Forward growth expectations worsening

May 15, 2022 – Weekly comment

Even as inflation data released this week were worse than expected (yoy CPI 8.3%, Core 6.2% and PPI 11.0%) calendar spreads for next year declined substantially on the week. For example, EDZ2/EDZ3 one-year settled at a new low of 6 bps, down from 23 the previous Friday. The high of this year on January 10 was 68.5.

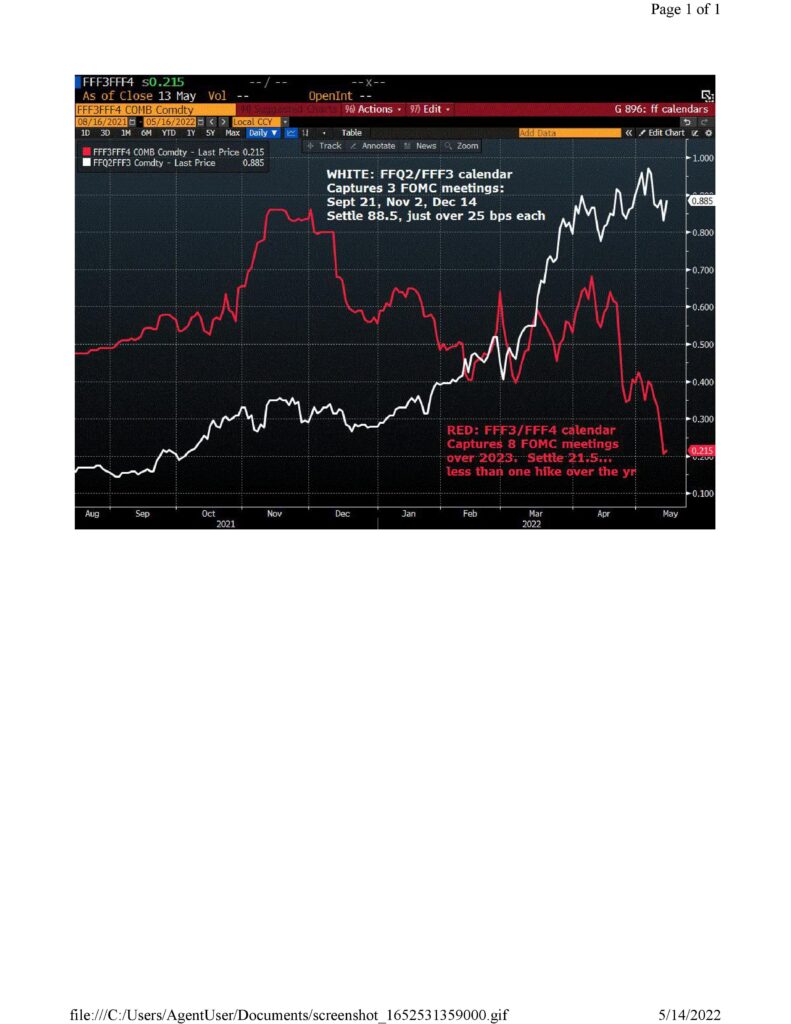

Below is a graph showing the stark change in tightening expectations (or lack thereof). The white line is August’22 Fed funds vs January’23. That five-month calendar captures three FOMC meetings, Sept 21, Nov 2 and Dec 14. August is a ‘clean’ month with no meeting. This spread settled 88.5; it started the year below 30. There is a bit more than 25 bps per meeting priced into this spread. The red line is FFF3/FFF4 which captures 7 FOMC meetings next year. That spread settled 21.5 bps, down from 68 on April 8 (the high of this year) and 39 last week. For all of next year, the market is expecting less that one 25 bp hike, and that’s expected to come in the first half. (FFN3/FFF4 is -11).

The lowest contract on the euro$ strip has been EDM’23 which is the last contract that reflects libor rather than sofr. It settled Friday at 9668.5 or 3.315%. The lowest settle was just prior to the May FOMC meeting, at 9631.5 or 3.685%. The June’23 SOFR contract is also lowest on the strip at 9697 or 3.03%, vs a low just before the FOMC of 9663.5. Since the FOMC, about 3/8% of forward tightening has been taken out of these contracts.

A note on ED vs SOFR: EDZ2/EDZ3 is 6.0 vs SFRZ2/SFRZ3 at 15.0. What accounts for the difference? After June 2023 there is no credit component embedded in euro$ contracts as they will transfer to SOFR. While the spreads SOFR to ED in Sept 23, Dec 23 and March 24 are all static at 26, the spread between SFRZ2 and EDZ2 is 35 bps (9725 vs 9690). EDZ2 reflects both credit risk and a ‘turn of the year’ premium.

Former NY Fed President Dudley defined financial conditions as incorporating 1) short and long term interest rates 2) equity prices 3) the value of the dollar 4) credit spreads. The SF Fed’s Mary Daly said last week she would like to see financial conditions tighten further. Let’s take a quick look. On 12/31/2021 SFRZ2 was 9818.5 and it settled Friday at 9725. 93.5 bps of tighter conditions. The ten year note was 1.51% now it’s 2.92% for 141 bps. The dollar index DXY was 95.67, now 104.56, a rally of over 27%. SPX 4766 to 4024, a loss of nearly 16%. The BBB/Baa spread to treasuries has gone from 121 to 187 bps. HYG and JNK have both fallen about 12%. For good measure, the front WTI contract has gone from 75.21 to 110.49. These tighter financial consitions have contributed to a fierce decline in U of Michigan’s Consumer Sentiment index from 101 pre-covid to 59.1 last week. Since the year 2000 sentiment has only been lower in the heart of the financial crisis in 2008/09 and in 2011. Any indication of just how much tighter you’d like to see Mary?

A quote from Daly in 2020: “I think we need to learn what full employment in the US is experientially as opposed to guessing and then stopping short of fully realizing it.” A quote from the NY Times 12/31/21: “My community members are telling me they’re worried about inflation… What influenced me quite a lot was recognizing that the very communities we’re trying to serve when we talk about people sidelined from the labor market are the very communities that are paying the largest toll of rising food prices, transportation prices and housing prices.” Just now getting familiar with the idea of trade-offs? Here’s an idea: look at what forward market prices are telling you. One other quick note, employment is a lagging indicator.

The last cycle highs in treasury yields were set in 2018. In November 2018, the Five-yr topped at 3.09%. This month it equaled that level, reaching 3.08% on May 6. All other maturities have fallen slightly shy of 2018 highs: Two-yr in 2018 hit 2.97% vs 2.78%. Ten-yr 3.24% in 2018 vs 3.13% and Thirty-yr 3.45% vs 3.23%. In terms of technical targets, 2018 levels are a fairly high hurdle. Recall, these highs were posted just after Powell’s famous “nowhere near neutral” utterance, and the Fed had just ratcheted up QT to $50 billion per month. SPX had started its 20% decline following Powell’s neutral comment but accelerated in December. We’re following a similar script.

GDP in Q4 2019 was $21.694T. Q1 2022 was $24.382 (St Louis Fed). Change $2.688T

Fed’l Govt debt outstanding 2019 $19.040T. Q1 2022 $25.314, a change of $6.274T

Market Cap to GDP Dec 2019 149%. Dec 2021 199%. End of 2019 Wilshire mkt cap $33T. End of 2022 $48.6T. So stocks gained $15T in value. To get back to 149% of GDP would suggest a market cap of $36.3T; we’re currently at $40T. Of course, the ten year yield ended 2019 1.93%, while the end of Q1 2022 was 2.46% (now 2.84%) so future cash flows should be more heavily discounted in the current cycle.

The market is telling us that the economy is likely to cool, slowly bringing down inflation expectations. Yield levels from 2018 aren’t likely to be surpassed in the near term, though strength in food and energy costs in the face of a powerful dollar will mean actual inflation stays sticky. Equities are in a challenging environment.

OTHER MARKET THOUGHTS/ TRADES

Aug FF settled 9815.0 on Friday, a discount of 2 bps from the idea of two 50 bp hikes in June and July which would put the Fed Effective at 1.83% or 9817.0.

News this week includes Retail Sales and Industrial Production on Tuesday, expected 1.0% and 0.5%. Housing Starts Wednesday and Existing Homes on Thursday. Powell interview with WSJ Tuesday.

| 5/6/2022 | 5/13/2022 | chg | ||

| UST 2Y | 271.6 | 259.7 | -11.9 | |

| UST 5Y | 304.0 | 288.4 | -15.6 | |

| UST 10Y | 311.2 | 293.1 | -18.1 | |

| UST 30Y | 319.2 | 308.8 | -10.4 | |

| GERM 2Y | 32.0 | 10.6 | -21.4 | |

| GERM 10Y | 113.2 | 94.8 | -18.4 | |

| JPN 30Y | 100.8 | 99.8 | -1.0 | |

| CHINA 10Y | 283.0 | 281.9 | -1.1 | |

| EURO$ M2/M3 | 175.0 | 148.5 | -26.5 | |

| EURO$ M3/M4 | -30.5 | -27.0 | 3.5 | |

| EURO$ M4/M5 | -8.5 | -6.0 | 2.5 | |

| EUR | 105.48 | 104.13 | -1.35 | |

| CRUDE (active) | 109.77 | 110.49 | 0.72 | |

| SPX | 4123.34 | 4023.89 | -99.45 | -2.4% |

| VIX | 30.19 | 28.87 | -1.32 | |