July 24.

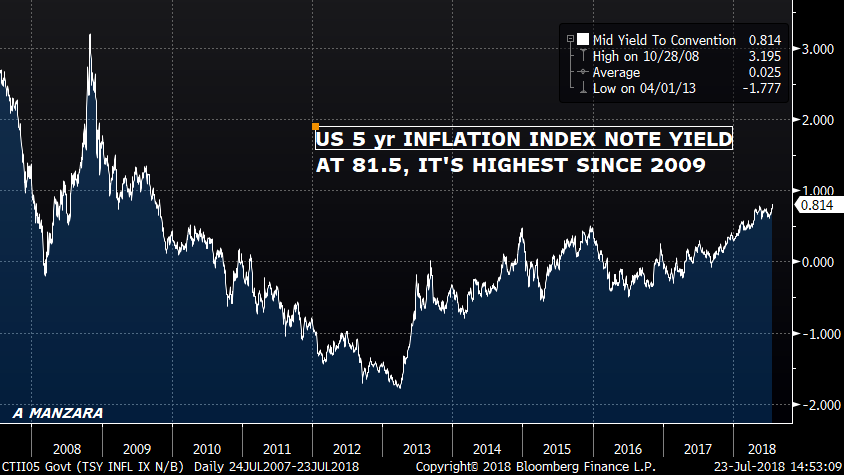

–Yields surged in Monday’s session though volume was still below average. Ten year rose 7 bps to 296.2. 30y also up 7 to 310. Blue euro$ pack (4th year out) was the weakest on the strip, falling 7.25 bps. Many near calendar spreads made new highs. The peak one-year spread is front EDU8/EDU9 which closed 55.5, up 5 on the day. The peak one-yr on a constant maturity basis was 63.75, set in mid-May. EDZ8/EDZ9 jumped 4 bps to 37.5. I also have included a chart of the 5yr Inflation Indexed note yield which is 81.5, the highest real yield since 2009.

–The sell off was sparked by concerns that Japan is going to alter its stimulus program at next week’s meeting, and perhaps lift the cap on the 10-year JGB, which has effectively been around 10 bps. Global removal of accommodation and bond buying….except for China, which is actively easing to support its economy. Yuan set a new low this morning and is currently 6.8163. From a ZH article quoting from Monday’s China State Council Meeting: “Domestic demand is being elevated in importance. Fiscal spending will be accelerated…” In response, China’s bonds jumped in yield as well. The slide in the yuan should be negative for US stocks, but a blow-out report from Alphabet yesterday is lifting all boats. News articles also cite high expectations for 2Q GDP out on Friday, expected 4.1%.

–Though not particularly large, one interesting trade yesterday was a buy of EDZ8 9725p 4.0s ref 9733.5, vs a sale of 0EZ 9675p 7.0s ref 9696.0 in EDZ9. Traded 3.0 credit and settled there. Strikes are 50 bps apart, and the extra 3 bp credit effectively makes it a sale of 53’s in the one-year spread (as mentioned above peak spread is 55.5. Z8/Z9 settled 37.5). This trade works on more aggressive near term tightening and flatter spread.

–PMI and 2y auction today.