CPI week

January 8, 2023

From last week: “In terms of year end prognostications, SFRZ3 settled 9547.0 or 4.53%, and the 9550 straddle at 100. There. That’s the prediction: 4.5% overnight rate (maybe 25 bps above the current target) plus/minus 100.”

The range on SFRZ3 on the first week of the new year was 9533 to 9562.5. Coincidentally, that was the range on Friday. Settle was 9559.5. Net change on the week was +12.5. The 9550 straddle settled 86.25, down nearly 14 on the week and the 9562.5 straddle settled 86.5 as implied vol was hammered out of rate markets.

Fed officials continue to indicate a terminal rate above 5% and resolve to keep rates high until they’re confident that inflation is unambiguously trending to target. The lowest FF contract is June’23 at settle of 9505 or 4.95%. On Dec 30 it settled 9503. While Bullard said data will determine whether the Feb 1 hike is 25 or 50, the market leans towards the former with FFG3 settle of 9536. A hike of 25 should result in a final settle of 9542.9, and 50 should be 9518.8.

Powell speaks on Tuesday at the Sveriges Riksbank Symposium on Central Bank Independence. CPI is released on Thursday, expected 6.5% yoy from 7.1 last, with Core 5.7% from 6.0 last. Financial conditions have clearly eased over the past several FOMC meetings. I looked at FOMC dates of 9/21, 11/2 and 12/14 and took the 3-day averages of those days and the following two for the ten-year yield, SPX and DXY. GT10 3.745%, 4.138%, 3.47% and now 3.57%. SPX 3747, 3750, 3981 and now 3895. DXY 111.7, 111.7, 104.4 and now 103.90. Certainly things are easier now than Sept and Nov. Powell will likely lean against those trends.

On the SOFR curve, June’23 is the lowest contract at 9506.5, again, near 5%. The June’25 contract is more than 200 bps lower in yield at 9712. Most of that expected decline is in the first year, as SFRM3/M4 spread settled -144 (9506.5/9650.5). The Fed wants inflation down, while the market sees a significant drop in economic activity due to high funding rates.

From Chris Long on Linked In (link at bottom)

I’ve watched ISM Manufacturing Prices Paid for a long time, and while I know that it doesn’t track consumer prices perfectly, eventually it does have an impact. After today’s surprisingly below-expectations Average Hourly Earnings (along with a downward revision to the prior month), more Fed hikes seem destined to lead to a policy error – hiking too fast without waiting to see the impact of that hiking. The reversal and sharp rally in the fixed income market today tells me that the market is already figuring this out. [Avg Earnings yoy were 4.6% vs expectations of 5.0%. Workweek hours at 34.3 were the lowest level of 2022]

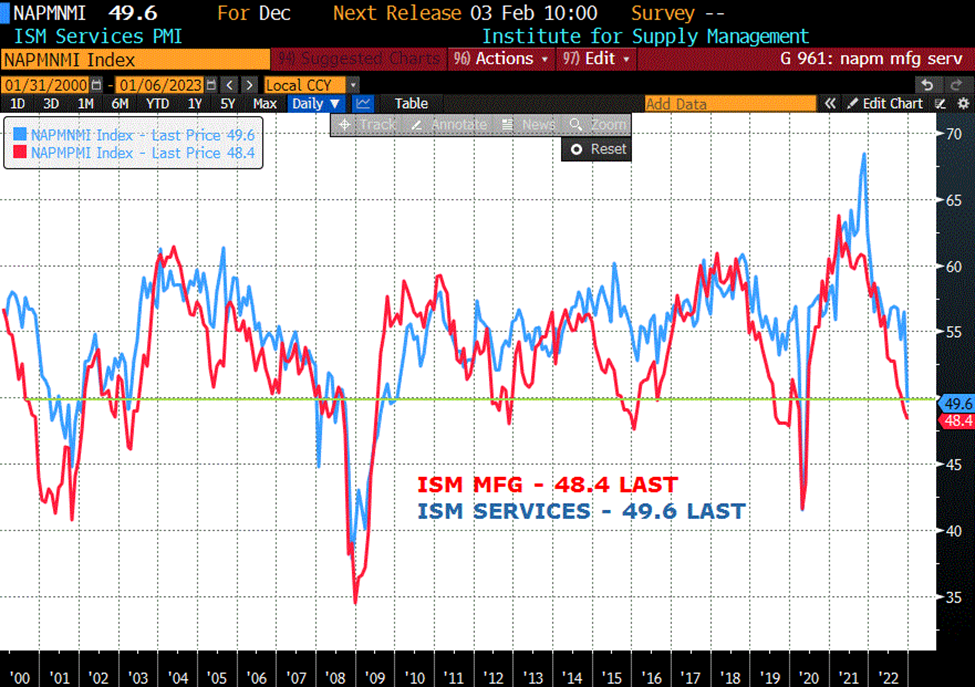

Below is a chart of ISM Mfg and Services. Both are now below 50. The only question now is how much political pressure will the Fed be able to take in its quest to quell inflation before having to ease. The market obviously thinks easing will occur in 2H. There was a block trade on Friday making the opposite case. FFK3/FFF4 calendar spread traded -43.75 in size of 4800. Settles were 9506.5 and 9551.5 so -45.0. A buyer of this spread would hope for no easing in the five FOMC meetings embedded in this period: June 14, July 26, Sept 20, Nov 1 and Dec 13. Rather, the idea is that current perceptions of an ease over that period dissipate, which would cause FFF4 to grind lower in price. On the other hand, imagine a scenario where the Fed hikes at the next couple of meetings, and economic fissures give way to gaping cracks. Possible for the Fed to ease 25 at every meeting in the last half of the year?

Similar trades took place in Dec’23 SOFR options. For example, SFRZ3 9537.5/9512.5/9500 broken put butterfly was bought for 7 and the 9512.5/9487.5/9475 broken p fly was bought for 5. The former has a breakeven of 9530.5, max value at 9512.5 and makes 5.5 at any level below 9500. Downside trades in short term futures tend to be structures that are targeting specific FF levels. Upside trades have, on balance, been more aggressive.

Zoltan Pozsar released a note Friday expecting the Fed to restart QE in June. “Don’t expect the put under gov’t debt to prop up risk assets: Unlike QE in the context of low interest rates and a risk asset put, the coming QE will be in the context of Treasury market dysfunction. The coming QE will aim to police swap spreads at high levels of interest rates, not to depress yields to inflate risk assets.”

The problems are obvious. EFFR at 4.33% is above every rate on the treasury curve past the 2y, which ended the week at 4.26%. A change in policy from the BOJ will make JGB yields more attractive, conceivably pulling capital away from US treasuries at the margin. This week we have 3, 10 and 30y auctions starting Tuesday, $40b, $31b, $18b. As noted above, yields are generally lower than peaks associated with Sept and Nov FOMC meetings. This week’s auctions may give clues as to whether Pozsar’s thesis is correct.

.

| 12/30/2022 | 1/6/2023 | chg | ||

| UST 2Y | 440.3 | 425.8 | -14.5 | |

| UST 5Y | 397.0 | 371.2 | -25.8 | |

| UST 10Y | 384.0 | 356.9 | -27.1 | wi 357.5/56.5 |

| UST 30Y | 393.3 | 369.2 | -24.1 | Wi 369.5/69.0 |

| GERM 2Y | 276.4 | 258.1 | -18.3 | |

| GERM 10Y | 257.1 | 221.0 | -36.1 | |

| JPN 30Y | 160.1 | 159.7 | -0.4 | |

| CHINA 10Y | 283.9 | 283.5 | -0.4 | |

| SOFR H3/H4 | -77.5 | -96.5 | -19.0 | |

| SOFR H4/H5 | -88.5 | -101.0 | -12.5 | |

| SOFR H5/H6 | -6.5 | -6.5 | 0.0 | |

| EUR | 107.03 | 106.44 | -0.59 | |

| CRUDE (CLG3) | 80.26 | 73.77 | -6.49 | |

| SPX | 3839.50 | 3895.08 | 55.58 | 1.4% |

| VIX | 21.67 | 21.13 | -0.54 | |