Change in the Landscape

September 25, 2022 – Weekly comment

On August 1, 2021, I wrote a piece titled Keystones, after watching a PBS nature show ‘The Discovery of Keystone Species’. The premise of the documentary is that a system without keystone species — typically apex predators– gets thrown out of balance. The related concept is ‘The Landscape of Fear’. If there are no big cats, gazelles are blithely free to overgraze, leading to parched fields. As scientist John Terborgh succinctly concludes:

“Remove the predator and it leads to the deterioration of the whole system. Loss of predators is almost always a loss of diversity. We coined the word ‘downgrading’ to describe it.”

My analogy was that the Keystone in modern capitalism is the base interest rate.

The Fed, by cutting rates to zero and encouraging investors to pile into the riskiest assets, was instrumental in throwing the health of the economy out of whack. Zombie corporations that could barely meet interest expenses out of cash flows were allowed to survive and even flourish.

Druckenmiller has often called funding rates an important “hurdle to capitalism”. Savers provide the capital to productive enterprises and deserve compensation for foregoing consumption. When the Fed sets the price of risk at zero, capital is misallocated.

We don’t want the economy to be the fat antelope who doesn’t realize the big cats have returned. We want it to be more like Dewey Oxburger, “a lean mean fightin’ machine.”

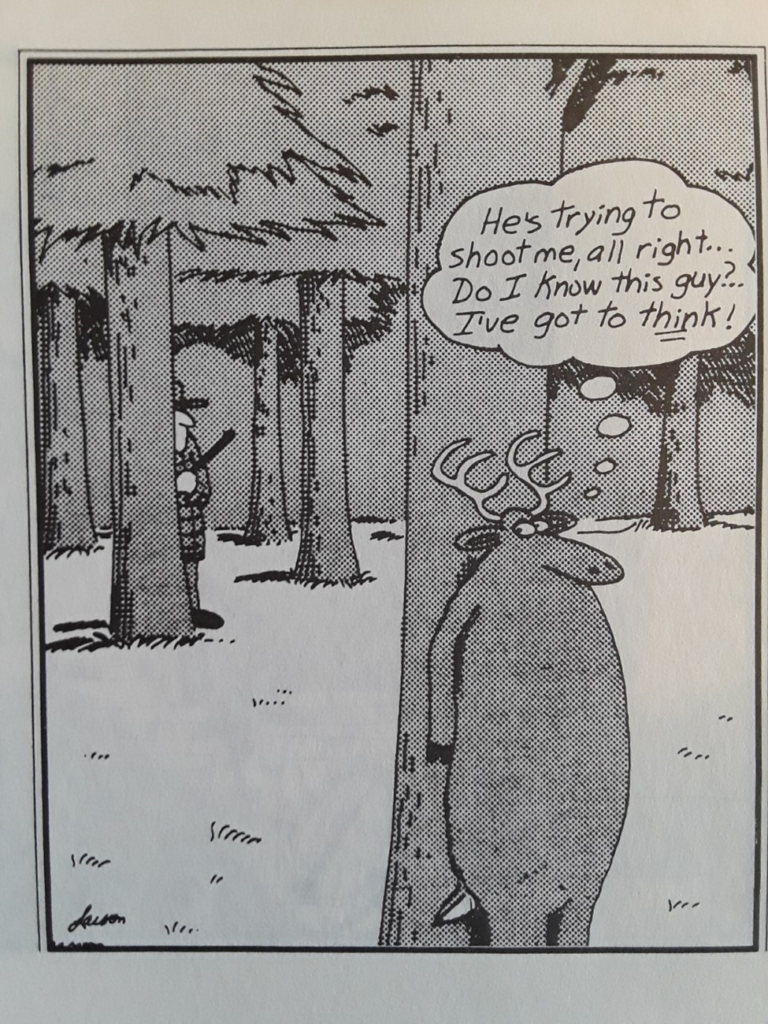

The Fed and other Central Banks are now raising rates to rid the economy of the very excesses that previous policies encouraged, which unsurprisingly included runaway inflation as an offshoot. I’ve included a helpful Far Side image depicting Powell behind one tree, and the retail investing public behind the other. In his Jackson Hole speech, Powell vowed to keep at it until the job is done and assured us that higher interest rates “…will bring some pain to households and businesses.” It doesn’t get much clearer than that, and the message was punctuated by the 75bp hike on Wednesday.

The equity market has put up its tail in notice, and interest rates have started to sprint. On the week both twos and fives rose over 35 bps, to 4.21% and 3.98%. SPX is down 23% from the January high. The Jan’23/Jan’24 Fed Funds futures spread, which can be thought of as a rough proxy for expected Fed action over 2023 was negative 56 on August 1. On Friday it settled positive 12.5, up from negative 24 just one week ago. Friday’s settles: FFF3 9571.0 and FFF4 9558.5. In the new Fed projections for end of year FF rates, the 2022 rate was pegged at 4.4% and end of 2023 at 4.6%. The rates on the FF contracts are 4.29% and 4.415%, quite close but BELOW the Fed projections. In June, the Fed estimate for the end of 2022 was 3.4%, while the June 17 settle for FFF3 (the Friday after the FOMC) was 9643.0 or 3.57%. At least with respect to the end of 2022, the Fed is now “ahead of the curve” as opposed to being behind in June.

It was August 2007 when Cramer unleashed his rant against Fed Chairman Bernanke and St Louis Fed President Poole in the company of the unflappable Erin Burnett. Cramer: “Bernanke’s being an academic…he has NO IDEA how bad it is out there. NO IDEA!”

https://www.youtube.com/watch?v=SWksEJQEYVU

As it turned out, Cramer’s timing pre-dated the market high by two months; SPX made its high for the GFC move on October 11, 2007.

On Friday, we heard a similar (and more reasoned) ‘NO IDEA’ rant by Wharton Professor Jeremy Siegel, arguing that commodities and housing are now falling in price, and that money supply has emphatically reversed course (see M2 yoy pct change chart below). “The Fed is too tight!” Professor Siegel has post-called the SPX high by over nine months. [He’s an academic, after all].

Professor Siegel clearly called out the Fed for ignoring market signals and focusing on lagging indicators. The charge of the Fed being primarily driven by academics and not market practitioners has been thrown out there numerous times, and the idea that “the market is NOT the economy” seems to be an implicit principle in Powell’s approach. The contrast between the ‘Fed Listens’ event on Friday and market price action couldn’t have been more telling as several business owners sat around a big conference table sharing the challenges of their particular operations with Fed members who asked a few bland questions in response.

OTHER MARKET THOUGHTS / TRADES

New buyer Friday of 110k SFRZ2 9600/9625cs 2.25 to 2.5. Settled 2.25 vs 9560.5.

New Home Sales and Case-Shiller home prices on Tuesday. PCE Deflator on Friday.

Treasury auctions 2’s, 5’s and 7’s Monday, Tuesday, Wednesday.

| 9/16/2022 | 9/23/2022 | chg | ||

| UST 2Y | 385.4 | 420.8 | 35.4 | w/I 421.0/19.5 |

| UST 5Y | 362.4 | 397.7 | 35.3 | w/I 398.0/97.0 |

| UST 10Y | 344.7 | 369.1 | 24.4 | |

| UST 30Y | 351.6 | 361.0 | 9.4 | |

| GERM 2Y | 153.3 | 191.8 | 38.5 | |

| GERM 10Y | 175.6 | 202.4 | 26.8 | |

| JPN 30Y | 128.7 | 129.0 | 0.3 | |

| CHINA 10Y | 268.0 | 268.0 | 0.0 | |

| SOFR Z2/Z3 | -31.5 | -1.5 | 30.0 | |

| SOFR Z3/Z4 | -65.0 | -72.5 | -7.5 | |

| SOFR Z4/Z5 | -18.0 | -26.0 | -8.0 | |

| EUR | 100.16 | 96.90 | -3.26 | |

| CRUDE (CLZ2) | 84.07 | 78.25 | -5.82 | |

| SPX | 3873.33 | 3693.23 | -180.10 | -4.6% |

| VIX | 26.30 | 29.92 | 3.62 | |