If You Build It…

January 7, 2024 – Weekly Comment

**************************************

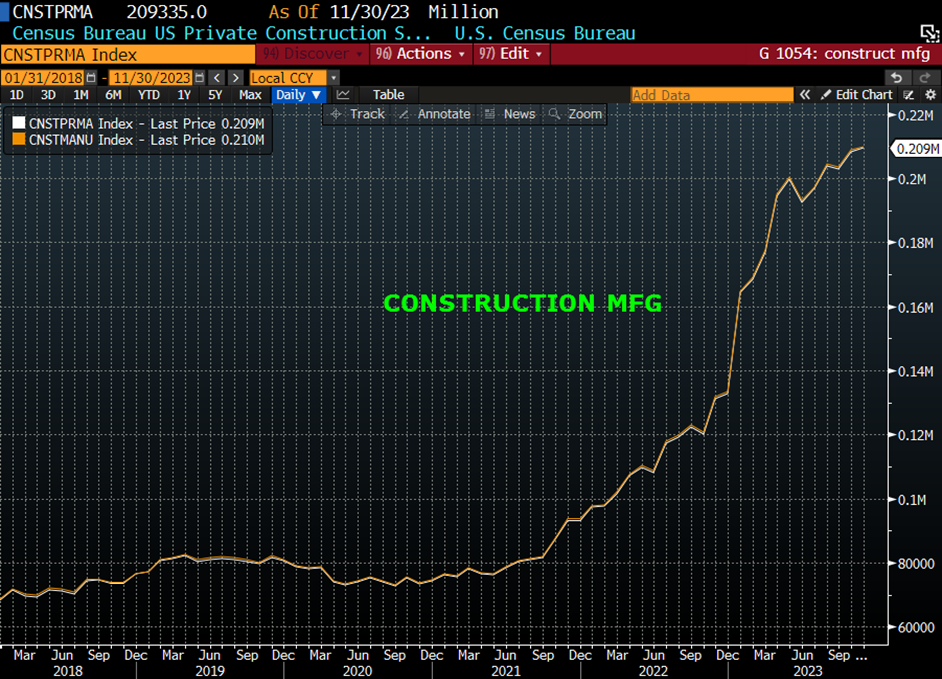

I’m coming right out with an admission that I am lifting this idea from Doomberg, so that I can hopefully tiptoe around the plagiarism peril that plagues our “cut-and-paste” world. I didn’t realize the extent of the construction boom until I saw the Doomberg charts, (copied below). Of course I recall that Lorie Logan, President of the Dallas Fed, made these comments in a speech in October of 2023: [more on Logan and her momentous speech from this weekend below]

Some of my contacts highlight a significant increase in manufacturing and nonbuilding construction, both nationally and in this region. The number of manufacturing construction projects in Texas is the highest in 22 years. With so many projects in the pipeline, construction contract values are also at record highs. Some of this activity appears related to initiatives to spur clean energy, infrastructure and the domestic semiconductor industry.

Last summer, in June 2023, this article from the Treasury Dept cited the surge in construction spending for manufacturing facilities. From the article: “Real manufacturing construction spending has doubled since the end of 2021. The surge comes in a supportive policy environment for manufacturing construction: the Infrastructure Investment and Jobs Act (IIJA), Inflation Reduction Act (IRA) and CHIPS Act each provided direct funding and tax incentives for public and private manufacturing construction.”

[CHIPS ACT signed in August 2022]

- The boom is principally driven by construction for computer, electronic, and electrical manufacturing—a relatively small share of manufacturing construction over the past few decades, but now a dominant component.

- Manufacturing construction is one element of a broader increase in U.S. non-residential construction spending, alongside new building for public and private infrastructure following the IIJA. The manufacturing surge has not crowded out other types of construction spending, which generally continue to strengthen.

Again from Doomberg:

With the country awash in cheap hydrocarbons and the federal government throwing a gusher of cash at the manufacturing sector through laws like the Infrastructure Investment and Jobs Act, Inflation Reduction Act, and CHIPS and Science Act, a boom in manufacturing construction is underway, and this “surge in construction will eventually translate into a surge in hiring for manufacturing jobs.”

I suppose one can make the argument that extraordinary deficit spending by the gov’t has sparked the boom in mfg construction, which will lead to a seamless hand-off of renewed growth to the private sector, which might help pay down the deficits.

Not yet, it seems.

The payroll report was released Friday. Manufacturing payrolls were up just 6k (26k in Nov). From the BLS, “In December construction employment continued to trend up (+17k)… Construction added an avg of 16k jobs per month in 2023, little different [but lower] than the 2022 avg of 22k.”

Over calendar year 2023, payrolls increased by an average of 225k per month. (The outsized month was January at 472k). Of that, government added an average of 56,000 jobs per month in 2023, more than double the average monthly gain of 23,000 in 2022. So, 25% of all jobs added were in government. Still feeling positive about forward growth?

In December, health care added 38k jobs; the average growth was 55k in 2023, compared with the 2022 average monthly gain of 46k. Nearly half of job gains in ’23 were gov’t and health care. A cynic might claim that outsized deficit spending simply added another layer of government on top of government, a likely impediment to forward growth. And it’s making people sick.

**************************

Dallas Fed President Lorie Logan gave a momentous speech Saturday. Here’s the link:

https://www.dallasfed.org/news/speeches/logan/2024/lkl240106

First, from the Dec 13 FOMC minutes:

Several participants remarked that the Committee’s balance sheet plans indicated that it would slow and then stop the decline in the size of the balance sheet when reserve balances are somewhat above the level judged consistent with ample reserves. These participants suggested that it would be appropriate for the Committee to begin to discuss the technical factors that would guide a decision to slow the pace of runoff well before such a decision was reached in order to provide appropriate advance notice to the public.

It’s clear that Logan was a major participant in that part of the discussion, and that slowing QT will likely be announced at the Jan 31 FOMC. From her speech on Saturday:

The emergence of typical month-end pressures suggests we’re no longer in a regime where liquidity is super abundant and always in excess supply for everyone. In the aggregate, though, as rate conditions demonstrate, the financial system almost certainly still has more than ample bank reserves and more than ample liquidity overall.

…

So, given the rapid decline of the ON RRP, I think it’s appropriate to consider the parameters that will guide a decision to slow the runoff of our assets. In my view, we should slow the pace of runoff as ON RRP balances approach a low level. Normalizing the balance sheet more slowly can actually help get to a more efficient balance sheet in the long run by smoothing redistribution [of liquidity] and reducing the likelihood that we’d have to stop prematurely.

In addition, she warned about easing financial conditions since October and said another hike could be needed to counteract the stimulative effects of looser conditions.

Yet over the past few months, long-term yields have given back most of the tightening that we saw over the summer. We can’t count on sustaining price stability if we don’t maintain sufficiently restrictive financial conditions.

Part of what appears to be happening is that when the data are strong, as occurred over the summer, market participants perceive a wider range of potential rate outcomes and require compensation for that risk in the form of higher term premiums. And when the data soften, as happened recently, that term premium comes out because market participants perceive more of an upper bound on policy rates. Some model-based term premium estimates remain higher than levels seen last summer, but I’m mindful that all else equal, a lower term premium leaves more work to be done with the fed funds target.

On Friday, SFRH4 atm 9493.75 straddle settled 18.75 ref 9493.0. There are 68 days until expiration, and the market currently assigns significant odds of an ease at the March 20 FOMC (> than 2 in 3). Logan’s comments about the ‘normal’ return of month-end pressures, and the possibility of a hike, along with uncertainty related to QT, suggest to me that SFRH4 vol is too low. An undercurrent of Logan’s comments is that liquidity distribution may entail some friction, or stress, but in an environment where liquidity is generally ample, some evidence of stress is a feature, not a bug. Logan’s speech is sort of a counterpoint to Powell’s tacit acceptance of easier financial conditions. This was an important speech. It will be interesting to see if her comments are echoed by other Fed officials.

Logan ran the NY Fed’s desk. She is likely more experienced, knowledgeable and connected to the markets than any other Fed President, or board member for that matter. Most Board members are academics.

*****************

Does a 15-17 bp back-up in yields last week suggest enough of a concession for auctions to sail through this week?

3y on Tuesday, $52b

10y Wednesday, $37b

30y Thursday, $21b

CPI is on Thursday. Expected 3.2% yoy with Core 3.8%.

Taiwan election on January 13.

| 12/29/2023 | 1/5/2024 | chg | ||

| UST 2Y | 426.0 | 438.7 | 12.7 | |

| UST 5Y | 385.0 | 400.7 | 15.7 | |

| UST 10Y | 388.0 | 404.2 | 16.2 | wi 404.0/03.5 |

| UST 30Y | 403.0 | 420.0 | 17.0 | wi 420.0/19.5 |

| GERM 2Y | 240.4 | 256.8 | 16.4 | |

| GERM 10Y | 202.4 | 215.6 | 13.2 | |

| JPN 20Y | 138.2 | 136.0 | -2.2 | |

| CHINA 10Y | 256.0 | 252.0 | -4.0 | |

| SOFR H4/H5 | -156.5 | -142.5 | 14.0 | |

| SOFR H5/H6 | -35.0 | -34.0 | 1.0 | |

| SOFR H6/H7 | 8.5 | 6.5 | -2.0 | |

| EUR | 110.38 | 109.43 | -0.95 | |

| CRUDE (CLG4) | 71.65 | 73.81 | 2.16 | |

| SPX | 4769.83 | 4697.24 | -72.59 | -1.5% |

| VIX | 12.45 | 13.35 | 0.90 | |

https://www.dallasfed.org/news/speeches/logan/2023/lkl231009