I’ll get you back next week

July 21, 2024 – Weekly comment

**********************************

This is Popeye’s friend Wimpy. Favorite saying: “I will gladly pay you Tuesday for a hamburger today!”

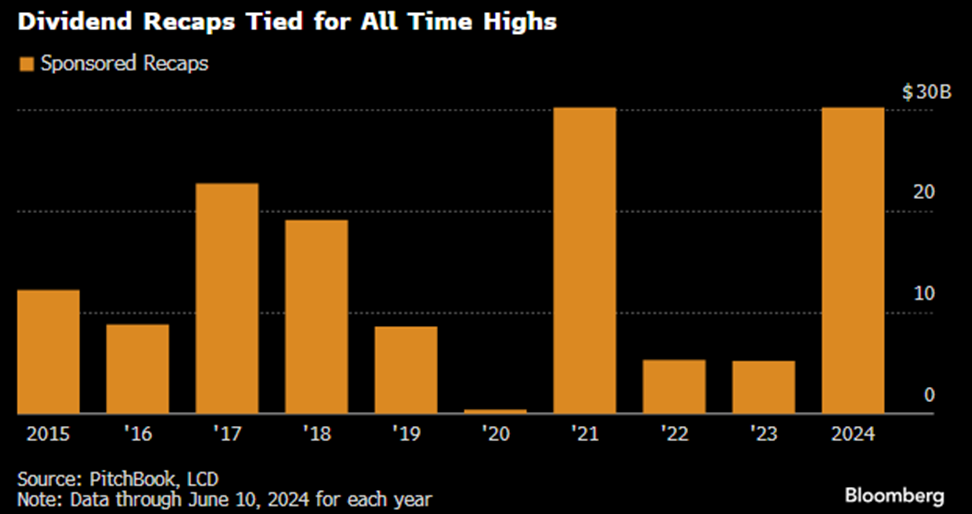

A friend (thanks TMS) mentioned that the recent Elliott Wave Theorist had a section on dividend recapitalizations, which cited a Bloomberg article from June 17: Private Equity Won’t Stop Gorging on Debt to Pay Investors. From the BBG article:

Managers of exclusive pools of capital have long promised fat, and fast, returns to their limited partners, such as endowments and insurers. But their pledges have fallen victim to a serious drought in mergers and acquisitions and initial public offerings that’s upended their normal course of exiting holdings and handing the proceeds over. Dividend recaps are a feasible alternative because debt investors flush with cash are lining up to buy all kinds of credit products.

A dividend recap involves borrowing to pay out cash to investors. The company, which isn’t throwing off the requisite cash flow, is loaded with more debt. Huge red flag, perhaps not at zero rates, but certainly in this environment. There’s a cute article on Axios that has a different take: Another sign of investor optimism: Dividend recaps are back. This one is from January 29, 2024 (link at bottom). The article is actually more balanced than the headline would indicate, but it really tries to put a positive spin on actions taken due to economic stress. Depending on Wimpy to pay you back.

Another article from The Korea Times has this quote, which is related to NVDA, but really captures the broader idea of a slowdown:

Comparing the recent enthusiasm toward AI to the gold rush, the head of Korea’s major chipmaker and the largest business lobby anticipated that the U.S. firm [NVDA] would maintain its lead at least over the next three years, just as the sellers of pickaxes and jeans did during the mass migration of miners to the west of North America in the 19th century.

“When there was no more gold, the sellers became unable to sell pickaxes,”

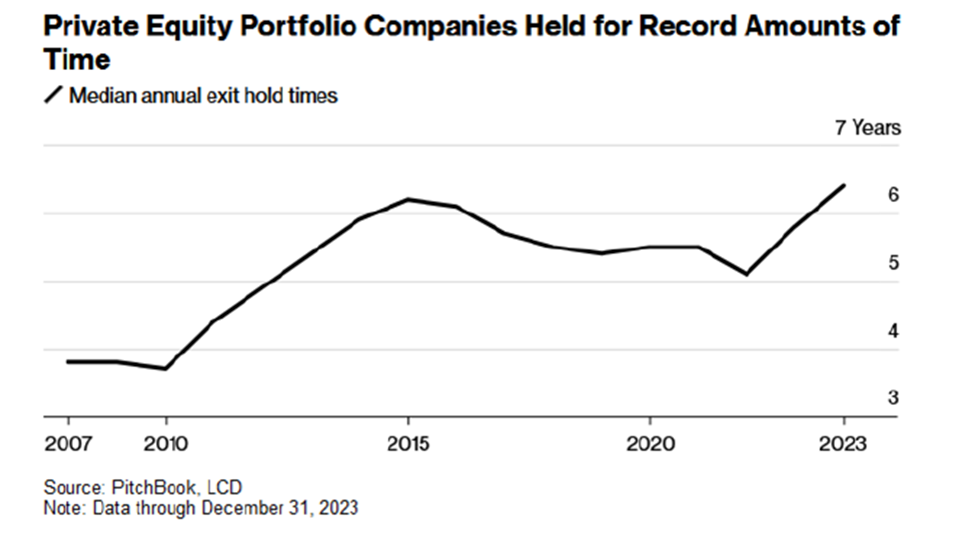

I’ve copied a couple of charts from the June Bloomberg article below, and the link is at bottom.

And here’s another chart, which I would caption (from personal experience)

WHEN A TRADE BECOMES AN INVESTMENT:

I absolutely am wading into a topic above my depth here, but it does seem as if non-bank lenders are posing significant systemic risks, or at least are raising odds of a hard slowdown. Another BBG article highlights a similar tactic. From July 18: Private Credit Pushes Deeper Into Risk Wall Street is Fleeing.

Such borrow-now, pay-later deals are proliferating. Payment-in-kind, or PIK debt, allow borrowers to pay interest with more debt. One controversial practice cropping up on more deals involves a “synthetic PIK,” which lets companies defer interest payments without calling the loan PIK.

Of course, there are all kinds of prudent asset managers. The numbers that I have seen from my cursory research don’t look particularly large. But then, they didn’t think subprime mortgage lending was that big of a deal back in the day.

A company called Blue Owl Capital (OWL) is on an acquisition spree, last week buying Atalaya Capital Mgmt “pushing deeper into the red-hot private credit market.” Blue Owl is paying $450m up front, $350m in equity and $100m in cash. In April, OWL bought Prima in a deal comprised of $157m equity and $13m in cash. A BBG note on Owl says: “Overall accrual rates and portfolio measures are solid, though fixed-charge coverage has slipped, PIK income has risen and non-accruals of 2.5% in 1Q are on the rise.” A BBG reporter values OWL’s assets at around $215b. But they seem to be able to use their stock as currency. Market cap is $28b, while Blackrock cap is $124b and Blackstone is $168b. All three surged following the lower than expected CPI data. This topic bears watching…

****************

Last week I posted a chart of the MOVE index and wrote this: “MOVE index, a measure of implied volatility in treasuries… ended the week near the low of the year, as yields eased in the context of a steepening curve with inflation concerns receding. VIX similarly closed near the low of the year at 12.46; in fact it’s near the post-covid low. Insurance is cheap.”

Insurance is still cheap though vols are up. MOVE from 86.8 to 94.3 this week. From Credit Bubble Bulletin:

The VIX (S&P500 volatility) Index jumped 4.1 this week to 16.52, the largest weekly increase since (banking crisis) March 2023. The VIX closed Friday at the high since the April (Israel/Iran missile tit-for-tat) spurt of de-risking/deleveraging.

Note: Israel struck a Yemeni port city in response to Houthi attacks. Netanyahu scheduled to meet Biden on Tuesday in Washington.

Other upcoming events:

Treasury auctions, $69b 2y Tuesday, $30b 2y FRN Wednesday, $70b 5y Wed, $44b 7yr Thursday

Inflation data Friday:

PCE Price MoM 0.0 from 0.0

PCE Price YoY 2.4 from 2.6

PCE CORE MoM 0.1 from 0.1

PCE CORE YoY 2.5 from 2.6

Olympics start Friday, July 26.

JULY 27 Trump speaks at BITCOIN 2024 conference in Nashville

JULY 29 Treasury Refunding Announcement

JULY 31 FOMC

OTHER THOUGHTS/ TRADES

It wasn’t a particularly big week for rates, though treasury yields rose 4 to 5.5 bps across the curve, with notable weakness into the end of Friday.

The types of trades that have become more prevalent on the SOFR curve are buying near calls or call spreads and selling midcurves with the same expiration to express a steepening bias.

For example, there had been a decent amount of SFRH5 9600c vs 0QH5 9700c, buying the near. Futures settlements on Friday: 9568 in SFRH5 and 9637.5 in SFRH6, so 32 otm vs 62.5 otm. Option spread settled -0.75 for the near (17.0 vs 17.75). This futures spread, SFRH5/H6, settled -69.5, but there’s a pretty steep roll as SFRZ4/Z5 settled -97 (9532/9629). SFRZ4 9600c settled 4.0 vs 0QZ5 9700c at 10.0 so if nothing else changes, this trade rolls negatively, but of course if futures remain below strikes both calls go out worthless on March 14. Perception of near-term aggressive ease needed.

Last week the trade was +SFRZ4 9525/9550cs (8.5 settle vs 9532) vs -2QZ4 9675/9700cs (7.0 settle vs 9644.5). So this is an in-the-money cs vs 30.5 otm. Data that doesn’t support a near term ease will probably negatively impact this trade. Similar play: +SFRM5 9575/9600cs vs 2QM5 9650/9675cs, paid 1 for front June. Settled 11.75 vs 9596.5 and 10.5 vs 9646.5.

As the prospects for easing have been moved forward, the peak contract on the SOFR strip has also moved closer. For example, at the end of May, the third blue or the 15th quarterly was the peak, and now it’s migrated one year closer and is the third green or 11th contract (SFRH7 at 9647). In considering a steepener on the SOFR curve, the critical factor is to select the near contract that will be most impacted by ease, and to try to sell something further out, ideally near or past the peak of the strip.

Below is a chart of US (active contract) vs Blackrock. Seems to be some divergence since the start of this year, though perhaps a steepening curve (with lower funding rates in the near term) is the most important catalyst for asset mgrs.

| 7/12/2024 | 7/19/2024 | chg | ||

| UST 2Y | 446.2 | 450.5 | 4.3 | wi 446.5/446.0 |

| UST 5Y | 411.1 | 416.1 | 5.0 | wi 415.0/414.5 |

| UST 10Y | 418.7 | 423.9 | 5.2 | |

| UST 30Y | 440.1 | 445.0 | 4.9 | |

| GERM 2Y | 282.3 | 278.4 | -3.9 | |

| GERM 10Y | 249.6 | 246.7 | -2.9 | |

| JPN 20Y | 187.0 | 183.1 | -3.9 | |

| CHINA 10Y | 225.9 | 226.0 | 0.1 | |

| SOFR U4/U5 | -128.0 | -122.5 | 5.5 | |

| SOFR U5/U6 | -30.5 | -29.0 | 1.5 | |

| SOFR U6/U7 | 0.5 | -1.0 | -1.5 | |

| EUR | 109.08 | 108.85 | -0.23 | |

| CRUDE (CLU4) | 81.02 | 78.64 | -2.38 | |

| SPX | 5615.35 | 5505.00 | -110.35 | -2.0% |

| VIX | 12.46 | 16.52 | 4.06 | |

https://blinks.bloomberg.com/news/stories/SEX54QT0G1KW

https://www.axios.com/2024/01/29/private-equity-dividend-recap

https://www.koreatimes.co.kr/www/tech/2024/07/129_378969.html

https://blinks.bloomberg.com/news/stories/SGO92WDWRGG0

https://blinks.bloomberg.com/news/stories/SGPRECDWLU68