Jay’s World

February 5, 2023 – Weekly Comment

Let me bring you up to speed. My name is Wayne Campbell. I live in Aurora, Illinois, which is a suburb of Chicago – excellent. I’ve had plenty of jo-jobs; nothing I’d call a career. Let me put it this way: I have an extensive collection of name tags and hairnets.

-Wayne’s World

Leisure and hospitality added 128,000 jobs in January compared with an average of 89,000 jobs per month in 2022. Over the month, food services and drinking places added 99,000 jobs, while employment continued to trend up in accommodation (+15,000). [BLS]

I’m not making fun of these jobs. When I was a kid, I was trying to work up to when I would actually GET a name tag. Department store clerk (Wieboldts), liquor store stockboy (Armanetti’s), painter. I had all those jobs before I became a runner on the CBOT floor. I’ve got a copy of my first Rudolf Wolff paycheck somewhere…those were the days when all the runners knew where good ‘happy hour’ bars were that would have some sort of a free buffet, so they could have dinner for the price of a few beers. The point is, those jobs don’t pay a lot.

How do we get a number of 517k for NFP when (tech) layoff announcements are becoming prevalent? From John Mauldin: “The household data looked huge at 894k jobs added. Except the BLS made a normal ‘adjustment’ to the population control data which actually added 810k of those jobs. That puts the HH survey much more in line with the ADP report of 106k jobs. Seasonal adjustments also had a big effect this time. Jobs growth, while still strong, isn’t as strong as January’s report suggests.”

https://www.bls.gov/news.release/empsit.nr0.htm

[Data above is in a table about ¾ way down]

So what did the markets do? Rate futures erased the rally from Wednesday’s FOMC. On Tuesday TYH3 was 114-165. Thursday’s settle 115-175. Friday 114-135. A bit more aggressive in short rates (same days), SFRM4 9650.5, to 9669.0 to 9643.0. FFG4, a year forward, settled 9559.0 or 441 bps, down 25.5 on Friday. As if the market simply said, ‘let’s remove one of those quarter-point eases we had priced in, because this was a big number.’ As an aside, about 1.25 hours before the release on Friday, someone sold on block, 13996 FFF4 at 9559.0. That contract settled 9538. Probably just a coincidence. At least he had the decency not to cover on Friday afternoon; open interest was +14493.

Also from Mauldin’s weekend piece, quoting Michael Wilson of MS:

As we have noted many times over the past year, the over-earning phenomenon this time was very broad as indicated by the fact that ~80% of S&P industry groups are seeing cost growth in excess of sales growth.

Costs rising faster than sales. Not that great for stocks, one would think. I am way over my head in terms of analyzing quarterly earnings reports. (What I DO remember though, is a new manager at the liquor store having us re-stock the shelves with the best sellers on the easy-to-get-to top shelf, and that we had to tag the prices near the top of the label on the right side, so that the cashiers could always see the price quickly and keep those conveyers moving).

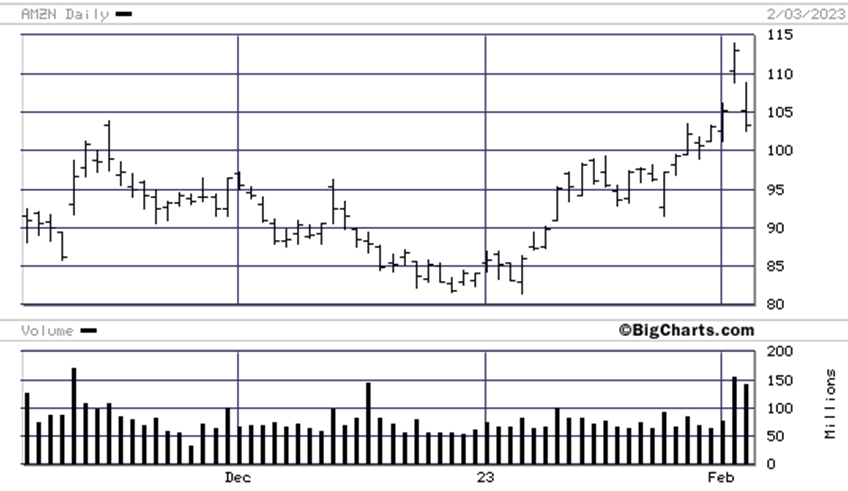

So let’s look at the big retailer: AMZN. Not the report, just the price action.

That’s what we call an island top. All of Thursday’s huge volume, underwater on Friday. Down 8.4%. But I thought I’d look a bit closer at another company, Starbucks*.

From last week’s report, North American revenues (Comp store sales) +10%, of which 1% was change in transactions and 9% was Change in Ticket. So a bit better than inflation. While Operating Income was up 12% to 1212.4 (millions), operating margin compressed over the year from 18.9% to 18.5%. [these results are just N Amer; about 17% of SBUX stores are in China]. Is this what MS’s Wilson is talking about? Anyway, the stock took a profit-taking dive Friday, down 4.4%. Scrolling down in SBUX report, “the company announced the expansion of a partnership with DoorDash…with the goal of full nationwide availability in all 50 states by March 2023.” (isn’t that what nationwide means?). So how’s DoorDash doing? Losses as far as the eye can see. HOW DO WE DO IT? VOLUME. Reported losses proudly exceed estimated losses (and growing) for the past 4 quarters, with the last Sept 2022 qtr at -77 cents per share. Stock closed at 59.02, down 7.48% on Friday, and, like AMZN, completely reversed an upward surge from Thursday.

Starbucks: “Let me get this straight, you’re going to subsidize every delivery made at the expense of your shareholders?” DoorDash “YES WE ARE”. Starbucks, “OK, we’d like to expand our relationship with you!”

As a BBG article headlined: The Fed is all that Matters… “The profit outlook for companies in the S&P 500 Index is rapidly deteriorating – yet analysts can’t raise their stock-price targets fast enough.”

My conclusion is that the market really isn’t fully buying into headline strength of the payroll report. Expectations remain for another 25 bp hike in March. However, a spread like SFRU3/SFRU4 settled -164, up only 2.5 on Friday, just 13 higher than the lowest settle of -177, which is also the most negative of any one-year calendar spread for the cycle. The market is convinced of a slowdown that will necessitate eases beginning some time this year.

Auctions of 3s ($40b), 10s ($35b) and 30s ($21b) start on Tuesday. Only raising $29b new cash.

Powell speaks Tuesday. Williams and Waller and Barr and Bostic and Cook and Kashkari all on Wednesday. If they need to hone the message, the opportunity is this week.

OTHER THOUGHTS /TRADES

Last week I mentioned SFRM3/Z having settled -48, “a rough indication that the market expects 50 bps of ease in 2H.” Well that, of course, was a bit loose in terms of a conclusion, as a friend pointed out. On Friday, SFRM3/Z3 settled -45.5. One might think that a ‘higher for longer’ FF target would be justified given the blockbuster payroll report, and that this spread might have gone much more positive, say to -37ish. Maybe it’s more instructive to look at FF contracts for cleaner estimates of Fed hiking. FFN3 is the lowest contract settle on the FF strip at 9498, and the only one above 5%. There are three meetings in front of this contract: Mar 22, May 3, June 14. There is also a meeting on July 26, which would affect the last 5 days of the contract. Current EFFR (as of Thursday) is 458. FFN3 is 44 bps higher at 502. There is no FOMC meeting in August. That contract (FFQ3) settled 9500, exactly at 5%. According to BBG, the first meeting in January 2024 is the 31st. So the spread from August’23 to Jan’24 is an adequate estimate for tightening in the last half of the year. That spread is -38 (9500/9538).

Huge buyer this week of SFRZ3 9550/9750cs 33 to 35 (90k). Settled Friday at 29.75 ref Z3 9544.5. Somewhat interesting was buying of 94.50 SFRZ3 puts for 4.5 on Friday. Not big size, only 13k traded; settled 5.75. However, it’s a 5.5% strike, an upper estimate for year-end of the more hawkish analysts. Once again, I’ll mention 0QM3 (June 16, 2023 expiration on SFRM4 underlying) 9550p, which settled 5.75 on Friday (up 1.25 on the week) vs SFRM4 9643.0. Open interest in this strike is still the most of any midcurve SOFR put, at 243k.

| 1/27/2023 | 2/3/2023 | chg | ||

| UST 2Y | 420.5 | 429.9 | 9.4 | |

| UST 5Y | 362.1 | 366.2 | 4.1 | |

| UST 10Y | 351.8 | 353.0 | 1.2 | |

| UST 30Y | 363.4 | 362.4 | -1.0 | |

| GERM 2Y | 258.0 | 254.7 | -3.3 | |

| GERM 10Y | 223.9 | 219.2 | -4.7 | |

| JPN 30Y | 157.3 | 151.2 | -6.1 | |

| CHINA 10Y | 292.8 | 289.5 | -3.3 | |

| SOFR H3/H4 | -92.0 | -83.5 | 8.5 | |

| SOFR H4/H5 | -99.0 | -107.0 | -8.0 | |

| SOFR H5/H6 | -7.5 | -8.5 | -1.0 | |

| EUR | 108.69 | 107.99 | -0.70 | |

| CRUDE (CLH3) | 79.68 | 73.39 | -6.29 | |

| SPX | 4070.56 | 4136.48 | 65.92 | 1.6% |

| VIX | 18.51 | 18.33 | -0.18 | |

https://s22.q4cdn.com/869488222/files/doc_financials/2023/q1/1Q23-Earnings-Release-Final-(2.2).pdf

https://www.nasdaq.com/market-activity/stocks/dash/earnings

*I’m short SBUX