Flows

September 5, 2022 – Weekly comment

When I was on the CME trading floor, I recall a particularly busy day. The details are a bit fuzzy, but something like the first two greens in euro$ futures were getting pounded relative to other contracts. What I remember clearly was that I had done some sort of simple spread, let’s say selling the first red to the first green, and had gotten off a price well above previous day’s settle. Again, it’s not the details of the spread that matter, it’s that Denise Miniscalco who had worked her way up to being a pit broker, walked up to me at my desk to deliver the endorsed trading cards, and proceeded to explain to me, in no uncertain terms, as to how we were able to get this price done.

Now, this woman was years younger than me, a petite attractive brunette (is that sexist? Well, sure). She told me who was doing what. “Stumpy and Bono were selling the green pack for Greenwich. Solly was selling first green to first blue.” It was something like that. All concerned with particular flows that were influencing the curve shape. It wasn’t about a piece of fundamental news that was causing anything. Pure flows. She knew exactly what she was talking about. That was the floor local mentality. Who is doing what, and what the big positions are. A lot of locals made a lot of money remembering those details.

Maybe it doesn’t need to be complex.

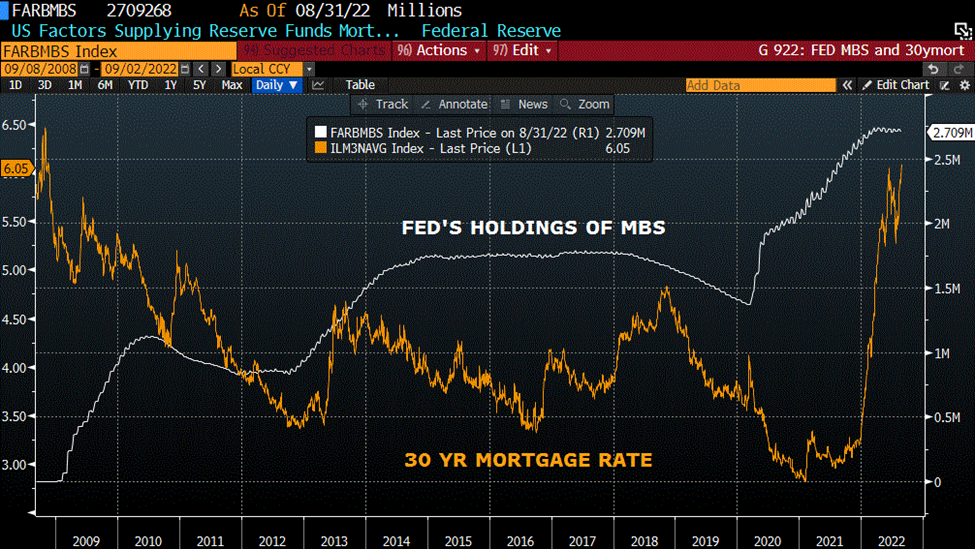

I saw a chart on twitter which overlaid the 30yr mortgage rate on the Fed’s Balance Sheet holdings of MBS. Unfortunately, I can’t find the chart now; it had various useful notations on it. I recreated the chart above (apologies to original twitter author). The Fed holds $2.7T of MBS and will be shedding $35b per month (along with $60b treasuries), starting now. It’s worth noting, I suppose, that according to the Fed’s Z.1 report, total Household Home Mortgages total $12T in Q1 2022. So I guess the Fed holds 22% of the home mortgage market. (Next Z.1 is released on Friday).

If the Fed isn’t buying, then rates have to go up, right? Unfortunately, it’s not quite that simple. The 30 yr mortgage rate has doubled in a year. But it actually appears on the chart as if rates initially run up when the Fed is paring back the balance sheet, or is EXPECTED to, and then decline as risk assets lose favor and the Fed’s lack of support slows economic growth. The explosion in mortgage rates this year makes the 2013 Taper Tantrum look like just that, a brief tantrum.

Maybe it’s just as simple as Putin’s description from mid-June:

Unable or unwilling to find other solutions, the governments of leading Western economies simply accelerated their money-printing machines and used this ignorant method to cover their unprecedented budget deficits. I have already citied this figure: over the past two years, the money supply in the US has grown by more than 38%. That’s 5.9 trillion dollars. The EU’s money supply has also increased dramatically over this period. It grew by about 20%, or 2.5 trillion euros. Today’s rising prices, accelerating inflation, shortages of food and fuel, and problems in the energy sector are the result of system-wide errors in the economic policies of the current US administration and European bureaucracy.

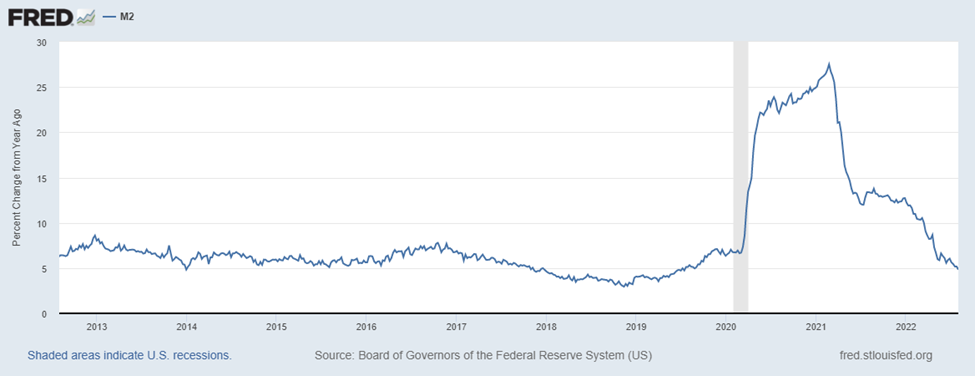

Of course we know that Putin’s invasion of Ukraine is also a factor, but again, according to the Fed’s report, M2 in the beginning of Feb 2020 was $15.393T, and in Feb of 2022 was 21.571T or a 40% increase. If the currency is depreciating relative to goods due to whirring printers, then of course lenders demand more depreciated dollars in future interest.

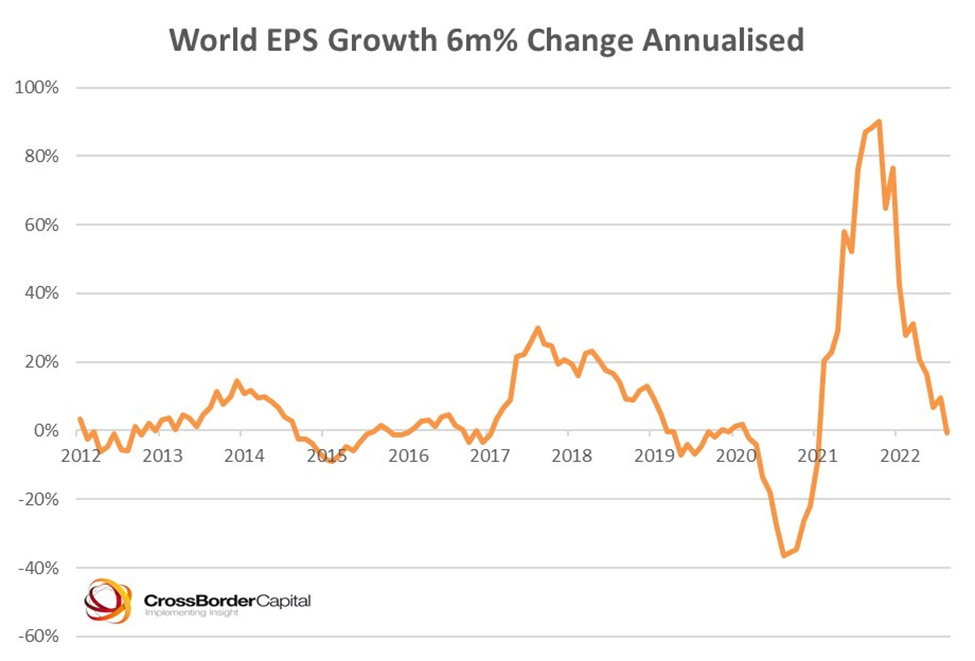

Attached is a chart of yoy M2 growth from the St Louis Fed website. The burst of inflation we’re seeing is a direct result of the extraordinary growth in M2 starting in 2020. They say it takes a year for monetary policy to flow through the economy. What’s going to happen now? Interestingly, the M2 chart looks a lot like a chart posted on twitter by CrossBorder Capital on EPS, though the latter has a lag.

In the final analysis, the sharp slowdown in money supply growth coupled with the Fed’s inflation fight will likely affect equity markets more than fixed income. That’s not to say that bonds are set to rally. The Fed’s withdrawal of liquidity will continue to weigh on all financial assets.

OTHER MARKET THOUGHTS / TRADES

Post-employment data, the market lessened chances of a 75 bp hike at the Sept 21 FOMC. For example, SFRU2 rallied 6.5 bps to settle 9682. EDU2 settled 9665.5, +6.25. In terms of the latter, the rate is 3.345% with 3m Libor having set at 3.15814, a basis of 18.7 bps which must converge in two weeks.

October Fed Funds (FFV2) closed +4.5 at 9702.5. The midpoint of 50 or 75 bps is 9704.5. So there is still a slight tilt toward the latter, but it will likely fall to the Sept 13 CPI data to solidify expectations. Of course, the ECB meeting on Thursday also looms. Brainard speaks on the Economic Outlook midday Wednesday, and Powell on Thurs in a moderated discussion on Monetary Policy at the Cato Institute.

With the disappearance of the credit component in short end rates as the transition to SOFR occurs, it’s worth looking at Hi Yield and Investment Grade Corp Bond Index futures listed on the CBOE. Unfortunately, these contracts do not yet have the liquidity to warrant interest, but I suspect that’s likely to change. On BBG, IHBA <index> is investment grade but has only 486 contracts in open interest. (Closely related it LQD etf). IBYA <index> is hi-yld with aggregate OI of 794. (Closed related to HYG). More on these contracts as liquidity improves.

| 8/26/2022 | 9/2/2022 | chg | ||

| UST 2Y | 338.6 | 339.8 | 1.2 | |

| UST 5Y | 319.3 | 329.8 | 10.5 | |

| UST 10Y | 303.3 | 319.1 | 15.8 | |

| UST 30Y | 320.3 | 334.1 | 13.8 | |

| GERM 2Y | 98.7 | 110.2 | 11.5 | |

| GERM 10Y | 139.0 | 152.7 | 13.7 | |

| JPN 30Y | 114.1 | 126.2 | 12.1 | |

| CHINA 10Y | 266.0 | 263.6 | -2.4 | |

| EURO$ U2/U3 | 44.5 | 49.0 | 4.5 | |

| EURO$ U3/U4 | -58.0 | -55.5 | 2.5 | |

| EURO$ U4/U5 | -23.5 | -16.5 | 7.0 | |

| EUR | 99.66 | 99.66 | 0.00 | |

| CRUDE (CLZ2) | 91.55 | 85.90 | -5.65 | |

| SPX | 4057.66 | 3924.26 | -133.40 | -3.3% |

| VIX | 25.56 | 25.47 | -0.09 | |

https://www.federalreserve.gov/newsevents/pressreleases/monetary20220727a1.htm

https://twitter.com/PutinDirect

https://www.cboe.com/tradable_products/corporate_credit/cboe_iboxx_ishares_corporate_bond_index_futures/