Deer (in the headlights) season

November 17, 2019 – Weekly comment

In the beginning of November, the Atlanta Fed’s GDPNow Q4 estimate was 1.5%. On Friday, with the release of Retail Sales and Industrial Production, that estimate was downgraded to 0.3%. Real personal consumption expenditures and gross private domestic investment decreased from 2.1 and -2.3 to 1.7 and -4.4%.

The NY Fed’s GDP Nowcast estimate for Q4 was as high as 1.96% in late September, but has been continuously revised lower and, after Friday’s data, was cut to 0.39%. The extra digit of accuracy is a nice flourish out of the NY Fed, amusingly giving the illusion of econometric precision.

Cass Transportation reports that North American freight volumes printed negative yoy for the 11th straight month. The decline in October was -5.9%. From the report, “…we repeat our message from the previous five months: the shipments index has gone from ‘warning of a potential slowdown’ to ‘signaling an economic contraction.’ …demand is weaker across almost all modes of transportation, both domestically and internationally. …Several key modes are suffering material increases in the rates of decline, signaling the contraction is getting worse.”

China’s auto sales fell 5.8% yoy in October. Sales growth has been in negative territory every month since June 2018. Global auto sales are on track to decline for the second consecutive year.

US stocks have soared to new highs.

On the week, the US ten year yield fell nearly ten bps from 1.928% to 1.831%. The curve flattened, with twos down only 5.2 bps to 1.61%. Inflation data were about as expected in the middle of the week with yoy Core CPI +2.3%.. Late on Thursday, after Powell went out of his way in Congressional testimony to say that the Fed did NOT want to control the FF rate “…through frequent interventions to actively manage the supply of reserves”, the Fed intervened with the announcement of 28 and 42 day term repos, to hopefully get the market over the year-end finish line without repo drama. Though Powell said that recent t-bill buying and repo operations did “not represent a change in the stance of monetary policy”, constant tinkering indicates that the Fed doesn’t have as strong of a stance on monetary policy as they would like you to believe. On Wednesday, the Oct 30 FOMC meeting minutes are released, and we’ll get a better sense of the case for a December pause.

As of Friday, the market is accepting the idea of a December lull, and has expressed confidence that the Fed will do whatever it takes to make funding available through the end of the year. EDZ9 closed at 98.10, exactly at the November contract level (EDX9), which settles to libor on Monday morning. The 98.125 straddle settled 7.5, down from 9.0 the previous Friday. The spread between EDZ9 and FFF0 settled 36.0, at the low end of the recent range. At 98.46 or 1.54%, the January 2020 FF contract is just 2 bps higher than the front November FF contract, so there’s only a minuscule ease possibility being priced.

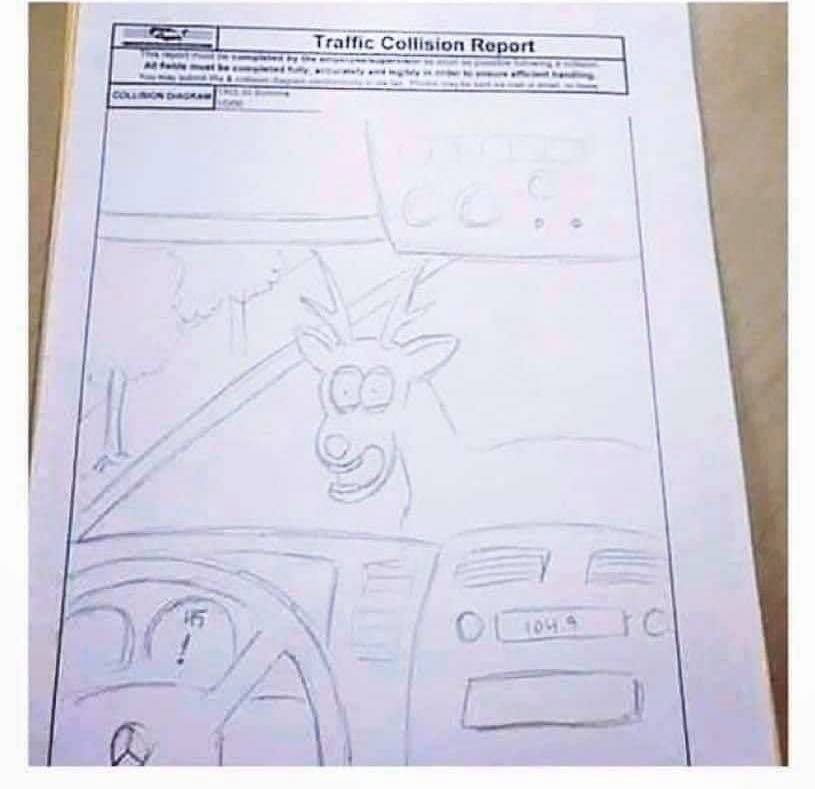

Sometimes you just need a picture or a chart to capture the essence of the situation. This is an actual Traffic Collision Report from the Kenosha, WI Police Department, submitted by an officer tasked with making a diagram of the incident.

That deer could be the Fed confronting the reserve shortage. The car is cruising along like the stock market.

There was a time when the Fed wanted to break the economy’s dependency on asset inflation. There was a time when Fed officials talked about ‘normalizing’ rates. Here’s the message the stock market is now hearing: “The Fed will continue to inject liquidity which we will use to compress risk premium. The Federal government will ramp up economic support for Trump’s re-election, including a subpar Phase I agreement. If the Fed won’t overtly cut FF, we’ll just buy further out the curve in anticipation of total acquiescence.” Caught between the headlights. And the indexes make new highs.

I was going to write a bit more, but the whole investment landscape boils down to Druckenmiller’s observations: “…focus on the central banks and focus on the movement of liquidity. Most people in the market are looking for earnings and conventional measures. It’s liquidity that moves markets.”

Since I’m on the whole deer season thing, I’ll end with another timely picture (The Far Side).

OTHER MARKET/TRADE THOUGHTS

December treasury options expire on Friday. There will be lots of wing replacements, probably in February or March options. Something like buys of TYG 123 puts for 1/64th. Vol is once again cheap.

As I had mentioned during the week, Eurodollar risk reversals unsurprisingly continue to reflect much more concern about market events that will cause a plunge in short rates rather than an increase. On Friday, EDM0 settled 9840, EDM0 9862.5c 7.0 and 9812.5p 2.25. While the 9812.5 put is 27.5 out of the money, the call of equal premium (2.25) is the 9900 strike, 60 bps otm. The 9862.5 strike needs at least two Fed rates cuts to play.

Despite this week’s rally, bonds still look as if the longer term test will be higher yields. Vol on USH0 is again below 8%, near the low end of the recent range. At the end of the week Lagarde gives her first speech as head of the ECB and European bond yields have already been perking up. A surge in long end yields would be an appropriate challenge for the ECB.

| 11/8/2019 | 11/15/2019 | chg | |

| UST 2Y | 166.2 | 161.0 | -5.2 |

| UST 5Y | 173.1 | 164.8 | -8.3 |

| UST 10Y | 192.8 | 183.1 | -9.7 |

| UST 30Y | 241.4 | 230.8 | -10.6 |

| GERM 2Y | -61.6 | -63.3 | -1.7 |

| GERM 10Y | -26.3 | -33.4 | -7.1 |

| JPN 30Y | 44.9 | 44.5 | -0.4 |

| EURO$ Z9/Z0 | -27.5 | -36.0 | -8.5 |

| EURO$ Z0/Z1 | 1.5 | -2.0 | -3.5 |

| EUR | 110.19 | 110.53 | 0.34 |

| CRUDE (1st cont) | 57.24 | 57.72 | 0.48 |

| SPX | 3093.08 | 3120.46 | 27.38 |

| VIX | 12.07 | 12.05 | -0.02 |