July 8 Weekly. Running with the bond bulls

Despite the release of FOMC minutes and Friday’s employment data, net week-over-week changes were small. The most notable market event was inversion of the Eurodollar curve, where the red pack (2nd year forward) to gold pack (5th year forward) settled NEGATIVE 0.5 bp on Thursday (it bounced back to +0.75 Friday). In treasuries, 2/10 and 5/30 also posted new lows for the cycle on that day. On the week, the 30 yr bond yield fell 5 bps to 293.8. On a technical basis, this level is a just below the 50% retracement from December’s low of 268.8 to May’s high of 324.7. It is also below the closing yield set at the end of May, when bonds spiked higher due to European stress associated with fears that Italy might abandon the euro. At that time, the Italian bank index was posting a new low, and the euro was testing 1.15, also a new low for the year. Since then, there have been small rebounds, with the euro closing 1.1744, up from 1.1683 in the previous week. On Friday the Italian government indicated plans to raise the Deficit/GDP target to around 1.4% from the current goal of 0.8%, but that news was taken in stride as a modest backslide in the context of the broader concerns about the Euro.

Five and ten year yields are still well above end of May levels, so perhaps calling for a general rally led by bonds is premature. However, it appears as if the long end is interpreting the trade war as more of a drag on economic growth than as an inflationary catalyst.

On Friday, Ray Dalio tweeted, “Today is the first day of the war with China.” Also note that he has recently fretted about how the economy will react when US tax stimulus fizzles in 2020. Indeed, on the Eurodollar futures curve, the most negative section is the 2020 contracts vs the 2021 contracts. (EDH0 thru EDZ0 average 97.025, while EDH1 thru EDZ1 average 97.050, for a spread of -2.5 bps). Obviously the markets have taken Dalio’s concerns to heart. I would also note that back month Eurodollar vol remains very well bid given global uncertainties. For example EDH21 9700 straddle was 92.0 bps at the end of February with the contract settling 9702.5 on 27-Feb. In mid-April the contract was 9699.0 and the straddle was 87.5, and just prior to the end of May it was as low as 83.0. On Friday this straddle settled 88.75. Either these are great sales, or the market is hinting of trouble ahead. Interestingly there was a late buyer of 10k EDH21 9550p for 3.0 on Friday after it had already settled 2.75.

Of course, it is not only Dalio that thinks trade wars could be more negative than generally thought. Here’s a quote from BBG on June 29:

European Central Bank President Mario Draghi warned European Union leaders that an escalating trade war between the U.S. and the world’s biggest economies may have a larger impact than policy makers and investors currently expect. …Rising tensions could erode confidence to an extent that is difficult to gauge, Draghi told the 27 heads of government from the bloc at a summit in Brussels on Friday. The complexity of intertwined global supply chains could magnify the impact on the world economy, he said, according to a person familiar with the discussion, who asked not to be named as the debate wasn’t public.

On Monday Draghi addresses the European Parliament in Brussels, and the sentiments above are likely to be expounded upon as tariffs have now been instituted. As Lacy Hunt mentioned on a CNBC interview recently, the synchronized global growth story is now more likely to turn into a synchronized global slowdown.

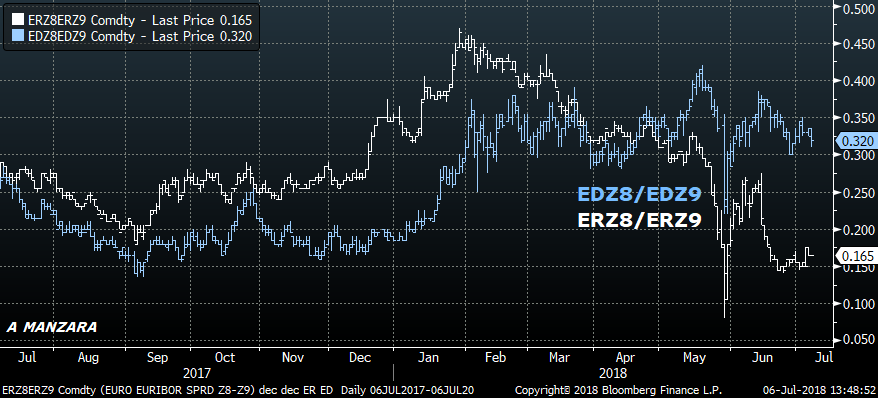

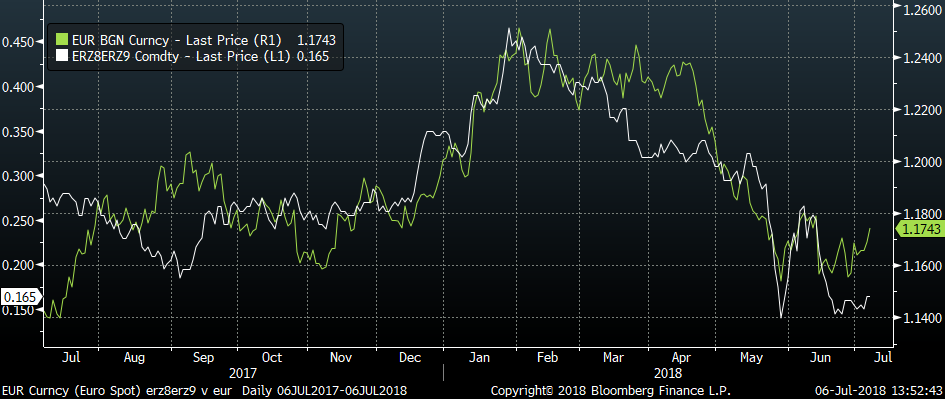

Below are just a couple of charts below relating to the Euro. The top chart plots the one year Eurodollar calendar spread EDZ8/EDZ9 vs the same in Euribor (ERZ8/ERZ9). The euribor spread (in white) has been trending lower since February, while the Eurodollar spread (blue) has held a sideways pattern. The second chart shows the same ERZ8/ERZ9 spread as a line chart in white, with the EURO overlaid in green. Obviously a pretty strong correlation between these two. This week’s euro rally is either just a relief reaction, or it may be an indication that Eurodollar spreads are going to see a bit more flattening in the nearer part of the curve as a reflection of negative consequences of trade wars.

While Draghi speaks at the start of the week, the Fed will release the Monetary Policy Report prepared for Powell’s semi-annual Congressional testimony on Friday, July 13. Powell’s actual testimony will occur the following week on the 17th. Nothing indicates that Powell’s Fed is deviating from a course of gradual rate hikes. If end of the week comments DO indicate a change, then a rush to exit from flatteners will ensue.

This week also includes treasury auctions which will be interesting as the threat of Chinese sales of treasuries hangs over the market as retaliation for tariffs.

OTHER MARKET THOUGHTS/ TRADES

On Friday there was a sale of ~100k TYU 121/122cs at 15/64s. On June 11, TYU 120/122cs bought for 29 to 30 in 100k. Open interest shows a drop of 76k in 122c and rise of 89k in 121c, so the original position has now been switched to long 120/121cs. Settles: 120c 52, 121c 23 and 122c 10. Interestingly, all treasury futures showed open interest increases on Friday’s modest rally, +16.6k TU, +21k FV, +30.5k TY and +5.8k in US. Portends strong demand at auctions.

| 6/29/2018 | 7/6/2018 | chg | |

| UST 2Y | 252.8 | 254.1 | 1.3 |

| UST 5Y | 273.3 | 272.1 | -1.2 |

| UST 10Y | 285.3 | 282.9 | -2.4 |

| UST 30Y | 298.8 | 293.8 | -5.0 |

| GERM 2Y | -66.5 | -65.8 | 0.7 |

| GERM 10Y | 30.2 | 29.2 | -1.0 |

| JPN 30Y | 70.6 | 67.9 | -2.7 |

| EURO$ Z8/Z9 | 32.5 | 32.0 | -0.5 |

| EURO$ Z9/Z0 | 1.5 | 1.0 | -0.5 |

| EUR | 116.83 | 117.44 | 0.61 |

| CRUDE (1st cont) | 74.15 | 73.80 | -0.35 |

| SPX | 2718.37 | 2759.82 | 41.45 |

| VIX | 16.09 | 13.37 | -2.72 |