It’s a mad world

November 3, 2019 – Weekly

In 2018, the dollar growth of nominal GDP was less than the dollar growth of the national debt. That means that there is no growth. We’re having an illusion of growth. It means that we’re issuing IOUs and spending it, and it shows up in the calculations as growth. But spending is not growth. –Jeffrey Gundlach from an interview with Finanz und Wirtschaft

That’s a pretty stark statement from Gundlach. Nominal GDP was $18.715 Trillion in 2016, $19.519T in 2017 and $20.580T in 2018. The change from 2016 to 2017 was $804B and from 2017 to 2018 was $1.061T. The Federal Budget deficit in FY2019 was $984 billion (from $779B in 2018). By borrowing and spending, “growth” occurs. A dollar borrowed is getting about a dollar added to GDP. Multiplier effect? Gone.

The picture above of course, is Alfred E Neuman, the Mad magazine mascot whose motto is “What, me worry?” Not to be confused with Adam Neumann who was single-handedly able to eviscerate some $40 billion in supposed value from WeWork. It is a mad, mad, mad world. Normally, I try to pull together market information and anecdotal news stories to create some sort of cohesive summary to the week. These days, it’s anything but cohesive.

There’s an interesting CNBC interview highlighted on ZeroHedge with Jim Chanos, famed short seller founder of Kynikos. The interview was from Sept 19. The conversation was about GrubHub, the price of which was nearly cut in half last week. But the interesting (worrying?) anecdote was that Chanos said many of the contractor/employees had been getting letters from the IRS saying they hadn’t been paying medicare and social security taxes of 15.3%. Typically, an employer pays half, 7.65% and the employee pays half. But independent contractors (should) pay the entire amount. That’s right off the top, even if total income isn’t enough to generate any additional federal tax liability. Chanos figures the 15.3% works out to about $2/hr for drivers. He refers to this model as labor cost arbitrage. Of course, in the bigger picture, the ‘gig’ economy is primarily independent contractors. That’s a lot of IRS notices. At the time of the interview GRUB was $62, it closed last week at $33.72.

The Fed, as widely expected and priced by near interest rate contracts, cut the target FF rate last week to 1.50/1.75%. The Fed signaled reticence to cut further, and the markets more or less subscribe to that view. On the week, EDZ9 settled +1 at 98.10, while EDH0 was +3.5 at 98.345. The curve flattened with 30’s down 8.2 bps to 2.211% and 2’s down 6.4 to 1.562%. Tens ended -7.3 at 1.728%. These declines occurred in spite of a much stronger employment report than expected, which also featured positive revisions to previous months. As a result, implied volatility was crushed. For example, EDH21 9850 straddle on the week went from 58.5 to 55.5 and 0EH from 37.0 to 33.0. 2EH 9850 straddle went from 37.0 to 33.5. The bulk of the declines occurred on Friday. In terms of pricing for forward rate cuts, Nov/Jan FF spread settled -5.5; less than 25% chance of another cut in December. The Jan20/Jan21 FF spread settled -31.5 and EDH0/EDH1 at -21.5, roughly forecasting one cut throughout all of next year. The market is setting up for a quiet glide into year end.

They used to call GM (General Motors) a “very large pension plan with a car company attached.” In a way, that is what the US is becoming, a very large social security and medicare plan with an economy attached. US federal spending is the main driver of growth through deficit spending and the Federal Reserve is funding the deficit through its repo operations and outright buying of treasuries. No one at all is talking about fiscal austerity. Indeed, it’s exactly the opposite. Why then shouldn’t stocks make all time highs? Certainly, earnings aren’t the catalyst. Charlie Bilello notes that “With 74% of companies having reported, S&P 500 GAAP earnings are down 2% over the past year, first decline since Q1 2016.” It was reported that Berkshire is now sitting on a record cash pile of $128 billion. If Buffet thought reasonable investment opportunities were available, I doubt the cash hoard would be that large.

A lot of people have been saying that a Warren presidency would cause an immediate plunge in the stock market. Perhaps that would be the initial reaction, but if the model remains ‘borrow and spend, and don’t worry about the borrowing part because the Fed has our back’, then perhaps values continue higher. What’s the limiting factor? With MMT, it’s an increase in inflation. Given an acquiescent Fed, the more immediate limitation might be the value of the dollar and that is currently flashing a low-pulse amber alert, with DXY having started October near 99.50 and ending Friday at the low of a three-month range at 97.12. Perhaps there will be a hiccup before the Fed realizes the need for more aggressive outright monetization. For example, this week brings auctions of 3, 10 and 30 year treasuries in total of $84 billion, raising over $23 billion in new cash. If foreign buyers hesitate due to concerns about the dollar, it will be left to domestic investors (the Fed) to fill the gap.

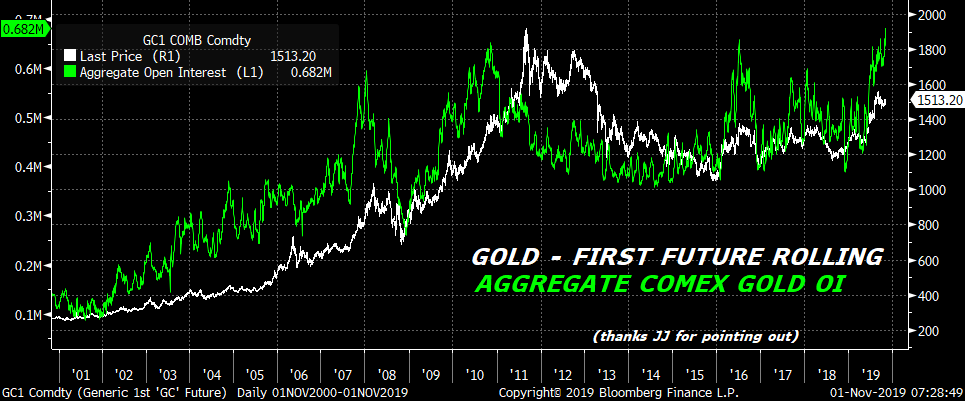

Maybe that’s why gold is seeing renewed interest. Friend JJ notes that open interest on Comex Gold has made a new all time high even as the price remains below the 2011 peak.

Besides the auctions, this week features Factory Orders on Monday and Service ISM on Tuesday. NY Fed’s Williams speaks Wednesday.

OTHER MARKET/TRADE THOUGHTS

The NY Fed’s GDP Nowcast pegs Q4 growth at 0.8%, a downgrade due to the weak ISM Mfg data. The Atlanta Fed GDP Now Q4 forecast dropped to 1.1% from 1.5%, though it’s still quite early in the cycle.

On Thursday as rate futures pushed toward the highs of the week, there was new buying of 35k TYZ 130/129 put spread for 19 (settled Thursday at 18 vs 130-095) and 25k USZ 160/158 p spd for 28 (settled 29 vs 161-12). With Friday’s pullback as a result of the employment data, TYZ 130/129 ps settled 22 vs 130-00.5 and USZ 160/158 ps settled 37 vs 160-20. More talk of progress on US/China Phase 1 should cause further pressure on bonds (with an additional auction concession) but I would suspect these trades could be exited this week.

| 10/25/2019 | 11/1/2019 | chg | |

| UST 2Y | 162.6 | 156.2 | -6.4 |

| UST 5Y | 162.7 | 155.6 | -7.1 |

| UST 10Y | 180.1 | 172.8 | -7.3 |

| UST 30Y | 229.3 | 221.1 | -8.2 |

| GERM 2Y | -65.2 | -65.7 | -0.5 |

| GERM 10Y | -36.2 | -38.2 | -2.0 |

| JPN 30Y | 39.5 | 33.8 | -5.7 |

| EURO$ Z9/Z0 | -34.5 | -39.5 | -5.0 |

| EURO$ Z0/Z1 | -4.0 | -5.0 | -1.0 |

| EUR | 110.81 | 111.67 | 0.86 |

| CRUDE (1st cont) | 56.66 | 56.20 | -0.46 |

| SPX | 3022.55 | 3066.91 | 44.36 |

| VIX | 12.65 | 12.30 | -0.35 |