Inflate out of it

May 10, 2023

–Three yr wi was 3.723, went off 3.695; strong demand. 10y today. NFIB small business optimism weak at 89.0.

–CPI today expected 5.0 yoy vs 5.5 and Core 5.5 vs 5.6.

–Vol up in front SOFR contracts, for example SFRH4 was down 0.5 at settle (9618.5) but almost every otm call settled +1 on the day. SFRH4 9625^ settled 132.75, was 129/130 Monday.

–Yesterday I cited St Louis Fed chart showing that HH equity in residential real estate was near a record high 71%.

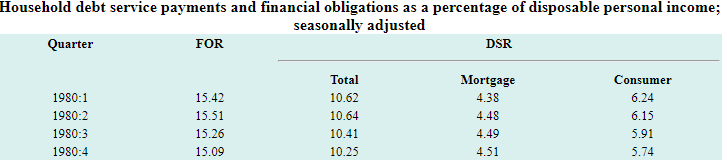

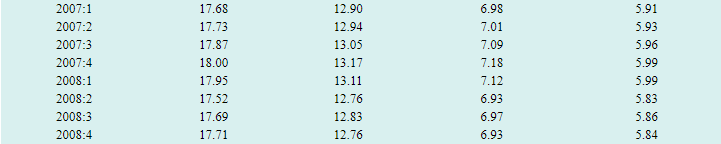

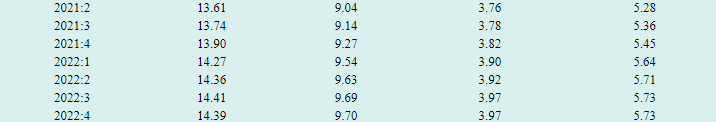

Today are some excerpts from the FOR, Financial Obligations Ratio, which shows mortgage & consumer credit in separate columns. The FOR adds rents, auto leases, home insurance and property taxes. Overall the household sector currently looks ok, though the report notes that calculations are difficult and that changes are the most important aspect of the report.

https://www.federalreserve.gov/releases/housedebt/