I can pay the higher gas price if I can keep the Russian tank for free

March 2, 2022

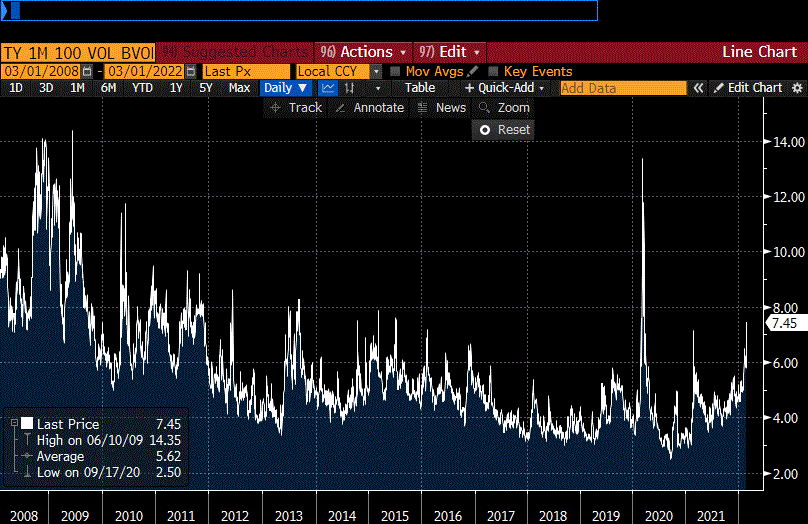

–The wrenching adjustments that have occurred due to the Ukraine conflict are taking a pause, with stocks bouncing, treasuries easing, gold and grains lower (grain article linked below). However, CLJ2 is above 107/bbl this morning, up $4 from yesterday’s close. In my area, a gallon of regular gas was 3.79 last week and 4.09 yesterday afternoon. As can be seen on the attached chart, TY vol has exploded higher, though still well below peak Covid and the GFC. On Friday I marked the atm TYM 126 ^ at 2’49, yesterday the atm 128.5^ settled 3’23. Likely worth looking at buying put 1×2’s here (sell 2 legs) as any retracements in treasury prices will surely coincide with vol declines.

–Biden gave the State of the Union address, followed by Powell’s congressional testimony today. Recently the text of comments has been released prior to his appearance, but I have not seen a link yet on the Fed site. What is clear is that the market has massively scaled back the prospect of near-term rate hikes. The peak performer on the euro$ curve was EDM’23, up 27 bps yesterday to 9818.0. On Friday, that same contract settled 9768.5, so 49.5 bps in two sessions, essentially erasing two hikes. Yesterday EDH’2/EDH’3 settled at a new recent low of 103.25; on Friday it was 146.75. EDH’2/EDM’2 three-mo spread settled at a new recent low of 31.25 vs a high of 58.25 on Valentine’s day. H2/M2 vs U2/Z2 had exploded to as high as 29 last month, but settled 1.25 yesterday. Open interest across the euro$ curve declined by 154k contracts, unsurprisingly indicating short covering. A small part of the OI change is due to migration into SOFR futures, which gained 11k. April Fed Funds settled 9968.0, anchoring the March FOMC at 25 bps. FV open interest plunged 104k as the 5-yr cash yield sank over 15 bps to 1.563%.

–There was continued buying of TYJ 130c yesterday, which added 34k positions, settling at 39/64 (up 25 on the day) vs TYM2 128-23+. These were bought Monday for 9 to 13.

–The IRS in the US could take a page out of the Ukrainian tax collection book. Here’s a new one:

“Have you captured a Russian tank or armored personnel carrier and are worried about how to declare it? Keep calm and continue to defend the Motherland! There is no need to declare the captured Russian tanks and other equipment, because the cost of this … does not exceed 100 living wages (UAH 248,100),” https://en.interfax.com.ua/news/general/804441.html

| No need to declare captured Russian tanks, other equipment of invaders as income – NAPCUkraine’s National Agency for the Protection against Corruption (NAPC) has declared that captured Russian tanks and other equipment are not subject to declaration. “Have you captured a Russian tank or armored personnel carrier and are worried about how to declare it? Keep calm and continue to defend …en.interfax.com.ua |