Crunch

July 30, 2023 – weekly comment

SUMMARY

Rates are restrictive and will eventually squeeze inflation lower (if maintained)

Lacy Hunt interview (Wealthion). GDI and GDP typically track though can diverge over the short term. GDI has been negative in 3 of the last 4 quarters. Q2 GDP primarily due to auto assemblies; won’t repeat. Gov’t has negative multiplier; deficit has been completely funded by domestic non-bank buyers (siphons money away from productive projects). Credit crunch is here. Consumer spending shift from discretionary to non-discretionary (food and energy).

https://www.youtube.com/watch?v=AQwJUkZGi-M&t=2596s

https://hoisington.com/pdf/HIM2023Q2NP.pdf

Base effects are going to be more challenging for inflation. RBOB gasoline at new high for the year and WTI crude is at the top end of the range. Falling energy prices were a large benefit in the inflation fight; likely over. High energy also acts as a “tax” on the US consumer.

BOJ. Tweet by @EffMktHype : US10s swapped back to yen yield ~0.056% currently. So you can start to see why allowing JGB10s to rise above 0.5% starts to become an attractive proposition for Japanese bondholders and a negative flow dynamic for ROW.

Powell noted inflation not likely to hit target until 2025. Obviously aware of base effects. He also noted SLOOS is out Monday (Sr Loan Officer Survey). Bank loans and leases have decelerated. Yellow Freight bankruptcy (that particular strike is settled). Rolling debt will become an increasingly large problem.

NFP Friday.

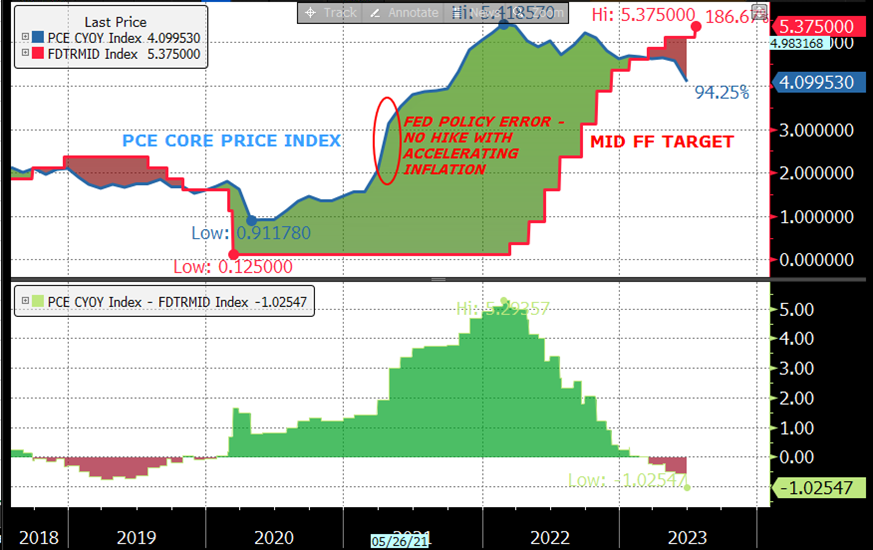

RESTRICTIVE

Below is a chart of PCE YOY CORE price index in blue and the midpoint of the Fed Fund target in red, over the past five years. The spread between the two is in the lower panel. The red shaded areas represent FFs being above this rate of inflation, which can be thought of as restrictive policy. As of December 2018, the last hike of that cycle, the move into restrictive territory was solidified. This time, it occurred in March 2023. Obviously, there are two ways to get to a restrictive stance, either the FF target is raised or the inflation rate is falling. Economic orthodoxy is that the former influences the latter. But once the FF target has become restrictive, it’s reasonable to think that inflation will have a tendency to decelerate. The critical points are, of course, how quickly inflation might subside and how long the Fed maintains a restrictive rate. The Fed is AT its destination.

In 2019, the Fed kept the rate restrictive for the better part of a year, even though the last hike (Dec 18) to the first ease (July 19) was only seven months. Thus far, the move to restrictive only occurred in March 2023.

I have also included a chart of the ten-year inflation-indexed note yield, often thought of as the “real” yield. I am positing that levels above 1% are restrictive, and that threshold was crossed in this cycle in September 2022. That is, by this measure of restraint, the duration has lasted longer, about eight months so far. The rate of change and magnitude is also important and the move from -120 bps to +170 bps is the most rapid in history. (In the US, inflation-indexed notes were first issued in 1997).

CRUDE OIL AND GASOLINE

RBOB in blue. WTI in black. New 2023 high in former

BOJ

10-yr JGB cap raised from 50 bps (now a soft cap) to 100 bps hard cap. Probably more important than the market currently thinks.

Yen futures Friday settles. JYU3 0.007148. JYZ3 0.0072525. Sell at Sept rate and buy back Dec implies loss of 1.46% over three months. Pretty high hurdle to fund USD investments in yen.

YELLOW FREIGHT BANKRUPTCY

Only about 30k job losses, but the implication is that debt can’t be rolled. From the NYT:

As of the end of March, Yellow’s outstanding debt was $1.5B, including about $730 million that is owed to the federal gov’t. [Covid bailout loan] Yellow has paid approximately $66 million in interest on the loan, but it has repaid just $230m of the principal owed on the loan, which comes due next year.

SLOOS is Monday. TBAC Financing Estimates Monday.

ISM Mfg Tuesday

NFP is Friday, expected 200k. Rate 3.6%. Avg Weekly Hours becoming more important, expected 34.4, same as last.

.

| 7/21/2023 | 7/28/2023 | chg | ||

| UST 2Y | 484.4 | 489.3 | 4.9 | |

| UST 5Y | 409.3 | 419.3 | 10.0 | |

| UST 10Y | 384.0 | 396.7 | 12.7 | |

| UST 30Y | 390.6 | 402.7 | 12.1 | |

| GERM 2Y | 309.3 | 305.1 | -4.2 | |

| GERM 10Y | 246.9 | 249.2 | 2.3 | |

| JPN 30Y | 132.5 | 138.5 | 6.0 | |

| CHINA 10Y | 261.5 | 266.3 | 4.8 | |

| SOFR U3/U4 | -106.5 | -91.0 | 15.5 | |

| SOFR U4/U5 | -84.0 | -86.0 | -2.0 | |

| SOFR U5/U6 | -17.5 | -20.5 | -3.0 | |

| EUR | 111.26 | 110.19 | -1.07 | |

| CRUDE (CLU3) | 77.07 | 80.58 | 3.51 | |

| SPX | 4536.34 | 4582.23 | 45.89 | 1.0% |

| VIX | 13.60 | 13.33 | -0.27 | |

https://www.bea.gov/data/income-saving/gross-domestic-income

https://www.federalreserve.gov/releases/g17/current/table2.htm