I like the idea of lending at 20%

January 10, 2023

–Powell comments today followed by the three year auction. Large reversal in ESH yesterday as it made an early high of 3973.25 (+57.75) only to go negative by the end of the day with a late print of 3912.00 (-3.50). Dollar index at its lowest level since the middle of last year, and nearing the 50% retracement from mid-2020 low to last year’s high. The halfway mark is 102.18 vs 103.19 late yesterday.

–New lows in some of the near one-yr SOFR calendars. The lowest is Sept’23/Sept’24 which fell 2.5 to -160 (9529.5/9689.5). While Fed officials parrot the need to keep rates high this year to make sure inflation is vanquished, the market simply won’t accept the idea that the Fed will maintain inflation vigilance. A couple of weeks ago there was a large buyer of SFRM3/U3 at -19, and it quickly rallied to -12.5. If the Fed holds rates steady, this spread should approach zero. Yesterday it fell 2 to -19.5.

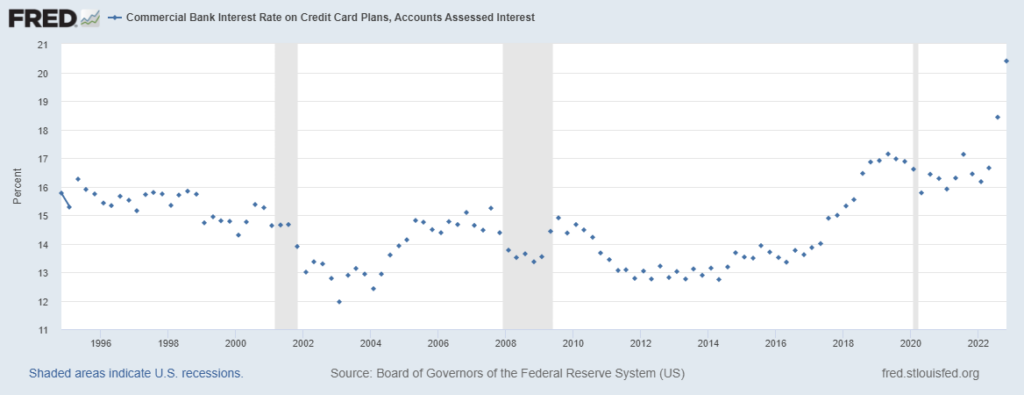

–Consumer credit released yesterday: “In Nov consumer credit increased at a seasonally adj annual rate of 7.1%. Revolving increased at a rate of 16.9% while non-revolving increased at an annual rate of 3.9%.” I suppose it’s related to holiday shopping, or maybe the jump in revolving indicates a stretched consumer. The St Louis Fed website has a chart on Credit Card interest rates on accounts assessed interest. The latest: 20.4%. Very few hedge funds can boast returns of 20%. The Fed’s plan is to raise rates, push unemployment up, thereby tamping down on consumer demand, all of which will suppress inflation. 20.4%.