Inflation deceleration

May 11, 2023

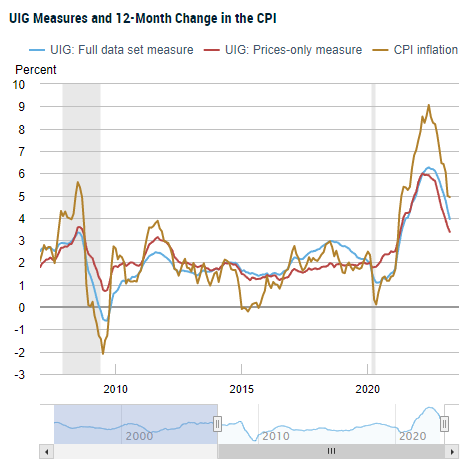

–CPI slightly better than expected at 4.9% yoy. NY Fed’s Underlying Inflation Gauge declined as well:

- The UIG “full data set” measure for April is currently estimated at 4.0%, a 0.3 percentage point decrease from the current estimate of the previous month.

- The “prices-only” measure for April is currently estimated at 3.4%, a 0.2 percentage point decrease from the current estimate of the previous month.

–Rate futures immediately surged as the market was set up short going into the data. Tens ended down about 8 bps to just over 3.43%. SFRM4 was the leader on the SOFR curve, closing +16 at 9679. New low settle in SFRU3/U4 one-yr calendar spread at -176 (9532/9708) down 6 on the day. (Low settle on any 1-yr calendar has been M3/M4 at -192).

–On Tuesday NY Fed’s Williams said he didn’t see any reason for the Fed to cut rates this year. Consider these six-month spreads: SFRU3/SFRH4 settled -102 (9532/9634). SFRZ3/SFRM4 settled -99.5 (9579.5/9679). The market doesn’t much care what Williams thinks, forward spreads indicate fairly dramatic cuts, even if the Fed can hold steady in the short term.

–The stock market DOES care however, about what Nick Timiraos says: “If the Fed was poised to take a summer vacation, the April CPI report won’t spoil those plans.” (Afternoon tweet). Stocks responded positively. The good news is that inflation is stabilizing. The bad news is that the credit crunch is just beginning and the debt ceiling circus is in full swing.

–PPI and 30y auction today. PPI yoy expected 2.4% with Core 3.3%.