Interest rate anguish

December 10, 2019

–Yields steady to slightly lower yesterday with tens ending 1.829% in front of today’s auction. There continues to be buying in TY calls: TYF 131 call 4 paid for 45k, settled 4 vs 128-31 with open interest up 36k, expire 2 weeks from Friday, approx 24 bps away. TYF/TYG 130 call calendar was also added to, buyer of 16-17 for >10k, settled 15 (27, 12). Tomorrow is the last FOMC of the year, with impeachment proceedings moving along and a China tariff decision looming over the weekend.

–Trucking company Celadon filed for bankruptcy, apparently due to executive fraud for cooking the books that couldn’t withstand a slowdown in business combined with high debt levels. Reportedly 3000 truckers are stranded as gas cards have been shut down. One-off, or more pervasive?

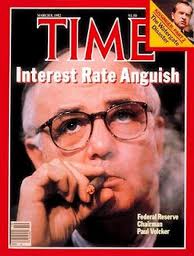

–The death of Paul Volcker, former Fed Chairman who led the fight against inflation is naturally being compared to the life of the bond bull market which Volcker initiated. Both over? 30-yr bond auction on Thursday, yielding just a shade over 225 bps. Volcker used to move Fed Funds more than that in a DAY.

–Really interesting thread on Saudi Aramco by Jawad Mian ( https://twitter.com/jsmian/status/1204298059921993728 ) briefly outlining how Standard Oil developed Saudi oil infrastructure (and almost failed) in the 1930’s, only to finally hit big in 1938. Softbank’s Masayoshi Son is giving up on his 50% stake in the dog-walking business Wag, which was recently valued at $650 million (the Saudis are big investors in Softbank).