In 2007 the first cut was 50 bps, on Sept 18…

September 16, 2024

*********************

–On Sept 18, 2007 the Fed initiated the first cut, from 5.25 to 4.75. SPX rallied, gaining about 6% from the Sept 17 close, to the high settle on 10/9 of 1565. That remained the high until 2013. (High print was 10/11/07). So 16 or 17 trading sessions after the first ease was the high from which the GFC unfolded. Dates line up the same; I would note that Oct 4 is the employment report. FOMC announcement and press conf is Wednesday, September 18.

–Friday featured continued strength in the front end, with SFRZ4, H5, M5 and U5 closing at new highs. 9596.5, 9662.5, 9697.5 and 9712. SFRH5 was the leader, settling +9.0 on the day. The price of 9662.5 is 200 bps above where the recently expired SFRM4 ended, at 9463. SFRH6 was only +2 at 9720 (high point on the curve) and SFRH7 was +1 at 9712. Buyer of 50-60k SFRZ4 9550p for 2.25 to 2.5.

–Treasury curve steepened to new highs on strength in front. 2’s fell 7.4 bps to 3.574 and 10’s fell 3.2 to 3.646. 2/10 was as low as -50 on June 25, now +7.2 less than three months later. 5/30 also at a new high of +55.2.

–BOJ meeting is at end of week. While today is a holiday in Japan, this morning JPY is at a new low for the year sub-140 (139.91 as of this note). Low on 12/28/23 was 140.25.

–News today includes Empire Mfg, expected -4.0 from -4.7. While -4 would be close to the high for this calendar year, it hasn’t been above zero since late 2023.

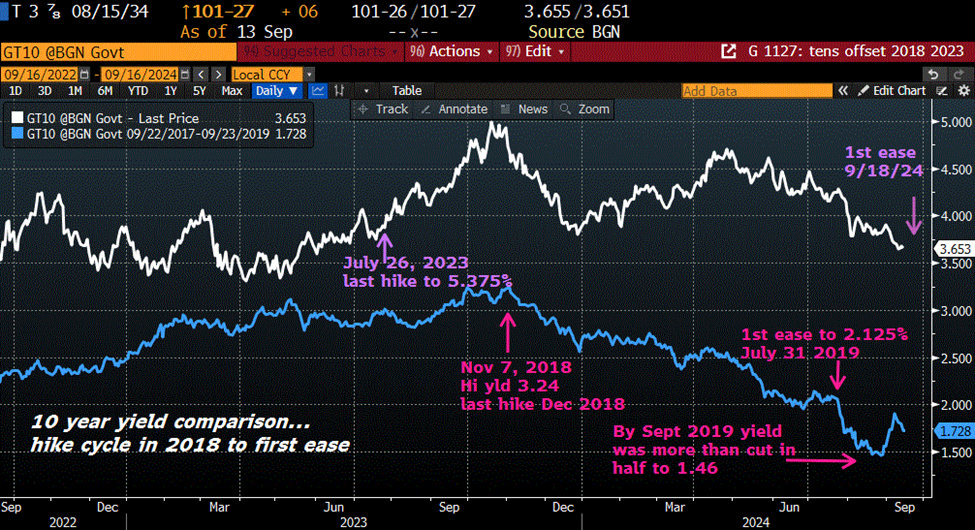

–The end of the hiking cycle in 2018 probably isn’t much of a comparison for today as the peak rate was only 2.25 to 2.50%, but I suppose the takeaway would be a lower 10y yield. Image below. I am guessing that the high FF target of 2.25 to 2.5 at the end of 2018 should act as a floor for the easing to come.