Forced to react

April 4, 2025

**************

–SPX -4.8% and Nasdaq Comp -6% yesterday, with somewhere around $2.5T erased, according to various reports.

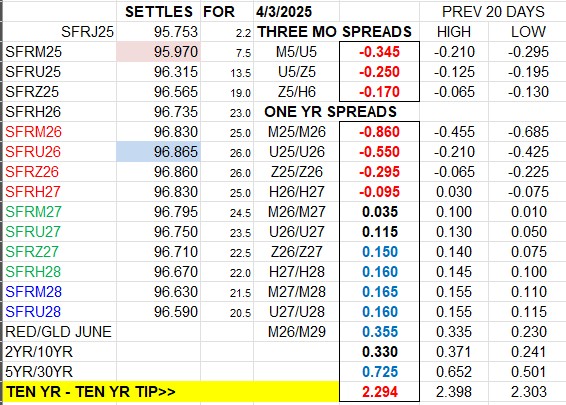

–SFRU6 is still the peak on the SOFR strip, but now much higher having surged 26 bps yesterday to 9686.5. The calendars in front made new recent lows (red), and calendars from Z6 forward made new highs (blue). SFRM5/M6 is most inverted at -86.0 (9597, +7.5 & 9683.0, +25.0). Simplistically, one might say they priced [an additional] 25 bp ease into reds. In treasuries, 2’s down 18 bps to 3.723%, 5’s were the leader down 19.2 to 3.759% and tens down just 14.2 bps to 4.053%. In the old days that might have meant a 30y fixed mortgage at 5.375%. Not now.

–Vol exploded. I have thought that 3% is sort of a soft cap for reds in terms of price/yield. This morning’s high in SFRU6 is 9699.5, so we’re there. However, if short calls in SOFR against the backdrop of a massive loss in perceived wealth, you don’t have the luxury of “sort ofs”. There is only open ended risk that must be capped. Just for the sake of comparison, on March 17, SFRM6 settled 9637.5 and the atm straddle was 90 bps. Yesterday M6 settled 9683, nearly 50 bps higher, and the 9687.5^ settled 95.75.

–Today NFP expected 140k. Yesterday’s employment component in ISM Services was 46.2, takes out the lows for 2024. Powell speaks at 11:25. He’s not going to say the Fed’s easing, but get a couple of more days like this and he will. Certainly he will say the Fed is watching employment carefully and will react if conditions deteriorate. Yesterday’s Atlanta Fed GDP Now at -2.8% for Q1. Gold-adjusted it’s -0.8%.

–SPX at the close has taken away HALF of last year’s rise. On a closing basis, the low in 2024 was 4688 on 4-Jan and the high was 6090 on 6-Dec. That low to high was a gain of 29%.