Debasement

March 3, 2024

***************

“Throughout history, many campaigns had been lost by stopping on the wrong side of the river.”

–attributed to General Patton

Powell is in front of Congress this week, Wed and Thurs, and Bloomberg declares: Powell about to double down on ‘No Rush to Cut’.

The enemy is within.

BAML (Michael Hartnett) notes:

US national debt rising $1tn every 100 days ($32tn to $33tn took 92 days, $33tn to $34tn 106 days, $34tn to $35tn will take 95 days); financing domestic bliss & overseas wars. US budget deficit past 4 years = 9.3% of GDP…little wonder “debt debasement” trades closing in on all-time highs, i.e. gold $2077/oz, bitcoin $67734.

Pimco urges the resurrection of bond vigilantes:

(Bloomberg) — Pacific Investment Management Co. is warning that US fiscal profligacy threatens to drag the Treasury market back to the 1980s, a time when bond vigilantes demanded far higher compensation to own longer-dated bonds.

“What if we are heading back to the future, to a market resembling prior decades when higher term premiums prevailed?” they asked in a paper published Thursday. Term premium is generally described as the extra yield investors seek to own longer-term debt instead of rolling over into shorter-term securities as they mature. It’s viewed as protection for bond holders against unforeseen risks such as inflation and supply-demand shocks, beyond other drivers of Treasury yields including economic growth and Federal Reserve policy.

“If the term premium returned even to levels common in the late 1990s to early 2000s – around 200 bps – that would likely become the defining feature of financial markets during this era,” the California-based money manager cautioned, adding such an outcome “would not only affect bond prices, but also prices of equities, real estate, and any other asset that is valued based on discounted future cash flows.”

Financial analysts use “term premium” as a neatly defined input in the exercise of valuing bonds. I would characterize it more as ‘loss of confidence’. It doesn’t necessarily need to be contained in a tight box with algebraic parameters. Think of it more like Pandora’s box. Think of it as someone simply saying, “Get me out.”

The enemy which is boxing in Powell is runaway federal spending that clearly distributes benefits unevenly and unstably across the economy. The lower segments are scarred by rising delinquencies and inflation, while the top see benefits in rising home values and high yields on savings.

I was prompted by a friend this week to mention the bitcoin rally (thanks PB). The reason I stumbled on the quote at the top of this note is because I was searching for a General Patton strategy, which I recall this way: Fierce fighting at the front lines, which may involve heavy casualties, once broken can lead to relatively easy, wide-open gains. It’s an appropriate analogy for market behavior. The ‘stopping on the wrong side of the river’ refers specifically to Powell’s campaign to bring inflation back to target. That goal risks being thwarted by what BAML refers to as “debt debasement”. Friend Rob Luxem at TJM (from whom I gain valuable crypto insights) had pointed out this week that bitcoin is making new highs vs yen, yuan and other global currencies. And, are you sitting down for this? Even against the Turkish Lira. But not against gold.

Total crypto market cap is currently about $2.34 trillion. Bitcoin is about half that at $1.2 trillion. The market cap of NVDA is just over $2 trillion. It has added $1 trillion of market cap in the past four months. So, the increase in the value of NVDA in four months is nearly worth the total market cap of bitcoin. Now it’s true as well that bitcoin has doubled since the middle of October. The point is that huge nominal dollar values are rapidly changing across the financial landscape. Which makes the job of all central banks that much more difficult. I’m sure Senator Warren and others will take that into account as they warmly welcome Powell with the express purpose of shifting the blame for fiscal irresponsibility onto the Fed’s plate.

What happens if the “bond vigilantes” return? I suppose we’ll know by how many times ‘term-premium’ is mentioned in the financial press. In terms of yield, in 2023 the ten year posted a low in April of 3.31% and a high in October of 4.99%. The midpoint is 4.15%, exactly where tens were trading Friday. A move above this year’s high of 4.32% would probably suggest a revisit of 5%. The area around 4% should provide strong support.

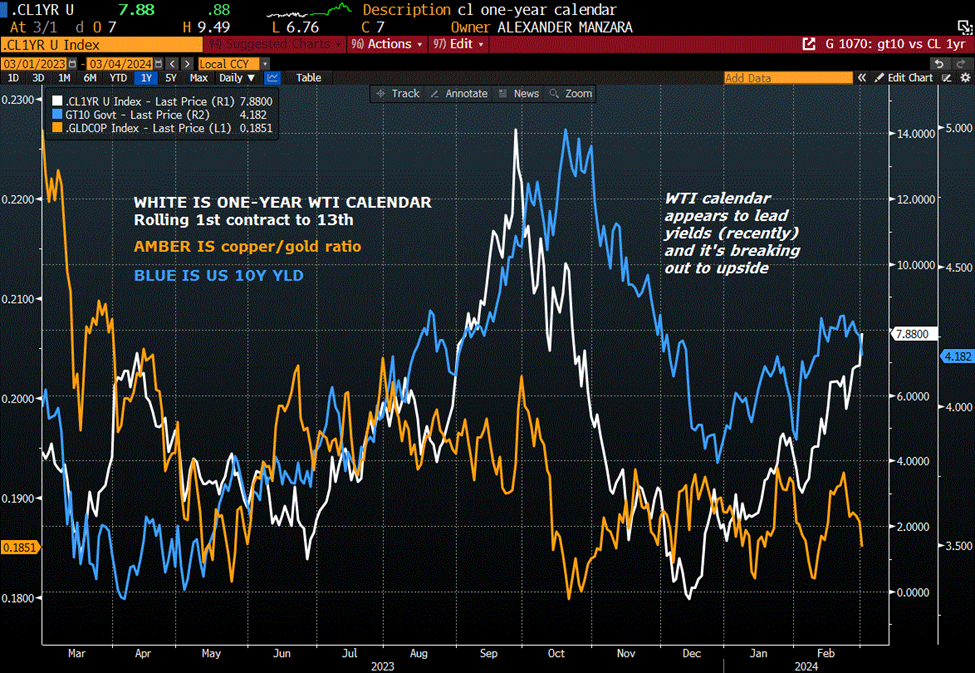

Below I have updated a chart that I first posted last week, the rolling one-year WTI calendar vs the US ten year yield. The oil calendar appears to lead the move in yields; higher near-term oil prices suggest tightness for physical and is perhaps an inflationary signal. I added Gundlach’s copper/gold ratio, which is indicating LOWER rather than higher yields. The global economy is soft. The US has been supported by fiscal largesse. Does it all end post-election?

Upcoming events include:

Powell testimony on Wednesday and Thursday.

Employment on Friday

March 20 FOMC/ discussion about trimming QT

XBT halving in April

BOJ possibly ending negative funding rates in April

| 2/23/2024 | 3/1/2024 | chg | ||

| UST 2Y | 465.7 | 452.9 | -12.8 | |

| UST 5Y | 426.8 | 415.7 | -11.1 | |

| UST 10Y | 425.6 | 417.8 | -7.8 | |

| UST 30Y | 437.8 | 432.7 | -5.1 | |

| GERM 2Y | 285.3 | 289.0 | 3.7 | |

| GERM 10Y | 236.3 | 241.3 | 5.0 | |

| JPN 20Y | 144.5 | 144.3 | -0.2 | |

| CHINA 10Y | 240.0 | 238.3 | -1.7 | |

| SOFR H4/H5 | -110.3 | -119.0 | -8.8 | |

| SOFR H5/H6 | -53.0 | -54.0 | -1.0 | |

| SOFR H6/H7 | -1.5 | -0.5 | 1.0 | |

| EUR | 108.23 | 108.41 | 0.18 | |

| CRUDE (CLJ4) | 76.49 | 79.97 | 3.48 | |

| SPX | 5088.80 | 5137.08 | 48.28 | 0.9% |

| VIX | 13.75 | 13.11 | -0.64 | |