It’s a Bob Ross market

August 7, 2022 – weekly comment

The following tweet is by @_elvishpresley_

[every time I watch the joy of painting]

*5 minutes in*

yellow ochre?? for a snow-covered mountain?! alright bob ross this time you’ve really lost it

*15 minutes in*

bob ross you son of a bitch

The Joy of Painting ran on tv from January 1983 to May 1994. The format of the program started with a blank canvas on an easel. Bob Ross would hold his palette and had a bunch of brushes to demonstrate various techniques, and by the end of the half hour he would produce a landscape painting.

I had seen some of the early shows but was drawn further into the Bob Ross orbit during covid when we were stuck inside. The show is strangely mesmerizing, and I don’t know if Covid is the reason, but Bob Ross has surged in popularity even with a younger cohort, perhaps partially due to the wine and painting workshops that are now popular for a night out.

The tweet is funny because it’s accurate. He starts with a mountain and progressively works to the foreground, adding boulders and rivulets, saplings and wildflowers; it’s amazing. All the while he’s saying in a smoothing voice, “Maybe we’d like a happy little tree here.” And “maybe that tree needs a friend.” All of a sudden a grove of pine trees appears.

As relates to the market:

[Last Friday SFRZ2 settles 9674.5]

*tuesday*

SFRZ2 9600 puts?? buying a 4% strike? everyone knows the Fed’s about to pivot. this time you’ve gone too far!

*friday NFP*

SFRZ2 9642.5. son of a bitch

Maybe we should print a happy little Service ISM number of 59.9. Now pull out your big brush and imagine 598k NFP with an unemployment rate of just 3.5%. “It’s unbelievable that you can have that much power. But on this canvas, you do.” And there’s your final portrait. Recession-proof.

After the payroll number, one bank suggested the possibility of an intermeeting hike, taking FFQ2 down to a low of 9764.0 or 236 bps (settled 9765.75). The next FOMC is Sept 21 and the Fed Effective rate since the July FOMC has been 233 bps (with one day at 232). Printing 3 bps above the current EFFR with effectively 1/3rd of the month already pegged is astonishing. There are those that say the Fed has damaged its credibility, and certainly the economic projections support that view, but no one is doubting the possibility of large hikes to quell inflation. October Fed Funds (FFV2) which captures the Sept 21 FOMC (along with any unscheduled hikes) settled 9698.5 or 301.5. With current EFFR 233, a 50 bp hike would result in 283 or 9717 while 75 would be 308. Obviously, the market has tilted heavily toward the latter.

The internals of the employment report weren’t as strong as the headline suggested. For example. The household survey has been diverging significantly from the headline establishment data. However, it barely matters going into Tuesday’s CPI number (expected yoy 8.7 with Core 6.1). Either the Fed tries to thread the needle to achieve a soft landing or it crushes inflation expectations. That’s the choice after CPI. The easier goal to accomplish is the latter.

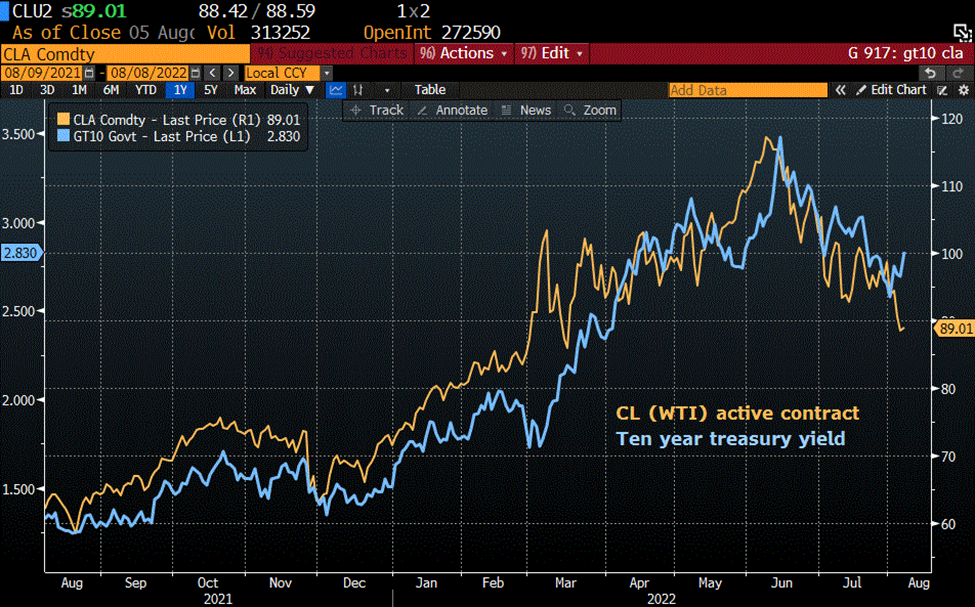

On June 10 CPI printed 8.6 with Core 6.0, the highest numbers up to that time. On June 14, rates topped, with the ten year yield 3.47%, and on June 16 SPX bottomed at 3667. Just a week before, WTI had topped at 117.15 on June 8. On July 13, CPI was 9.1 with core 5.9%. CL was at 93.83. The ten year yield went from 293.5 on July 13 to just 3.027 one week later (a rather modest move). SPX made its most recent bottom on July 14 at 3790, just after CPI. The price of oil seems to have been the dominant factor.

Now, after Friday’s NFP the ten year yield jumped to 283 from 264 the previous week. SPX rallied slightly on the week to 4145. CLU2 is 89.01. There’s a bit of divergence here. The administration wants the oil price down. The Fed wants the ten year yield to be more restrictive. Tens tend to follow the price of oil, but the administration is just about out of bullets in terms of draining the SPR.

With a head and shoulders top formation in the ten-year yield, I had thought a target of 2.40% was attainable. That’s still plausible but the yield has to stay below the recent 303 high.

Besides inflation data (CPI Tuesday and PPI Wednesday) the treasury auctions 3s, 10s and 30s Tuesday, Wednesday, Thursday. The 2/10 treasury spread made a new low of -41 this week. The ten year yield is 283, 50 above the current EFFR and 54 above the SOFR rate. If the Fed hikes 50 in September then positive carry likely vanishes. The banking model of lend long, borrow short is facing increasing headwinds.

OTHER MARKET THOUGHTS/ TRADES

The 2-yr treasury yield surged 34 bps this week to 3.24%. The 6/14 high was 3.43% and the subsequent 7/19 high was 3.24%. The trend for the short end is toward higher yields. SFRM3 (the biggest mover) was 9703.5 on 7/29, but settled 9657 Friday, for a total 46.5 bps as the market pivoted away from the Fed pivot. SFRH3 which is the lowest contract on the strip at 9639 or 3.61%, was down 44 bps.

While the 2 yr yield is just 19 bps away from the June high, SFRH3 is still 40 away from the low settle on 6/14 of 9599, which, by the way, is the lowest any near SOFR contract has settled on the move. SFRU3 at 9677 is fully 38 above the SFRH3 price. Said another way, there is a strong gravitational pull lower on SFRU3, which argues for the idea of being long Sept midcurve put flies on SFRU3, with a target around 25 lower than here, depending on your view of actual Fed hikes.

| 7/29/2022 | 8/5/2022 | chg | ||

| UST 2Y | 289.7 | 324.4 | 34.7 | |

| UST 5Y | 269.3 | 297.4 | 28.1 | |

| UST 10Y | 264.3 | 283.6 | 19.3 | wi 2.830/825 |

| UST 30Y | 297.7 | 306.5 | 8.8 | wi 3.045/040 |

| GERM 2Y | 28.1 | 47.8 | 19.7 | |

| GERM 10Y | 81.7 | 95.5 | 13.8 | |

| JPN 30Y | 119.5 | 115.3 | -4.2 | |

| CHINA 10Y | 276.5 | 274.6 | -1.9 | |

| EURO$ U2/U3 | -25.0 | 2.5 | 27.5 | |

| EURO$ U3/U4 | -50.5 | -59.5 | -9.0 | |

| EURO$ U4/U5 | -13.5 | -22.0 | -8.5 | |

| EUR | 102.27 | 101.84 | -0.43 | |

| CRUDE (active) | 98.62 | 89.01 | -9.61 | |

| SPX | 4130.29 | 4145.19 | 14.90 | 0.4% |

| VIX | 21.33 | 21.15 | -0.18 | |

https://en.wikipedia.org/wiki/Bob_Ross