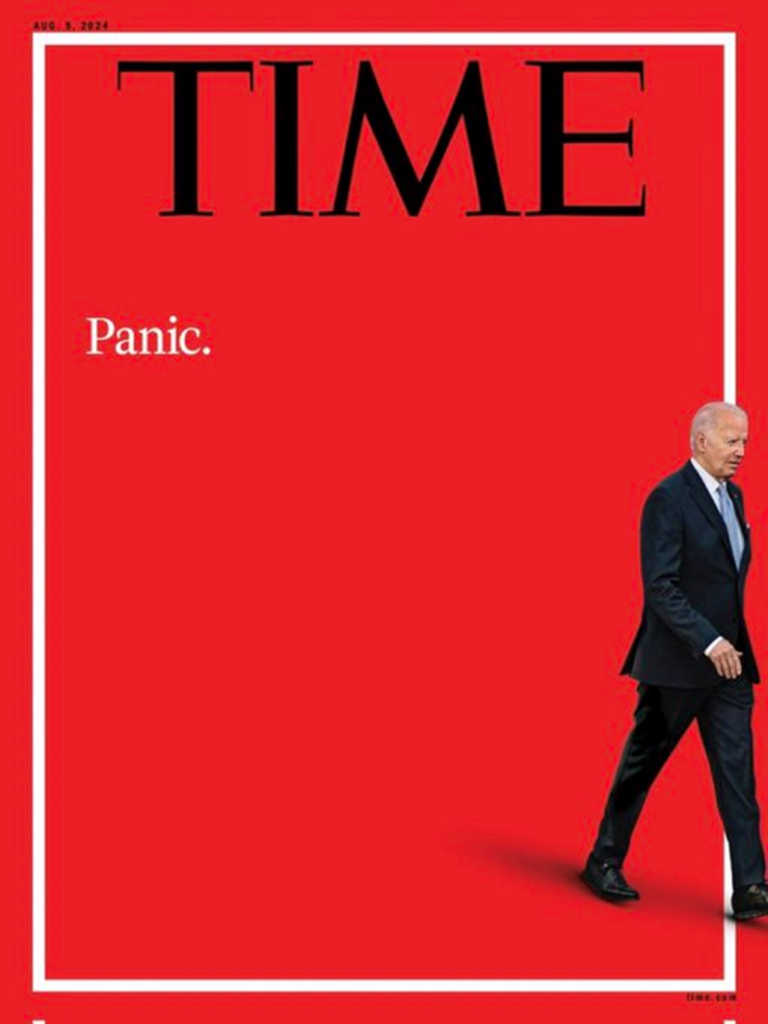

It’s not panic if you’re first

June 30, 2024 – Weekly Comment

***********************************

On Friday afternoon, bonds had a “Um… look. We finally beat Medicare” moment. Which is to say, crystallization that out-of-control government spending is not compatible with sub-4.5% bond yields. On Friday’s settlement the 30y was 4.50%; an hour later it was 4.56% as USU fell from 118-10s to 117-14.

Well, maybe that wasn’t it. There were, perhaps, a confluence of factors that sparked selling:

1) The Supreme Court overturned the Chevron decision; will lead to a rollback of regulatory shackles imposed by overly zealous agencies.

2) Odds shifting in favor of another Trump term; “I am the king of debt. I love debt.” Of course, at the end of this 2016 clip he adds, “…but now you’re talking about something that’s very, very fragile and something that has to be handled very, very carefully.” [Something that hasn’t been done recently]

https://www.facebook.com/watch/?v=10153748022289087

Related to increased odds of a Trump win is the chance of a Powell replacement. His official term as Fed Chair ends May 15, 2026.

3) Having sailed through stress tests, banks are upping their dividend payouts. I don’t know if this follows logically, but if a bank is paying out capital, then maybe there’s less with which to buy treasuries? It’s not a great look with respect to income inequality. I think I saw these two snippets on the same BBG website page: Banks pass Fed stress tests and increase dividends…while a nearby headline was ‘Credit Cards Get Stress Test Spotlight With Losses Hitting 40%’. Too-big-to-fail banks are doling out cash to shareholders while consumers struggle to pay the bills.

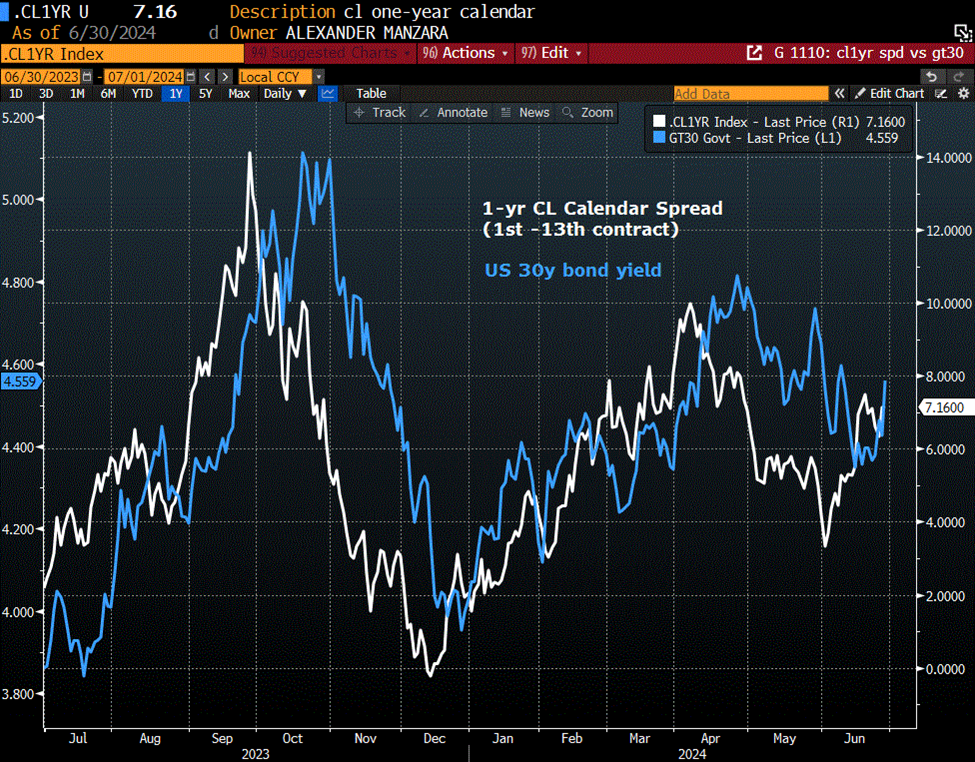

4) August crude oil settled at its highest level in two months at 81.54, and the near one-year calendar, CLQ4/CLQ5 has rallied aggressively, settling Friday at 7.16. Perhaps this move is partially due to increased hostilities and threats between Israel and Lebanon (Hezbollah/Iran). X post example from Saturday: “Multiple sonic booms from Israeli aircraft heard over areas of Southern Lebanon as well as the capital of Beirut.” Chart below overlays CL 1-yr calendar and GT30 yield (oil cal appears to lead).

5) Possible Japanese selling of UST to support the yen.

Adjusting for new 2 and 5yr notes, I marked 2/10 up 5.1 bps on the week to -37.7 and 5/30 up 4.2 bps to 17.3. If this latter spread closes above 20 a couple of times, the next test will be upper 30’s. Target should be 60 to 70. 58.5 is the 50% retrace from the 2021 high of 163 to the March 2023 low of -46. The double bottom target from 9/2022 and 3/2023 (both lows around -46) is +68 bps.

Interesting comments from Market Huddle this week featuring Vincent Deluard of StoneX. He suggests selling French OATS and buying Italy BTPs. The compelling aspects: He noted that France and Italy government deficits are nearly equal at 5.5% of GDP. But then he compared PRIMARY debt, saying that Italy could pay its bills if it didn’t have to pay interest…so Italy has a primary surplus, while France does not. The reason is that ten years ago, when spreads had blown up, Italy was issuing long term debt at 7-8% while long-term rates in France were negative. As time rolls forward and Italy is replacing high yield debt with lower rates, its fiscal position improves; it’s the exact opposite for France. Just the passage of time means that Italy becomes a better credit relative to France. Additionally, the trade carries positively. I think that this type of analysis tangentially underlines deterioration in US debt dynamics.

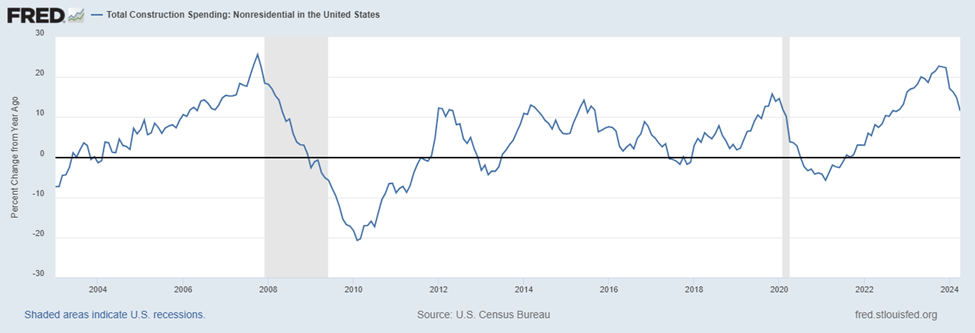

Below are just a couple of charts of non-residential Construction Spending. The CHIPS Act was likely one factor which was instrumental in the steady increase in spending since 2022. However, the growth rate has decidedly turned down (top chart is % yoy change while bottom chart is in dollars).

*************************************************************************

News this week includes ISM Mfg and Services (Monday and Wednesday). Construction Spending Monday. Powell speaks on Tuesday at the Forum on Central Banking in Sintra at 9:30. JOLTs also on Tuesday. ADP and FOMC Minutes on Wednesday.

For some reason, Employment data is released on Friday, after the Thursday 4th of July Holiday. It’s pretty clear that bonds are vulnerable to more downside. If yields can explode higher on a normal Friday afternoon, imagine what can happen on a Payroll Friday when no one is around. Long-end vol ended Friday on a strong note, but I suspect a bid for insurance will be evident on Monday morning.

Powell scheduled for semi-annual testimony on July 9. NOTE: The Semi-annual REPORT is released before the actual testimony.

Remember, it’s not ‘PANIC’ if you’re the first one to sell.

There’s almost no open interest in December Treasury futures and options. Dec treasury options expire on November 22, after the election — but who knows if the outcome will have been decided.

However, midcurve SOFR options are liquid with expirations on 13-Dec 2024 and 14-March 2025. Blue midcurves are correlated to longer dated treasuries. As an example, 3QZ4 9550p settled 6.0 with 14d vs SFRZ7 9633.5. The 9525 strike has a 10 delta and settled 3.75. In comparing nominal levels of atm straddles, 0QZ4 9600^ settled 66.0, 2QZ4 9625^ settled 64 and 3QZ4 9637.5^ settled 59.5. Of course, it makes some sense that nominal straddle levels are somewhat lower at higher strikes (representing lower yields). However, IF the curve really starts to steepen, blue puts will get a double kick from higher vols and higher yields.

| 6/21/2024 | 6/28/2024 | chg | ||

| UST 2Y | 468.3 | 471.6 | 3.3 | |

| UST 5Y | 426.6 | 432.7 | 6.1 | |

| UST 10Y | 425.5 | 433.9 | 8.4 | |

| UST 30Y | 439.7 | 450.0 | 10.3 | |

| GERM 2Y | 278.9 | 283.3 | 4.4 | |

| GERM 10Y | 241.2 | 250.0 | 8.8 | |

| JPN 20Y | 179.7 | 188.5 | 8.8 | |

| CHINA 10Y | 226.0 | 221.0 | -5.0 | |

| SOFR U4/U5 | -108.5 | -103.0 | 5.5 | |

| SOFR U5/U6 | -39.5 | -37.5 | 2.0 | |

| SOFR U6/U7 | -8.0 | -8.0 | 0.0 | |

| EUR | 106.97 | 107.23 | 0.26 | |

| CRUDE (CLQ4) | 80.73 | 81.54 | 0.81 | |

| SPX | 5464.62 | 5460.48 | -4.14 | -0.1% |

| VIX | 13.22 | 12.44 | -0.78 | |