Delusions

November 24, 2024 – Weekly Comment

******************************************

It is astonishing what foolish things one can temporarily believe if one thinks too long alone, particularly in economics…

The difficulty lies, not in the new ideas, but in escaping from the old ones, which ramify, for those brought up as most of us have been, into every corner of our minds.

—John Maynard Keynes, The General Theory of Employment, Interest and Money

Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, one by one.

― Charles MacKay, Extraordinary Popular Delusions and the Madness of Crowds

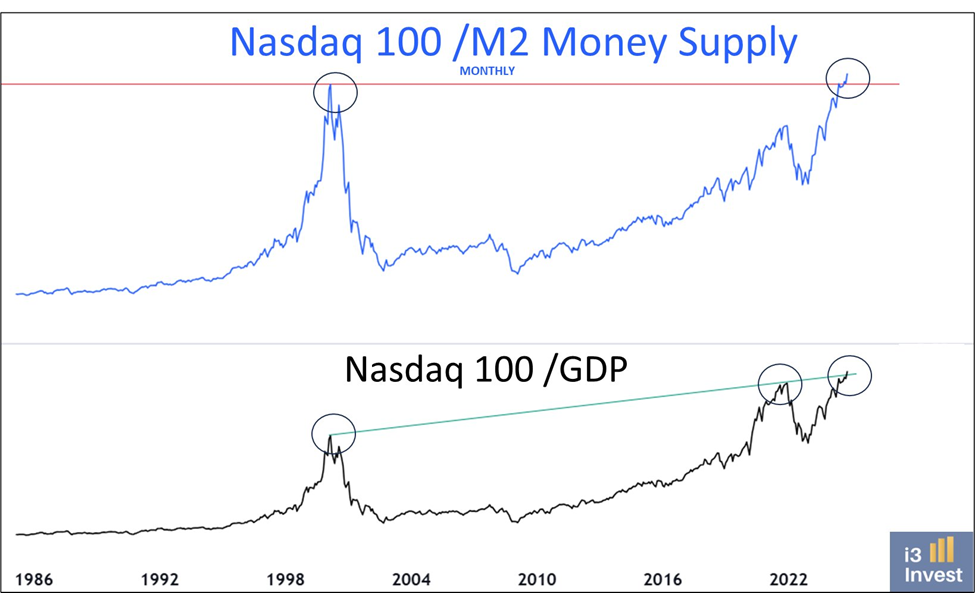

Chart above is by Guilherme Tavares @i3_invest posted 11/22. (thanks TS for highlighting and to YZ for MacKay quote).

The quotes above are perhaps somewhat contradictory. But the idea is that people can go mad alone (and perhaps help shape the maddening herd), or just run with the herd without the arduous effort of ever thinking about it. I think we’re in a ‘senses-recovery’ phase, but it might take a while.

The above chart represents that dynamic. According to BBG, market cap of NDX is $24.74T (NVDA is $3.47T), FTW5k -the Wilshire 5000- is $58.10T and GDP is $29.35T (St Louis Fed). The AI hype, as represented by the ratio of NDX to FTW5k peaked in June and appears to be reverting currently. By the way, this year’s peak is well above the dotcom surge in 2000.

I’m adding this X-post from last week from Arnaud Bertrand @RnaudBertrand

https://x.com/RnaudBertrand/status/1859446480198828360

The summary is that China sold $2 billion in USD denominated debt in Saudi Arabia at only a few bps above UST. Sort of a shot across the bow in terms of creating a parallel USD system. Here are a couple of interesting snippets:

This is where China’s strategy could become truly clever. China could use its US dollars to help Belt & Road countries pay off their dollar debts to Western lenders. But here’s the key: in exchange for helping these countries clear their dollar debts, China could arrange to be repaid in yuan, or in strategic resources, or through other bilateral arrangements.

In effect this would China placing itself as an intermediary at the heart of the dollar system, where the dollars still eventually make their way back to the US – just through a path that builds Chinese rather than American influence and progressively undermines the US’s ability to finance itself (with all the consequences this has on inflation, etc.).

In short this seems to be like some sort of Tai Chi ‘four ounces moving a thousand pounds’ (四兩撥千斤) move by China, using minimal force to redirect the dollar’s strength in a way that benefits China.

Last week I wrote about winning the war of incentives. Chairman Powell recently noted that emergency programs put in place during the pandemic were remarkable in that they were barely used; the fact that backstops were available restored market function. Same sort of idea.

Last week the US curve flattened. The 2y yield rose 7.2 bps to 4.367% while tens fell 1.8 bps to 4.406%. On the SOFR strip, the weakest contracts were SFRM5, down 10 at 9587 and SFRU5, also down 10 at 9596.5. By comparison SFRM8 and SFRU8 were UP 2.5 and 3.5 at 9619.5 and 9619. 2/10 spread is at risk of inverting again. In June this spread was negative 50 bps. On 9/25, just after the initial 50 bp cut, it was POSITVE 22.4. Friday was the lowest level since then. I guess it’s not too surprising…

We have a Fed wrestling with the idea of a higher neutral rate. We have a Federal Gov’t that last fiscal year ran a deficit close to 7% of GDP. The new economic orthodoxy is that issuance of high-yielding t-bills into affluent hands is stimulative, as interest payments become a more significant part of income. Now, the Federal Gov’t is being threatened with a serious diet (sans Ozempic). The big tech companies (many companies really) derive large amounts of revenue from the government. At the same time German’s 2y is imploding, down 13 bps on the week to 1.99%. Resulting strength in USD makes our exports more expensive. It’s not necessarily the case that restraint in fiscal activity causes recession, but coupled with a Fed that is less inclined to ease, it’s a significant risk.

On this holiday shortened week, we have FOMC minutes on Tuesday afternoon. Wednesday includes 3Q GDP revision, Durables, and most importantly, PCE price data. Month/month expected 0.2 with Core 0.3. Year/year expected 2.3 from 2.1 and 2.8 from 2.7. No data on Friday.

| 11/15/2024 | 11/22/2024 | chg | ||

| UST 2Y | 429.5 | 436.7 | 7.2 | wi 434.4 |

| UST 5Y | 429.4 | 429.6 | 0.2 | wi 428.6 |

| UST 10Y | 442.4 | 440.6 | -1.8 | |

| UST 30Y | 459.7 | 459.4 | -0.3 | |

| GERM 2Y | 212.2 | 199.1 | -13.1 | |

| GERM 10Y | 235.6 | 224.2 | -11.4 | |

| JPN 20Y | 188.4 | 189.0 | 0.6 | |

| CHINA 10Y | 207.3 | 208.0 | 0.7 | |

| SOFR Z4/Z5 | -57.0 | -51.0 | 6.0 | |

| SOFR Z5/Z6 | -5.5 | -12.5 | -7.0 | |

| SOFR Z6/Z7 | -1.5 | -3.5 | -2.0 | |

| EUR | 105.36 | 104.18 | -1.18 | |

| CRUDE (CLF5) | 66.92 | 71.24 | 4.32 | |

| SPX | 5870.62 | 5969.34 | 98.72 | 1.7% |

| VIX | 16.14 | 15.24 | -0.90 | |