortions and general malinvestment which is suffocating the system. A good example is the Fed buying $40 billion per month of agency MBS to keep mortgage rates close to 2.5% at a time when the Case-Shiller index of home values climbed 16.6% yoy in May. Mussels have taken over the tidepool. Bottom feeders are crushing any chance for new growth and diversity, clearly represented by repo facility usage of nearly $1 trillion at 5 bps.

Case-Shiller home price yoy increase from 1988 to present

My thought is that the keystone is the base interest rate. If the Fed just moved the funding rate to 2% and KEPT IT THERE, the entire system would adjust in a healthier way.

Entering the month of August, when the Jackson Hole Symposium is held, is an appropriate time to consider Greenspan’s 1999 speech at that event where he touches upon the same concept:

“Nonetheless, certain stable magnitudes are inferable from the process of discounting of future claims and values. One of the most enduring is that interest rates, as far back as we can measure, appear trendless, despite vast changes in technology, life expectancy, and economic organization. British long-term government interest rates, for example, mostly ranged between three percent and six percent from the early eighteenth century to the early twentieth century, and are around five percent today. Indeed, scattered evidence dating back to ancient Rome and before reflects the same order of interest rate magnitude, not a one percent interest rate nor 200 percent.”

I saw an amusing quote by Jim Iuorio: “Rule of thumb… if your used car is appreciating in value there is something very wrong with the monetary system.” How should we discount the future claims and value of a 2005 Toyota Camry?

What about financial panics? The Fed is known as the “Lender of Last Resort”. Not the lender of last resort at zero interest rates. Not the lender to everyone at zero interest rates. It is there to make credit available when normal channels have seized. If there’s a wounded caribou (or zombie company) out there that can’t make it with available credit given a base rate of 2 or 3% then perhaps its days are rightly over. The overgrazing of paying more and more for a given dollar of earnings or sales, spurred in part by repression on interest rates, will adjust to a more reasonable level.

OTHER MARKET THOUGHTS/TRADES

EDU1/EDU2 declined 2.5 bps on the week to 14, fully retracing the move up to 24.5 following the hawkish June FOMC. This occurred even as libor made a new historic low of 11.775. However, EDU2/EDU3 rose by 2.5 on the week to 53.5 coming out of the FOMC. Again, this level is well below the move to 65.5 following the June FOMC. But the red/green pack spread has pretty much traded in a sideways range since the surge in Q1. There are still strong expectations of hikes coming into late 2022, early 2023.

The odd aspect is that EDU3EDU4 fell 1.5 on the week to 37.5. Greens to blues were crushed on the hawkish June FOMC and continued to compress over the month of July. EDU3/U4 was 54 before the June FOMC, fell to 44 by the end of that week, bounced to 47.5 by the start of July and ended at Friday’s 37.5. This spread started the year at 24, put in a March high of 69, and has thus retraced 70% of the move. The market is indicating that a couple of hikes in 2023 will be enough to halt both inflation and the economy in general. I have a hard time accepting that thesis.

There’s a lot of news out this week, culminating in the employment report on Friday with NFP expected 900k. Interesting trade on Friday was a new buyer of 50k TYU1 133.5p (open interest +48k, settled 20 vs 134-145 with -0.28 delta). Implied vol remains at the lower end of the range since March, currently 4.4.

| 7/23/2021 | 7/30/2021 | chg | ||

| UST 2Y | 21.7 | 18.6 | -3.1 | |

| UST 5Y | 73.2 | 70.0 | -3.2 | |

| UST 10Y | 128.5 | 123.4 | -5.1 | |

| UST 30Y | 192.4 | 189.4 | -3.0 | |

| GERM 2Y | -72.5 | -76.2 | -3.7 | |

| GERM 10Y | -42.0 | -46.1 | -4.1 | |

| JPN 30Y | 65.4 | 63.5 | -1.9 | |

| CHINA 10Y | 291.2 | 285.5 | -5.7 | |

| EURO$ U1/U2 | 16.5 | 14.0 | -2.5 | |

| EURO$ U2/U3 | 51.0 | 53.5 | 2.5 | |

| EURO$ U3/U4 | 39.0 | 37.5 | -1.5 | |

| EUR | 117.73 | 118.69 | 0.96 | |

| CRUDE (active) | 72.07 | 73.95 | 1.88 | |

| SPX | 4411.79 | 4395.26 | -16.53 | -0.4% |

| VIX | 17.20 | 18.24 | 1.04 | |

https://www.pbs.org/video/the-serengeti-rules-41dfru/

Jackson Hole, 1999

https://www.federalreserve.gov/boarddocs/speeches/1999/19990827.htm