Financial Conditions again tightening

August 23, 2022

–Rates jumped Monday even as stocks tumbled. SPX down 2.1% while Nasdaq Comp was down 2.5%. Ten year yield rose 5 bps to 3.033% with the entire curve again yielding over 3%. The eurodollar and SOFR curves were much flatter with reds -12 and golds -3.625. The red/gold pack spread closed at -68.25…the year’s low was set on April Fools Day at -87.375, so less than 20 bps away. FFV2 settled 9703,0, again tilted toward 75 bps at the Sept 21 FOMC. The concern is that Powell will remain focused on the inflation fight and ignore collateral damage in risk assets (and, eventually, employment).

–Sept ED to Sept SOFR went out at 21.5, the lowest the spread has been since April. Perhaps somewhat interesting since the spread is set at 26 for contracts post the June 2023 transition.

–New highs in near ED spreads (curve steepened in front). EDU2/U3 settled 43.875 (+10 on the day) and SFRU2/U3 at 39.25 (+8.75). SFRZ2/Z3 where there had been a large block buy at -63 a couple of weeks ago, settled yesterday at -24, high since late June. The idea of stretching out hikes –or at least not pivoting toward ease– is gaining traction. Range on this spread has been spectacular. On June 9 it settled +20. The lowest settle was a month later on July 13 at -73 and now -24.

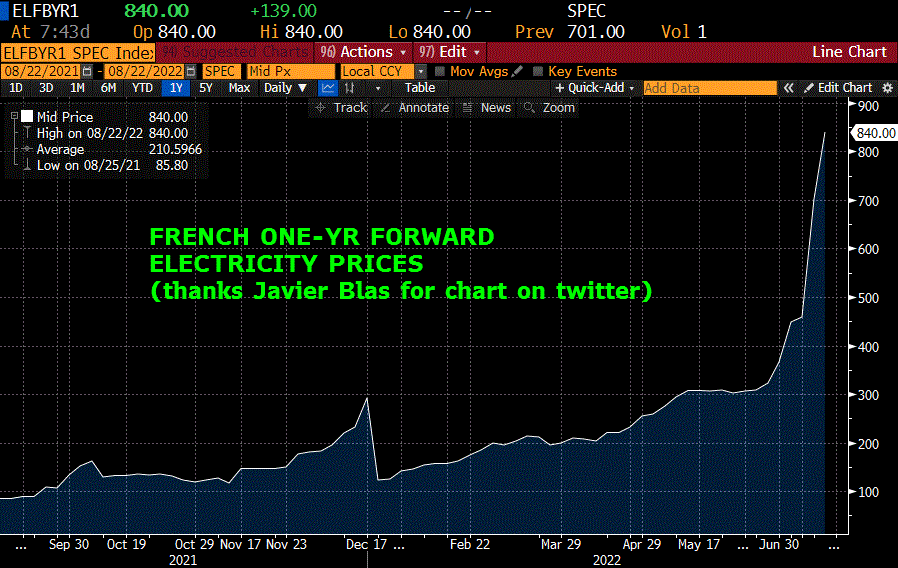

–Crude oil rebounded off steep losses yesterday as the Saudi energy minister “said OPEC+ had the means to deal with challenges including cutting production.” (RTRS). Yesterday’s low in CLV2 86.28. Price as of this note is 92.00. The attached chart shows one year forward French electricity prices. All european energy charts, whether electricity or Dutch natural gas, etc, look the same way: parabolic.

–DXY at a new recent high as EUR sinks below parity. US financial conditions rapidly tightening again with USD higher, rates higher, risk assets easing. Today’s news includes Richmond Fed and New Home Sales. Two-year auction, with 5s and 7s to follow Wednesday and Thursday.