CPI today

June 10, 2022

–A friend is calling it “the Biden rally” (thanks PC). SPX -2.4%. Yields rose with near ED calendars posting new highs. As EDM2 expires Monday, EDM2/EDM3 jumped 8.25 to 188.5. It’s the same in euribor with M3/M3 190. EDM2/EDU2 settled at a new high 93.0. Oct FF settled 9770.5, just a few bps higher in price than they should be if the Fed hikes 50 at each of the next three meetings. The curve flattened, with 5/30 spread down 4 bps to 10.5. On April 21 I had marked it at -2 bps, with a subsequent rally to 27. Markets are fragile, and the Fed’s forced pivot to inflation-fighting is adding to vulnerability.

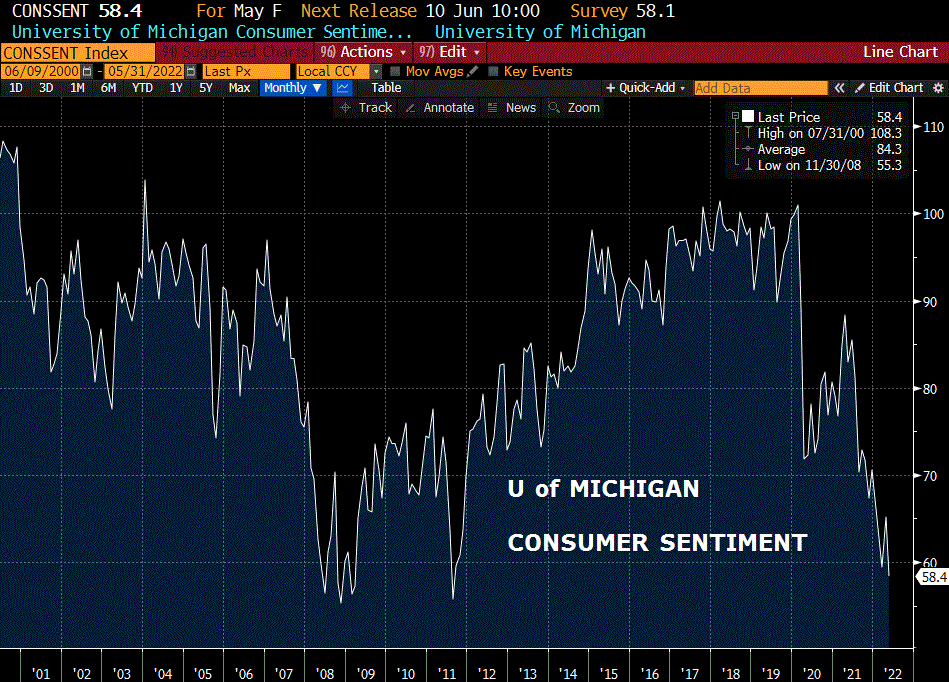

–Today brings the CPI report, expected 8.3% yoy, same as last, with Core 5.9 from 6.2 last. Yesterday’s Z.1 (flow of funds report from the Fed) showed Net Worth had declined slightly. In Q1 SPX fell 5%, so far in Q2 it’s down 11%, so things aren’t exactly better. Of course, real estate was marked higher in the report. Which brings us to today’s U of Michigan Consumer Sentiment report. Last was 58.4, which is nearing the lows of the Great Financial Crisis in 2008 at 55.3.