FOMC just hawkish enough to flatten curve slightly

January 30, 2025

******************

–I thought the FOMC press conference leaned slightly hawkish, but a client read it the other way, and I skimmed a couple of summaries noting that the statement was hawkish, but Powell walked it back. I would say the market supported the idea of a Fed on hold. At futures settlement, the curve had flattened. SFRM5 -3.5 (9591.5), M6 -2.5 (9609.5), M7 -1.0 (9602.5). In treasuries the 2y was up 2.1 bps to 4.224%, 10s +1.1 at 4.557% and 30s unch’d at 4.788%. April FF, which price odds for a March cut, settled 9573.0, down 2 on the day, i.e 28% chance of 25bp ease.

Initial focus was on this change in the statement:

From DEC:

Inflation has made progress toward the Committee’s 2 pct objective but remains somewhat elevated.

Yesterday:

Inflation remains somewhat elevated.

–In the press conference, Powell said the Fed is “… not highly restrictive, but meaningfully restrictive.” Said another way (which he did) funds are still above neutral, and “inflation remains somewhat elevated.”

–With respect to the new administration, he cited uncertainty about four things: tariffs, immigration, fiscal policies, and regulatory policies.

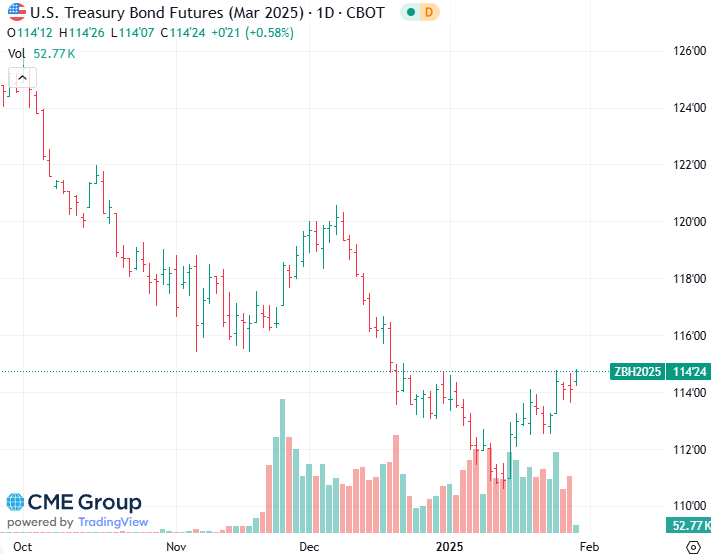

–I focused on USH5. Pre-Fed it had been hugging highs at 114-13. Post-Fed sold off, settling 114-03. Late in the electronic session, right back to 114-12. This morning the contract is testing the neckline traced out at recent highs. Hi on 12/31 114-23. Hi on 1/27 114-25. Now 114-23 (high this morning 114-26). This contract wants to go higher.

–Perhaps high PCE prices (released tomorrow) could change the mood, but I sort of think low numbers could cause all treasuries to rally, and marginally higher data will only serve to solidify the idea that the Fed’s not moving, which could cause more flattening and buying of the long end.

–One last thing: TY open interest added another 52k yesterday to 4.936m (on Dec 20 was 4.434m). A lot of buying in TY wk5 109.5 calls (paid 10 outright >10k and paid 7 for 109.5/110cs for 40k). These expire tomorrow, 109.5c settled 3 with OI 78k.

–Today Q4 GDP expected 2.6% (tho ATL Fed was revised down to 2.3%). Jobless Claims 225k.

..