Dr Copper, in the study, bludgeoned by a gold candlestick

June 22, 2022

–The front EDU2/EDU3 one-year calendar made a new low yesterday of 39 bps, down 4.5 on the day, as the market anticipates that Powell’s semi-annual testimony today will emphasize the Fed’s fight against inflation. In fact, EDU2/EDU3, the front one-year spread, is the ONLY positive one on the ED strip until EDM5/EDM6 which settled +0.5. The most negative one-year is EDH3/EDH4 at -45.5. Once again, the message from the market is that front-loaded hikes will work — by slowing the economy to a dead halt. Note that EDH3 remains the lowest contract on the strip at 9599.5 or 4.005%, consistent with a peak FF rate of 3.5-3.75%. EDH3/EDM3 settled at a new low -9.5 (9599.5/9609.0) ; the market has an easing bias early next year.

–BBG leads with a piece saying Citi economists see chance of global recession nearing 50%. Can’t help it, but all my mind can see is a few guys standing around the office with crumpled Taco Bell wrappers on their desks saying “let’s run it through the model” as one reaches in his pocket to flip a coin. One suggests using the word ‘nearing’ in the report, otherwise senior management might catch on.

–Looking at this morning’s price action: ESU -45, TYU +12 at 116-055 almost makes it seem as if someone knows what Powell is going to say. Of course, the Monetary Policy Report was already published on the Fed web site for those in Congress to read, all 77 pages, and you can tell they’ve done so by the fabulous questions we’ll be treated to…link here

https://www.federalreserve.gov/monetarypolicy/files/20220617_mprfullreport.pdf

–The curve was somewhat odd at Tuesday’s settle, with whites -1.75, reds +1.875, greens -0.75, blues -5.375 and golds -8.825. Fairly large steepening from reds to golds as reds (the second year forward) were the only contracts to settle positive on the day. Contracts past the reds are more correlated to longer maturity treasuries, and indeed the curve steepened there as well, with fives +4.1 bps, tens +6.8 to 3.305% and thirties +9.6 to 3.387%.

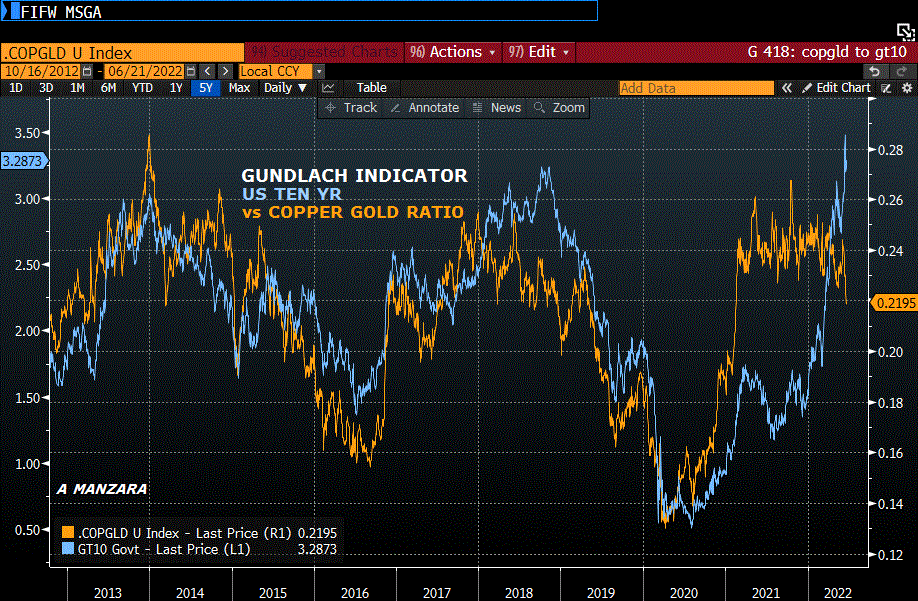

–With respect to longer maturities, I have attached the ‘Gundlach’ indicator of the copper/gold ratio to the ten year treasury yield. The former is falling as copper (HGN2, seen as an important economic input correlated with growth) has made a new low for the year. The copper/gold ratio has broken down to levels not seen since early 2021. However, treasuries have more or less ignored this signal as tens exceeded the 2018 yield peak just last week. This sort of looks like the 2018 divergence, which resolved with lower bond yields.